Receiving your Green Dot card is the first step toward convenient, flexible banking. Whether you're using it for direct deposit, online shopping, or everyday purchases, activation is essential before you can start spending. The process is designed to be fast and user-friendly, but knowing exactly what to do—and what to avoid—can save time and prevent frustration. This comprehensive guide walks you through every method of activation, common pitfalls, and expert-backed tips to get your card working in minutes.

Why Activation Is Necessary

Green Dot cards are issued without pre-activation to protect against fraud and unauthorized use. When you receive your card, it’s essentially in “sleep mode” until verified by the rightful owner. Activation links your identity to the card, confirms delivery, and enables access to funds. Skipping or delaying activation means you won’t be able to make purchases, withdraw cash, or set up digital wallets like Apple Pay or Google Pay.

According to financial security experts, delayed activation is one of the top reasons for lost access during emergencies. \"Consumers often assume the card works out of the box,\" says Marcus Tran, a fintech advisor with over a decade of experience.

“Activating immediately upon receipt ensures uninterrupted access to your money, especially if you rely on direct deposit or government benefits.” — Marcus Tran, Fintech Security Consultant

Methods to Activate Your Green Dot Card

Green Dot offers three primary ways to activate your card: online, by phone, and via the mobile app. Each method is secure and takes less than five minutes when done correctly.

Option 1: Online Activation (Recommended)

- Visit the official Green Dot activation website at www.green.dot.com/activate.

- Enter your 16-digit card number located on the front of the card.

- Input the 3-digit CVV code on the back of the card.

- Provide your full name, date of birth, and the last four digits of your Social Security Number (SSN).

- Confirm your address and create a 4-digit PIN for ATM and debit purchases.

- Click “Activate Card” and wait for confirmation.

Option 2: Phone Activation

If you prefer speaking with a representative or don’t have immediate internet access, call the toll-free activation line printed on the sticker affixed to your card. As of 2024, the number is 1-866-795-7606.

- Call the number and follow the automated prompts.

- Select “Activate Card” from the menu options.

- Have your card number, CVV, SSN, and personal details ready.

- Listen for verbal confirmation once the process completes.

- Write down the reference number provided for your records.

Phone support is available 24/7, making it ideal for urgent situations. However, peak hours (early mornings and weekends) may result in longer hold times.

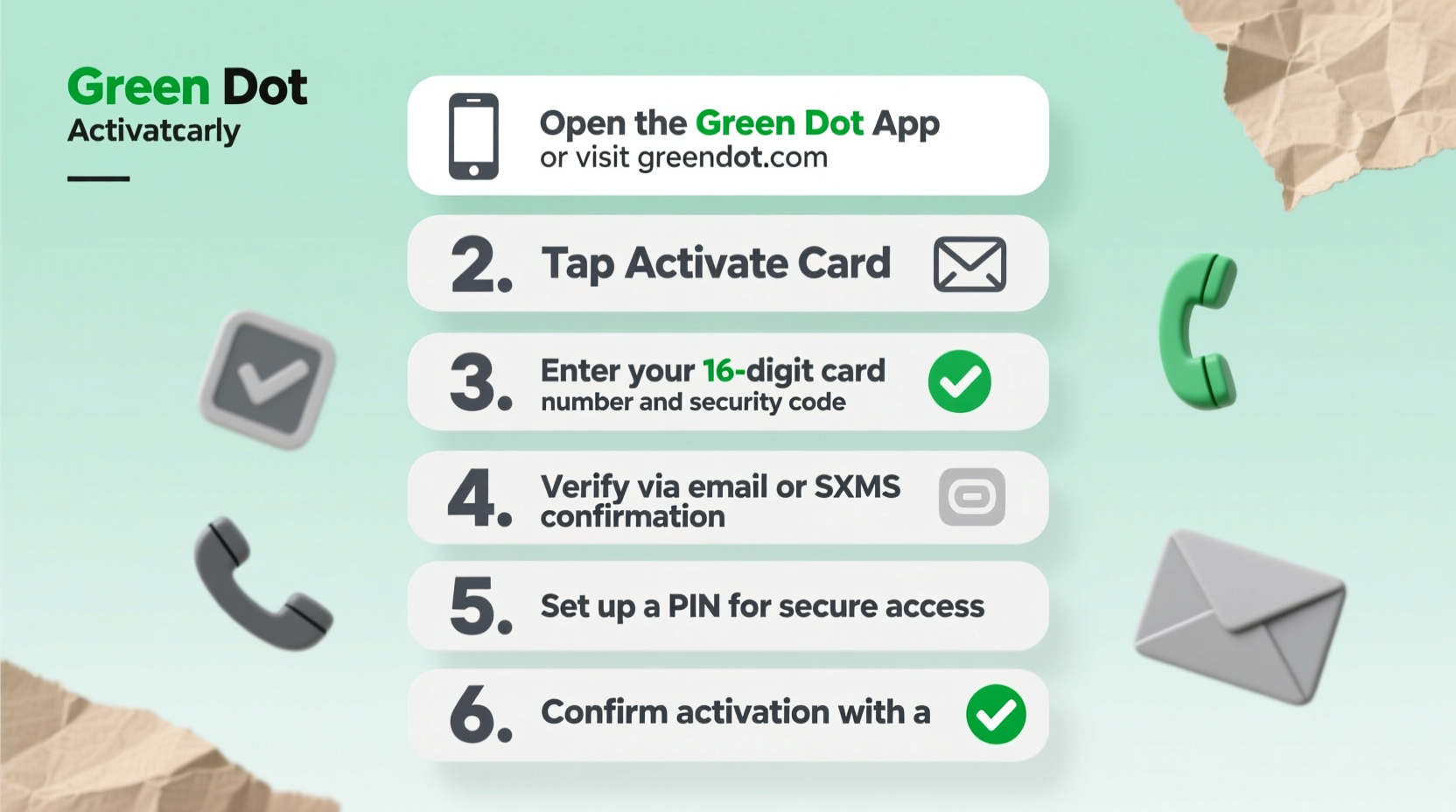

Option 3: Mobile App Activation

The Green Dot app (available on iOS and Android) allows full card management, including activation. This method is ideal for users who plan to manage their account digitally.

- Download “Green Dot” from the App Store or Google Play.

- Open the app and select “Activate a Card.”

- Use your phone’s camera to scan the card number or enter it manually.

- Verify your identity using the same personal information required online.

- Set your PIN and enable notifications for transaction alerts.

App activation often includes instant access to virtual card features, which can be used immediately for online purchases—even before the physical card arrives.

Common Activation Issues and How to Fix Them

While most activations go smoothly, some users encounter errors. Below are frequent problems and solutions:

| Issue | Possible Cause | Solution |

|---|---|---|

| “Card Not Found” Error | Incorrect card number entry or unregistered card | Double-check numbers; ensure the card has been properly registered with Green Dot |

| “Identity Verification Failed” | Mismatched personal info or outdated records | Verify spelling, SSN, and DOB; contact customer service if discrepancies persist |

| Activation Stalls Mid-Process | Internet disruption or server timeout | Restart the process on a stable connection; clear browser cache if using web version |

| PIN Not Accepted After Setup | System delay or incorrect input | Wait 10 minutes and retry; reset PIN via app if needed |

Real-Life Example: Quick Activation Saves the Day

Jamal, a rideshare driver in Phoenix, received his Green Dot card on a Tuesday but didn’t activate it until Friday morning. That afternoon, his usual bank account was frozen due to suspected fraud. With no access to cash or other cards, he remembered his Green Dot. He activated it via the mobile app in under four minutes, linked it to Google Pay, and continued accepting fares without interruption. By Sunday, he had deposited over $400 in earnings directly to the card.

This scenario highlights how timely activation isn't just convenient—it can be financially critical. Having a backup payment method ready ensures resilience in unpredictable situations.

Activation Checklist

Before starting, gather the following items to ensure a smooth process:

- ✅ Your Green Dot card (uncut and undamaged)

- ✅ A working smartphone, tablet, or computer with internet access

- ✅ Your Social Security Number (or ITIN, if applicable)

- ✅ Government-issued ID (for verification, if prompted)

- ✅ Pen and paper (to record confirmation number)

- ✅ Quiet environment (if calling customer service)

Having these ready reduces interruptions and increases success rates, especially during phone or app-based activation.

Frequently Asked Questions

Can I use my Green Dot card immediately after activation?

Yes, in most cases. Physical cards can be used instantly for purchases and ATM withdrawals once activated. Virtual card numbers generated in the app are available immediately for online transactions.

What if I lose my card before activating it?

Contact Green Dot customer service right away at 1-866-795-7597. They will cancel the unactivated card and issue a replacement. Note that a fee may apply unless the card was reported stolen.

Do I need to reload money onto the card after activation?

Not necessarily. Activation doesn’t add funds—it only enables usage. You’ll need to transfer money via direct deposit, bank transfer, cash reloads at retail locations, or mobile check deposit through the app.

Final Tips for Smooth Activation and Ongoing Use

Activation is just the beginning. To get the most from your Green Dot card, consider enabling multi-factor authentication, setting up low-balance alerts, and registering for early direct deposit (available up to two days faster). Also, review any monthly fees or usage limits associated with your specific card type—some versions offer free ATM access or higher spending caps.

Avoid sharing your PIN or activation details with anyone, even if they claim to be from Green Dot. Legitimate representatives will never ask for your full SSN or password over email or text.

Get Started Today

Your Green Dot card is more than a prepaid solution—it's a tool for financial independence, budgeting control, and seamless transactions. By activating it promptly and securely, you unlock immediate access to your money and open doors to digital banking convenience. Whether you choose online, phone, or app activation, the process is designed to be straightforward and efficient. Don’t let your card sit unused in a drawer. Take action now, complete activation in minutes, and start managing your finances with confidence.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?