If your business has moved or you’ve changed your mailing address, one of the most critical steps to maintain IRS compliance is updating your Employer Identification Number (EIN) address. Failing to do so can result in missed tax notices, delayed refunds, or even penalties. The IRS requires accurate contact information for all entities holding an EIN, whether it’s a corporation, LLC, partnership, or sole proprietorship with employees.

While the process may seem straightforward, many business owners make avoidable errors—such as using outdated forms or sending documents to the wrong IRS office—that delay processing. This guide walks you through every necessary action to update your EIN address correctly, efficiently, and without unnecessary complications.

Why Updating Your EIN Address Matters

The IRS uses your EIN-associated address to send important communications, including audit notices, tax return transcripts, CP notices for discrepancies, and refund checks. If your address is incorrect, you might not receive these in time—or at all—jeopardizing your ability to respond and remain compliant.

Additionally, state agencies and financial institutions often cross-reference IRS records. An outdated address could lead to delays in loan processing, permit renewals, or sales tax filings. Keeping your IRS address current ensures seamless operations across multiple regulatory touchpoints.

“Accurate IRS registration details are foundational to responsible business ownership. A simple address change, when ignored, can snowball into compliance issues.” — Laura Simmons, Enrolled Agent & Tax Compliance Advisor

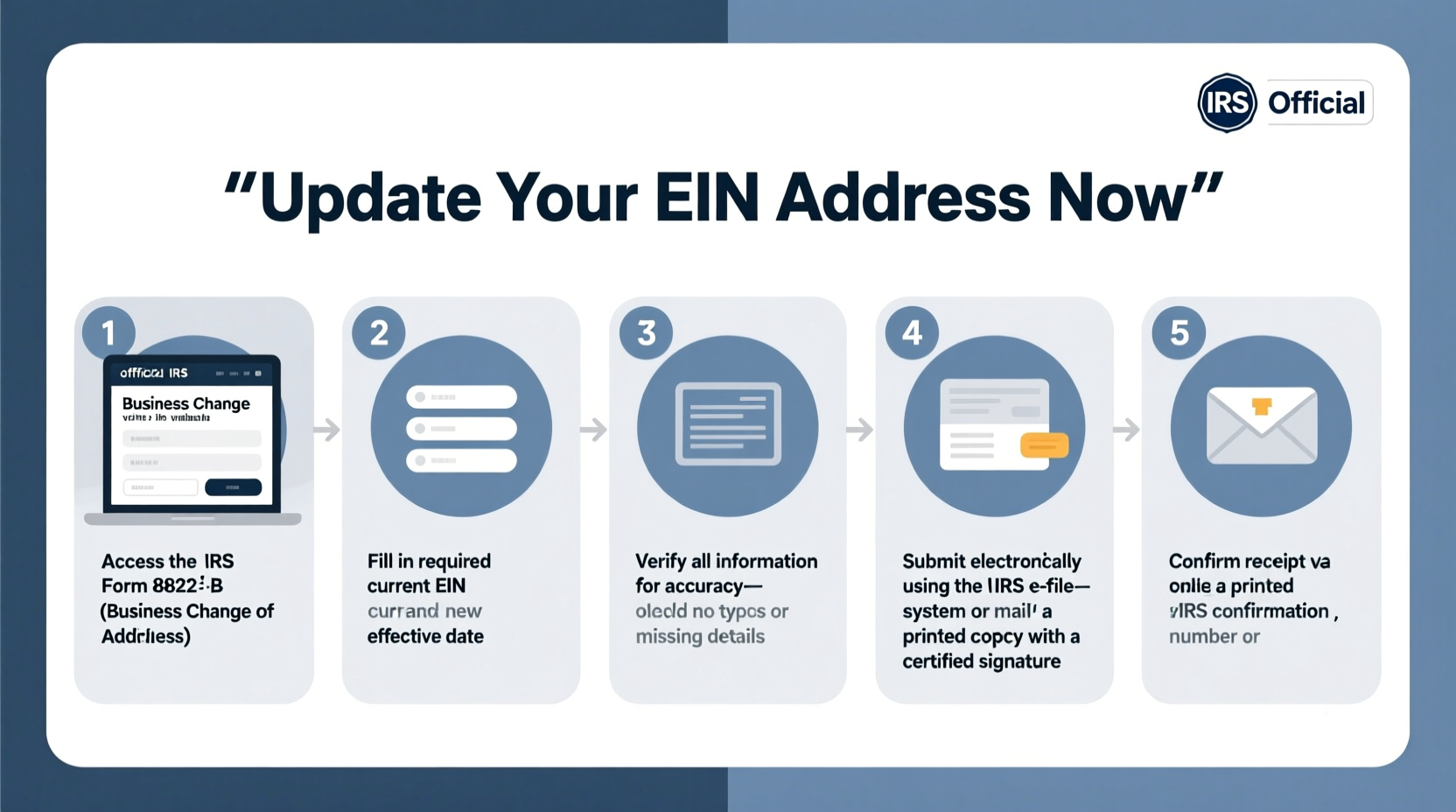

Step-by-Step Process to Update Your EIN Address

Follow this structured sequence to ensure your address update is processed without delays:

- Determine the type of address change: Are you updating your business’s mailing address, physical location, or both? The IRS primarily tracks your “principal business address” and “mailing address” separately if they differ.

- Gather required information: Have your EIN, legal business name, previous address, new address, and responsible party’s name ready.

- Choose the correct method: You can update your address via mail using Form 8822-B or, in limited cases, through direct notification with a timely filed tax return.

- Complete Form 8822-B: Fill out Form 8822-B, Change of Address or Responsible Party – Business, available on IRS.gov. Ensure accuracy in every field.

- Submit the form to the correct IRS center: Mailing addresses vary based on your state and whether you’re filing with or without a tax return. Double-check the current IRS submission chart.

- Keep a copy and track delivery: Retain a scanned copy and use certified mail with tracking to confirm receipt.

- Wait for confirmation: The IRS does not always send written acknowledgment, but processing typically takes 4–6 weeks.

Using Form 8822-B: Key Details and Common Errors

Form 8822-B is the standard tool for changing your business address with the IRS. While short—just one page—it demands precision. Below is a breakdown of essential fields and pitfalls to avoid:

| Field | What to Enter | Common Mistake |

|---|---|---|

| Business Name | Exact legal name as registered with IRS | Using a DBA or trade name without including the legal entity name |

| EIN | Your nine-digit EIN (XX-XXXXXXX) | Transposing numbers or omitting the hyphen |

| Old Address | Current address on file | Leaving blank or entering an outdated prior address |

| New Address | Full updated mailing and/or principal address | Abbreviating street names (use “Street” not “St”) or missing ZIP+4 |

| Responsible Party | Name and SSN/ITIN of individual listed on original EIN application | Entering a manager or employee not designated as responsible party |

One frequent error is attempting to update the responsible party and address simultaneously without proper documentation. Note: Changing the responsible party requires additional verification and cannot be done solely with Form 8822-B unless under specific conditions (e.g., death of the original party).

Mini Case Study: How a Delayed Address Update Cost a Small Business

Consider the case of “Summit Tech Solutions,” a small IT consulting firm based in Denver. In early 2023, the company relocated from a shared office space to a private suite but failed to update its IRS address. Later that year, the IRS sent a notice regarding a discrepancy in their quarterly payroll tax filing. The letter was returned as undeliverable.

Without realizing the issue, Summit continued operations. Six months later, they received a penalty notice for failure to respond—totaling $1,200. After contacting the IRS and proving the notice was never received due to the address mismatch, the penalty was eventually abated. However, the incident consumed over 10 hours of administrative time and caused significant stress.

This scenario underscores the importance of prompt address updates. A five-minute form submission could have prevented the entire ordeal.

Checklist: Ensuring a Smooth Address Update

- ☐ Confirm whether you need to update mailing, physical, or both addresses

- ☐ Locate your EIN and verify your legal business name

- ☐ Download the latest version of Form 8822-B from IRS.gov

- ☐ Complete all fields accurately, including responsible party details

- ☐ Verify the correct IRS mailing address based on your state and filing status

- ☐ Send via certified mail with return receipt requested

- ☐ Keep a digital and printed copy of the submitted form

- ☐ Update your address with state agencies, banks, and vendors simultaneously

Frequently Asked Questions

Can I update my EIN address online?

No, the IRS does not currently offer an online portal to change your business address. All updates must be submitted via mail using Form 8822-B or included on a timely filed tax return.

Do I need to update my EIN address if I only work from home?

Yes. Even if you operate as a sole proprietor from a home office, your EIN record should reflect your current mailing address. This ensures you receive any correspondence related to employment taxes or audits.

How long does it take the IRS to update my address?

Processing typically takes 4 to 6 weeks. During peak seasons (January–April), it may take longer. Use certified mail tracking to monitor delivery and follow up after six weeks if needed.

Final Tips for Long-Term Compliance

Updating your EIN address isn’t a one-time task. As your business evolves, make it a practice to review and verify your IRS registration details annually. Pair this check with your tax return preparation or fiscal year-end closeout.

If you’ve appointed a CPA or tax preparer, ensure they have access to your most recent information. Some professionals proactively submit address changes when filing returns, reducing redundancy.

Conclusion

Updating your EIN address with the IRS is a quick yet crucial responsibility of business ownership. By following the correct procedure—using Form 8822-B, mailing to the right IRS center, and maintaining records—you protect your business from communication gaps and compliance risks. Accuracy and timeliness are key.

Don’t wait until you miss an important notice. Take 15 minutes today to ensure your IRS records reflect your current address. Your future self—and your bottom line—will thank you.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?