Venmo has become one of the most popular peer-to-peer payment platforms in the U.S., widely used for splitting bills, paying friends, or receiving payments for side gigs. While the Venmo debit card makes accessing funds convenient, not everyone uses or wants one. The good news is that you can still withdraw money from your Venmo balance without relying on a physical card. Whether you're avoiding fees, waiting for card delivery, or simply prefer other banking methods, several reliable options exist.

This guide walks through practical, secure ways to move your Venmo balance into spendable cash—without needing a debit card. From direct bank transfers to strategic use of third-party services, you’ll learn how to access your money efficiently and safely.

Understanding Your Venmo Balance and Transfer Options

Before withdrawing funds, it’s important to understand how Venmo handles balances. When someone sends you money or you receive payments, those funds are stored in your Venmo account balance unless automatically transferred. To actually use that money as cash or in your regular bank account, you must initiate a transfer.

Venmo offers two primary transfer methods:

- Standard Transfer: Free, takes 1–3 business days to reach your linked bank account.

- Instant Transfer: Available for a 1.75% fee (minimum $0.25, maximum $25), completed within minutes to eligible accounts.

Both options allow you to access your funds without a debit card. Once the money lands in your bank account, you can withdraw cash via ATM, in-branch service, or digital wallet-linked cards not issued by Venmo.

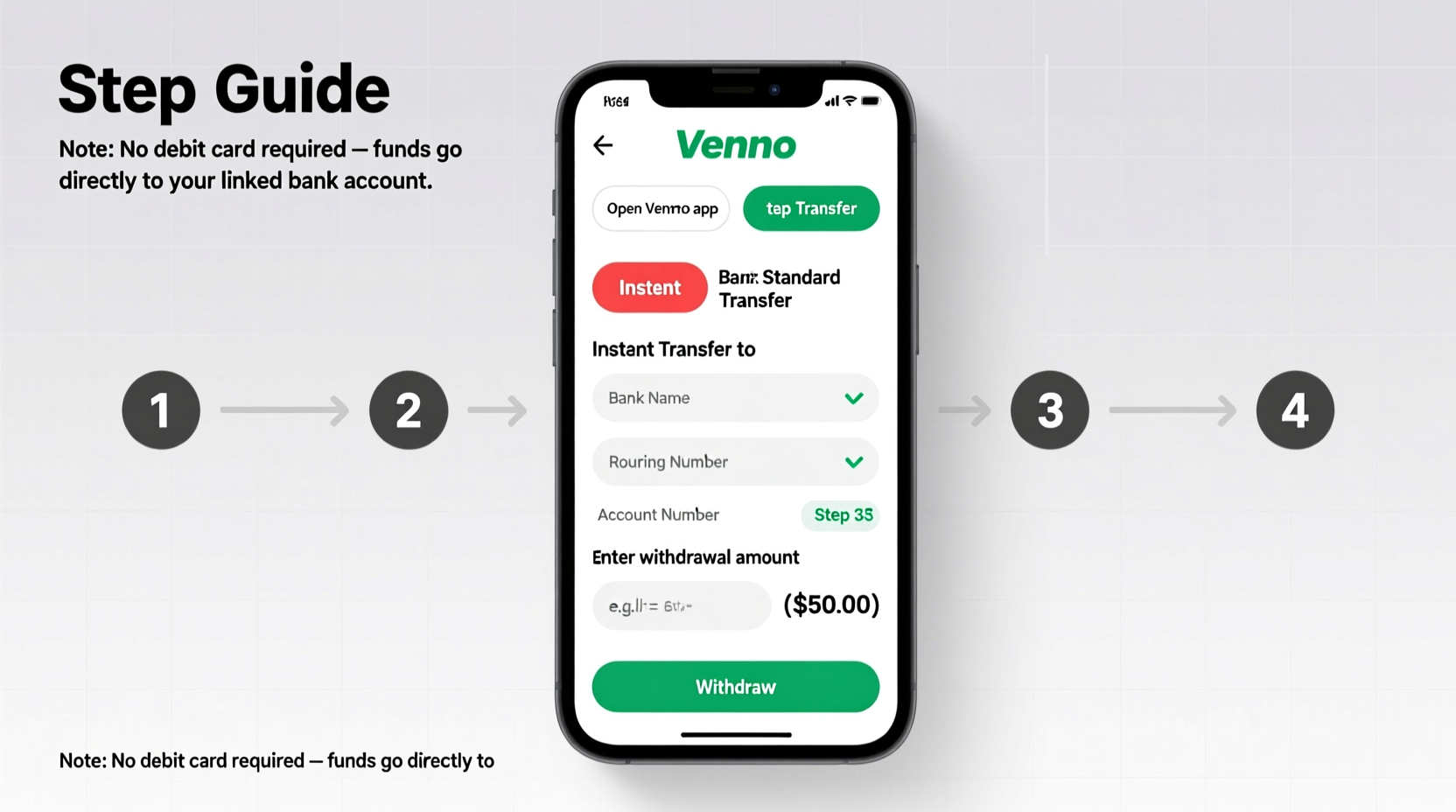

Step-by-Step: Withdrawing Funds via Bank Transfer

The most straightforward way to get cash from Venmo without a debit card is transferring to your bank and then withdrawing physically. Here’s how:

- Open the Venmo app and log in.

- Navigate to the “Balance” section on your home screen.

- Select “Transfer to Bank.”

- Choose either “Instant” (fee applies) or “Standard” (free).

- Enter the amount you wish to transfer.

- Confirm the transaction with your PIN, biometric authentication, or two-factor code.

Once processed, the funds will appear in your external bank account. From there, visit an ATM affiliated with your bank, insert your bank-issued debit card, and withdraw cash. Alternatively, request a withdrawal over the counter at a local branch.

This method works regardless of whether you have the Venmo card. It leverages your existing banking infrastructure, making it both safe and universally accessible.

Using Third-Party Apps as Intermediaries

If you don’t want to wait for a bank transfer or lack immediate access to a traditional bank, consider routing funds through compatible financial apps. Services like PayPal, Cash App, or even certain neobanks allow indirect movement of funds.

For example:

- Add the same bank account used in Venmo to Cash App.

- Transfer from Venmo to your bank (standard or instant).

- Log into Cash App and link the incoming deposit.

- Use Cash App’s own debit card—or its network of ATMs—to withdraw cash.

This workaround is useful if you already use multiple fintech platforms and want flexibility. However, avoid unnecessary fees by planning transfers during off-peak hours and choosing free withdrawal locations when possible.

Do’s and Don’ts When Bypassing the Venmo Debit Card

| Do’s | Don’ts |

|---|---|

| Link a reliable, FDIC-insured bank account for transfers. | Assume all transfers are instant—standard ones take days. |

| Monitor transfer fees, especially for instant options. | Forget to confirm ownership of linked accounts to prevent delays. |

| Use your bank’s in-network ATMs to avoid withdrawal fees. | Share login details with third-party services claiming faster access. |

| Keep transaction history for tax or record-keeping purposes. | Rely solely on unverified peer-to-peer cashout schemes. |

Real-World Example: Freelancer Accesses Earnings Without a Card

Jamal, a freelance graphic designer based in Atlanta, receives client payments through Venmo. He doesn’t use the Venmo debit card due to spending discipline concerns but needs weekly access to cash for groceries and transportation.

His routine: Every Friday, he initiates a $200 instant transfer (costing $3.50) to his Ally Bank account. Within ten minutes, the funds arrive. He then uses Ally’s mobile app to generate a temporary debit card number linked to his account, which he adds to Google Pay. At a nearby grocery store with a cash-back option, he purchases a $5 item and requests $195 in cash back—effectively withdrawing his full amount without visiting an ATM or paying extra fees.

This strategy blends speed, security, and cost-efficiency—proving that with smart planning, a Venmo debit card isn’t essential.

“Digital wallets have evolved so much that consumers no longer need a single issuer’s card to access their money. Interoperability between platforms gives users real control.” — Lena Park, Fintech Analyst at Financial Innovation Now

Frequently Asked Questions

Can I withdraw cash directly from a Venmo balance at an ATM?

No, unless you have the Venmo debit card, you cannot withdraw directly from an ATM using only your Venmo account. You must first transfer funds to a linked bank account and use a different debit card for withdrawal.

Are there any hidden fees when transferring from Venmo without a card?

Venmo does not charge for standard bank transfers. However, instant transfers incur a 1.75% fee. Additionally, your receiving bank or ATM operator might charge fees for withdrawals, especially outside their network.

How long does it take to get my money without a Venmo card?

Standard transfers take 1–3 business days. Instant transfers typically complete within 30 minutes, often in under 5 minutes. Weekends and holidays may delay processing times.

Alternative Tactics for Immediate Cash Access

In urgent situations where even a few hours feels too long, consider these alternatives:

- P2P Cash Pickup: Send money via Venmo to a trusted friend or family member who can withdraw it and give you cash in person.

- Digital Wallet Swaps: Use platforms like Zelle or PayPal (if linked to the same bank) to pull in transferred funds quickly after a Venmo-to-bank move.

- Retail Cashback: After transferring to your bank, make a small purchase at a supermarket or pharmacy that offers cashback—no additional fees, and immediate liquidity.

Final Thoughts: Independence from One Platform

While the Venmo debit card offers convenience, relying on it isn’t necessary—or always wise. By understanding how to leverage bank transfers, third-party apps, and smart retail tactics, you retain full control over your finances without being locked into a single ecosystem.

The key lies in planning: anticipate your cash needs, time your transfers wisely, and use low-cost withdrawal points. Over time, this approach reduces dependency, minimizes fees, and strengthens your overall financial agility.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?