Separating personal and business finances is one of the most critical steps in building a sustainable company. A dedicated business bank account not only simplifies accounting but also strengthens credibility with clients, vendors, and tax authorities. Yet, many entrepreneurs delay this step—either due to confusion about the process or uncertainty about which institutions offer the best terms. This guide walks you through each stage of opening and managing a business account with clarity and precision, ensuring your financial foundation supports long-term growth.

Why a Business Account Is Non-Negotiable

Operating without a formal business account may seem manageable in the early days, especially for solopreneurs or freelancers. However, as revenue grows and transactions multiply, mixing personal and business funds leads to disorganized records, inaccurate tax filings, and potential legal complications. A dedicated account provides clear transaction trails, simplifies bookkeeping, and enhances professionalism when issuing invoices or receiving payments.

Additionally, most payment processors—including Stripe, PayPal for Business, and merchant card terminals—require a verified business bank account to deposit funds. Without one, scaling operations becomes unnecessarily difficult.

“Establishing a business bank account isn’t just about convenience—it’s a foundational element of financial hygiene.” — Laura Simmons, Certified Public Accountant and Small Business Advisor

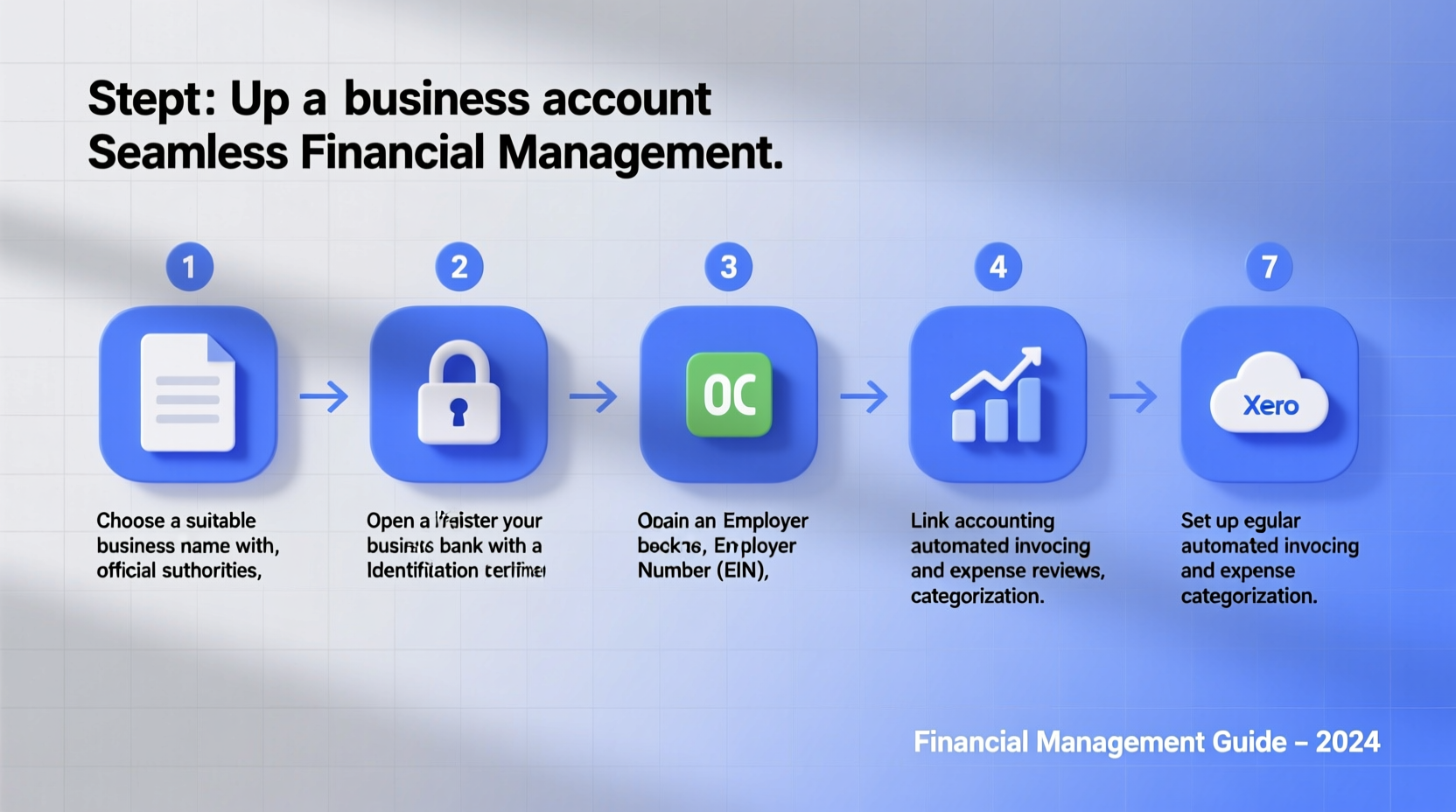

Step-by-Step Process to Open a Business Bank Account

Opening a business account involves more than walking into a bank with an ID. The process varies slightly depending on your business structure, but the following sequence applies universally across sole proprietorships, LLCs, partnerships, and corporations.

- Determine Your Business Structure: Identify whether you’re operating as a sole proprietor, partnership, LLC, or corporation. This affects the documentation required and influences liability protection.

- Register Your Business Name: If operating under a name other than your legal name (e.g., “Green Horizon Consulting”), file a DBA (“Doing Business As”) with your local government or state authority.

- Obtain an EIN from the IRS: Even if you're a sole proprietor without employees, securing an Employer Identification Number (EIN) adds legitimacy and is often required by banks. Apply online at the IRS website—it takes less than 15 minutes.

- Gather Required Documentation: Prepare your government-issued ID, EIN confirmation letter, articles of organization/incorporation (for LLCs or corps), and any partnership agreements.

- Research and Compare Banks: Not all banks offer the same features. Evaluate monthly fees, minimum balance requirements, ATM access, digital tools, and customer support before choosing.

- Submit Application—Online or In-Person: Many major banks now allow full account setup online. Smaller regional banks may require an in-branch appointment, especially for new entities.

- Fund the Account: Most institutions require an initial deposit—anywhere from $25 to $500—depending on the type of account.

Choosing the Right Type of Business Account

Not all business accounts are created equal. Selecting the right one depends on your cash flow patterns, transaction volume, and growth plans.

| Account Type | Best For | Key Features | Potential Downsides |

|---|---|---|---|

| Business Checking | Daily transactions, payroll, vendor payments | Unlimited transactions, check writing, debit card | Monthly fees; some limit free transactions |

| Business Savings | Emergency funds, saving for equipment | Interest earning, separate from operating funds | Limited withdrawals per month |

| Merchant Services Account | Retailers, service providers accepting cards | POS integration, quick deposit cycles | Transaction fees apply; may require underwriting |

| Online/NBFC Banks | Tech-savvy startups, remote businesses | No physical branch needed, strong app support | Limited in-person assistance |

Many entrepreneurs benefit from maintaining multiple accounts—a checking account for daily expenses, a savings account for taxes and reserves, and a separate merchant account for credit card processing. This segmentation improves budgeting accuracy and reduces accounting errors.

Real Example: How Maria Streamlined Her Freelance Finances

Maria runs a graphic design consultancy from home. For the first year, she used her personal checking account for client payments and software subscriptions. By tax season, reconciling deductible expenses took over 40 hours. After consulting an accountant, she opened a business checking account with an online bank offering zero monthly fees and integrated invoicing tools.

She transferred $1,000 as seed capital, began routing all client payments there, and set up automatic transfers to a separate savings account labeled “Taxes.” Within three months, her monthly bookkeeping time dropped from 10 hours to under two. More importantly, she qualified for a small business credit card based on her consistent deposits—something previously denied due to lack of formal business banking history.

Essential Tips for Ongoing Financial Management

Opening the account is just the beginning. To ensure smooth financial operations, follow these best practices after setup:

- Reconcile Monthly: Match your bank statements with accounting records every month to catch discrepancies early.

- Automate Transfers: Schedule recurring transfers to savings for taxes, equipment, or emergency funds.

- Use Accounting Software: Tools like QuickBooks, Xero, or FreshBooks sync directly with most business accounts, reducing manual data entry.

- Monitor for Fraud: Enable transaction alerts and review activity weekly, especially if employees have access.

- Avoid Commingling Funds: Never pay personal bills from the business account—even temporarily.

Checklist: Setting Up Your Business Account Successfully

Use this checklist to stay organized throughout the process:

- ☑ Decide on business structure (sole proprietor, LLC, etc.)

- ☑ Register business name (if different from legal name)

- ☑ Obtain EIN from IRS.gov

- ☑ Gather required documents (ID, EIN letter, formation papers)

- ☑ Research 3–5 banks and compare fee structures

- ☑ Choose between traditional, online, or credit union options

- ☑ Complete application (online or in person)

- ☑ Make initial deposit

- ☑ Link to accounting software and payment platforms

- ☑ Set up automatic transfers for tax savings and overhead

Frequently Asked Questions

Can I open a business account as a sole proprietor without an EIN?

Yes, many banks allow sole proprietors to use their Social Security Number instead of an EIN. However, using an EIN protects your personal information and makes future hiring or entity changes easier.

Are online business bank accounts safe?

Reputable online banks are FDIC-insured and employ advanced encryption and multi-factor authentication. They often offer stronger fraud detection systems than traditional branches. Always verify FDIC coverage before opening an account.

Do I need a business license to open a business bank account?

Not always. While some banks request proof of licensing—especially in regulated industries—most require only your EIN, ID, and formation documents. Check specific bank requirements ahead of time.

Final Steps Toward Financial Clarity

Setting up a business bank account is more than a procedural task—it’s a declaration of intent. It signals that you’re treating your venture as a legitimate enterprise, worthy of structured systems and professional standards. With the right account in place, backed by disciplined financial habits, you gain control over cash flow, reduce stress at tax time, and lay the groundwork for financing, expansion, and scalability.

The effort invested today pays dividends tomorrow. Whether you're launching a side hustle or scaling a growing team, take action now. Gather your documents, compare your options, and open that account. Your future self—and your accountant—will thank you.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?