Mobile banking has transformed the way we manage our finances. With Bancomer—commonly known as BBVA Mexico—you can perform everyday transactions from your smartphone without visiting a branch. Whether you're paying bills, sending money, or making purchases at stores, the BBVA app puts full control in your hands. This guide walks you through the process of setting up and using mobile banking with Bancomer, ensuring secure and seamless transactions every time.

Understanding Bancomer Mobile Banking

Bancomer’s mobile app, officially named BBVA México, is designed for simplicity and security. It supports a wide range of financial actions: checking balances, transferring funds, paying utility bills, scanning QR codes for instant payments, and even locking or unlocking your card remotely. The app is available for both iOS and Android devices and integrates biometric authentication (fingerprint or face ID) for added protection.

To use mobile banking effectively, ensure your device meets basic requirements: stable internet connection, updated operating system, and a registered Bancomer account. You’ll also need your debit or credit card linked to your online profile and access to your account credentials.

Setting Up the BBVA App for the First Time

Before you can start making payments, download and configure the official BBVA México app. Follow these steps carefully:

- Download the app from the Apple App Store (iOS) or Google Play Store (Android). Search for “BBVA México” and confirm it’s published by BBVA.

- Open the app and select “Regístrate ahora” (Register now) if you’re a new user.

- Enter your customer number (número de cliente), which can be found on your debit card or in previous bank correspondence.

- Create a password that meets security criteria: at least 8 characters, including uppercase, lowercase, numbers, and special symbols.

- Verify your identity via SMS code sent to your registered mobile number or email.

- Set up biometric login (optional but recommended) for faster, more secure access.

Once logged in, take a moment to review your account details. Confirm your linked cards, check recent transactions, and update your contact information if needed.

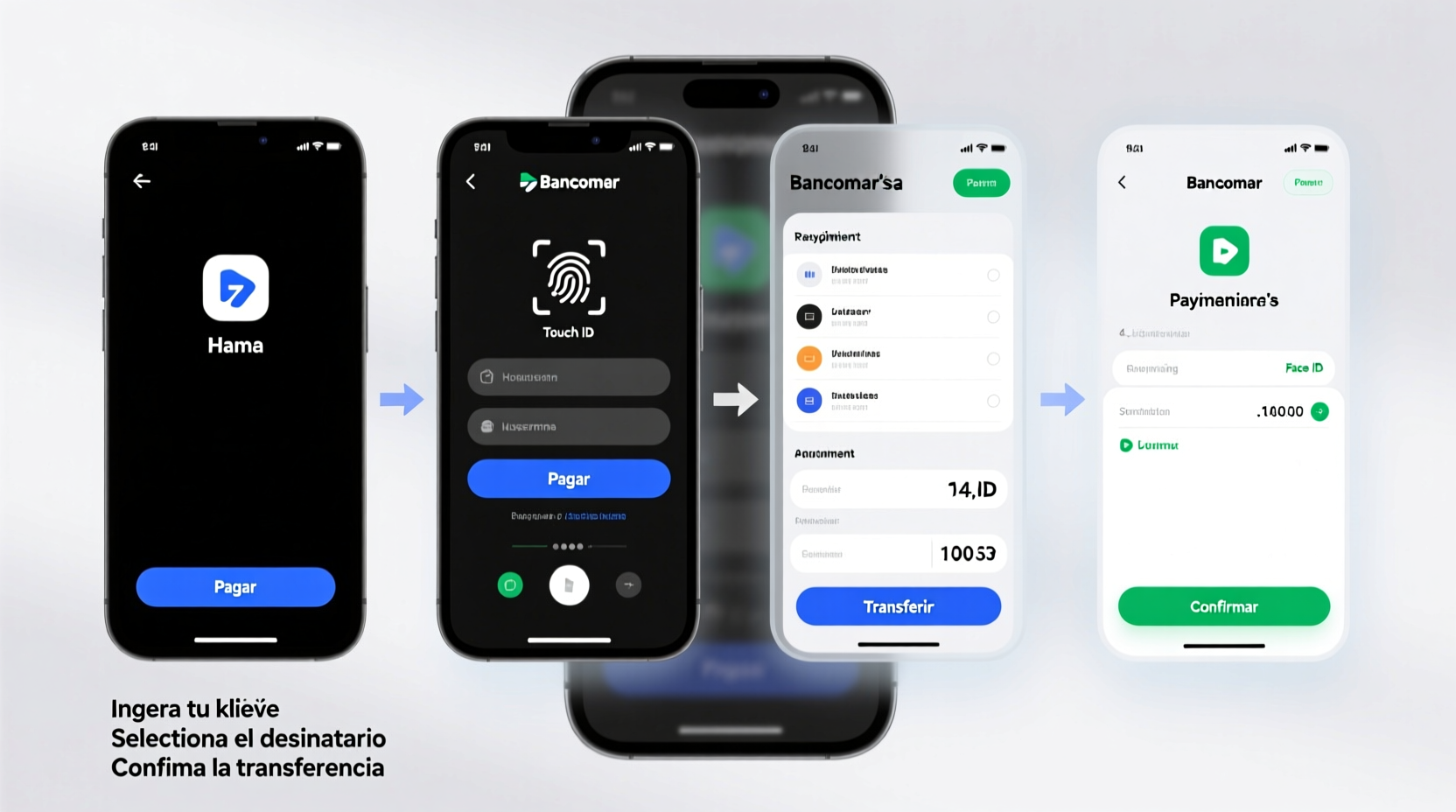

How to Make Payments Using the BBVA Mobile App

Paying with mobile banking through Bancomer is fast and versatile. Below is a detailed timeline of common payment methods supported by the app.

1. Paying Bills (Luz, Agua, Internet, etc.)

- Navigate to the “Pagar” tab at the bottom menu.

- Select “Pagar servicios” (Pay Services).

- Choose your service provider from the list (e.g., CFE, Telmex, Sky).

- Enter your account or reference number.

- Input the amount and select the account or card to deduct from.

- Confirm the transaction using your password or biometrics.

2. Sending Money to Another Person

- Tap “Enviar dinero” from the home screen.

- Select recipient: by phone number, email, or CLABE interbank key.

- Enter the amount and add an optional note.

- Review fees (usually none for same-bank transfers).

- Authenticate with your PIN or biometrics.

- The recipient receives funds instantly if they’re also with BBVA; otherwise, within minutes via SPEI network.

3. Scanning QR Codes at Stores

- Open the app and tap the camera icon or “Escanear código QR.”

- Point your phone at the merchant’s QR code.

- The amount and business name will appear automatically.

- Confirm payment source and approve with your fingerprint or passcode.

- You’ll receive a confirmation message and digital receipt.

“Mobile payments reduce cash dependency and lower fraud risks when combined with two-factor authentication.” — Carlos Méndez, Digital Banking Analyst at ITAM

Security Best Practices When Paying via Mobile Banking

While convenient, mobile banking requires vigilance. Cybercriminals often target financial apps through phishing, fake apps, or unsecured Wi-Fi networks. Protect yourself with these essential practices:

- Only download the BBVA app from official app stores.

- Avoid logging in over public Wi-Fi; use mobile data or a trusted network.

- Never share your password, customer number, or one-time codes.

- Regularly monitor your transaction history for unauthorized activity.

- Lock your card immediately in the app if your phone is lost or stolen.

| Do’s | Don’ts |

|---|---|

| Use strong passwords and change them periodically | Save login info on public devices |

| Enable biometric authentication | Click on suspicious links in SMS or emails claiming to be from BBVA |

| Update the app regularly for security patches | Store screenshots of your home screen with visible balance |

Mini Case Study: Maria’s First Mobile Payment Experience

Maria, a small business owner in Guadalajara, recently started accepting mobile payments from customers. She used her personal BBVA account to generate a static QR code displayed at her counter. One afternoon, a customer scanned the code and paid 285 MXN for handmade candles. Maria received an instant notification, verified the amount, and confirmed the sale—all without handling cash.

Later that week, she noticed a failed login attempt alert. Thanks to the notification, she immediately changed her password and enabled two-factor authentication. Her proactive response prevented any compromise. Today, over 70% of her daily sales come through mobile transfers and QR payments, streamlining her operations and reducing theft risk.

Frequently Asked Questions

Is there a fee for sending money through the BBVA app?

No, domestic transfers between BBVA accounts are free. SPEI transfers (to other banks) are also typically free, though some third-party services may charge a nominal fee. Always review the cost before confirming.

What should I do if my phone is stolen?

Act quickly: call BBVA customer service at *444 from your mobile or +52 55 5326 9200 from abroad. Use another device to log into the BBVA app and lock your card under “Tarjetas.” Consider uninstalling the app remotely via your phone’s find-my-device feature.

Can I pay international merchants with the BBVA app?

Yes, if the merchant accepts card payments online and your card is enabled for international transactions. You can toggle this setting in the app under “Administración de tarjetas” → “Compras en el extranjero.” Note that foreign exchange fees may apply.

Essential Checklist Before Making Your First Mobile Payment

- ✅ Download the official BBVA México app from App Store or Google Play

- ✅ Register using your customer number and valid identification

- ✅ Link your primary checking or savings account

- ✅ Set up biometric login (Touch ID, Face ID, or fingerprint)

- ✅ Verify your phone number and email in account settings

- ✅ Test a small transfer to another BBVA user to confirm functionality

- ✅ Review recent transactions weekly for accuracy

Final Thoughts and Next Steps

Using mobile banking with Bancomer simplifies your financial life. From splitting dinner bills to paying monthly utilities, the BBVA app offers speed, convenience, and robust security. As digital transactions become the norm, mastering mobile payments isn’t just useful—it’s essential.

Now that you understand the full process, take action today. Open the BBVA app, complete your profile, and make your first secure transaction. Share your experience with friends or family who still rely on cash or in-person banking. Together, we can move toward a smarter, safer financial future.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?