Starting a business doesn’t have to be complicated. For many first-time entrepreneurs, the sole proprietorship is the simplest and most accessible structure to begin with. It requires minimal paperwork, offers full control over operations, and allows profits to flow directly to the owner. However, simplicity doesn’t mean skipping due diligence. Understanding the legal, financial, and operational steps ensures your business starts on solid ground and grows sustainably.

What Is a Sole Proprietorship?

A sole proprietorship is an unincorporated business owned and operated by one individual. There is no legal distinction between the business and the owner—meaning you are personally liable for all debts and obligations. This structure is ideal for freelancers, consultants, artisans, and small service providers who want to start quickly without complex filings or fees.

Despite its informal nature, a sole proprietorship still requires thoughtful planning. You’ll need to handle taxes, register your business name (if different from your own), obtain necessary permits, and separate personal and business finances to protect yourself long-term.

“Sole proprietorships offer unmatched flexibility, but that freedom comes with responsibility. The key is building systems early—even when you’re the only employee.” — Maria Chen, Small Business Advisor & CPA

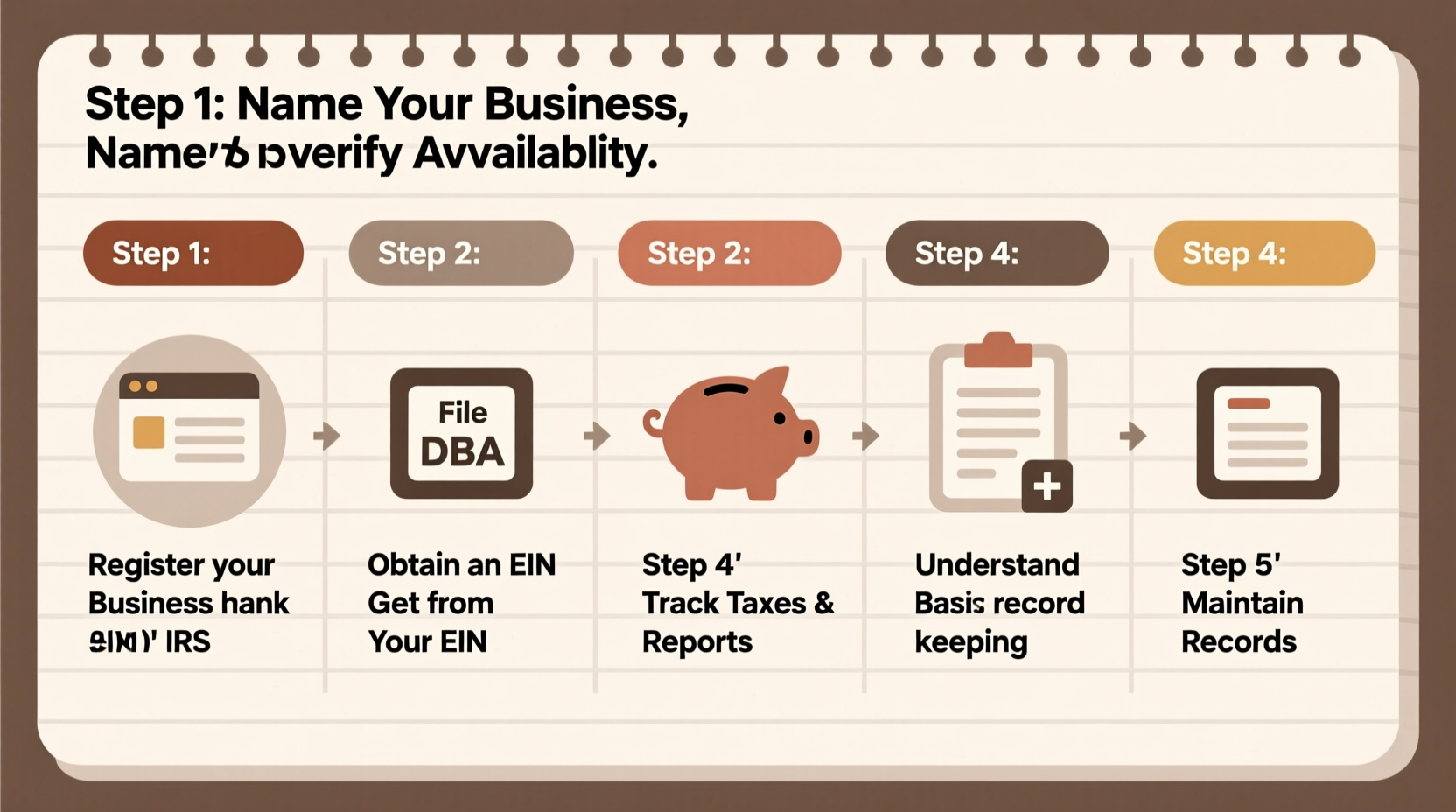

Step-by-Step Guide to Setting Up Your Sole Proprietorship

Follow this clear sequence to establish your business correctly and avoid common pitfalls in the early stages.

- Determine Your Business Idea and Niche

Select a product or service that aligns with your skills and meets market demand. Conduct basic research: Who are your competitors? What do customers value? A focused idea increases your chances of early traction. - Choose a Business Name

If you plan to operate under a name other than your legal name, you must file a “Doing Business As” (DBA) registration with your local county or state office. This allows you to open bank accounts and accept payments under your brand name. - Check Local Licensing and Permit Requirements

Some industries—like food services, childcare, beauty, or contracting—require specific licenses. Visit your city or county clerk’s website to verify what applies to your business type. - Obtain an Employer Identification Number (EIN)

Even without employees, an EIN from the IRS simplifies tax filing and helps open a business bank account. It’s free and can be applied for online at the IRS website. - Open a Business Bank Account

Keep your personal and business finances separate. Use a dedicated checking account and debit card for all business transactions. This separation strengthens credibility and simplifies accounting. - Set Up Basic Accounting Systems

Use affordable tools like Wave, QuickBooks Self-Employed, or even spreadsheets to track income, expenses, invoices, and estimated taxes. Consistent bookkeeping prevents year-end stress and supports informed decisions. - Understand Your Tax Obligations

Sole proprietors report business income on Schedule C of their personal tax return (Form 1040). You’ll also pay self-employment tax (Social Security and Medicare) and may need to make quarterly estimated tax payments.

Essential Tips for Long-Term Success

Launching is just the beginning. Sustainable growth depends on habits formed in the first 90 days.

- Create a Simple Business Plan: Outline your mission, target audience, pricing model, and short-term goals. It doesn’t need to be lengthy—just clear enough to guide your actions.

- Build an Online Presence: Claim a Google Business profile, create a basic website or portfolio, and maintain consistent branding across platforms.

- Save for Taxes Religiously: Set aside 25–30% of every payment you receive into a separate savings account labeled “Taxes.” This avoids surprises come April.

- Get Familiar with Deductible Expenses: Home office costs, internet, phone, supplies, travel, and health insurance premiums may be deductible. Keep receipts and log expenses monthly.

- Review Finances Weekly: Even if it’s just 15 minutes, regularly reviewing cash flow helps you spot trends, manage bills, and plan for slow seasons.

Do’s and Don’ts When Starting as a Sole Proprietor

| Do’s | Don’ts |

|---|---|

| ✔ Register your DBA if using a trade name | ✘ Assume you don’t need any permits |

| ✔ Open a separate business bank account | ✘ Mix personal and business spending |

| ✔ Save for taxes with each income deposit | ✘ Wait until tax season to organize records |

| ✔ Track mileage and business-related travel | ✘ Claim personal expenses as business deductions |

| ✔ Consult an accountant once a quarter | ✘ Try to do everything alone without expert guidance |

Real Example: From Side Hustle to Full-Time Income

Jamal started offering mobile car detailing on weekends while working full-time in logistics. He registered “ShineRide Detailing” as a DBA in his county, obtained a $75 vendor permit, and opened a separate bank account. Using a free invoicing app, he tracked every job and set aside 30% of earnings for taxes.

Within six months, Jamal was earning more from detailing than his day job. By keeping meticulous records and reinvesting profits into equipment, he transitioned to full-time entrepreneurship within a year. His early discipline around structure—not scale—made the difference.

Frequently Asked Questions

Can I hire employees as a sole proprietor?

Yes. While you remain the sole owner, you can hire independent contractors or W-2 employees. If hiring employees, you must withhold payroll taxes and report wages using your EIN.

Do I need liability insurance?

Highly recommended. Without corporate protection, your personal assets (car, home, savings) are at risk if a client sues. General liability insurance typically costs $300–$600 per year and provides crucial peace of mind.

Can I convert my sole proprietorship to an LLC later?

Absolutely. Many entrepreneurs start as sole proprietors and upgrade to an LLC after gaining traction. The process involves filing formation documents with your state and updating your EIN status with the IRS.

Final Checklist Before Launch

- ☑ Finalize business name and confirm availability

- ☑ File DBA (if applicable)

- ☑ Obtain required local/county permits or licenses

- ☑ Apply for an EIN (IRS.gov)

- ☑ Open a dedicated business bank account

- ☑ Choose an accounting method (cash vs. accrual)

- ☑ Set up a system to track income and expenses

- ☑ Research deductible expenses and keep documentation

- ☑ Create simple contracts or service agreements

- ☑ Consult a tax professional before filing your first return

Take Action Today

The sole proprietorship is more than a starting point—it’s a legitimate path to ownership, independence, and income on your terms. With low barriers to entry and straightforward setup, now is the time to act. Don’t wait for perfection. Choose a name, take the first legal step, and begin serving your first customer. Every successful business began exactly where you are: with an idea and the courage to begin.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?