Transferring money quickly and securely is essential in today’s fast-moving world—whether you're helping a family member, paying a contractor, or sending funds internationally. Wire transfers remain one of the most reliable ways to move money, but they come with risks if not handled correctly. Unlike credit card transactions, wire transfers are typically irreversible once completed. This makes it critical to verify every detail before hitting send.

This guide walks you through the safest methods for wiring money, breaks down associated fees, and provides practical steps to prevent fraud. Whether you’re using a bank, credit union, or digital service, understanding the process ensures your funds arrive securely and efficiently.

Understanding Wire Transfer Methods

Not all money transfers are created equal. The method you choose affects speed, cost, security, and convenience. Here are the most common options:

- Bank-to-Bank Wire Transfers: Traditional and secure, these are processed through systems like Fedwire (U.S.) or SWIFT (international). Ideal for large, time-sensitive transfers.

- Credit Union Services: Similar to banks but often offer lower fees for members. Some participate in shared branching networks.

- Digital Money Transfer Apps: Services like Wise, Remitly, and PayPal allow quick transfers with transparent fee structures and real-time tracking.

- Retail Money Transfer Services: Western Union and MoneyGram provide cash pickup options globally, useful when the recipient lacks a bank account.

Each method has its own verification process, transfer limits, and delivery timelines. Domestic wires usually clear within 24 hours; international wires can take 1–5 business days.

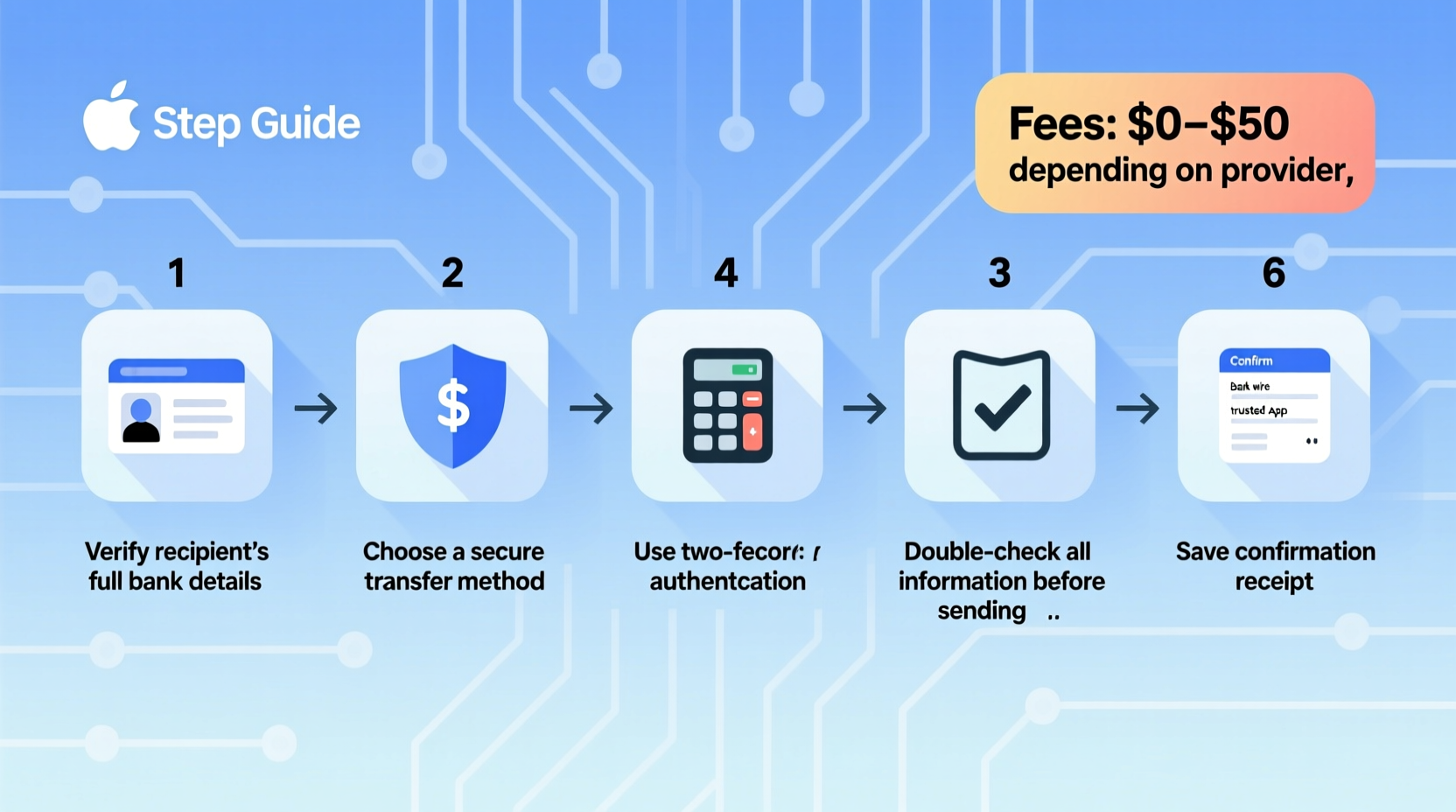

Step-by-Step Guide to Safely Wiring Money

- Verify the Recipient’s Identity: Confirm you know and trust the person receiving the funds. For unfamiliar requests, use video calls or official documentation to validate their identity.

- Gather Required Information: For domestic transfers: full name, bank name, routing number, and account number. For international: SWIFT/BIC code, IBAN (if applicable), and address.

- Log In Securely: Use only your bank’s official website or app. Avoid public Wi-Fi when initiating transfers.

- Enter Transfer Details Carefully: Input all information exactly as provided. Many banks require confirmation screens to reduce errors.

- Set Transfer Amount and Review Fees: Be aware of both outgoing and incoming fees. Some recipients are charged upon receipt.

- Confirm and Authorize: Use two-factor authentication (2FA) if available. Never skip final review screens.

- Save Confirmation Details: Keep the transaction ID, date, amount, and estimated delivery time. Most services provide tracking numbers.

Once submitted, contact the recipient to confirm receipt. If anything seems off, notify your financial institution immediately.

Comparing Fees and Transfer Speeds

Fees vary significantly depending on the service and destination. Below is a comparison of average costs for a $1,000 transfer:

| Service | Transfer Type | Avg. Fee | Speed | Recipient Gets Funds In |

|---|---|---|---|---|

| Major U.S. Bank | Domestic Outgoing | $25–$30 | Next business day | 1–2 days |

| Major U.S. Bank | International | $45 + intermediary fees | 1–5 business days | 3–7 days |

| Wise (formerly TransferWise) | International | $8–$15 (transparent) | Same day to 2 days | 1–3 days |

| Western Union | Cash Pickup | $5–$50 (varies by country) | Minutes to hours | Same day |

| PayPal | Instant Transfer | ~$30 (with currency conversion) | Instant (to PayPal balance) | Minutes |

Note: International transfers may involve intermediary banks that deduct $10–$30 unless “sender pays all fees” is selected—a crucial option for ensuring full delivery.

Red Flags and Fraud Prevention Tips

Wire transfer scams are common. Scammers often impersonate family members, landlords, or government officials demanding urgent payments. The FBI reports that losses from such fraud exceeded $300 million in 2023 alone.

“Once money is wired, it’s nearly impossible to recover. Treat every wire request as high-risk until independently verified.” — Sarah Lin, Senior Fraud Analyst at National Consumer Protection Bureau

To stay safe:

- Never wire money based solely on an email or text message.

- Use a separate phone number (not the one provided in the request) to call the person directly.

- Avoid urgency tactics—scammers pressure victims to act quickly.

- Be cautious with rental deposits or job-onboarding fees; legitimate entities rarely require wire payments upfront.

Real Example: A Cautionary Case

Martha, a retiree in Florida, received a call from someone claiming to be her grandson. The voice sounded familiar, and the caller said he was arrested in Mexico and needed $3,000 wired immediately. Panicked, Martha went to her bank and initiated a Western Union transfer.

Luckily, the teller asked follow-up questions and delayed the transaction. Martha called her daughter, who confirmed her son was at work in Colorado. The bank canceled the transfer just in time.

This scenario illustrates how emotional manipulation can bypass rational thinking. Had the teller not intervened, Martha would have lost her savings with little chance of recovery.

Checklist: Before You Wire Money

- ✅ I’ve spoken to the recipient using a known, trusted contact method.

- ✅ I’ve verified all banking details in writing (not over the phone).

- ✅ I understand the total fee structure (outgoing, incoming, conversion).

- ✅ I’ve selected “sender pays all fees” for international transfers.

- ✅ I’m using a secure device and network to initiate the transfer.

- ✅ I’ve saved the transaction reference number and confirmation.

Frequently Asked Questions

Can a wire transfer be reversed?

No. Once a wire transfer is processed, it cannot be reversed. Banks can only investigate if the transfer was fraudulent or made in error—but recovery is not guaranteed and depends on cooperation from the recipient’s bank.

What should I do if I sent money to the wrong person?

Contact your bank immediately. Provide the transaction ID and explain the error. While reversal is unlikely, some institutions may initiate a “trace” or request a voluntary refund from the recipient. Acting fast improves your chances.

Are online transfer services like Wise safer than banks?

They are equally secure but often more transparent. Services like Wise use end-to-end encryption, provide real exchange rates, and break down fees upfront. They also offer customer support in multiple languages, which helps during disputes.

Final Thoughts: Protect Your Money Like It’s Irreplaceable

Wiring money doesn’t have to be risky—if you take the right precautions. From verifying identities to choosing low-cost, transparent services, every step matters. Remember: no legitimate emergency requires secrecy or rushed decisions. When in doubt, pause and verify.

The best transfers are those done with confidence, clarity, and control. Use this guide as your reference before every wire, and make safety your top priority.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?