Your credit score plays a crucial role in your financial life—determining whether you qualify for loans, credit cards, or even rental agreements. Yet studies show that over one-third of consumer credit reports contain at least one error. Among the three major credit bureaus, Equifax is frequently used by lenders, making it essential to ensure its data about you is accurate. If incorrect information appears on your Equifax credit report, it can unfairly lower your score and cost you money in higher interest rates. The good news: federal law gives you the right to dispute these inaccuracies. This guide walks you through the process with clear, actionable steps to correct your report and regain control of your credit.

Why Credit Report Errors Matter

Inaccurate entries on your credit report—such as accounts you didn’t open, late payments you never made, or outdated balances—can significantly impact your creditworthiness. Even a single erroneous late payment can drop your FICO score by 50 points or more. Worse, identity theft-related fraud may go unnoticed without regular monitoring. The Fair Credit Reporting Act (FCRA) entitles consumers to dispute any information they believe is inaccurate or incomplete. Equifax must investigate your claim within 30 days and either verify, correct, or delete disputed items.

“Consumers who actively monitor and correct their credit reports often see noticeable improvements in their scores within weeks.” — Sarah Thompson, Consumer Credit Advocate at the National Consumer Law Center

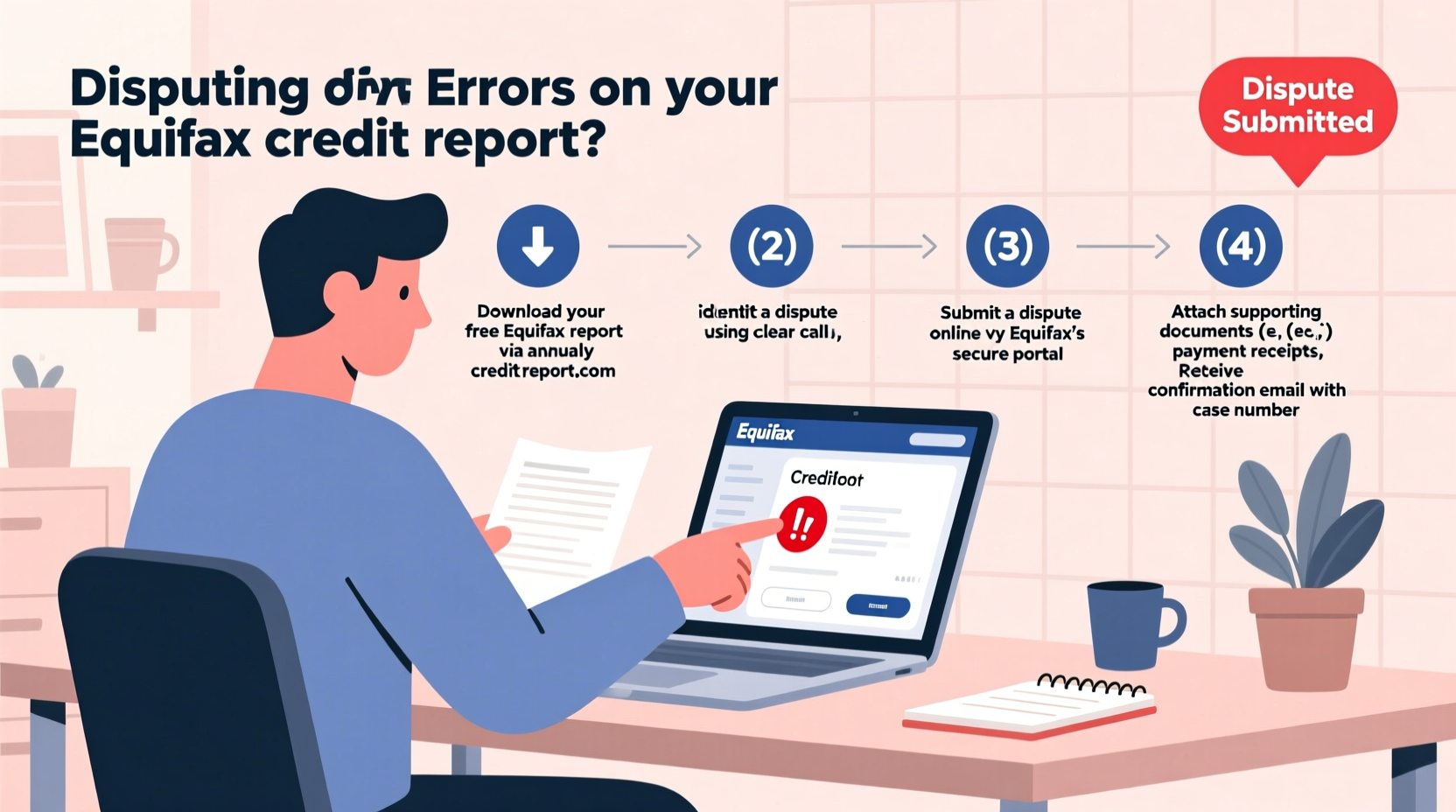

Step-by-Step Guide to Disputing Errors on Your Equifax Report

Successfully disputing an error requires organization, documentation, and persistence. Follow this proven sequence to maximize your chances of a favorable outcome.

- Request Your Free Equifax Credit Report

Visit AnnualCreditReport.com, the only government-authorized site for free weekly credit reports from all three bureaus. Download your Equifax report and review every section: personal information, account history, inquiries, and public records. - Identify and Document All Errors

Highlight any discrepancies such as:- Incorrect personal details (wrong address, misspelled name)

- Fraudulent accounts opened without your knowledge

- Duplicate accounts listed more than once

- Accounts showing incorrect balances or statuses

- Payments marked late when they were on time

- Outdated negative information beyond the 7-year reporting limit (10 years for bankruptcies)

- Gather Supporting Documentation

For each disputed item, collect evidence. This may include:- Bank statements proving timely payments

- Copies of loan agreements or credit card contracts

- Identity theft reports or police filings

- Previous correspondence with creditors

- A government-issued ID and proof of address if correcting personal info

- Submit Your Dispute to Equifax

You can file a dispute online, by phone, or by mail. While online filing is faster, mailing a paper dispute allows you to send copies of documents and create a verifiable paper trail.- Online: Visit Equifax’s dispute center, create an account, and follow prompts.

- By Mail: Send a detailed letter including your full name, address, date of birth, Social Security number, a list of disputed items with explanations, and copies (not originals) of supporting documents.

- Wait for the Investigation (Up to 30 Days)

Equifax has 30 days under FCRA to investigate (45 days if your dispute relates to information in your credit report obtained from your own direct request). They must contact the data furnisher (e.g., bank or lender) and request verification of the disputed item. - Review the Results

After the investigation, Equifax will send you a written response and a free updated credit report if changes were made. If the error was corrected, great. If not, you have the right to add a 100-word consumer statement explaining your side of the story. - Follow Up if Necessary

If the result is unsatisfactory, you can escalate the dispute by:- Contacting the data furnisher directly

- Filing a complaint with the Consumer Financial Protection Bureau (CFPB)

- Consulting a consumer law attorney if significant damages occurred

Common Mistakes to Avoid When Disputing Credit Errors

Even well-intentioned disputes fail due to simple oversights. Avoid these pitfalls to strengthen your case.

| Mistake | Why It Hurts Your Case | What to Do Instead |

|---|---|---|

| Disputing everything at once | Can appear frivolous; slows down processing | Focus on verified errors with strong evidence |

| Sending original documents | Risk of permanent loss | Always send photocopies or scanned PDFs |

| Missing deadlines | Delays resolution and credit repair | File disputes promptly upon discovering errors |

| Not following up | Unresolved issues remain on file | Track submission dates and request updates after 30 days |

Real Example: How One Consumer Fixed Her Credit Score in 6 Weeks

Marissa R., a 34-year-old teacher from Ohio, applied for a mortgage and was shocked to find her credit score was 632—far below her expected mid-700s. Upon reviewing her Equifax report, she discovered two medical collections from 2019 that had been paid in full but still marked as unpaid. She gathered EOB (Explanation of Benefits) statements and payment confirmations, then mailed a dispute letter with certified delivery. Within 22 days, Equifax removed both accounts. Her score jumped to 698, qualifying her for a lower mortgage rate and saving over $150 per month on her loan.

Essential Checklist for a Successful Credit Dispute

Use this checklist before submitting your dispute to ensure completeness and effectiveness.

- ✅ Obtained my latest Equifax credit report from AnnualCreditReport.com

- ✅ Highlighted all inaccurate or fraudulent entries

- ✅ Collected supporting documents (statements, IDs, receipts, etc.)

- ✅ Written a clear dispute letter with itemized explanations

- ✅ Made copies of all materials for my records

- ✅ Mailed the package via certified mail with tracking

- ✅ Set a calendar reminder to follow up after 30 days

Frequently Asked Questions

How long does an Equifax dispute take?

Equifax typically completes investigations within 30 days of receiving your dispute. If you submit additional information during the process, the timeline may extend to 45 days.

Can I dispute errors online, or should I mail them?

You can dispute online for speed, but mailing your dispute provides better documentation and legal protection. Certified mail creates a verifiable record, which is valuable if you need to escalate the issue later.

What happens if Equifax doesn’t fix the error?

If the investigation concludes the information is accurate, you can still request to add a consumer statement to your report. You may also file a complaint with the CFPB at consumerfinance.gov/complaint, which often prompts a faster re-review.

Take Control of Your Credit Today

Your credit report is not set in stone—it's a living document that reflects your financial history, but only if it's accurate. Errors happen, but they don’t have to define your creditworthiness. By taking the time to review your Equifax report, document discrepancies, and formally dispute inaccuracies, you’re not just fixing data—you're protecting your future. Whether you're planning to buy a home, finance a car, or simply want peace of mind, clean credit is foundational. Start today: pull your report, spot the errors, and take action. Your financial health depends on it.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?