Dissolving a limited liability company (LLC) is more than just stopping operations. It’s a formal process that protects your personal liability, ensures compliance with state laws, and prevents ongoing fees or penalties. Whether your business has run its course, you’re pivoting to a new venture, or circumstances have changed, closing your LLC properly is essential. This guide walks you through each phase—strategically, legally, and efficiently—so you can close your business with confidence.

Understanding LLC Dissolution: Why It Matters

An LLC offers liability protection and operational flexibility, but those benefits don’t end automatically when business activity stops. If you fail to formally dissolve your LLC, you may still be liable for annual report fees, franchise taxes, or even penalties for non-compliance. In some states, inactive businesses are subject to administrative dissolution, which can complicate future filings or impact your creditworthiness.

Formal dissolution removes your obligation to file reports and pay recurring fees. It also signals to creditors, vendors, and government agencies that the business is no longer active. Most importantly, it helps ensure that all debts are settled and assets are distributed correctly, minimizing legal exposure.

“Properly dissolving an LLC isn’t just about checking boxes—it’s about protecting your financial and legal standing after the business ends.” — Laura Simmons, Business Law Attorney

Step-by-Step Timeline for Dissolving Your LLC

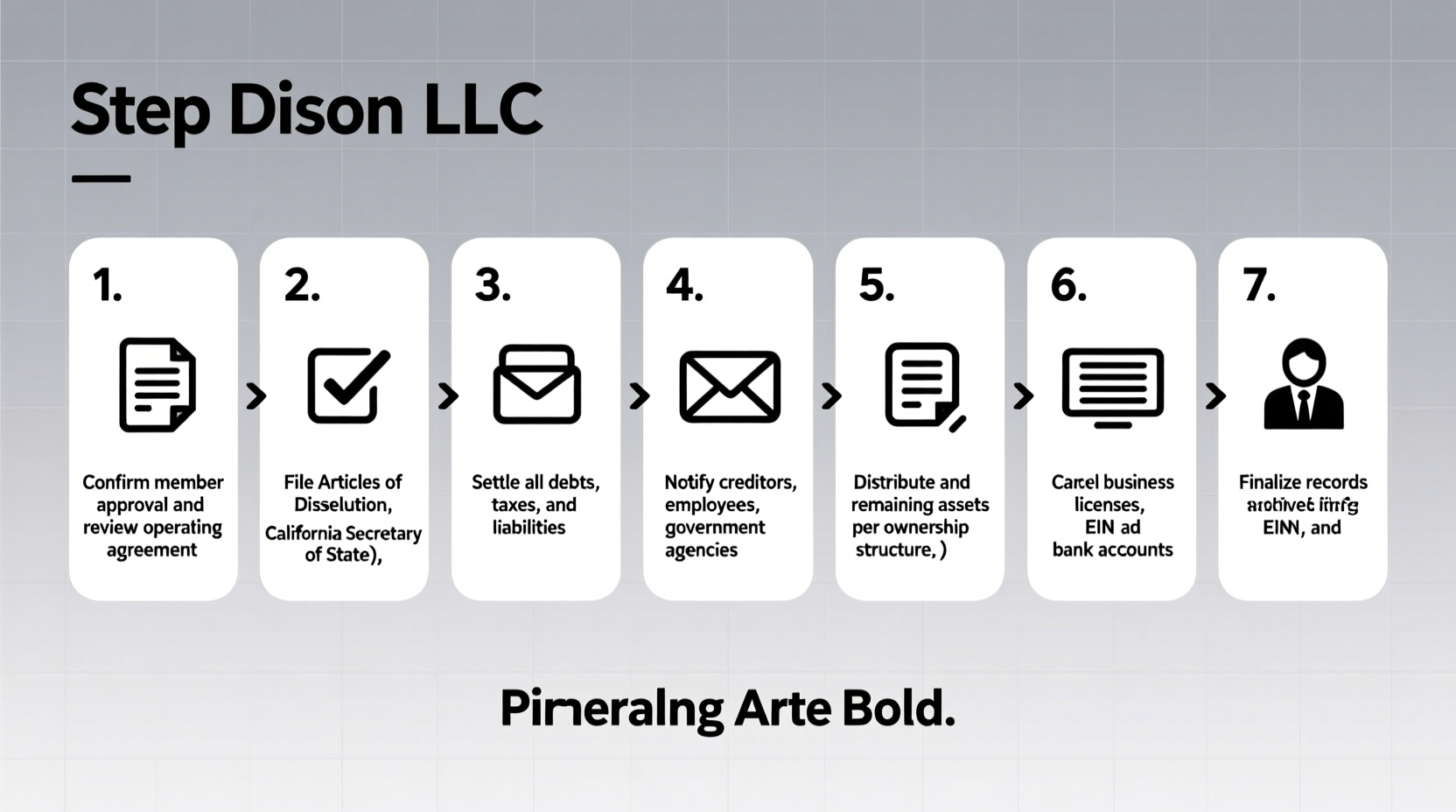

The dissolution process varies slightly by state, but the core steps remain consistent. Follow this timeline to navigate the process smoothly:

- Hold a Member Vote: Review your operating agreement to determine how dissolution decisions are made. Document the decision in writing.

- Settle Outstanding Debts: Pay off creditors or negotiate settlements. Keep records of all transactions.

- File Articles of Dissolution: Submit the required form to your Secretary of State. Some states require additional forms or fees.

- Close Business Tax Accounts: File final federal, state, and local tax returns. Cancel your EIN with the IRS if applicable.

- Notify Stakeholders: Inform customers, vendors, landlords, and employees about the closure.

- Distribute Remaining Assets: After debts are paid, distribute leftover assets to members according to ownership shares.

- Cancel Licenses and Permits: Close any professional licenses, DBAs, or local permits tied to the business.

Checklist: Key Actions Before Finalizing Dissolution

- Review your LLC’s operating agreement for dissolution procedures

- Obtain written consent from all members (if required)

- Pay all outstanding bills and settle liabilities

- Collect receivables from customers or clients

- Cancel business bank accounts and credit lines

- File final payroll and sales tax returns

- Submit Articles of Dissolution to your state

- Notify the IRS and state tax agency of closure

- Cancel your EIN or request a confirmation letter from the IRS

- Destroy or archive business records securely

Navigating State Requirements: A Comparison Table

Each state has specific rules for filing Articles of Dissolution. Below is a comparison of key details across five common jurisdictions:

| State | Filing Fee | Form Name | Processing Time | Online Filing? |

|---|---|---|---|---|

| California | $70 | Certificate of Surrender | 2–4 weeks | Yes |

| Texas | $40 | Certificate of Termination | 5–7 business days | Yes |

| New York | $60 | Articles of Dissolution | 3–6 weeks | No (mail only) |

| Florida | $35 | Articles of Dissolution | 2–3 weeks | Yes |

| Delaware | $200 | Certificate of Cancellation | 5–10 business days | Yes |

Note: Always verify current fees and procedures on your state’s Secretary of State website. Requirements can change without notice.

Avoiding Common Mistakes During LLC Dissolution

Even well-intentioned business owners make errors during dissolution. These missteps can lead to fines, lingering tax obligations, or personal liability.

- Failing to vote formally: Skipping member approval can invalidate the dissolution, especially if your operating agreement requires it.

- Ignoring tax filings: You must file a final tax return—even if the business earned no income during its last year.

- Not canceling the EIN: While the IRS doesn’t require cancellation, requesting a “closed” account letter provides proof the entity is inactive.

- Keeping business accounts open: Dormant bank accounts can incur fees or trigger reporting issues.

- Distributing assets too early: Paying out profits before settling debts can expose members to creditor claims.

Real-World Example: Closing a Small Consulting LLC

Sarah launched a marketing consulting LLC in Colorado three years ago. As client demand declined, she decided to close the business and transition to full-time employment. She followed these steps:

- Reviewed her operating agreement, which required majority member approval. Since she was the sole member, she drafted a resolution to dissolve.

- Paid off $8,000 in outstanding vendor invoices and collected $3,500 in pending client payments.

- Filed her final quarterly sales tax return and submitted a final federal tax return (Form 1065) marked “Final Return.”

- Submitted the Articles of Dissolution online through the Colorado Secretary of State portal ($10 fee).

- Called the IRS to notify them of closure and requested a letter confirming the EIN was no longer active.

- Closed her business bank account and canceled her fictitious name registration.

Within six weeks, Sarah received official confirmation of dissolution. She kept digital and printed copies of all documents for her records. By following the process methodically, she avoided late fees and maintained a clean business record.

Frequently Asked Questions

Can I reopen my LLC after dissolving it?

In most states, once an LLC is dissolved, it cannot be reopened. You would need to form a new LLC, obtain a new EIN, and re-register for taxes and licenses. Some states allow revival within a short window (e.g., 3–5 years), but this depends on jurisdiction and whether the entity was administratively dissolved.

Do I need a lawyer to dissolve my LLC?

While not legally required in most cases, consulting an attorney is advisable if your LLC has significant debt, multiple members, or pending litigation. Legal guidance helps ensure equitable asset distribution and protects against future liability claims.

What happens if I don’t file Articles of Dissolution?

Your LLC remains legally active. You’ll likely continue receiving annual report reminders and franchise tax bills. Failure to comply can result in administrative dissolution, fines, or loss of good standing, which may affect your ability to start new businesses in the state.

Final Steps and Moving Forward

Dissolving an LLC marks the end of one chapter—but done correctly, it sets the foundation for future ventures without lingering obligations. The process demands attention to detail, timely action, and clear communication with stakeholders. By following the steps outlined here, you protect your personal assets, maintain regulatory compliance, and close your business with integrity.

Remember, closure isn’t failure. It’s a strategic decision that reflects growth, adaptation, and responsibility. Whether you're stepping away from entrepreneurship or preparing for your next project, taking the time to dissolve your LLC properly demonstrates professionalism and foresight.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?