A cashier’s check is one of the most trusted forms of payment for large transactions such as car purchases, security deposits, or real estate down payments. Unlike personal checks, it’s guaranteed by the issuing bank, making it nearly as good as cash. However, even minor errors in completing a cashier’s check can lead to rejection, delays, or even fraud exposure. Knowing how to fill one out correctly—and securely—is essential for both buyers and recipients.

This guide walks you through every critical step, from requesting the check to verifying its authenticity, ensuring your transaction remains smooth, legal, and protected against financial risk.

Why Accuracy and Security Matter with Cashier’s Checks

Cashier’s checks are often used when trust between parties is limited. Because the funds are drawn directly from the bank’s own account—not the customer’s—the recipient assumes the payment is secure. But this trust hinges on proper execution. A misspelled name, incorrect amount, or missing endorsement can invalidate the check. Worse, criminals frequently forge cashier’s checks to scam individuals, particularly in online transactions.

According to the U.S. Federal Trade Commission (FTC), thousands of consumers lose money each year to fake cashier’s check scams. Ensuring accuracy and understanding verification protocols protects not only your finances but also your credibility in high-stakes deals.

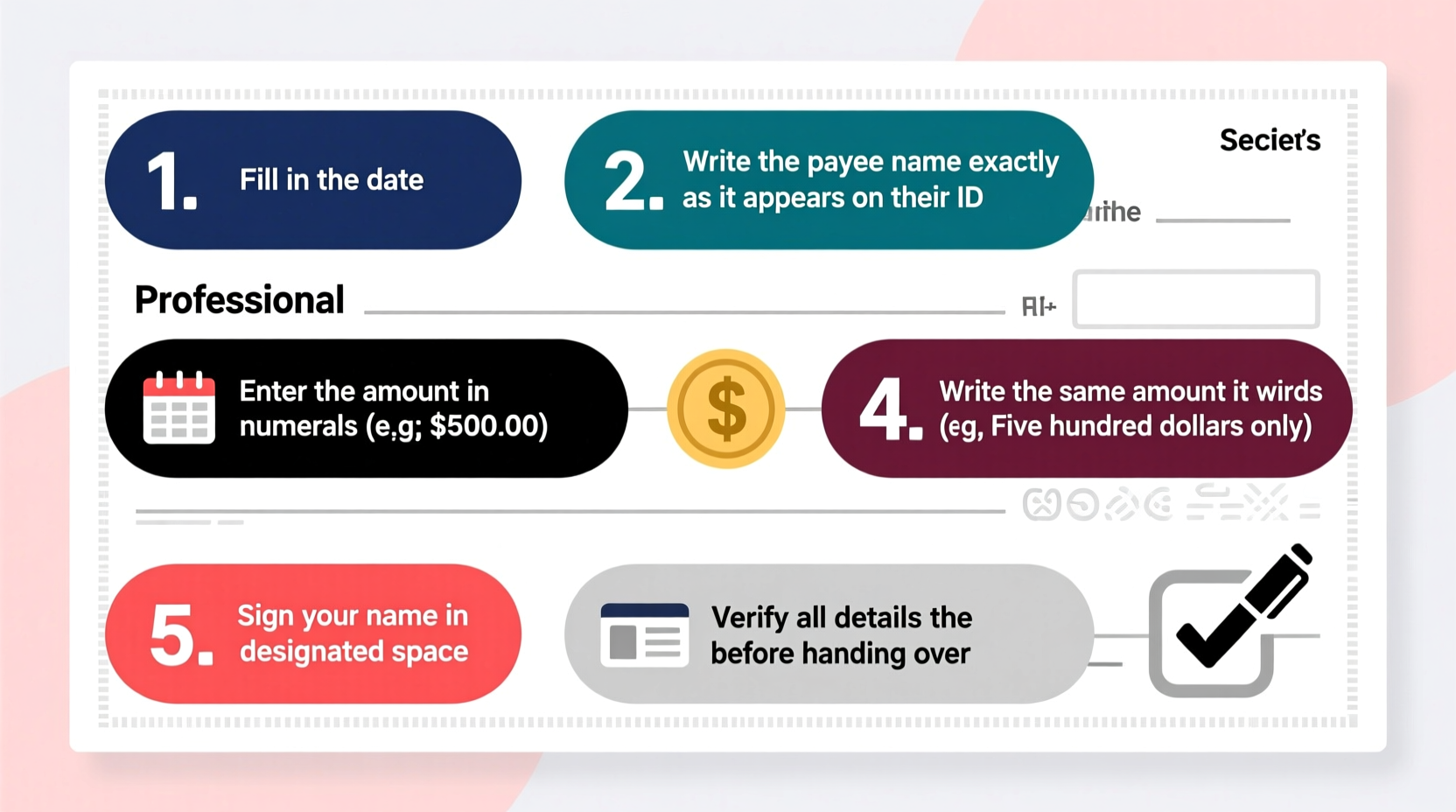

Step-by-Step Process: Requesting and Filling Out a Cashier’s Check

Unlike personal checks, you don’t physically \"fill out\" a cashier’s check yourself. Instead, the bank teller or representative prepares it under your direction. Your role is to provide accurate information and verify every detail before leaving the branch.

- Visit a Branch In Person: Most banks require you to appear in person to request a cashier’s check. Online issuance is rare due to fraud risks.

- Provide Valid ID: Bring government-issued photo identification (e.g., driver’s license, passport).

- Specify the Payee Name: Clearly state the full legal name of the individual or business receiving the check. Avoid abbreviations unless officially used.

- State the Exact Amount: Confirm whether the amount includes fees. Some banks charge $5–$15 per cashier’s check.

- Verify Funding Source: The bank will withdraw the full amount plus fee from your linked checking or savings account immediately.

- Review the Draft Before Printing: Double-check spelling, numbers, date, and payee before the teller finalizes the check.

- Obtain a Receipt: Always ask for a duplicate copy or transaction slip that includes the check number, amount, and issue date.

Key Elements of a Valid Cashier’s Check

Once issued, inspect the physical document carefully. A legitimate cashier’s check contains specific security and formatting features. Understanding these helps prevent acceptance of counterfeit versions.

| Element | Purpose | What to Look For |

|---|---|---|

| Bank Name & Logo | Authenticity verification | Official branding, no typos, printed—not handwritten |

| Payee Line | Identifies recipient | Matches recipient’s legal name exactly |

| Amount in Words and Numbers | Prevents tampering | Both fields must match; any discrepancy invalidates the check |

| Authorized Signature | Bank officer’s approval | Signature of bank employee, not yours |

| Watermarks & Security Strip | Fraud prevention | Holograms, microprinting, or UV-reactive ink (varies by bank) |

| Check Number & MICR Line | Tracking and processing | Magnetic ink at bottom with encoded routing and account data |

Common Mistakes to Avoid

- Using nicknames or informal names: “Mike” instead of “Michael Johnson” may cause rejection.

- Allowing blank spaces: Fraudsters can alter amounts if there’s room after the written amount.

- Signing the back prematurely: Endorsement should only happen upon receipt by the payee.

- Storing unused checks unsafely: Treat them like cash—keep in a locked place.

- Assuming instant clearance: While safer than personal checks, some banks hold cashier’s checks for up to two business days.

“Banks take responsibility for the validity of a cashier’s check, but the customer bears liability for providing incorrect details.” — Lisa Tran, Senior Compliance Officer at Midstate Financial Group

Real-World Example: The Rental Deposit That Was Rejected

Sophia needed to submit a $2,500 security deposit for her new apartment. She requested a cashier’s check made payable to “Apartment Living LLC,” but the leasing office was officially registered as “Apartment Living, Ltd.” When she handed over the check, the property manager refused it, citing a name mismatch. Sophia had to return to the bank, cancel the original check (for a $30 fee), and issue a corrected one—delaying her move-in by three days.

This scenario underscores the importance of confirming the recipient’s **exact legal name** before ordering the check. A quick phone call or email to the recipient could have prevented the setback.

Security Best Practices When Using Cashier’s Checks

Because cashier’s checks are high-value instruments, they attract scammers. Follow these steps to protect yourself:

- Never send to strangers: Only issue cashier’s checks to verified individuals or businesses.

- Keep proof of delivery: Save tracking numbers and delivery receipts.

- Report lost or stolen checks immediately: Contact your bank to initiate a stop payment or replacement process.

- Verify incoming checks: Call the issuing bank using a publicly listed number (not one provided by the sender) to confirm authenticity.

- Don’t fall for overpayment scams: If someone sends you a fake cashier’s check for more than owed and asks for a refund, it’s a scam.

FAQ: Common Questions About Cashier’s Checks

Can I get a cashier’s check online?

Most traditional banks do not allow full online issuance due to fraud concerns. Some credit unions and fintech platforms offer digital equivalents, but these are often e-checks, not true cashier’s checks. Always confirm the format and acceptability with the recipient.

What if I make a mistake on the check?

You cannot correct a cashier’s check once issued. You must cancel it and request a new one. This typically involves a cancellation fee ($15–$35) and waiting several weeks for the original check to clear before receiving a refund.

How long is a cashier’s check valid?

Most cashier’s checks do not expire, but banks may consider them “stale” after 90–180 days. Recipients should deposit them promptly. Some states impose dormancy rules after 3–5 years.

Final Checklist Before Issuing a Cashier’s Check

- ✅ Confirmed recipient’s full legal name

- ✅ Verified exact amount, including fees

- ✅ Provided valid photo ID at the bank

- ✅ Reviewed all printed details before finalizing

- ✅ Received a transaction receipt with check number

- ✅ Stored the check securely until delivery

- ✅ Used traceable delivery method if mailing

Conclusion: Confidence Through Precision

Filling out—or rather, properly requesting—a cashier’s check is a straightforward process when approached with attention to detail and caution. Whether you’re securing a lease, closing on a vehicle, or sending funds for a major purchase, the integrity of the transaction starts with accuracy. By following these guidelines, verifying recipient information, and safeguarding the instrument from fraud, you ensure your payment is accepted without delay or dispute.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?