The IRS Identity Protection PIN (IP PIN) is a critical tool for protecting your personal information from tax-related identity theft. With cybercrime rising, submitting your tax return without an IP PIN leaves you vulnerable. This six-digit number acts as a second layer of authentication, ensuring only you can file a tax return using your Social Security Number. If someone tries to file in your name, the IRS will reject the fraudulent return when the correct IP PIN isn’t provided.

Unlike passwords, which can be changed frequently or guessed, the IP PIN is unique, randomly generated, and issued annually by the IRS. It’s available to all eligible U.S. taxpayers—not just victims of identity theft. Understanding how to request, receive, store, and apply your IP PIN correctly ensures a smoother filing process and stronger financial security.

What Is an IRS Identity Protection PIN?

The IP PIN is a six-digit number assigned by the Internal Revenue Service to eligible taxpayers. It verifies your identity when you file your federal income tax return. Once obtained, you must enter it alongside your Social Security Number when e-filing. Without it, the IRS will reject your electronic submission.

There are two categories of IP PIN recipients:

- Voluntary participants: Any U.S. citizen with a valid SSN or Individual Taxpayer Identification Number (ITIN) can opt into the program.

- Mandatory recipients: Individuals who have previously been victims of tax-related identity theft are automatically enrolled and must use their IP PIN each year.

“Using an IP PIN reduces the risk of someone fraudulently filing a return in your name by adding a verified layer of identity confirmation.” — IRS Cybersecurity Task Force Report, 2023

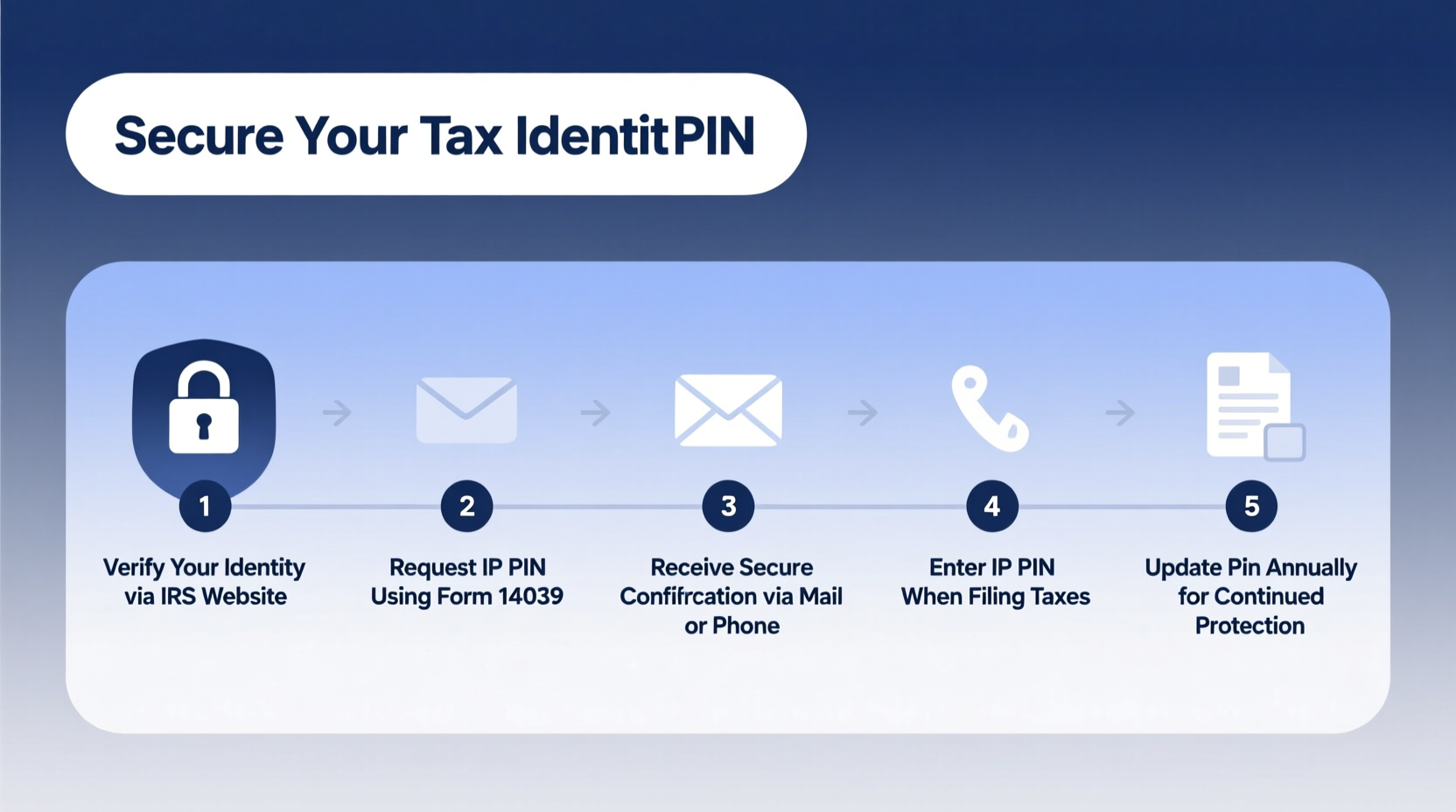

How to Securely Obtain Your IP PIN: A Step-by-Step Process

Obtaining your IP PIN is free and done entirely through the IRS website. Follow these steps carefully to verify your identity and receive your PIN.

- Visit the official IRS Get an IP PIN portal: Go to IRS.gov/GetAnIPPIN. Only use this site—never click on email links claiming to offer IP PIN services.

- Click “Continue” on the welcome screen and agree to the terms.

- Enter your personal information: Full name, Social Security Number, date of birth, filing status, and address exactly as they appear on your most recently filed tax return.

- Complete Secure Access authentication: You’ll need to create an account using ID.me, a government-verified identity provider. This involves uploading a photo ID and answering knowledge-based questions.

- Verify your identity: The system may ask about past credit accounts, loans, or other personal history to confirm you are who you claim to be.

- Access your IP PIN: Once authenticated, your six-digit IP PIN will display on-screen immediately.

What to Do After Receiving Your IP PIN

Getting the PIN is only half the battle. How you use and safeguard it determines its effectiveness.

Storing Your IP PIN Safely

Never save your IP PIN in unencrypted digital files, email drafts, or cloud notes. Instead:

- Write it down and keep it in a locked drawer separate from your Social Security card.

- If storing digitally, use a reputable password manager like Bitwarden or 1Password with strong encryption.

- Avoid sharing it over phone calls or text messages—even if someone claims to be from the IRS.

Using the IP PIN When Filing Taxes

When preparing your tax return via software such as TurboTax, H&R Block, or Free File Fillable Forms:

- Navigate to the “Personal Information” or “Electronic Filing” section.

- Enter your SSN as usual.

- Input your current-year IP PIN when prompted.

- Double-check for accuracy—errors cause processing delays.

If you're working with a tax preparer, provide the IP PIN only after confirming their legitimacy through the IRS Registered Tax Return Preparer Directory.

Common Mistakes and What to Avoid

Even well-intentioned taxpayers make errors that compromise security or delay refunds. Review the following table to understand key do's and don'ts.

| Action | Do | Don't |

|---|---|---|

| Receiving the IP PIN | Use the official IRS portal at IRS.gov | Respond to unsolicited emails or texts claiming to send your PIN |

| Storing the PIN | Keep it in a secure physical location or encrypted vault | Save it in plain text on your phone or computer |

| Filing with the PIN | Double-check entry before submitting | Reuse last year’s PIN—it expires annually |

| Sharing the PIN | Give it only to trusted preparers after verification | Tell family members or post it online |

“Last year, over 35,000 returns were flagged due to incorrect IP PIN entries—most caused by outdated or mistyped numbers.” — IRS Processing Analytics Brief, January 2024

Real-World Example: Preventing Fraud Before It Happens

Sarah Thompson, a school administrator from Ohio, had never heard of the IP PIN until she received a notice from the IRS stating a tax return had already been filed under her SSN. She hadn’t filed yet. After resolving the case—a process that took nearly five months—she was automatically enrolled in the IP PIN program.

“The next year, I went online and got my new PIN right away,” Sarah said. “When I filed my taxes, I entered it with confidence. No issues. Knowing that someone can’t just steal my number and file makes me feel safer every January.”

Her story reflects thousands of Americans who now proactively use the IP PIN to prevent repeat incidents. Even if you’ve never been a victim, enrolling early stops fraud before it starts.

Frequently Asked Questions

Can I get an IP PIN if I’ve never been a victim of identity theft?

Yes. Since 2021, the IRS has allowed any U.S. taxpayer with a valid SSN or ITIN to voluntarily request an IP PIN through the online portal. It’s encouraged as a preventive measure.

What happens if I lose my IP PIN?

You can retrieve it anytime by logging back into the Get an IP PIN tool using your Secure Access credentials. Do not call the IRS expecting them to provide it over the phone unless you’re reporting fraud.

Does the IP PIN expire?

Yes. A new IP PIN is issued each calendar year. Using last year’s PIN will result in rejection of your e-filed return. The current PIN becomes available starting mid-January for the upcoming tax season.

Final Checklist Before Filing

Before submitting your return, ensure you’ve taken these essential actions:

- ✅ Verified your identity through the IRS Get an IP PIN portal

- ✅ Retrieved your current-year IP PIN (not last year’s)

- ✅ Stored the PIN securely—physically or in encrypted format

- ✅ Confirmed your tax software accepts IP PIN input

- ✅ Entered the PIN accurately during e-filing

- ✅ Avoided sharing the PIN except with authorized professionals

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?