Starting a 501(c)(3) nonprofit is a powerful way to turn a mission into action. Whether you're passionate about education, environmental conservation, or community development, forming a tax-exempt organization allows you to raise funds, apply for grants, and operate with public trust. However, the process involves legal, financial, and administrative steps that require careful planning. This guide walks you through each phase—strategically, legally, and sustainably—to ensure your nonprofit launches strong and compliant.

Define Your Mission and Conduct Feasibility Research

Every successful nonprofit begins with a clear purpose. Start by articulating your mission: What problem are you solving? Who will benefit? Why does this work matter now?

Before investing time and money, conduct due diligence. Research existing organizations in your field. Are there similar nonprofits already serving your target community? If so, consider collaboration instead of duplication. Use tools like GuideStar or ProPublica’s Nonprofit Explorer to analyze their finances, programs, and impact.

Ask yourself:

- Is there a demonstrated need for this service?

- Can I secure initial funding and volunteer support?

- Do I have access to advisors or mentors in the nonprofit sector?

Build a Strong Founding Team and Governance Structure

A nonprofit is not a solo venture. You’ll need a board of directors to provide oversight, strategic direction, and fiduciary responsibility. Most states require at least three board members for incorporation.

Select individuals who bring diverse skills—legal, financial, marketing, or subject-matter expertise—and who are genuinely committed to your cause. Avoid stacking the board with friends or family only; prioritize competence and alignment with your mission.

“Governance isn’t bureaucracy—it’s the backbone of accountability and sustainability.” — Dr. Laura Chen, Nonprofit Leadership Institute

Your board will be responsible for:

- Approving bylaws

- Hiring key staff (including the executive director)

- Overseeing financial health

- Ensuring compliance with state and federal laws

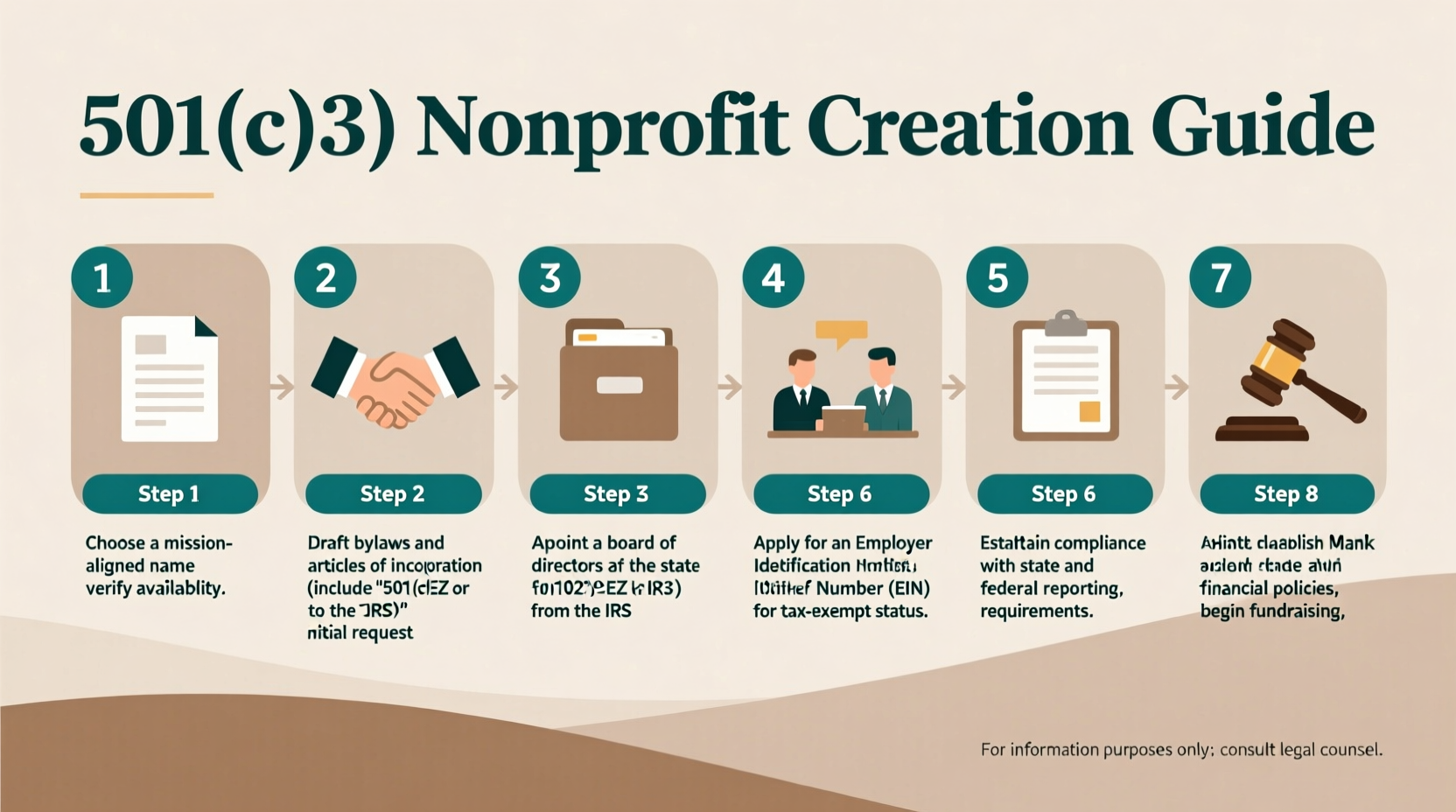

Incorporate Your Nonprofit at the State Level

To qualify for 501(c)(3) status, your organization must first be legally formed as a corporation under state law. This step creates a separate legal entity, protecting founders from personal liability.

Here’s how to incorporate:

- Choose a name: Ensure it’s unique and complies with your state’s naming rules. Most states prohibit names that imply government affiliation or mislead the public.

- File Articles of Incorporation: This document includes your nonprofit’s name, purpose, registered agent, and dissolution clause specifying that assets will go to another 501(c)(3) upon closure. Many states offer nonprofit-specific templates.

- Pay filing fees: These vary by state—typically between $50 and $150.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS. It’s free and required for banking, hiring, and tax filings.

After incorporation, hold your first board meeting to adopt bylaws, appoint officers, and record foundational decisions. Keep detailed minutes—these are essential for audits and grant applications.

Apply for Federal Tax Exemption (IRS Form 1023 or 1023-EZ)

This is the core of becoming a 501(c)(3). The IRS reviews your application to confirm your organization operates exclusively for charitable, educational, religious, or scientific purposes.

You’ll need to file either:

- Form 1023-EZ: For smaller nonprofits expecting less than $50,000 in annual revenue and total assets under $250,000. It’s streamlined and takes 2–4 weeks.

- Form 1023: For larger or more complex organizations. Requires detailed narratives about programs, budgets, and governance. Processing can take 3–6 months.

Required attachments include:

- Articles of Incorporation with 501(c)(3) purpose and dissolution clauses

- Bylaws

- Board member list

- Projected budget for the next three years

- Conflict of interest policy

Once approved, you’ll receive a Determination Letter confirming your tax-exempt status—a critical document for donors and funders.

Comply with Ongoing Legal and Financial Requirements

Tax exemption isn’t a one-time achievement. To remain in good standing, your nonprofit must meet ongoing obligations.

| Requirement | Action | Frequency |

|---|---|---|

| Annual IRS Filing | File Form 990, 990-EZ, or 990-N (e-Postcard) | Annually by the 15th day of the 5th month after fiscal year-end |

| State Charitable Registration | Register before soliciting donations in most states | Varies; often annually |

| Corporate Renewal | File annual report with Secretary of State | Annually |

| Financial Oversight | Maintain books, conduct audits if required | Ongoing |

Failure to file Form 990 for three consecutive years automatically revokes your 501(c)(3) status. The IRS publishes revoked organizations publicly, damaging credibility.

Mini Case Study: GreenRoots Youth Farm

Jamie Lopez wanted to teach urban teens sustainable agriculture. After researching existing programs, she identified a gap in hands-on farming education for high schoolers. She recruited two teachers and a local farmer to form her board, incorporated in Ohio, and filed Form 1023-EZ with a clear program description and budget. Within eight weeks, she received tax-exempt status. By registering early with the Ohio Attorney General’s Charitable Trusts Unit, she avoided penalties when launching a crowdfunding campaign. Three years later, GreenRoots serves over 120 students annually and partners with two city schools.

Essential Checklist for Launching Your 501(c)(3)

Use this checklist to stay on track:

- ✅ Define a clear, charitable mission

- ✅ Research demand and existing organizations

- ✅ Recruit a qualified, independent board

- ✅ Choose a compliant name and file Articles of Incorporation

- ✅ Obtain an EIN from the IRS

- ✅ Draft and adopt bylaws and conflict of interest policy

- ✅ Hold first board meeting and document decisions

- ✅ Prepare and submit IRS Form 1023 or 1023-EZ

- ✅ Register for charitable solicitations in applicable states

- ✅ Open a dedicated nonprofit bank account

- ✅ Begin tracking income, expenses, and donor records

- ✅ File annual Form 990 and renew state filings

Frequently Asked Questions

Can I pay myself running a nonprofit?

Yes. Founders and employees can receive reasonable compensation for services rendered. However, excessive pay or self-dealing transactions can jeopardize tax-exempt status or trigger IRS penalties.

How long does 501(c)(3) approval take?

The 1023-EZ typically takes 2–6 weeks. The full Form 1023 may take 3–8 months, especially if the IRS requests additional information.

Do I need a lawyer to start a nonprofit?

Not legally required, but highly recommended. An experienced nonprofit attorney can help structure your organization correctly, avoid common pitfalls, and ensure your documents meet IRS standards.

Conclusion: Turn Vision Into Impact

Creating a 501(c)(3) is more than paperwork—it’s the foundation of a lasting social enterprise. With a clear mission, disciplined execution, and commitment to transparency, your organization can attract supporters, deliver meaningful programs, and grow sustainably. The journey demands patience and precision, but the reward—lasting change in your community—is unmatched.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?