Keeping your contact information up to date with your bank is essential for security, fraud alerts, and seamless access to digital banking services. If you’ve recently changed your mobile number and are a BBVA customer, you don’t need to visit a branch or wait on hold with customer service. You can securely update your mobile number directly at a BBVA ATM—fast, free, and without assistance.

This guide walks you through the entire process, from preparation to confirmation, ensuring your personal data remains protected while giving you full control over your account settings.

Why Updating Your Mobile Number Matters

Your mobile phone number is tied to multiple layers of your banking experience: SMS authentication, transaction alerts, password resets, and two-factor verification. An outdated number puts you at risk of missing critical notifications or being locked out of your own accounts during recovery attempts.

BBVA recognizes this and has integrated self-service options into its ATM network, allowing customers to manage profile details securely—without requiring in-person appointments or lengthy phone calls.

What You’ll Need Before Starting

To successfully update your mobile number via a BBVA ATM, ensure you have the following ready:

- A valid BBVA debit card linked to the account needing the update

- Your current PIN for that card

- The new mobile number you wish to register (must be active and capable of receiving SMS)

- Approximately 5–7 minutes of uninterrupted time at the ATM

Note: This service is available only at BBVA-operated ATMs in the United States. Not all third-party or non-BBVA ATMs support profile management functions.

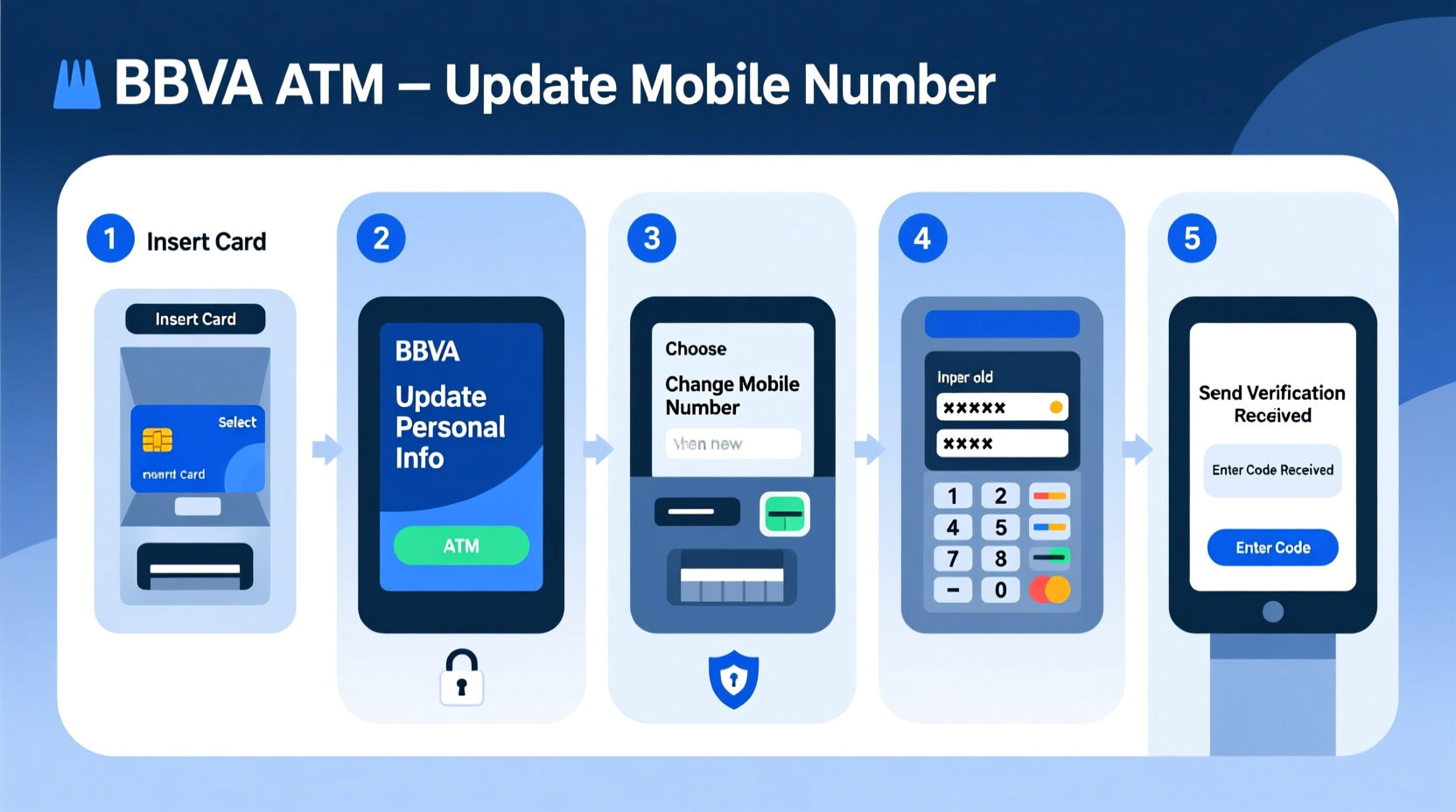

Step-by-Step Guide to Updating Your Mobile Number

- Locate a BBVA ATM: Use the BBVA app or website’s ATM locator tool to find the nearest BBVA-owned machine. Look for signs indicating “BBVA Bank” branding—not just any ATM accepting BBVA cards.

- Insert your debit card: Insert your BBVA debit card into the slot with the chip facing up. Wait for the system to read your card and prompt you to enter your PIN.

- Enter your PIN: Carefully input your four-digit PIN using the keypad. Ensure no one is watching you enter this sensitive information.

- Select 'Account Services': After authentication, the main menu will appear. Navigate to the option labeled “Account Services,” “Profile Settings,” or similar—this may vary slightly depending on the ATM interface version.

- Choose 'Update Contact Information': Within Account Services, select “Update Phone Number” or “Manage Contact Info.” The exact wording may differ, but it should clearly relate to personal details.

- Select 'Mobile Number': Confirm you want to update your mobile number. The screen will display your current registered number for verification.

- Enter your new mobile number: Using the on-screen keypad, carefully type in your new 10-digit U.S. phone number. Double-check each digit before proceeding.

- Confirm via SMS verification: BBVA will send a one-time verification code to the new number. Wait for the text message (usually within 30 seconds), then enter the code shown on the ATM screen.

- Finalize and log out: Once verified, the system confirms the update. The ATM may print a receipt summarizing the change. Remove your card, take the receipt if provided, and end the session securely.

“Updating your contact information at an ATM reduces fraud risk by ensuring alert messages reach the right device immediately.” — Carlos Mendez, Senior Security Analyst, BBVA USA

Do’s and Don’ts When Updating Your Number

| Do’s | Don’ts |

|---|---|

| Use a quiet, well-lit BBVA ATM location | Perform this in crowded or poorly lit areas where others might observe your actions |

| Verify the new number receives the SMS code promptly | Enter a number not under your control (e.g., temporary burner phones) |

| Keep the confirmation receipt until you verify functionality | Leave your card in the machine or forget to log out |

| Test online banking login afterward to confirm alerts work | Assume the change is instant across all systems—allow up to 1 hour for full sync |

Real Example: Maria’s Smooth Transition

Maria had recently switched mobile carriers and found she wasn’t receiving her BBVA fraud alerts. She visited a local BBVA ATM during her lunch break, inserted her card, and followed the prompts under “Account Services.” After entering her new number and verifying it with a text code, the screen displayed: “Contact information updated successfully.” That evening, she initiated a small online purchase and immediately received the expected transaction alert—confirming the update worked perfectly.

She later noted, “I was skeptical about doing something like this at an ATM, but it took less than six minutes and felt completely secure.”

Checklist: Ensure a Successful Update

- ✅ Located a BBVA-branded ATM

- ✅ Have your BBVA debit card and correct PIN

- ✅ New mobile number is active and accessible

- ✅ Signal strength is sufficient on the new device to receive SMS

- ✅ No pending account freezes or holds

- ✅ Completed test transaction post-update to verify alerts

Frequently Asked Questions

Can I update my email address at the ATM too?

Currently, BBVA ATMs only support mobile number updates. To change your email address, use the BBVA mobile app or log in to your online banking portal.

Is there a limit to how many times I can update my number?

While there's no hard limit, frequent changes may trigger a temporary security review. BBVA monitors unusual activity to prevent unauthorized access, so avoid making repeated changes unless necessary.

Will updating my number affect my mobile banking app?

No. In fact, it enhances app functionality. Once updated, your new number will receive push notification prompts, login verifications, and password reset codes. However, you may need to re-authenticate the app after the change.

Security Best Practices During the Process

Although BBVA’s ATM interface uses encryption and real-time verification, your behavior plays a crucial role in maintaining security. Shield the keypad when entering your PIN. Avoid ATMs with suspicious attachments (like skimming devices). If the machine looks tampered with—walk away.

After completing the update, monitor your account for any unfamiliar login attempts or transactions over the next 48 hours. Consider enabling biometric login in the BBVA app for added protection moving forward.

Conclusion: Take Control of Your Banking Experience

Updating your mobile number at a BBVA ATM is a simple yet powerful way to maintain control over your financial security. With just a few taps and a verification code, you ensure that every alert, authentication request, and emergency notification reaches you without delay.

You don’t need special permissions, long waits, or paperwork. The technology exists today—designed for convenience and backed by robust safeguards. Whether you’ve changed numbers due to relocation, carrier switch, or loss of a device, now you know exactly how to keep your banking aligned with your life.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?