Filing taxes without your W-2 form can be frustrating, especially if you’ve changed jobs or misplaced important documents over the years. The W-2 is essential for accurately reporting income to the IRS and avoiding delays or audits. Whether you’re preparing a late return, verifying earnings, or applying for a loan that requires proof of income, retrieving old W-2s is often necessary. Fortunately, multiple reliable pathways exist to recover these critical documents—even from decades ago.

This guide walks through every practical method available to retrieve past W-2 forms, including digital options, employer outreach, IRS requests, and third-party tools. With clear steps, real-world examples, and expert-backed advice, you’ll be equipped to locate any missing W-2 efficiently and securely.

Why Past W-2 Forms Matter

The W-2 form reports wages earned, taxes withheld, and other compensation details from your employment in a given year. The IRS uses this data to verify your tax return. If you file without it—or with incorrect information—you risk processing delays, penalties, or even an audit.

Common reasons people need old W-2s include:

- Filing an amended return (Form 1040-X)

- Applying for a mortgage, student aid, or government benefits

- Verifying income history during job applications

- Rebuilding financial records after loss due to fire, flood, or theft

Employers are required by law to keep W-2 records for at least four years, but many retain them much longer. The Social Security Administration (SSA) also maintains wage records indefinitely, which makes retrieval possible even when employers no longer exist.

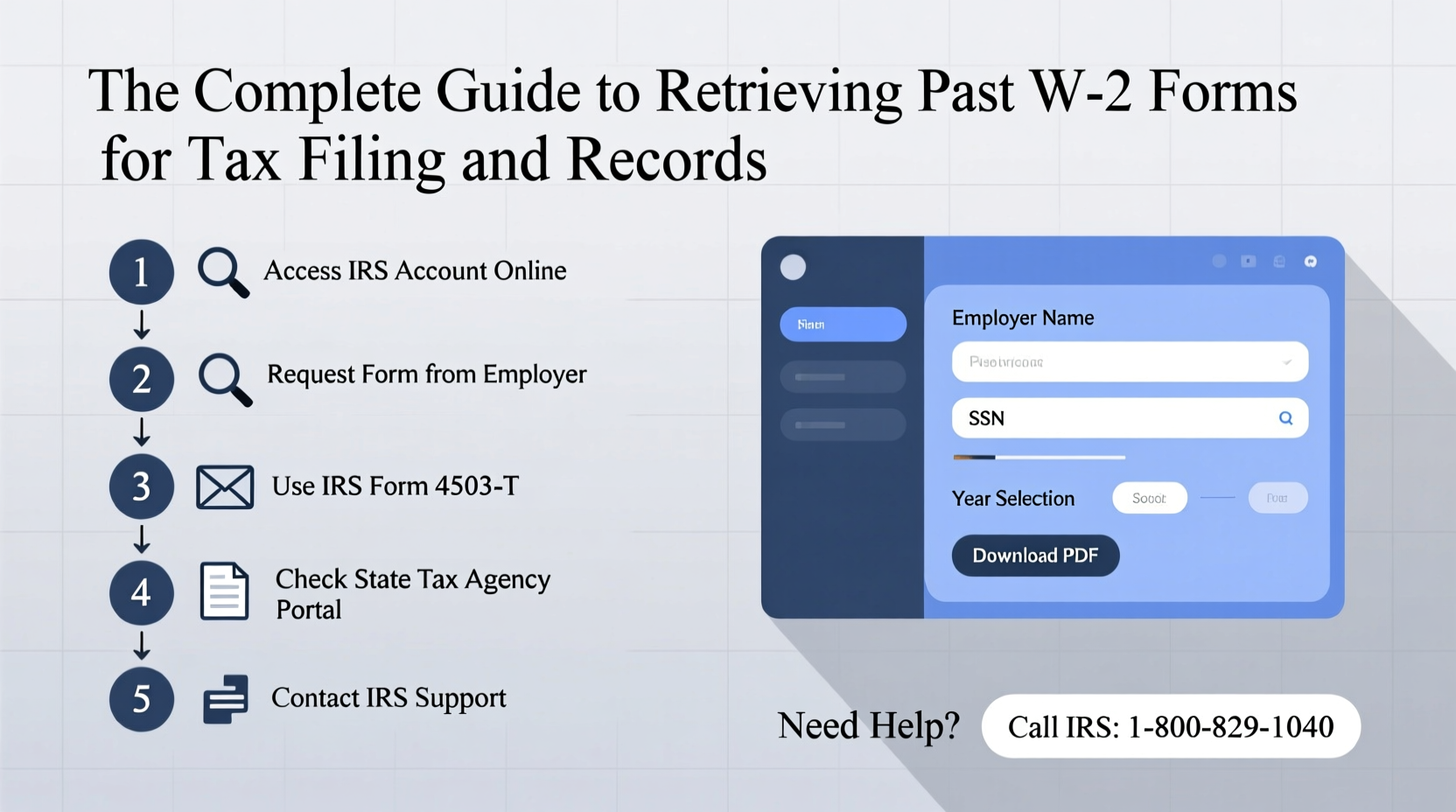

Step-by-Step Guide to Retrieving Old W-2 Forms

Follow this structured approach to maximize your chances of recovering any missing W-2:

- Check Your Personal Records: Look through physical files, email archives, cloud storage (Google Drive, Dropbox), or old tax returns. Many people attach W-2s to prior filings.

- Contact Your Former Employer: Reach out to HR or payroll departments. Provide full name, SSN, employment dates, and mailing address.

- Use Online Payroll Portals: If your former company used ADP, Paychex, or another digital system, log in with old credentials or request account recovery.

- Request a Wage Transcript from the IRS: When other options fail, submit Form 4506-T for a free wage and income transcript containing W-2 data.

- Order a Full Copy from the IRS (if needed): For actual copies of filed W-2s (not just transcripts), use Form 4506—but expect fees and processing time.

How to Contact Former Employers Effectively

When reaching out to a former employer, clarity and documentation increase success rates. Use this checklist when making contact:

Retrieval Checklist

- Full legal name used during employment

- Social Security Number (for verification)

- Dates of employment (start and end)

- Last known address while employed

- Email or phone number for follow-up

- Specific year(s) of requested W-2(s)

If the company has been acquired, try searching the successor organization’s website or contacting their HR department. For defunct businesses, state labor departments or unemployment offices may have archived records.

“Many employers still store legacy payroll data electronically—even after closing. Don’t assume a closed business means lost records.” — Lisa Tran, IRS Retired Tax Examiner

Using IRS Services to Access Wage History

When employer contact fails, the IRS offers two primary tools: the Wage and Income Transcript and the Photocopy of Filed Return.

| Service Type | Data Provided | Cost | Processing Time | Best For |

|---|---|---|---|---|

| Wage & Income Transcript (Form 4506-T) | Summary of income and withholding per year | Free | 10–30 days | Tax preparation, income verification |

| Copy of Actual W-2 (Form 4506) | Exact copy of filed W-2 form | $62 per year requested | 75 days | Legal documentation, disputes |

To request a transcript using Form 4506-T:

- Download Form 4506-T from IRS.gov.

- Fill in your personal information and check box 7a (\"Wages\") or 7b (\"All\").

- List tax years needed (up to 10).

- Sign and date the form.

- Mail or fax to the address listed on the form.

Note: Transcripts typically arrive within four weeks and show all W-2, 1099, and other income forms reported to the IRS under your SSN.

Real Example: Recovering a Decade-Old W-2

James Rivera worked at a small tech startup from 2012 to 2014. The company shut down in 2016, and he never saved digital copies of his W-2s. In 2023, he applied for a home loan and was asked to provide income verification for three consecutive years—including 2013.

He first tried contacting former colleagues, but none had access to payroll systems. He then searched public records and found that the company had been acquired by a larger firm in 2015. After calling the acquiring company’s HR department with his employment details, they located his W-2 in archived data and emailed a scanned copy within five business days.

James avoided the $62 IRS fee and received a legitimate document accepted by his lender—all because he traced corporate lineage and persisted with professional communication.

Common Mistakes to Avoid

- Waiting until tax deadline week: Processing times vary; start early.

- Providing incomplete identification: Missing SSNs or mismatched names delay responses.

- Assuming online portals are gone forever: Some services archive employee data for years.

- Not verifying retrieved data: Errors happen. Cross-check totals with pay stubs or bank deposits.

- Paying for a photocopy when a transcript suffices: Most institutions accept IRS transcripts as valid proof.

Frequently Asked Questions

Can I get a W-2 from 20 years ago?

Yes. While employers are only required to keep W-2s for four years, the IRS retains wage data indefinitely. You can request a transcript for any year going back decades via Form 4506-T.

What if my employer refuses to send a W-2?

If a current or former employer won’t issue a W-2 upon request, report them to the IRS using IRS Form 3949-A. Include as much detail as possible. The IRS can compel compliance.

Is a wage transcript the same as a W-2?

No. A transcript summarizes income and withholding but isn’t an official W-2 copy. However, most banks, lenders, and agencies accept transcripts as proof of income. Only request a physical copy (via Form 4506) if specifically required.

Secure Storage Tips for Future W-2s

Once recovered, protect your W-2s properly:

- Scan and store digital copies in encrypted folders or password-managed cloud storage.

- Keep physical copies in a fireproof safe or safety deposit box.

- Back up files across multiple devices or services.

- Include W-2s when archiving annual tax returns.

“Digital organization today prevents hours of stress tomorrow. Treat your W-2 like a birth certificate—irreplaceable and worth protecting.” — Dana Pruitt, Certified Financial Planner

Final Steps: Take Control of Your Tax Records

Missing W-2 forms don’t have to derail your financial plans. With persistence and the right resources, you can retrieve income records from nearly any point in your career. Start with personal archives, move to employer outreach, and rely on IRS transcripts when necessary. Avoid unnecessary fees by knowing when a summary suffices over a certified copy.

Now is the perfect time to gather and digitize all your past W-2s—even if you don’t need them yet. Create a dedicated folder labeled “Tax Documents” and commit to saving each new W-2 as you receive it. A few minutes now can save days of frustration later.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?