Access to immediate funding can be the difference between seizing an opportunity and missing out. Whether you're planning a major purchase like travel, medical procedures, or home improvements, Uplift offers point-of-sale installment financing that spreads payments over time—without interest if paid on schedule. Unlike traditional credit cards, Uplift provides fixed monthly payments and transparent terms, making budgeting easier. This guide walks you through the entire process of applying for Uplift financing, from checking eligibility to maximizing your approval odds and boosting your buying power.

Understanding Uplift Financing: How It Works

Uplift is a financial technology company that partners with merchants across industries—travel, healthcare, retail, and wellness—to offer instant financing at checkout. Instead of charging high-interest rates upfront, Uplift approves qualified applicants for installment plans typically ranging from 3 to 60 months. The key benefit? No surprise fees or compounding interest when you make payments on time.

Unlike a credit card, where your spending limit depends on your credit line, Uplift evaluates each transaction individually. This means even if you have a lower credit score, you may still qualify based on the specific purchase and provider partnership.

“Uplift’s model reduces friction at checkout while offering consumers predictable payments. It’s especially valuable for large one-time expenses.” — Sarah Nguyen, Fintech Analyst at Consumer Finance Insights

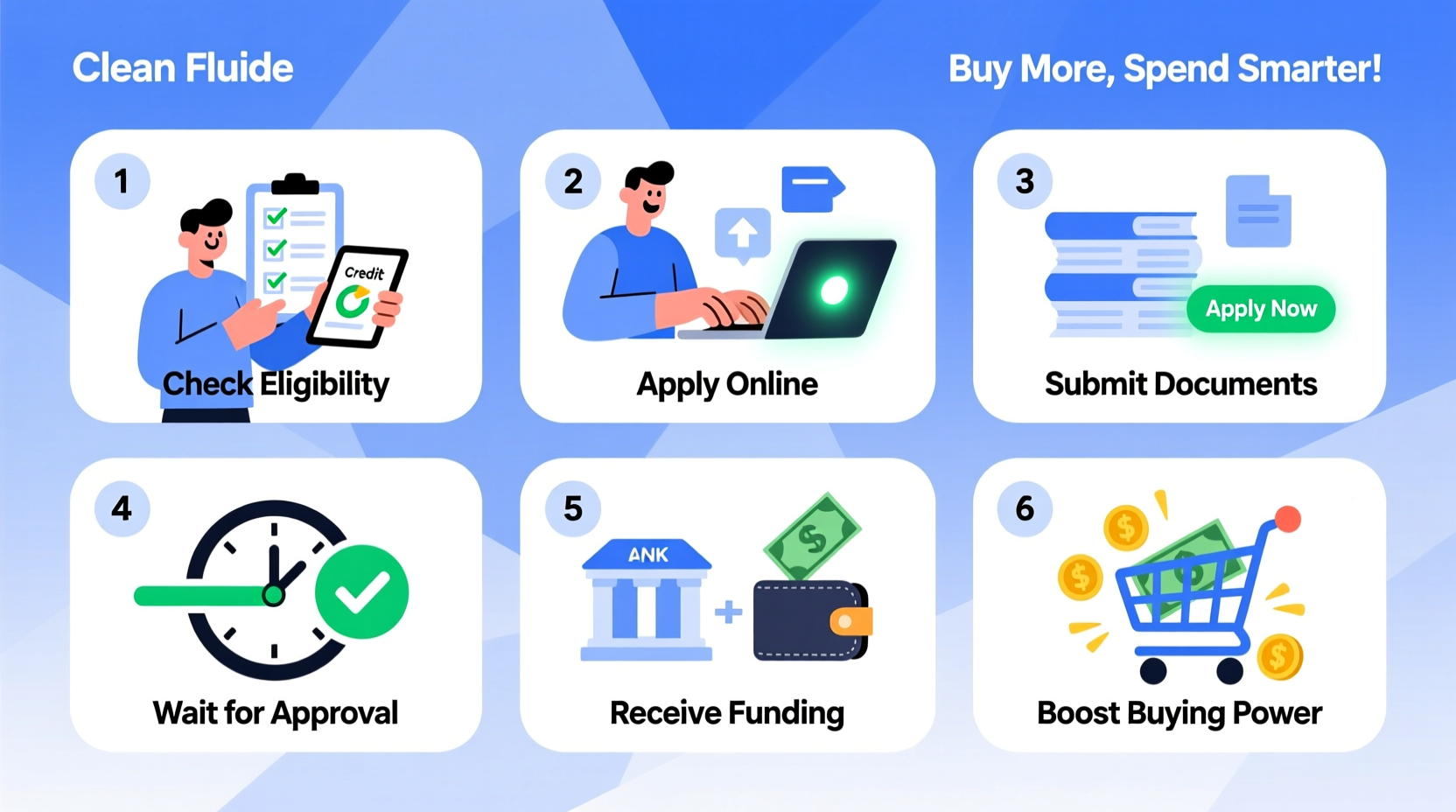

Step-by-Step Guide to Applying for Uplift Financing

The application process is fast, digital, and designed to integrate seamlessly into online or in-person purchases. Follow these steps to successfully apply and get approved.

- Choose a Merchant That Partners with Uplift

Select a service or product from a business that uses Uplift as a payment option. Popular partners include airlines (like Sun Country), elective surgery clinics, dental offices, and fitness equipment retailers. - Select Uplift at Checkout

During payment, look for “Monthly Payments” or “Pay Over Time” and select Uplift as your method. You’ll see available repayment terms (e.g., 12, 24, or 36 months). - Enter Personal Information

Provide your full name, date of birth, address, Social Security number (last four digits often sufficient), and income. This information is used for identity verification and underwriting. - Submit for Instant Decision

Uplift performs a soft or hard credit check depending on the merchant and loan amount. Most decisions are delivered within seconds. - Review Terms and Approve

If approved, review your APR (Annual Percentage Rate), monthly payment amount, and total cost. Confirm agreement to proceed. - Complete Purchase

Once confirmed, your purchase is processed, and repayment begins according to the schedule.

Eligibility Requirements and How to Improve Approval Odds

While Uplift doesn’t publish a minimum credit score, approvals typically favor applicants with fair to good credit (620+ FICO). However, other factors play a significant role:

- Stable income source

- Valid government ID

- U.S. residency

- Bank account in good standing

- Debt-to-income ratio below 40%

To improve your chances of approval:

- Ensure all personal details match your credit report exactly.

- Avoid applying during periods of recent job change or income fluctuation.

- Use your legal name and current address—discrepancies can trigger declines.

- Consider adding a co-applicant if permitted by the merchant.

| Factor | What Uplift Looks For | Tips to Strengthen Application |

|---|---|---|

| Credit History | No recent defaults, bankruptcies, or collections | Pay down revolving balances before applying |

| Income Verification | Consistent monthly earnings (W-2, self-employed, or retirement) | Have pay stubs or tax returns ready if requested |

| Employment Status | Active employment or reliable income stream | Wait until after probation period if newly hired |

| Loan Amount | Typically $100–$50,000 depending on provider | Start with smaller purchases to build history |

Real Example: Financing a Dental Procedure with Uplift

Jamal, a freelance graphic designer, needed $8,000 for a dental implant but didn’t want to drain his emergency fund. His dentist’s office offered Uplift financing through a partnered provider. At checkout, Jamal selected the 36-month plan, entered his information, and received approval within 45 seconds—despite having a 640 credit score.

His monthly payment was $256 at 14.9% APR. By setting up autopay, he qualified for a 0.5% rate reduction. More importantly, the structured payments allowed him to maintain cash flow while improving his oral health. After six months of on-time payments, he applied again for vision correction surgery—and was approved faster due to his positive repayment track record.

How Uplift Boosts Your Buying Power

Buying power isn’t just about income—it’s about access to capital when you need it. Uplift increases your effective purchasing ability in several ways:

- Liquidity Preservation: Keep cash reserves intact for emergencies instead of paying upfront.

- Predictable Budgeting: Fixed payments help avoid overspending or debt spirals.

- Access to Premium Services: Afford higher-quality care or products that were previously out of reach.

- No Prepayment Penalties: Pay off early to save on interest without penalties.

For example, a $3,000 vacation package becomes manageable at $108/month over 36 months rather than a single lump sum. This flexibility empowers consumers to make value-driven decisions rather than price-limited ones.

Checklist: Before You Apply for Uplift Financing

- ✅ Confirm the merchant accepts Uplift

- ✅ Know the total cost and financing range

- ✅ Gather personal details (SSN, address, income proof)

- ✅ Review your credit report for errors

- ✅ Decide on preferred repayment term

- ✅ Ensure email and phone are accessible for verification

Frequently Asked Questions

Does Uplift do a hard credit check?

It depends on the merchant and loan amount. Some transactions trigger a soft inquiry (no impact on credit), while others require a hard pull. You’ll be notified before any hard check occurs.

Can I use Uplift for multiple purchases?

Yes. Each application is evaluated independently. Having an existing Uplift loan doesn’t disqualify you, provided you’re in good standing.

What happens if I miss a payment?

Late fees may apply, and missed payments could lead to account suspension or collection actions. However, Uplift offers customer support to help adjust payment dates or set up hardship plans.

Maximize Your Financial Flexibility

Uplift financing bridges the gap between desire and affordability. With clear terms, quick approvals, and responsible lending practices, it enables smarter spending decisions without sacrificing quality. By understanding the application process, preparing your finances, and using the service strategically, you can unlock opportunities that once seemed out of reach.

Whether it’s enhancing your health, investing in comfort, or experiencing life-changing travel, Uplift gives you the tools to move forward—on your terms.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?