When you finance a vehicle, the lender holds a legal claim—called a lien—on your car until the loan is fully paid. Even after making your final payment, that lien doesn’t automatically disappear. Without proper documentation, you can’t sell, trade in, or transfer the title of your vehicle. Unfortunately, many drivers assume their responsibility ends with the last payment, only to face delays and frustration months later when they try to move forward.

Securing a lien release doesn’t have to be complicated. With the right steps, clear communication, and timely follow-up, you can complete the process efficiently and gain full ownership of your vehicle. This guide walks you through each stage—from confirming payoff to receiving official documentation—and helps you avoid common pitfalls that slow things down.

Understand What a Lien Release Is—and Why It Matters

A lien release (also known as a lien satisfaction or title release) is an official document issued by your lender stating that your auto loan has been paid in full and their financial interest in the vehicle is terminated. This document is required to update the vehicle’s title with your state’s Department of Motor Vehicles (DMV).

Without it, the DMV will still list the lender as the lienholder, even if you’ve made all payments. That means you don’t legally own the car free and clear. You may also encounter issues if you plan to sell the vehicle, register it in another state, or insure it under a new policy.

“Many consumers believe paying off their loan automatically clears the title. But without the lien release paperwork, the system still sees the lender as having rights to the vehicle.” — Mark Reynolds, Auto Finance Consultant

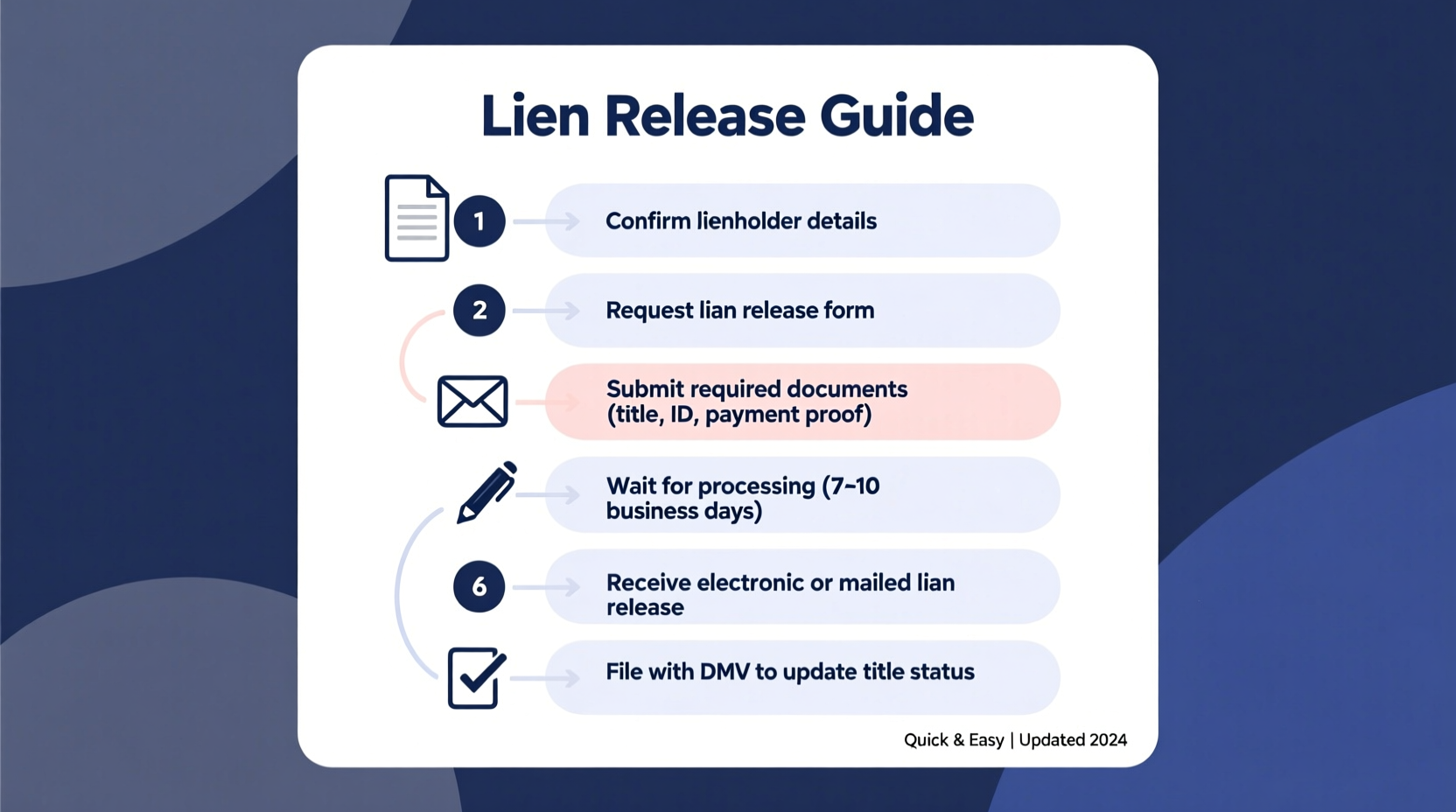

Step-by-Step Process to Secure Your Lien Release

- Confirm Your Final Payment Has Cleared

Wait for written confirmation from your lender that your account is closed and paid in full. Don’t rely solely on your bank statement or online portal. Request a formal payoff letter or statement showing zero balance. - Contact the Lender to Request Lien Release Documentation

Call or email your lender directly. Ask specifically for:- The original lien release form (often Form MV-13 or equivalent)

- A notarized lien release letter (if required by your state)

- The physical title with “Lien Released” marked (if applicable)

- Verify How Documents Will Be Delivered

Some lenders mail documents directly to the DMV; others send them to you. Confirm which method applies to your case. If sent to you, ensure they are originals—not copies. - Track Delivery and Follow Up

If you haven’t received anything within 10–14 business days, contact the lender again. Keep records of all communications. Consider sending a follow-up request via certified mail for paper trails. - Submit Documents to Your State DMV

Once you receive the lien release, submit it along with any required forms (like title transfer or duplicate title applications) to your local DMV. Some states allow online submission; others require in-person visits. - Receive Your Clean Title

After processing, the DMV will issue a new title in your name without any lien listed. Store this in a secure location—it’s proof of full ownership.

Common Mistakes That Delay the Process

Even with prompt action, errors can cause weeks—or months—of unnecessary delay. Avoid these frequent missteps:

- Assuming automatic processing: Many lenders do not proactively file lien releases unless instructed or required by state law.

- Not verifying the correct mailing address: If the lender sends documents to an outdated address, you won’t receive them.

- Mixing up electronic vs. paper titles: Some states use electronic liens. In those cases, the lender electronically notifies the DMV upon payoff—no physical document is issued. Know your state’s system.

- Failing to check for typos: Incorrect names, VINs, or dates on the lien release can invalidate the document.

Checklist: Securing Your Car Lien Release

- ✅ Confirm final payment has cleared and account is closed

- ✅ Request lien release documents in writing

- ✅ Verify whether lender sends docs to DMV or to you

- ✅ Track delivery status and follow up within two weeks

- ✅ Review all documents for accuracy before submitting

- ✅ File paperwork with your state DMV promptly

- ✅ Obtain and store your clean title securely

State-by-State Variations: What You Need to Know

Laws and procedures vary significantly across states. For example:

| State | Lien Release Method | Timeframe for Processing | Special Notes |

|---|---|---|---|

| California | Lender mails release to DMV | 4–6 weeks | You can request expedited processing for $20 |

| Texas | Lender sends release to borrower | 2–3 weeks | Borrower must submit release + Application for Texas Title |

| New York | Electronic notification (if e-lien enabled) | 1–2 weeks | No paper release issued in e-lien cases |

| Florida | Lender mails release to owner | 3–5 weeks | Must apply for new title within 30 days |

To find your state’s specific requirements, visit your DMV website or call their customer service line. Search terms like “[Your State] + lien release process” yield accurate results.

Real Example: How One Driver Avoided a Costly Delay

Sarah from Austin, Texas, paid off her SUV in January and assumed she’d receive the title shortly after. Six weeks passed with no mail. When she called her lender, she learned they had sent the lien release to her old address—she had moved six months earlier but hadn’t updated her contact info.

She requested a reissue and submitted the document to the Texas DMV with Form VTR-130-SOF. Because she acted quickly, she received her clean title in 10 days. However, she nearly missed selling her car to a private buyer who required proof of ownership upfront.

Lesson: Always confirm your current mailing address with your lender before payoff. Update it proactively, even if you’ve notified other institutions.

Frequently Asked Questions

What if my lender goes out of business?

If your lender has been acquired or dissolved, contact the National Motor Vehicle Title Information System (NMVTIS) or your state DMV. They can help verify payoff and guide you through alternative documentation, such as a surety bond or affidavit of lien satisfaction.

Can I sell my car without a lien release?

Technically, yes—but only if the buyer agrees to take over the loan, which is rare and risky. Most private buyers and dealerships require a clear title. Without a lien release, you cannot legally transfer full ownership.

How long should I wait before escalating the issue?

If you haven’t received confirmation or documents within 14 business days of payoff, start following up. After 30 days, consider filing a complaint with the Consumer Financial Protection Bureau (CFPB) or your state attorney general’s office.

Final Steps: Protecting Your Ownership Rights

Securing a lien release isn’t just about paperwork—it’s about protecting your financial and legal interests. A vehicle is often one of the most valuable assets a person owns. Letting administrative oversights stand in the way of full ownership undermines the effort it took to pay it off.

Stay proactive. Treat the post-payoff phase with the same diligence as your monthly payments. Double-check every detail, keep copies of all correspondence, and act swiftly if something seems off.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?