Opening a bank account is one of the most essential financial steps you can take—whether you're managing personal finances, starting a business, or building credit history. While the process may seem straightforward, navigating the requirements, choosing the right institution, and understanding the implications of different account types can make a significant difference in your long-term financial health. This guide walks you through every stage with clarity, offering practical advice, real-world examples, and tools to ensure your banking experience is secure, efficient, and tailored to your needs.

Understand the Types of Bank Accounts Available

Before opening an account, it’s crucial to understand which type best fits your financial goals. Banks typically offer several options, each designed for different purposes:

- Checking Account: Ideal for daily transactions like paying bills, using debit cards, and receiving direct deposits. Most come with no or low interest but offer high liquidity.

- Savings Account: Designed to help you accumulate money over time with higher interest rates. Withdrawals are limited by federal regulations (typically six per month under Regulation D).

- Money Market Account (MMA): Combines features of checking and savings accounts, often with higher interest and limited check-writing privileges. Usually requires a higher minimum balance.

- Certificate of Deposit (CD): A time-bound deposit with fixed interest rates. Funds are locked in for a set term; early withdrawal usually incurs penalties.

- Joint Account: Shared between two or more people, commonly used by spouses or family members. All parties have equal access and responsibility.

“Choosing the wrong account type can lead to unnecessary fees or missed growth opportunities. Always match the account to your spending and saving behavior.” — Laura Simmons, Certified Financial Planner

Know What Documents You’ll Need

Banks are required by law to verify your identity under the USA PATRIOT Act. The exact documents may vary slightly by institution, but generally, you'll need the following:

| Document Type | Examples | Notes |

|---|---|---|

| Primary ID | U.S. driver’s license, state ID, passport | Must be government-issued and current |

| Social Security Number (SSN) | SSN card, W-2 form, tax return | Required for credit reporting and tax purposes |

| Proof of Address | Utility bill, lease agreement, official mail | Must be recent (within 60 days) and show your name and address |

| Secondary ID (if applicable) | Student ID, employee badge, foreign passport | May be requested if primary ID lacks photo or address |

Non-residents or immigrants may use alternative documents such as an Individual Taxpayer Identification Number (ITIN), visa, or permanent resident card. Some banks offer “second-chance” accounts for those with past banking issues, though these may come with restrictions or higher fees.

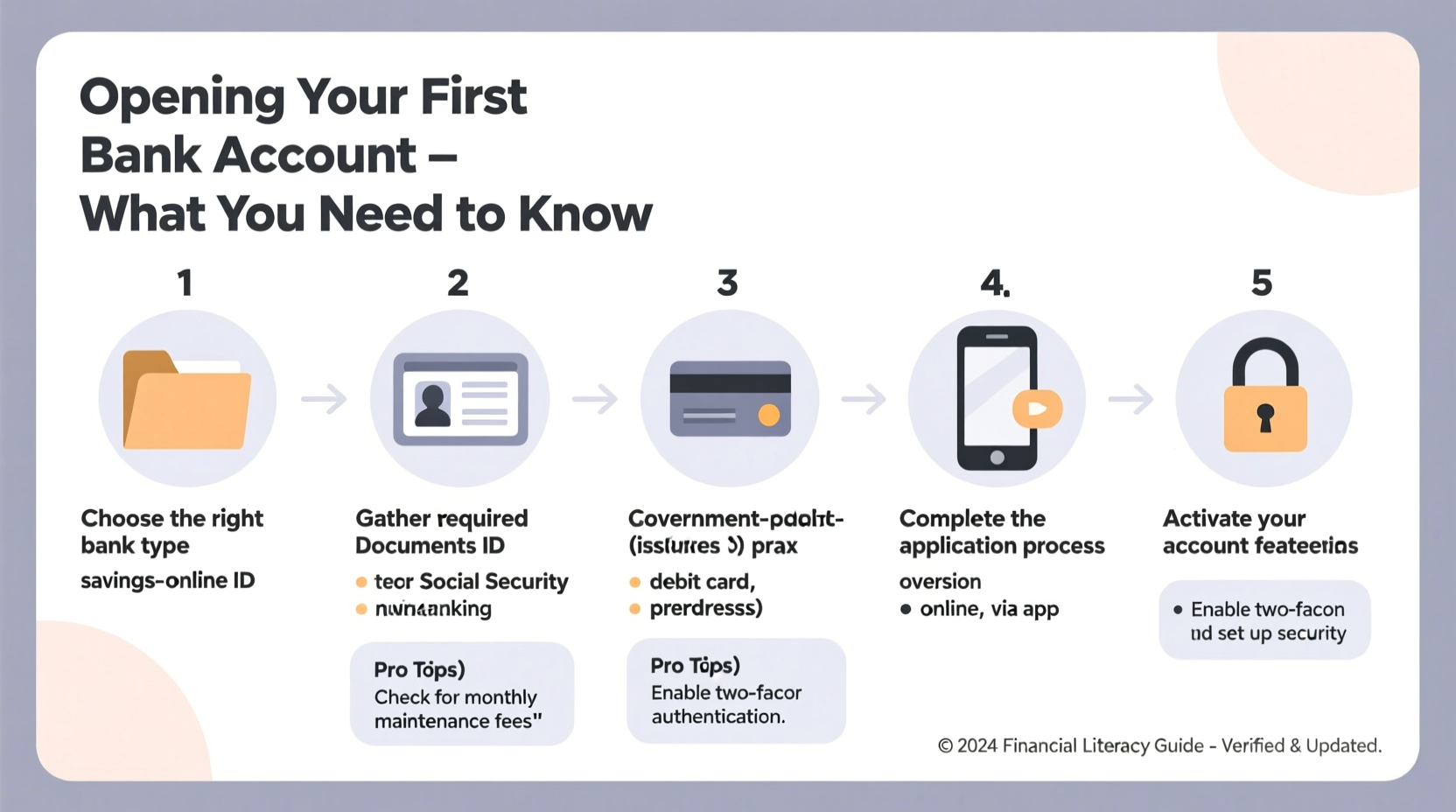

Step-by-Step Guide to Opening Your Account

The actual process of opening a bank account can be completed online or in person. Here's a clear, five-step approach:

- Research and Compare Banks: Look at national banks, credit unions, and online-only institutions. Consider factors like ATM access, customer service, mobile app quality, and fee structures.

- Gather Required Documents: Have your ID, SSN, and proof of address ready. For joint accounts, both parties must provide documentation.

- Choose Your Account Type: Based on your financial habits—frequent transactions vs. saving goals—select the appropriate product.

- Submit Application: Fill out the application either online or at a branch. Online applications typically take 10–15 minutes. You’ll need to create login credentials and agree to terms.

- Make Initial Deposit: Most banks require a minimum opening deposit, ranging from $25 to $100. Fund your account via transfer, check, or cash (in-branch).

After submission, the bank will perform a soft inquiry on your ChexSystems report—a database that tracks past banking misconduct like overdrafts or fraud. A negative record doesn’t automatically disqualify you but may affect approval.

Real Example: Maria’s First U.S. Bank Account

Maria, a graduate student from Colombia, moved to Chicago for her master’s program. She needed a local bank account to receive her stipend and pay rent. Initially overwhelmed, she researched credit unions known for serving international students. She chose a local credit union that accepted her passport, I-20 form, and university email as proof of address.

The entire process took 20 minutes in person. She opened a no-fee checking account with a $50 initial deposit and linked it to her mobile banking app the same day. By avoiding large national banks that required a U.S. credit history, she saved time and gained access to bilingual support and free international wire services.

Avoid Common Pitfalls: Do’s and Don’ts

Even simple mistakes can delay account opening or result in ongoing costs. Use this checklist to stay on track:

| Do’s | Don’ts |

|---|---|

| Compare monthly maintenance fees and minimum balance requirements | Assume all accounts are fee-free |

| Read the fine print on overdraft policies | Enable overdraft protection without understanding the fees |

| Use online tools to estimate interest earnings | Ignore APY (Annual Percentage Yield) when comparing savings accounts |

| Opt for paperless statements and alerts | Forget to set up fraud monitoring or transaction notifications |

“Over half of new account holders don’t realize they’re being charged a monthly fee until it shows up on their statement. Always ask: ‘What fees apply, and how can I waive them?’” — James Reed, Consumer Banking Analyst

Frequently Asked Questions

Can I open a bank account with bad credit?

Yes. Most banks do not run a traditional credit check when opening a standard checking or savings account. However, they may review your history through ChexSystems. If you’ve had accounts closed due to fraud or unpaid fees, you might need a second-chance account.

Is it safe to open a bank account online?

Yes, provided you use a reputable, FDIC-insured bank or NCUA-insured credit union. Ensure the website URL begins with \"https://\" and look for trust seals. Avoid public Wi-Fi during setup.

How long does it take to get a debit card?

If opening online, your debit card typically arrives by mail within 7–10 business days. Some banks offer instant digital cards for immediate use with mobile wallets. In-branch openings often include same-day card issuance.

Final Checklist Before You Apply

- ✅ Identify your primary banking needs (spending, saving, or both)

- ✅ Research at least three banks or credit unions

- ✅ Confirm required documents and minimum deposits

- ✅ Check for hidden fees (ATM charges, monthly maintenance, overdraft)

- ✅ Ensure FDIC or NCUA insurance coverage ($250,000 per depositor, per institution)

- ✅ Prepare digital or physical copies of ID, SSN, and address proof

Take Control of Your Financial Future

Opening a bank account is more than a formality—it’s the foundation of financial independence. With the right preparation, you can avoid common traps, reduce unnecessary costs, and build a relationship with an institution that supports your goals. Whether you're a first-time account holder, a newcomer to the country, or someone rebuilding financial stability, the tools and knowledge are within reach. Start today: compare your options, gather your documents, and take that first confident step toward secure, smart banking.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?