Cancelling a credit card may seem like a simple task—just stop using it and call customer service, right? But doing it incorrectly can lead to unexpected fees, credit score damage, or even lingering financial obligations. Whether you're eliminating debt, simplifying finances, or switching to a better rewards program, the way you cancel a credit card matters. Done right, cancellation can be a smart financial move. Done poorly, it can cost you in the long run.

This comprehensive guide walks you through every essential step to cancel your credit card safely, protect your credit history, and avoid common pitfalls.

Why You Might Want to Cancel a Credit Card

There are several valid reasons people consider closing a credit card account:

- High annual fees: If the benefits no longer outweigh the cost, it makes sense to reevaluate.

- Unwanted temptation: For those working on controlling spending, removing access to credit can support financial discipline.

- Duplicate rewards programs: Holding multiple cards with similar perks can dilute value and complicate redemption.

- Better alternatives exist: A new card might offer higher cashback, travel benefits, or lower interest rates.

- Security concerns: After fraud or a data breach, some users prefer to close compromised accounts.

However, not all reasons justify immediate cancellation. Closing a card impacts your credit utilization ratio and average account age—two key factors in your credit score. Understanding these effects is critical before taking action.

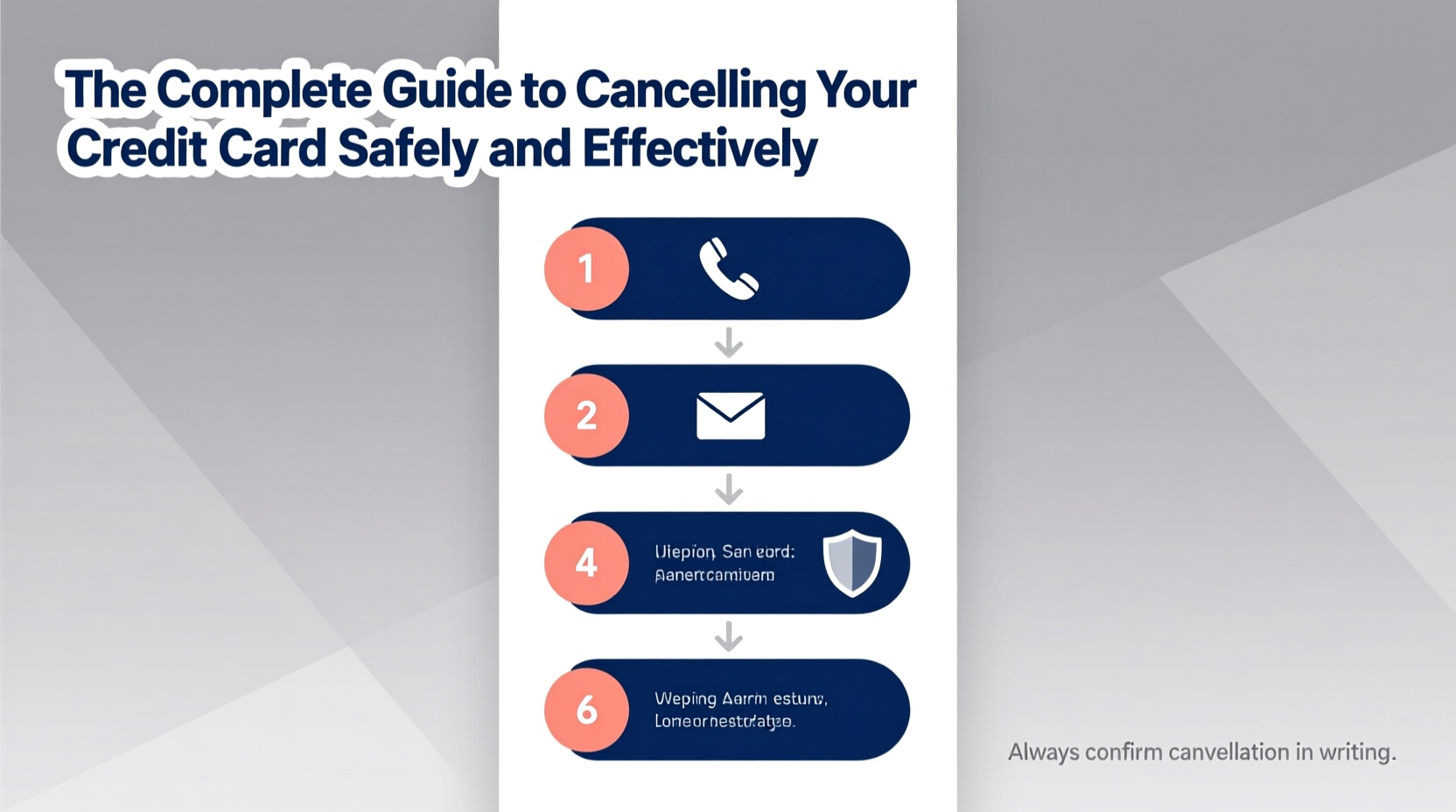

The Step-by-Step Process to Cancel Your Credit Card

Cancelling a credit card isn’t complete when you cut up the plastic. Follow this structured timeline to ensure a clean, secure closure:

- Check your balance and redeem rewards: Pay off any remaining balance in full. If you have accumulated rewards (points, miles, cashback), use or transfer them before closing—many issuers void rewards upon account closure.

- Identify recurring payments: Review bank statements or use budgeting apps to find subscriptions or automatic bills linked to the card. Update each with a new payment method to prevent missed payments.

- Contact customer service: Call the number on the back of your card. Avoid online cancellation forms unless they provide live support. Speak to a representative to confirm final details.

- Request written confirmation: Ask the agent to send a letter or email stating the account has been closed at your request. This protects you if disputes arise later.

- Cut up the card: Once the balance is zero and confirmation is received, destroy the physical card. Consider cutting through the chip and magnetic stripe.

- Monitor your credit report: Check your credit file 30–60 days after cancellation to verify the account shows as “closed” and reflects a $0 balance.

This process ensures that no residual charges appear, your credit remains intact, and your personal data stays protected.

Do’s and Don’ts When Cancelling a Credit Card

| Do’s | Don’ts |

|---|---|

| Pay off the balance in full before closing | Close your oldest card without considering credit age impact |

| Transfer unused rewards before cancellation | |

| Update auto-payments linked to the card | Assume online closure is complete without follow-up |

| Get verbal and written confirmation of closure | Close multiple cards at once—this can significantly hurt your credit score |

| Review your credit report post-cancellation | Forget to cancel associated add-on cards (e.g., authorized user accounts) |

Real-Life Scenario: Sarah’s Strategic Card Cancellation

Sarah had held a premium travel card for five years. It offered excellent airline perks but came with a $95 annual fee. After changing jobs and reducing her travel, she realized she wasn’t earning enough value to justify the cost.

Instead of cancelling outright, she called her issuer and asked about product changes. The representative offered to switch her to a no-fee version of the same card—keeping her original account open, preserving her credit history, and maintaining her accumulated points.

Sarah accepted the downgrade. Her credit utilization remained stable, her credit age didn’t reset, and she avoided the risk of a score drop. She achieved her goal—eliminating the fee—without compromising her financial health.

This case illustrates that cancellation isn’t always necessary. Sometimes, restructuring your account delivers the same benefit with less risk.

“Closing a credit card can trigger a temporary dip in your credit score, especially if it’s one of your oldest accounts or has a high credit limit. Always weigh the long-term impact.” — Marcus Reed, Certified Financial Planner

Key Tips for Protecting Your Credit Score

Your credit score relies heavily on two metrics affected by card cancellation: credit utilization and length of credit history.

- Credit utilization: This measures how much of your available credit you’re using. Closing a card reduces your total limit, potentially increasing your utilization ratio—even if your spending stays the same.

- Average age of accounts: The longer your credit history, the better. Closing an old card shortens your average account age, which may lower your score.

To minimize damage:

Also, avoid closing multiple cards in a short period. Spacing out closures by several months gives your credit profile time to stabilize.

Frequently Asked Questions

Will cancelling a credit card hurt my credit score?

It can, temporarily. The impact depends on the card’s age, credit limit, and your overall credit mix. Closing a high-limit card increases your utilization rate. Closing an old card shortens your credit history. Both factors may lower your score by a few points to over ten, depending on your profile.

Can I reopen a credit card after cancellation?

Sometimes—but not always. Some issuers allow reactivation within 30–60 days, especially if there was no history of delinquency. However, once an account is closed and removed from their system, reopening typically requires a new application, which triggers a hard inquiry.

What should I do if the issuer won’t cancel my card?

Some companies resist cancellations to retain customers. Be firm but polite. State clearly: “I would like to close my account at my request.” If they refuse, ask to speak with a supervisor. Document the call date, time, and agent name. Follow up with a certified letter requesting closure if needed.

Final Checklist Before Cancellation

- ✅ Pay off the entire balance or transfer it to another card

- ✅ Redeem or transfer all accumulated rewards

- ✅ Identify and update all automatic payments

- ✅ Contact customer service and request closure

- ✅ Confirm the account will be reported as “closed by consumer”

- ✅ Request written confirmation via email or mail

- ✅ Cut up the physical card after closure confirmation

- ✅ Check your credit report in 4–6 weeks to verify the update

Take Control of Your Financial Future

Cancelling a credit card doesn’t have to be risky. With careful planning and attention to detail, you can eliminate unnecessary fees, reduce temptation, and streamline your finances—all without harming your credit. The key is preparation: settle balances, preserve rewards, protect your credit history, and document every step.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?