Opening a bank account used to mean long lines, paper forms, and multiple trips to a branch. Today, most financial institutions allow you to open an account entirely online—in as little as 15 to 30 minutes. But speed shouldn’t come at the cost of security. Whether you're switching banks, starting your first account, or setting up a joint account, doing it right matters. This guide walks you through each stage with clarity, safety tips, and real-world insights so you can get started confidently.

Why Open a Bank Account Online?

Online banking has evolved beyond convenience—it’s now the standard for modern financial management. Digital-first banks offer competitive interest rates, no monthly fees, and tools like instant money transfers and mobile check deposits. According to the Federal Reserve, over 70% of U.S. adults have used online banking services in the past year. The shift reflects not just preference but necessity: faster access, better transparency, and stronger fraud protection than traditional models.

But not all online experiences are equal. Some platforms make setup easy; others leave users confused or exposed to phishing scams. Knowing the correct steps—and avoiding common pitfalls—ensures your personal and financial data stays protected while you gain full access to your new account.

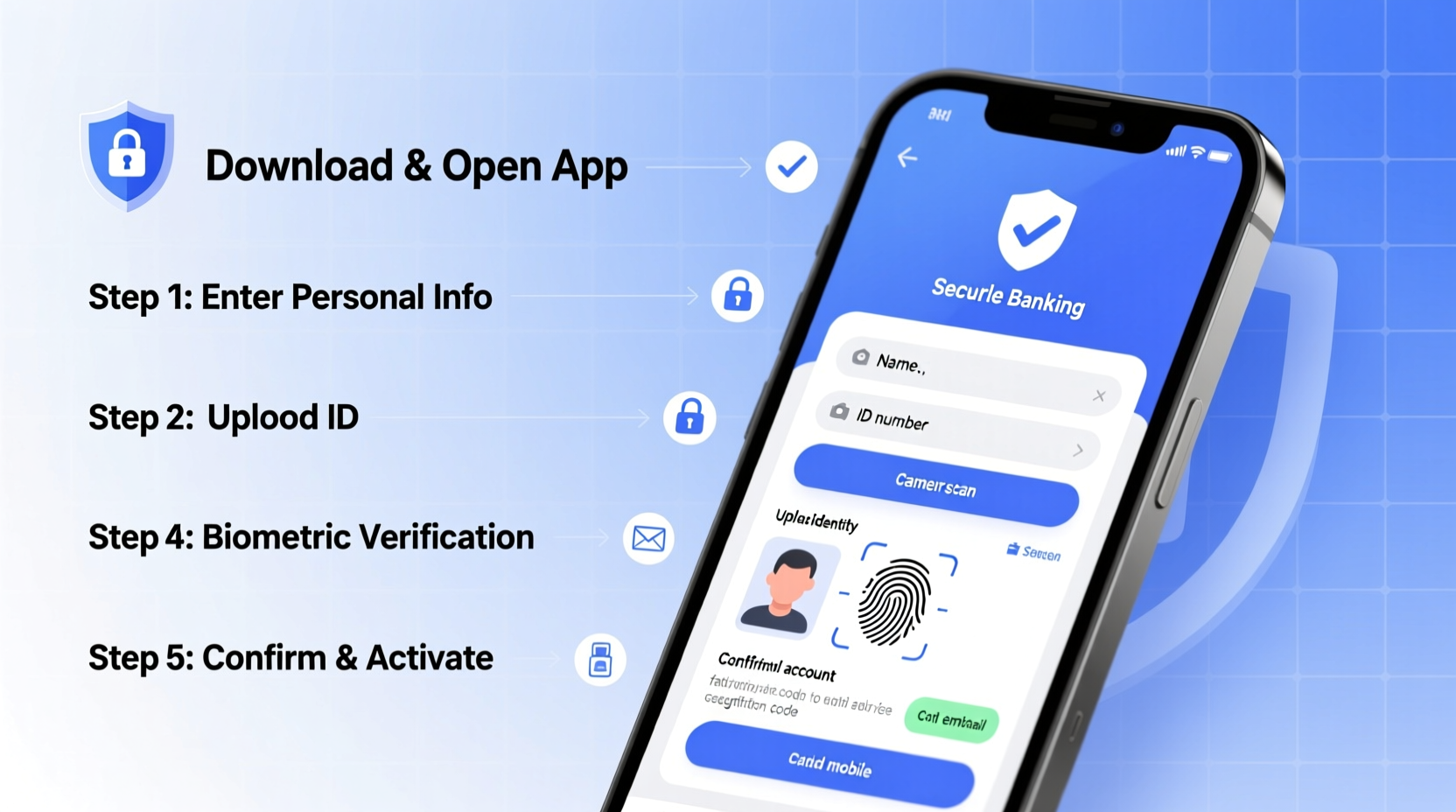

Step-by-Step Process to Open an Account Online

Follow this proven sequence to complete your application efficiently and securely. Most major banks and credit unions follow a similar flow, whether you're opening a checking, savings, or joint account.

- Choose the Right Bank or Credit Union

Select a federally insured institution (FDIC or NCUA). Look for features that match your needs: low fees, high APY on savings, ATM access, and mobile app ratings. - Gather Required Documents

You’ll need:- Government-issued photo ID (driver’s license, passport)

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Proof of address (utility bill, lease agreement, or recent bank statement)

- Email address and phone number

- Visit the Official Website

Type the bank’s URL directly into your browser—never click links from unsolicited emails. Verify the site uses HTTPS (look for the padlock icon). - Start the Application

Navigate to “Open an Account” or “Banking” section. Choose your account type (e.g., online savings, checking with debit card). - Fill Out Personal Information

Enter your legal name, date of birth, employment status, and contact details. Double-check spelling and accuracy. - Verify Your Identity

The bank will ask security questions based on your credit history or use document upload (photo of ID + selfie). Some use biometric verification via their mobile app. - Make an Initial Deposit

Transfer funds from an existing account using routing and account numbers, or link a debit card. Minimums vary—some digital banks require $0 to open. - Set Up Security Preferences

Create strong login credentials, enable two-factor authentication (2FA), and set up alerts for transactions. - Review and Submit

Read terms and conditions carefully. Confirm all information is correct before submitting. - Wait for Approval

Most decisions are instant. If additional verification is needed, the bank may contact you within 1–2 business days.

Security Best Practices During Setup

Your identity and financial data are valuable targets. Scammers often mimic legitimate bank websites or send fake approval emails. Protect yourself with these strategies:

- Use a private, secure internet connection—avoid public Wi-Fi when submitting sensitive data.

- Never share passwords, PINs, or one-time codes with anyone, including customer service reps who call you.

- Check the website URL closely. Fraudulent sites may use misspellings like “chase-bank-login.com” instead of “chase.com”.

- Enable multi-factor authentication immediately after account creation.

- Download the official bank app only from Apple App Store or Google Play—never third-party sources.

“Digital banking is safe when consumers take proactive steps. The biggest risks aren’t the systems—it’s user behavior.” — Lisa Tran, Cybersecurity Advisor at Financial Integrity Institute

What to Do After Opening Your Account

Approval is just the beginning. To maximize benefits and minimize risks, take these immediate actions:

Account Activation Checklist

- Activate your debit card through the mobile app or automated phone line

- Set up direct deposit if switching primary accounts

- Link external accounts for transfers (verify via micro-deposits if required)

- Customize transaction alerts (e.g., purchases over $50, login attempts)

- Save customer service number and fraud reporting line in your phone

Common Pitfalls and How to Avoid Them

Even experienced users make mistakes during online enrollment. Below is a comparison of typical errors versus best practices.

| Pitfall | Why It’s Risky | Smart Alternative |

|---|---|---|

| Using weak passwords like “123456” or your birthday | Easily guessed or cracked by bots | Use a password manager to generate and store complex 12-character passwords |

| Clicking email links to start application | Phishing sites can steal your SSN and ID info | Type the bank’s name directly into your browser |

| Skipping two-factor authentication | Single-layer login increases breach risk | Always enable 2FA via authenticator app or text (preferably app) |

| Leaving devices unlocked during application | Others may see or save your entered data | Close tabs and log out after finishing; clear browser cache if on shared devices |

Real Example: Maria’s Smooth Online Banking Transition

Maria, a freelance graphic designer in Austin, needed a new online checking account with no monthly fees and good mobile tools. She compared three neobanks and chose one with early direct deposit and cashback rewards. On a Sunday evening, she visited the official site using her home Wi-Fi, uploaded her driver’s license, answered identity questions, and deposited $100 via her old bank’s transfer feature. Within 10 minutes, her account was active. By Monday morning, she’d set up direct deposit from her clients’ payment platforms. No branch visit, no paperwork, and full control by day two.

Her key insight? “I almost clicked a Google ad that looked like the bank’s page—but the URL had extra letters. I typed it myself and saved my info from going to a scammer.”

Frequently Asked Questions

Can I open a bank account online without a Social Security Number?

Yes. Many banks accept an Individual Taxpayer Identification Number (ITIN) or other documentation for non-residents or undocumented individuals. Some credit unions also offer alternative ID programs for immigrants.

How fast will I get my debit card?

Most banks mail your card within 5–7 business days after approval. Some offer instant virtual cards for online purchases, with physical cards arriving later.

Is it safe to upload my ID online?

Yes—if done through the bank’s encrypted portal. Reputable institutions use AES-256 encryption and never store images longer than necessary. Avoid sending IDs via email or unsecured messaging apps.

Final Steps and Next Actions

Opening a bank account online doesn’t have to be stressful or risky. With the right preparation, awareness of red flags, and attention to detail, you can complete the process securely in less time than a coffee break. The key is choosing a trusted institution, verifying every step, and locking down your account with strong security settings from day one.

Now that you know how simple and safe it can be, take action today. Whether you’re building an emergency fund, managing freelance income, or simplifying your finances, a reliable online bank account is the foundation. Set aside 20 minutes, follow this guide, and enjoy the freedom of modern banking—on your terms.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?