Closing your Experian account may be necessary for various reasons—perhaps you no longer need credit monitoring, you're consolidating services, or you're concerned about data privacy. Whatever the reason, it's important to close your account properly to protect your personal information and avoid unintended charges. Unlike some platforms, Experian doesn’t offer a one-click cancellation through its online portal, which can make the process confusing. This guide walks you through each stage with clarity, ensuring your account is terminated securely and completely.

Why Closing Your Experian Account Requires Care

Experian is one of the three major credit bureaus in the United States, offering services ranging from free credit reports to premium identity protection and credit monitoring subscriptions. While these tools are valuable, they often come with recurring billing if you're on a trial or paid plan. Failing to cancel correctly could result in automatic renewals, unexpected charges, or lingering access to your financial data.

Moreover, because Experian handles sensitive personal information—including your Social Security number, credit history, and payment details—it’s crucial to ensure that your data is handled appropriately during closure. A rushed or incomplete cancellation might leave your information vulnerable or create gaps in your digital footprint cleanup.

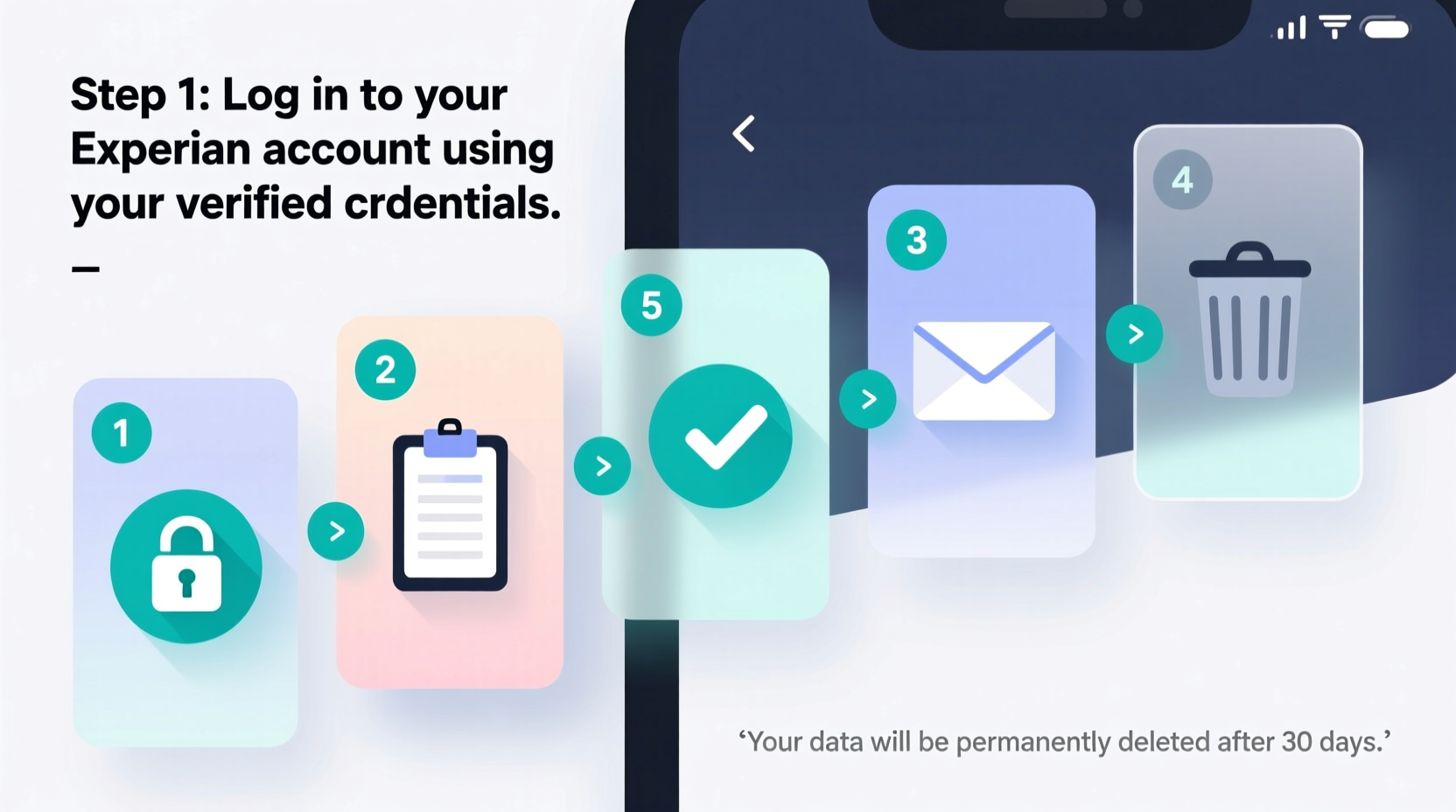

Step-by-Step Process to Close Your Experian Account

The process requires attention to detail. Follow these steps in order to ensure a smooth and secure closure.

- Review Your Current Subscription: Log into your Experian account at experian.com. Navigate to your account settings or subscription page to confirm whether you’re on a free plan, trial, or paid membership. Note the renewal date and pricing.

- Cancel Any Active Services: If you’re enrolled in a paid plan like IdentityWorks or CreditWorks, you must cancel before terminating the account. These services auto-renew unless canceled at least three days before the next billing cycle.

- Contact Customer Support: Since Experian does not allow self-service cancellation online, you must call their customer service line at 1-888-397-3742. Be ready with your account information, including your full name, address, and the last four digits of your Social Security number.

- Request Full Account Closure: Clearly state that you want to close your account permanently—not just pause or suspend it. Ask the representative to confirm in writing (via email) that the account has been closed.

- Remove Payment Methods: After cancellation, go back to your account (if still accessible) and delete any saved credit cards or bank accounts to prevent future use.

- Clear Browser Data: Log out of all devices and clear cookies or saved passwords associated with Experian to reduce risk of unauthorized access.

Timeline of What to Expect

| Step | Action | Time Required |

|---|---|---|

| 1 | Log in and review subscription | 5–10 minutes |

| 2 | Call customer service | 15–30 minutes (wait times vary) |

| 3 | Receive confirmation | Within 24–48 hours |

| 4 | Verify closure via email | Check inbox daily for 3 days |

Common Pitfalls to Avoid

- Assuming online cancellation is available: Many users expect to find a “Close Account” button in settings. It doesn’t exist—cancellation is phone-only.

- Failing to act before renewal: Paid plans renew automatically. Cancel at least three business days prior to avoid another charge.

- Not requesting written confirmation: Verbal approval isn’t enough. Always ask for an email confirming the closure.

- Leaving payment methods linked: Even after cancellation, stored cards could be charged erroneously or exploited if credentials are compromised.

Mini Case Study: Sarah Successfully Closes Her Trial Account

Sarah signed up for a 30-day free trial of Experian’s Premium Credit Monitoring service. She set a reminder two weeks before the trial ended but forgot to cancel. When she noticed a $21.99 charge on her credit card, she logged in to cancel—but found no option. Confused, she searched online and discovered she had to call customer support.

She called the toll-free number, waited 22 minutes, and explained her situation. The agent processed the cancellation and refunded her the first month’s fee as a courtesy. Sarah then removed her card from the account and requested written confirmation. Three days later, she received an email stating her account was fully closed. By acting quickly and following up, she avoided further charges and protected her data.

Expert Insight on Credit Bureau Account Management

“Consumers often overlook the importance of formally closing accounts with credit bureaus. Even inactive accounts can pose risks if payment methods remain stored or if phishing attempts mimic official communications.” — Linda Chavez, Consumer Privacy Advocate and Former FTC Advisor

Essential Checklist for Closing Your Experian Account

Use this checklist to ensure nothing is missed during the closure process:

- ✅ Log into your Experian account to verify subscription status

- ✅ Note your next billing date (if applicable)

- ✅ Prepare identification details (SSN last 4, address, email)

- ✅ Call Experian customer service at 1-888-397-3742

- ✅ Request permanent account closure (not suspension)

- ✅ Ask for email confirmation of closure

- ✅ Remove all saved payment methods

- ✅ Log out from all devices

- ✅ Clear browser cache and saved passwords

- ✅ Monitor your bank statement for 30 days post-cancellation

Do’s and Don’ts When Canceling Your Experian Account

| Do’s | Don’ts |

|---|---|

| Call customer service well before your renewal date | Wait until after being charged to cancel |

| Ask for a reference number and follow-up email | Accept verbal confirmation only |

| Delete stored credit card information | Leave payment methods saved in your profile |

| Keep records of all communication | Forget to document the agent’s name and call time |

| Check your email for closure confirmation | Assume the account is closed without proof |

Frequently Asked Questions

Can I close my Experian account online?

No, Experian does not allow account closure through its website or mobile app. You must contact customer service by phone at 1-888-397-3742 to request termination.

Will closing my Experian account affect my credit score?

No. Your Experian credit report and score will remain intact even after closing your account with the company. Your credit history is maintained independently of your subscription to monitoring services.

What happens to my data after I close my account?

Experian retains your personal information in accordance with federal regulations and its privacy policy. However, your access to tools like credit alerts, FICO scores, and identity monitoring will end immediately upon closure.

Final Steps and Peace of Mind

Closing your Experian account doesn’t have to be stressful. With preparation and persistence, you can terminate your relationship with the bureau securely and efficiently. The key is to take proactive steps—don’t wait for a surprise charge or data concern to prompt action. By following this guide, you protect your financial identity, avoid unnecessary fees, and maintain control over your digital presence.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?