Filling out IRS Form W-4 correctly is one of the most important steps you can take to ensure your tax obligations are met without surprises at tax time. For single filers, especially those with straightforward financial situations, the process can be simple—but only if you understand what each section means and how it affects your paycheck. An incorrect W-4 could lead to owing thousands in taxes or receiving a smaller-than-expected refund. This guide walks through every part of the form with clarity, precision, and real-world application so you can make informed decisions.

Why Your W-4 Matters More Than You Think

Your W-4 tells your employer how much federal income tax to withhold from your paycheck. While it may seem like a routine HR form, its impact is direct: too little withholding, and you might face a tax bill come April; too much, and you're giving the government an interest-free loan. The IRS redesigned the W-4 in 2020 to eliminate personal allowances and instead use a more transparent system based on credits, adjustments, and filing status.

As a single filer—someone who is unmarried, divorced, or legally separated—you typically don’t qualify for certain joint-filing benefits, but you also avoid some complexities that married couples face. That makes this version of the W-4 simpler, though not risk-free. Missteps still happen, especially when people skip sections or misunderstand their eligibility for tax credits.

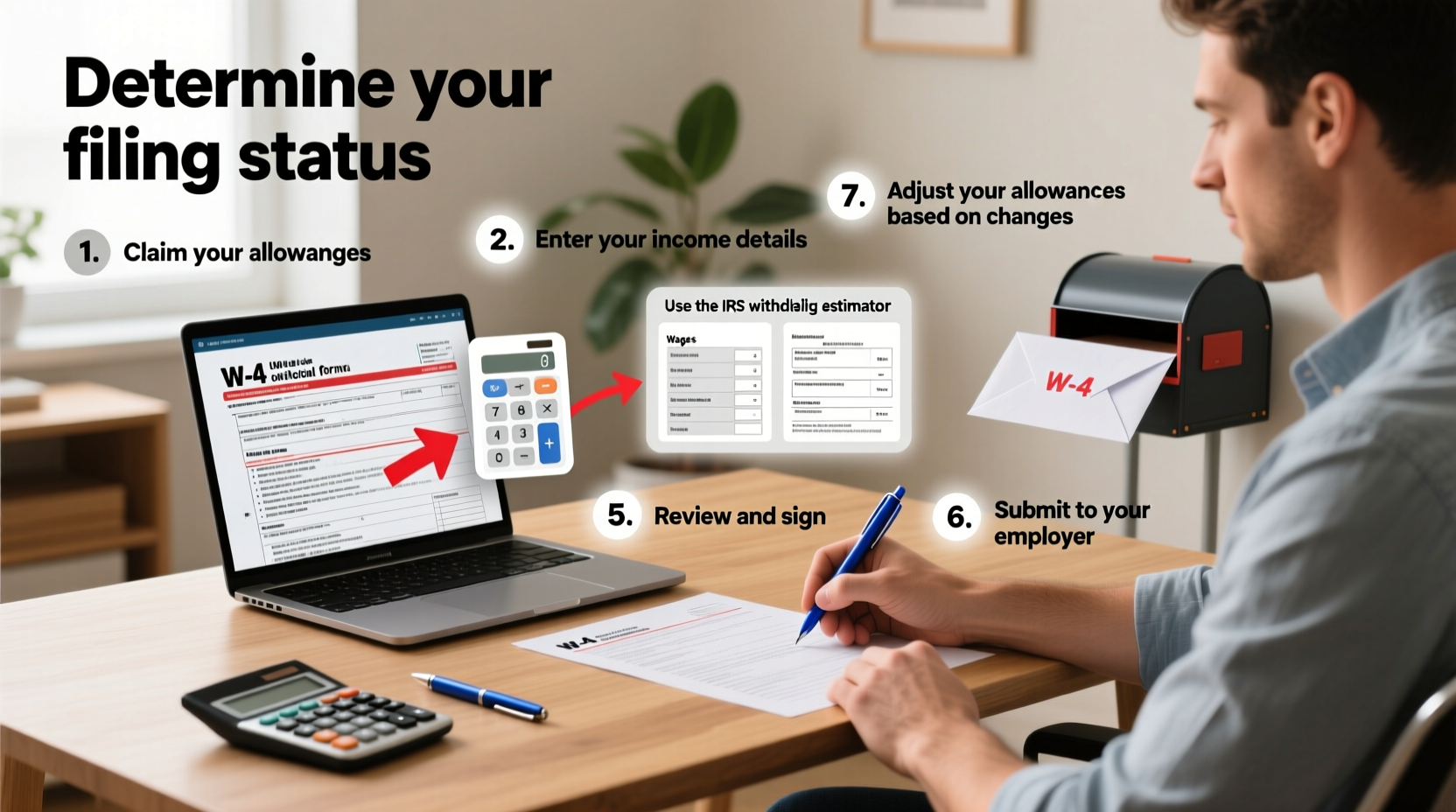

Step-by-Step Guide to Completing Each Section

The current W-4 has five steps. Not all apply to everyone, but understanding each ensures accuracy. Follow these instructions carefully.

Step 1: Enter Personal Information

Provide your full name and Social Security number exactly as they appear on your Social Security card. Any mismatch here can trigger IRS alerts or processing delays. Also, confirm your address is up to date with your employer.

Step 2: Multiple Jobs or Spouse Works (Even If Single)

If you have more than one job at the same time—or if you work and also receive substantial income from gig platforms, freelance contracts, or side businesses—you should check this box. Even as a single filer, multiple sources of income increase your tax bracket risk.

The IRS recommends either:

- Using the Tax Withholding Estimator tool online, or

- Checking the box in Step 2 and letting your employer withhold extra from each job to cover combined tax liability.

Step 3: Claim Dependents (If Applicable)

Most single filers without children won't claim dependents. However, if you support a qualifying relative—like an aging parent, sibling, or cousin—you may be eligible for the Credit for Other Dependents ($500 per person).

To qualify, the dependent must meet IRS criteria:

- Be a U.S. citizen or resident alien

- Earn less than $4,700 in 2024

- Receive over half of their financial support from you

- Live with you for more than half the year (with exceptions)

If eligible, enter the credit amount here. The IRS provides a worksheet in Publication 15-T to calculate this precisely.

Step 4: Other Adjustments

This optional section allows you to fine-tune withholding based on other factors:

- Other Income (Not From Jobs): Report non-wage income such as interest, dividends, or retirement distributions expected during the year. If you expect $200+ monthly in taxable investment income, entering it here prevents underpayment penalties.

- Deductions: If you plan to itemize deductions or claim significant above-the-line deductions (e.g., student loan interest, IRA contributions), estimate them here. This reduces your taxable income and adjusts withholding accordingly.

- Extra Withholding: Want to pay more tax per paycheck? Maybe you anticipate a large tax bill due to capital gains or self-employment income. You can request an additional dollar amount withheld from each check (e.g., $50 extra per pay period).

Step 5: Sign and Date

No form is valid without your signature and the current date. Submit the completed W-4 to your employer’s payroll department. Keep a copy for your records.

Checklist: Final Review Before Submission

Before handing in your W-4, run through this checklist to avoid common errors:

- ✅ Name and SSN match Social Security card exactly

- ✅ Correctly addressed multiple job situation (if applicable)

- ✅ Claimed dependent credits only if qualified

- ✅ Included other income or deductions that affect tax liability

- ✅ Signed and dated the form

- ✅ Submitted updated W-4 after major life changes (new job, second income stream, etc.)

Common Mistakes Single Filers Make

Even seemingly minor oversights can lead to tax issues. Here are frequent pitfalls:

| Mistake | Consequence | Solution |

|---|---|---|

| Leaving Step 2 blank with multiple jobs | Under-withholding, potential tax debt | Check box or use IRS estimator |

| Claiming dependents incorrectly | Audit risk or disallowed credits | Verify relationship and support rules |

| Ignoring side gig income | Underpayment penalty | Add estimated tax via Step 4(c) |

| Never updating W-4 after job change | Withholding misalignment | Review W-4 annually or after income shifts |

Real Example: Sarah’s Smart Adjustment

Sarah, a 28-year-old graphic designer in Denver, works full-time at a marketing firm and freelances on weekends. Her main job pays $75,000/year, and she earns about $12,000 annually from freelance projects. Initially, she filled out her W-4 claiming only her primary job and didn’t account for freelance income.

At tax time, she owed $1,800 because no taxes were withheld on her side income. The following January, she revised her W-4: She checked Step 2 (multiple jobs) and added $100 extra withholding in Step 4(c). This adjustment brought her total withholding in line with her actual tax liability. By mid-year, she was on track for a small refund—exactly what she wanted.

“We see many young professionals overlook side income on their W-4. The key isn’t guessing—it’s adjusting proactively.” — James Lin, Enrolled Agent and Tax Educator

Frequently Asked Questions

Can I claim “exempt” on my W-4 as a single filer?

You can only claim exempt if you had no federal income tax liability last year and expect none this year. Most single filers with full-time jobs do not qualify. Claiming exempt when ineligible results in under-withholding and possible penalties.

How often should I update my W-4?

Review your W-4 annually or whenever there’s a major change: new job, second income source, marriage, divorce, or receipt of a large inheritance or bonus. Life events directly affect your tax picture.

Does filling out the W-4 affect my tax return?

The W-4 doesn’t change how much tax you ultimately owe—that’s determined by your income and deductions on Form 1040. However, it controls how much is taken from each paycheck. Accurate withholding helps you avoid owing money or getting a large refund you could’ve used earlier.

Take Control of Your Paycheck Today

Accurately completing your W-4 isn’t complicated once you understand the logic behind each section. As a single filer, you have the advantage of simplicity—but also the responsibility to ensure your withholding reflects your full financial reality. Whether you’re starting a new job, juggling gigs, or just reviewing your finances, now is the perfect time to double-check your W-4.

Use the IRS Tax Withholding Estimator, consult a tax professional if needed, and never assume last year’s settings still apply. A few minutes spent today can save hundreds—or even thousands—tomorrow.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?