As tax season approaches, one of the most important documents you’ll need is your W-2 form. If your employer uses ADP as their payroll provider, you’re in luck—ADP offers a secure, user-friendly platform where employees can access, view, and download their W-2s online. However, first-time users or those unfamiliar with the system may find the process confusing. This guide walks you through every step clearly and efficiently, ensuring you get your W-2 without delays or frustration.

Why Accessing Your W-2 Through ADP Matters

Most employers using ADP provide electronic W-2 forms through the MyADP portal. This method is faster, more secure, and environmentally friendly compared to paper copies. The IRS permits electronic delivery of W-2s as long as employees consent and have reliable access. By retrieving your W-2 via ADP, you reduce the risk of lost mail, gain immediate access once it's posted, and can download a copy for personal records.

According to the IRS, employers must provide W-2 forms to employees by January 31st each year. With ADP, eligible employees typically gain access around this date, though timing depends on your employer’s payroll processing schedule.

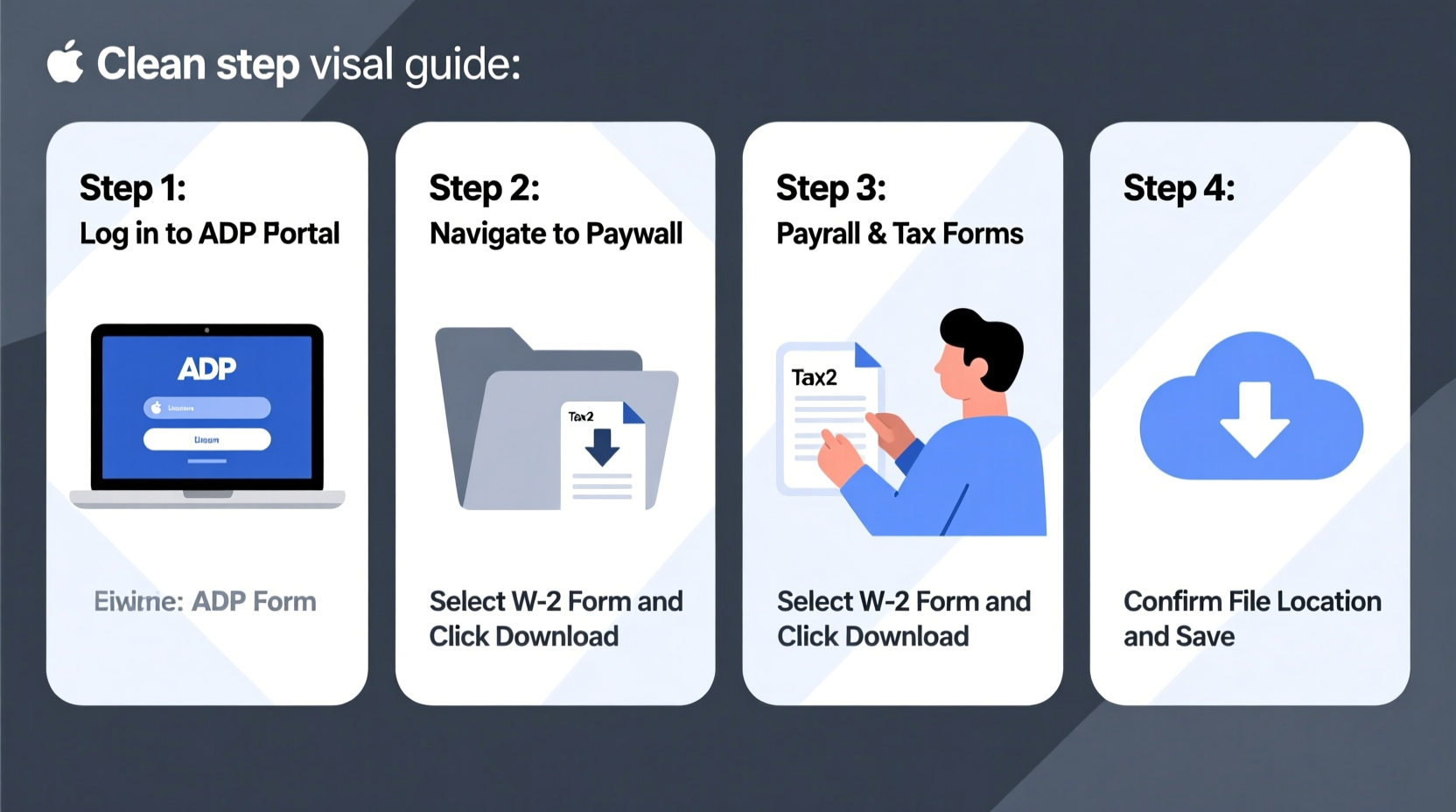

Step-by-Step: How to Log In and Download Your W-2

Follow this detailed sequence to successfully access your W-2 through ADP. Ensure you're using a secure internet connection and a compatible browser such as Chrome, Firefox, or Edge.

- Visit the ADP Login Portal: Go to https://portal.adp.com. This is the official login page for ADP clients.

- Select Your Login Type: Click “Log In” under the “Team Member” section if you're an employee. Some organizations may use single sign-on (SSO); check with HR if unsure.

- Enter Your Credentials: Input your username and password. These are typically provided during onboarding. If you’ve never logged in, you may need to register first.

- Complete Multi-Factor Authentication (MFA): ADP often requires MFA via text, email, or authenticator app. Follow the prompts to verify your identity.

- Navigate to Pay Statements: Once inside, go to the “Pay & Taxes” section. Look for “View W-2/W-2C” or similar wording.

- Select the Correct Tax Year: Choose the year you need. W-2s are archived annually, so older forms remain accessible.

- Download or Print: Click “Download” to save a PDF version. You can also print directly from your browser if needed.

Troubleshooting Common Access Issues

Even with clear instructions, some users encounter obstacles. Here are frequent problems and how to resolve them:

- Forgot Password: Use the “Forgot Password?” link on the login screen. You’ll receive reset instructions via your registered email or phone.

- No Account Setup: If you’ve never registered, click “Register Now” on the login page. You’ll need your ADP ID, which your employer should have provided.

- Employer Not Enrolled in eDelivery: Confirm with HR that your company allows electronic W-2s. Some organizations still issue paper forms only.

- W-2 Not Available Yet: Employers upload W-2s after finalizing year-end payroll. If it’s not visible by February 5th, contact your payroll department.

- Browser Compatibility: Clear your cache or try logging in from another device. Disable pop-up blockers when downloading.

“Electronic W-2s through platforms like ADP improve accuracy and accessibility, reducing last-minute tax filing stress.” — Laura Simmons, Certified Public Accountant and Payroll Consultant

Checklist: Preparing to Access Your W-2 on ADP

Before logging in, ensure you have everything ready to streamline the process:

- ✅ Active internet connection

- ✅ Computer or smartphone with updated browser

- ✅ ADP username and password (or registration details)

- ✅ Registered mobile number or email for MFA

- ✅ Employer’s ADP client name (if required during login)

- ✅ Adobe Reader or PDF viewer installed

Do’s and Don’ts When Handling Your Electronic W-2

| Do’s | Don’ts |

|---|---|

| Download and save your W-2 immediately upon availability | Leave your W-2 only on a public or shared device |

| Verify all information (name, SSN, wages, taxes) for accuracy | Assume automatic data transfer to tax software—always double-check |

| Contact HR or payroll if discrepancies are found | Ignore missing or incorrect W-2s; act promptly |

| Use strong passwords and enable two-factor authentication | Share your ADP login credentials with anyone |

Real Example: Maria Retrieves Her First W-2 Online

Maria, a customer service associate at a mid-sized logistics firm, had always received paper W-2s in past years. In January 2024, she received an email from her employer stating that W-2s would now be available exclusively through ADP. Initially hesitant, she followed the steps outlined in a company FAQ sheet. After registering with her ADP ID and verifying her phone number, she navigated to the “Pay & Taxes” tab, selected 2023, and downloaded her W-2 within minutes. She saved it to her personal folder and uploaded it directly into her tax preparation software. When a colleague expressed concern about not receiving a paper copy, Maria reminded her to check ADP—both retrieved their forms the same day, avoiding a potential filing delay.

Frequently Asked Questions

Can I get a paper W-2 if I prefer it over the electronic version?

Yes, but only if your employer supports paper distribution. Federal law allows employers to provide W-2s electronically unless the employee opts out. Contact your HR department early in January to request a physical copy if needed.

How long does ADP keep my past W-2s?

ADP typically retains W-2 forms for at least seven years. You can access previous years’ documents by selecting the appropriate tax year in the W-2 section of your account. For records older than seven years, contact your employer directly.

Is it safe to download my W-2 from ADP?

Yes. ADP uses industry-standard encryption and security protocols to protect sensitive payroll data. As long as you log in from a secure device and do not share your credentials, your information remains protected.

Final Steps and Best Practices

Once you’ve downloaded your W-2, take a moment to review it thoroughly. Confirm that your Social Security number, full name, total wages, federal and state tax withholdings, and employer details are correct. Any errors could delay your refund or trigger IRS inquiries. If something appears inaccurate, notify your payroll or HR department immediately—they can issue a corrected W-2 (Form W-2C).

Consider integrating your W-2 data into tax software like TurboTax, H&R Block, or Free File. Most platforms allow direct upload or manual entry using the values from your ADP-generated form. Keep your downloaded copy organized with other tax documents for at least three to seven years, as recommended by the IRS.

Take Action Today

Your W-2 is essential for accurate and timely tax filing. By understanding how to access it through ADP, you take control of your financial responsibilities with confidence. Whether you're a new employee navigating the system for the first time or a seasoned user ensuring smooth processing, following these steps ensures you're prepared. Don’t wait until the last minute—log in, download, verify, and store your W-2 securely. Share this guide with coworkers who might need help, and start the tax season stress-free.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?