Navigating the car-buying process can be overwhelming, especially when financing is involved. One of the smartest moves you can make is securing a preapproved auto loan before stepping onto a dealership lot. Preapproval gives you negotiating power, helps you stay within budget, and reduces pressure during the purchase. More importantly, it shifts you from being a shopper into a serious buyer—someone dealers respect and engage with differently. This guide walks you through each stage of obtaining a preapproved auto loan with clarity and confidence.

Why Preapproval Matters

A preapproved auto loan means a lender has conditionally agreed to lend you a specific amount based on your creditworthiness and financial history. Unlike prequalification—which is an estimate—preapproval involves a hard credit check and verified documentation, making it far more reliable.

With preapproval in hand, you’re no longer dependent on dealer financing, which often comes with higher interest rates or hidden incentives that benefit the salesperson. You also avoid prolonged negotiations about financing terms while sitting in the finance office for hours.

“Preapproval transforms the car-buying experience. It puts control back in the buyer’s hands and often leads to better overall deals.” — Lisa Tran, Consumer Finance Advisor at CreditWise Strategies

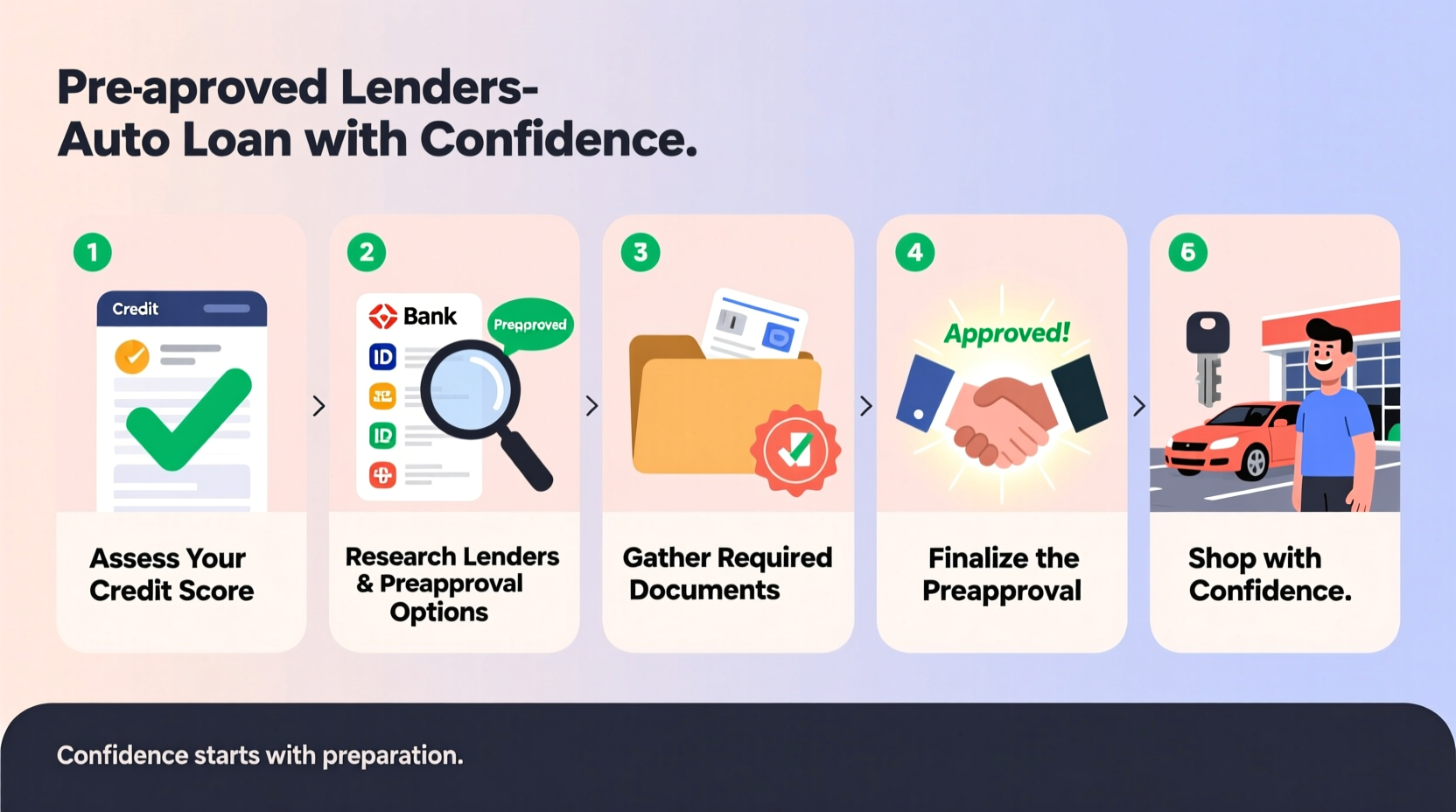

Step 1: Assess Your Financial Health

Before applying for any loan, understand where you stand financially. Lenders evaluate several key factors:

- Credit score: Most lenders require a minimum of 600 for conventional loans, though subprime options exist (with higher rates).

- Debt-to-income ratio (DTI): Ideally below 36%. High DTI may limit borrowing capacity.

- Employment stability and income: Consistent earnings improve approval odds.

- Savings and down payment ability: A larger down payment improves loan terms and reduces monthly payments.

Step 2: Research Lenders and Compare Offers

Not all lenders are created equal. Explore multiple sources to find competitive rates and favorable terms. Consider these options:

| Lender Type | Pros | Cons |

|---|---|---|

| Credit Unions | Lower interest rates, personalized service, flexible terms | Membership requirements; limited branch access |

| Online Banks | Fast processing, competitive APRs, nationwide availability | Fewer in-person support options |

| Dealerships | Convenience, manufacturer incentives | Potentially inflated rates, upselling on add-ons |

| Traditional Banks | Trusted institutions, local branches | Slower approvals, stricter criteria |

Use online comparison tools like Bankrate, NerdWallet, or LendingTree to view real-time preapproval offers without affecting your credit initially. These platforms use soft inquiries to match you with potential lenders.

Step 3: Gather Required Documentation

To move from prequalification to formal preapproval, you’ll need to submit verified documents. Having them ready speeds up the process significantly.

📋 Preapproval Checklist:- Government-issued ID (driver’s license or passport)

- Proof of income (recent pay stubs, W-2s, or tax returns if self-employed)

- Proof of residence (utility bill or lease agreement)

- Social Security number

- Current vehicle information (if trading in)

- Bank statements (for down payment verification)

Some lenders offer digital submission via mobile apps or secure portals. Upload clear, legible copies to avoid delays.

Step 4: Submit Applications Strategically

Apply to 2–3 lenders within a 14-day window. Multiple inquiries during this period are typically treated as a single event by credit bureaus, minimizing impact on your score.

When submitting applications:

- Be honest about your income and debts.

- Specify the loan amount you're seeking (based on your target vehicle price minus down payment).

- Indicate preferred loan term (commonly 36, 48, 60, or 72 months).

Wait for conditional approval, which includes the maximum loan amount, interest rate, and estimated monthly payment. Review all terms carefully—especially fees, prepayment penalties, and balloon payments.

Step 5: Use Preapproval to Your Advantage at the Dealership

Once approved, you’ll receive a preapproval letter valid for 30 to 60 days. Bring this document when shopping for cars.

💬 Real Example: Sarah, a first-time buyer, secured a preapproved loan at 4.2% APR from her credit union. At the dealership, the finance manager offered a “special” rate of 5.9% through a partner bank. Because she had preapproval, Sarah politely declined and used her own financing—saving over $1,300 in interest over five years.Dealers may still try to persuade you to use their financing. Stay firm but respectful. If they offer a lower rate than your preapproval, request written confirmation and verify it independently before switching.

Common Pitfalls to Avoid

Even with preapproval, mistakes can undermine your savings and leverage. Watch out for these traps:

- Overextending your budget: Just because you’re approved for $35,000 doesn’t mean you should spend that much.

- Ignoring loan terms: A low monthly payment might come with a 72-month term, leading to negative equity early on.

- Skipping the fine print: Read origination fees, default clauses, and insurance requirements.

- Applying too broadly: Excessive hard inquiries outside the 14-day window can ding your credit score.

FAQ

Does preapproval guarantee I’ll get the loan?

Not always. Preapproval is conditional. Final approval depends on the vehicle appraisal, title status, and whether your financial situation changes before funding.

Can I get preapproved with bad credit?

Yes, but expect higher interest rates and stricter terms. Some lenders specialize in rebuilding credit through auto loans. Be cautious of predatory lending practices—avoid loans with APRs above 20% unless absolutely necessary.

How long does preapproval take?

Many online lenders provide decisions within minutes. Full approval with documentation may take 1–3 business days. Credit unions sometimes take longer due to manual reviews but often offer better rates.

Final Steps and Confidence-Building Tips

Securing a preapproved auto loan isn’t just about getting financed—it’s about entering the car market as an informed, empowered buyer. Follow this final checklist before driving off the lot:

- Confirm the preapproval letter is current and includes all key terms.

- Ensure the vehicle you choose fits within your approved loan amount.

- Verify that the dealer accepts outside financing (most do, but some discourage it).

- Review the final contract line by line before signing.

- Keep a copy of all signed documents and disclosures.

“The most confident buyers aren’t those with the biggest budgets—they’re the ones who did their homework and walked in with financing already secured.” — Marcus Reed, Auto Industry Analyst

Conclusion

Getting a preapproved auto loan is one of the most effective ways to simplify car buying, reduce stress, and protect your wallet. By understanding your finances, comparing lenders, and using preapproval strategically, you gain control over the entire transaction. No more last-minute surprises, inflated rates, or high-pressure tactics. You set the terms. You drive the deal.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?