Transferring a vehicle title as a gift in Texas is a common practice—whether you're passing down a car to a family member, gifting it to a close friend, or helping a loved one get on the road. While the process may seem straightforward, missing a single step can result in delays, fines, or even rejection at the county tax office. This comprehensive guide breaks down every stage of the Texas gift title transfer with clear instructions, real-world examples, and expert-backed tips to ensure your transaction is smooth, compliant, and efficient.

Understanding Gift Title Transfers in Texas

In Texas, a \"gift title transfer\" occurs when a vehicle changes ownership without monetary exchange. The Texas Department of Motor Vehicles (TxDMV) treats this differently than a standard sale, primarily because no sales tax is due if the transfer qualifies as a true gift between immediate family members. However, not all relationships qualify for tax exemptions, so understanding eligibility is critical.

A gift title transfer requires the completion of specific forms, verification of identification, and submission through your local County Tax Assessor-Collector’s office. Unlike private sales, where a buyer pays sales tax based on purchase price, gift transfers focus on relationship status and proper documentation.

“Many people assume gifting a car avoids all fees—but that’s only half true. You still owe registration and title fees, and non-family gifts may trigger use tax.” — Carlos Mendez, TxDMV Compliance Advisor

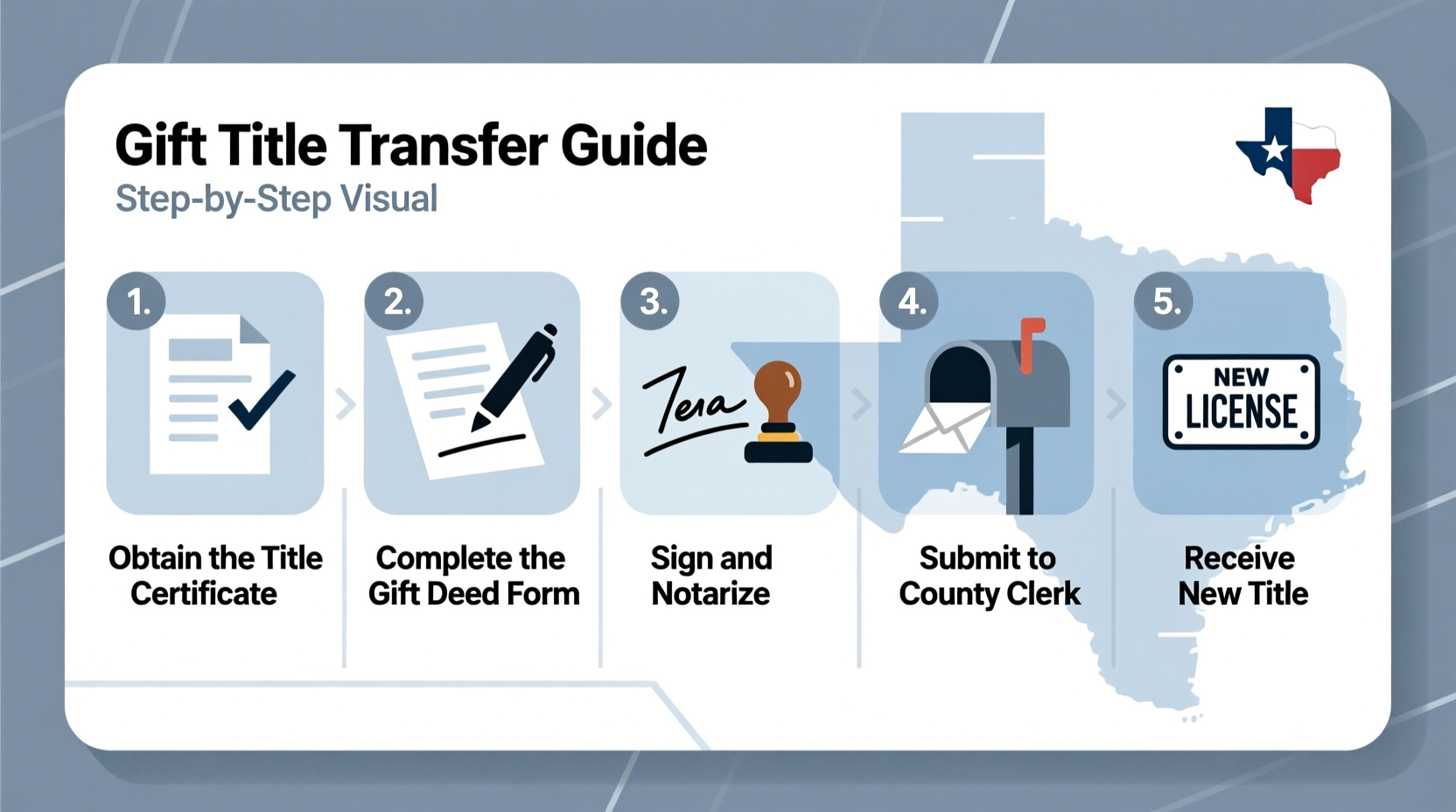

Step-by-Step Guide to Completing a Gift Title Transfer

Follow these seven essential steps to legally transfer a vehicle title as a gift in Texas:

- Verify eligibility for gift transfer: Only certain familial relationships qualify for sales tax exemption. Immediate family includes spouses, parents, children, grandparents, grandchildren, and siblings.

- Obtain the signed title from the current owner: The seller (giver) must sign the back of the title in front of a notary. Include printed names and dates.

- Complete Form VTR-130U (Application for Texas Title): This form is required for all out-of-state and in-state title transfers. Indicate “Gift” in the purchase price section.

- Submit proof of insurance: The recipient must have active liability coverage meeting Texas minimums.

- Provide valid ID and proof of residency: Both parties may need government-issued photo IDs. The recipient must show proof of Texas residency. <6> Pay applicable fees: Fees include title transfer ($33), base registration fee ($50.75), and potential local county fees.

- Submit documents at the County Tax Office: Visit the office in the county where the recipient resides. Processing typically takes 3–7 business days.

Required Documents Checklist

To avoid multiple trips and processing delays, gather these items ahead of time:

- Original Texas title, properly signed and notarized

- Completed Form VTR-130U

- Proof of liability insurance (current policy declaration page)

- Valid photo ID (driver’s license or state ID)

- Proof of Texas residency (utility bill, lease agreement, etc.)

- Odometer disclosure statement (if vehicle is under 10 years old)

- Emissions inspection certificate (required in designated counties)

Tax Implications and When Use Tax Applies

One of the most misunderstood aspects of a gift title transfer is taxation. While gifts between immediate family members are exempt from Texas motor vehicle sales tax, other relationships are not.

If the recipient is not an immediate family member—such as a cousin, fiancé, or close friend—the TxDMV may assess \"use tax\" based on the vehicle’s standard presumptive value (SPV). This tax functions similarly to sales tax and must be paid at the time of transfer.

| Recipient Relationship | Sales/Use Tax Due? | Notes |

|---|---|---|

| Spouse, Child, Parent | No | Fully exempt under Tex. Tax Code §152.103 |

| Grandparent, Grandchild, Sibling | No | Also eligible for exemption |

| Cousin, Friend, Fiancé | Yes | Tax calculated on SPV from TxDMV database |

| Out-of-State Resident | Varies | May owe home state tax; Texas does not collect |

Real Example: Transferring a Car to a College-Bound Son

Maria, a resident of Austin, wanted her son Diego to have reliable transportation during his first year at Texas State University. She decided to gift him her 2018 Honda Civic. Since Diego is her biological son, the transfer qualified for a sales tax exemption.

Maria gathered the signed title, completed Form VTR-130U, and included Diego’s new rental agreement as proof of residency in Hays County. Diego purchased minimum liability insurance and brought his student ID and driver’s license. They visited the Hays County Tax Office together, submitted all documents, and paid $83.75 in combined title and registration fees. Within five days, Diego received his official Texas title and registration sticker.

Their preparation saved time and avoided complications. Had Maria forgotten the emissions inspection—required in Hays County—the application would have been rejected.

Common Mistakes to Avoid

Even small errors can derail a gift title transfer. Watch out for these frequent issues:

- Unsigned or improperly notarized titles: A missing signature or expired notary seal invalidates the transfer.

- Incorrect purchase price entry: Writing “$0” instead of “Gift” can trigger automatic tax assessment.

- Missing emissions certification: Required in 98 Texas counties, including Houston, Dallas, and San Antonio.

- Using outdated forms: Always download Form VTR-130U directly from the official TxDMV website.

- Assuming both parties don’t need to appear: Some counties allow mail-in transfers, but many require the recipient to appear in person.

Frequently Asked Questions

Can I gift a car with a lien on the title?

No. Any outstanding lien must be paid off and released by the lender before the title can be transferred. The lienholder holds legal ownership until the loan is satisfied.

Do I need a bill of sale for a gift transfer?

While not mandatory, a bill of sale is highly recommended—even for gifts. It should state “No monetary consideration exchanged” and include vehicle details, VIN, and both parties’ signatures. This protects against future disputes.

How long does a gift title transfer take?

Processing usually takes 3 to 7 business days after submission. Digital applications via some county portals may reduce wait times. Physical title delivery by mail typically follows within two weeks.

Final Tips for a Smooth Transfer

Success hinges on attention to detail and understanding local requirements. Here are three final recommendations:

Conclusion: Make Your Gift Official and Stress-Free

Gifting a vehicle in Texas can strengthen family bonds, support a loved one’s independence, or simplify estate planning. With the right preparation, the title transfer process is manageable and often tax-efficient. By following the steps outlined here—verifying eligibility, gathering documents, understanding tax rules, and avoiding common pitfalls—you ensure the gift is not just generous, but legally sound.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?