Filing taxes as Head of Household can significantly reduce your tax liability and increase your refund compared to the standard Single or Married Filing Separately status. However, many taxpayers miss out on this benefit because they’re unaware of the specific IRS criteria or assume they don’t qualify. This guide walks you through every stage—from determining eligibility to completing your return—so you can claim this valuable filing status with confidence.

Understanding Head of Household Status

Head of Household (HoH) is a tax filing status designed for unmarried individuals who maintain a home for a qualifying person, such as a child or dependent relative. It offers lower tax rates and a higher standard deduction than filing as Single. For 2024, the standard deduction for HoH is $20,800, compared to $13,850 for Single filers—a difference that directly lowers taxable income.

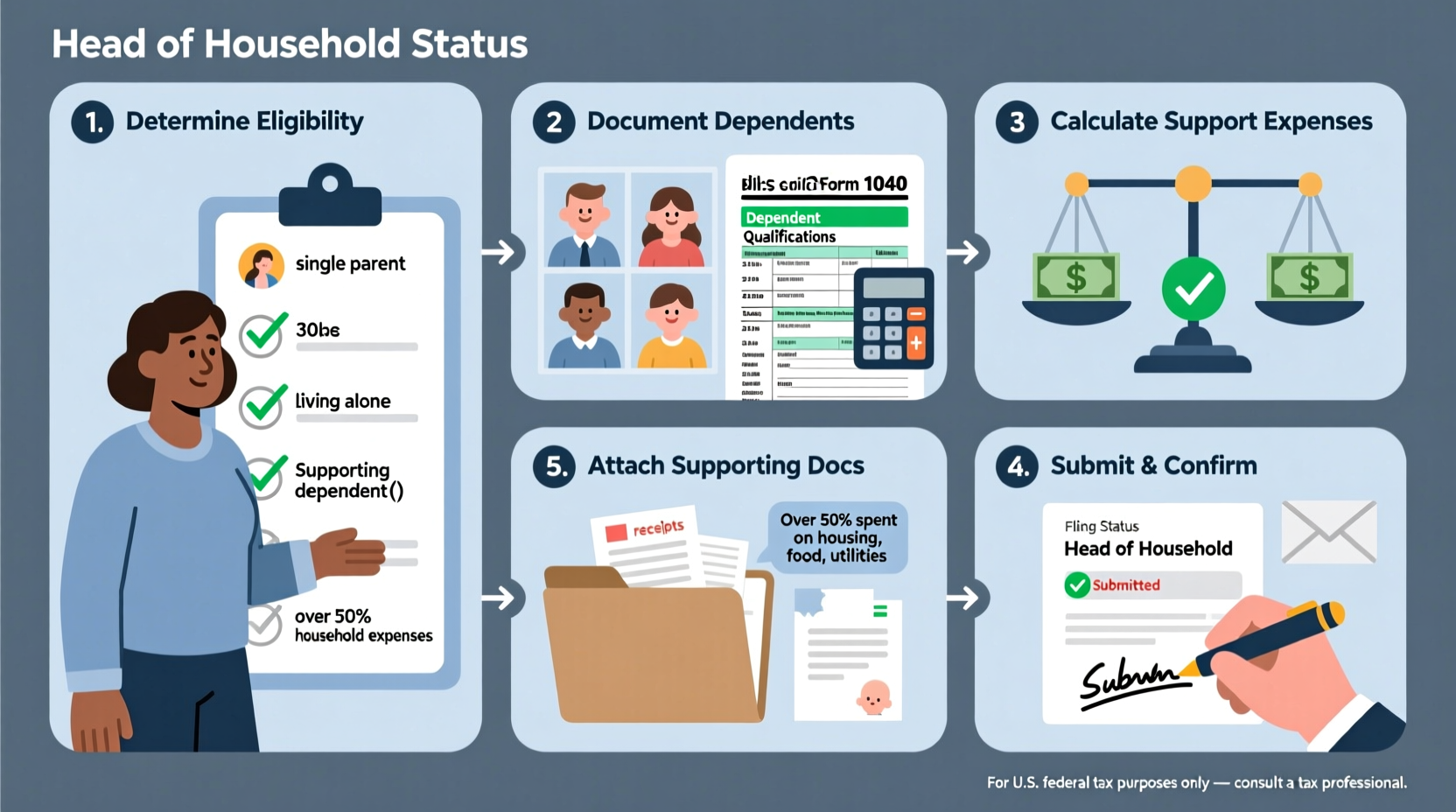

To qualify, you must meet five core requirements: marital status, household maintenance, tax year residency, dependency, and income contribution. These are not optional checkboxes—they are enforced strictly by the IRS. Misclassifying your status can lead to audits, penalties, or repayment demands.

“Head of Household is one of the most underclaimed but impactful statuses available. If you're supporting a home for a dependent, it’s worth reviewing your eligibility—even if you only spent part of the year living with them.” — Linda Chen, Enrolled Agent and Tax Advocate

Step-by-Step Qualification Checklist

Follow this timeline-based checklist to determine if you qualify for Head of Household status in the current tax year.

- Confirm Unmarried Status: You must be considered unmarried on the last day of the tax year. This includes being legally single, divorced, or separated under a final decree. If you’re separated but still legally married and lived with your spouse at any point during the last six months, you likely do not qualify.

- Identify a Qualifying Person: This is typically a child, stepchild, foster child, sibling, parent, or other relative whom you can claim as a dependent. The person must have lived with you for more than half the year, unless they are a parent (who doesn’t need to live with you).

- Verify Residency: The qualifying person must have lived with you in your home for more than 182 days (half the year). Temporary absences—such as school, illness, or military service—still count as time lived with you.

- Prove Home Maintenance: You must have paid more than half the cost of keeping up a home during the tax year. This includes rent or mortgage payments, utilities, groceries, repairs, and property taxes. Keep receipts, bank statements, and bills as proof.

- File Your Own Return: You cannot file jointly with another taxpayer. If you’re eligible for HoH, you must file independently.

Common Scenarios and Real Examples

Eligibility isn't always black and white. Consider these realistic situations where HoH status applies—or doesn’t.

Case Study: Maria, Single Mother with Shared Custody

Maria is divorced and shares joint custody of her 10-year-old son. He spends alternating weeks with each parent. In 2023, he lived with Maria for exactly 26 weeks. She also paid 70% of the rent, utilities, and food for the apartment they share when he's present.

Outcome: Maria qualifies for Head of Household. Although her son didn’t live with her for a continuous six-month period, the total days exceed 182. Plus, she clearly maintained the household. She can claim HoH even though the other parent may claim the child tax credit under tiebreaker rules.

Case Study: James, Supporting an Elderly Parent

James lives alone but pays 60% of his mother’s assisted living costs. His mother does not live with him due to medical needs. He claims her as a dependent because she meets the income and relationship tests.

Outcome: James qualifies for HoH. Parents are the only qualifying relatives who don’t need to live with you. As long as James provided over half of her support and she meets dependency rules, he can file as Head of Household.

Case Study: Taylor, College Student Living Off-Campus

Taylor is 22, works part-time, and lives in an apartment. Her younger sister lives with their grandmother 30 miles away. Taylor sends money occasionally but doesn’t claim her sister as a dependent.

Outcome: Taylor does not qualify. No qualifying person lives with her, and she doesn’t claim a dependent. She must file as Single.

Do’s and Don’ts When Claiming Head of Household

| Do’s | Don’ts |

|---|---|

| Keep detailed records of household expenses (rent, utilities, groceries) | Assume shared custody automatically disqualifies you |

| Use IRS Form 2441 if you have childcare expenses | Claim HoH if your spouse lived with you in the last six months |

| Consult a tax pro if both parents claim HoH for the same child | Forget that emotional support doesn’t count as financial support |

| Review IRS Publication 501 for updated thresholds | Overlook the “more than half” expense rule—it’s strict |

Filing Process: From Preparation to Submission

Once you’ve confirmed eligibility, follow these steps to file correctly.

- Gather Documentation: Collect W-2s, 1099s, proof of dependents (birth certificates), and expense records (bank statements, rent receipts, utility bills).

- Determine Dependency: Use IRS tools or software to confirm you can claim the qualifying person. They must meet age, relationship, residency, and gross income tests.

- Select Correct Filing Status: On Form 1040, check the box for “Head of Household” under Filing Status. Do not leave it blank or default to Single.

- Claim Dependent Credits: Attach Schedule EIC if claiming the Earned Income Credit, and ensure the Child Tax Credit is applied correctly.

- E-File or Mail Return: Most tax software will validate HoH eligibility during intake. If filing manually, double-check Form 1040 instructions.

Frequently Asked Questions

Can I file as Head of Household if I’m divorced?

Yes, if you were legally divorced or separated by December 31 and paid more than half the cost of maintaining a home for a qualifying child or dependent. Your marital status on the last day of the year determines eligibility.

What if my ex-spouse also claims Head of Household?

The IRS uses tiebreaker rules. Generally, the parent with whom the child lived the longest during the year gets priority. If time is equal, the parent with the higher adjusted gross income (AGI) wins. Only one parent can claim HoH per child.

Does living with roommates affect my eligibility?

No, as long as your qualifying person (e.g., child) lived with you for more than half the year and you paid more than half the household costs. Roommates’ contributions don’t count toward your expenses unless they’re dependents.

Final Steps and Next Actions

Claiming Head of Household status isn’t just about saving money—it’s about receiving fair recognition for the financial and emotional responsibility of maintaining a household. If you've been supporting a child, parent, or other dependent from your own resources, you likely qualify.

Start now: pull last year’s return, review your living situation, and gather three months’ worth of housing and utility bills. Compare them to your income contributions. If you consistently covered more than half, mark your calendar for next tax season—or amend your prior return if you missed out.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?