Knowing your bank account number is essential for setting up direct deposits, paying bills, transferring money, or verifying identity with financial institutions. Yet many people hesitate or struggle when they need to locate this sensitive information quickly. The good news: there are several secure, reliable ways to access your account number—without compromising your financial safety. This guide walks you through every legitimate method, highlights common pitfalls, and provides expert-backed strategies to protect your data while retrieving what you need.

Why Your Bank Account Number Matters

Your bank account number is a unique identifier assigned by your financial institution to distinguish your account from millions of others. It’s used in nearly all banking operations, including ACH transfers, wire payments, automatic bill pay setups, and tax refund deposits. Unlike your routing number (which identifies the bank), your account number is personal and private. Misuse can lead to unauthorized transactions or identity theft if exposed carelessly.

Because of its sensitivity, banks design multiple layers of protection around this information. You won’t find it printed on debit cards, and customer service representatives often require verification before disclosing it. Understanding where and how to retrieve it safely ensures you stay compliant with security protocols while avoiding scams.

How to Find Your Account Number Safely: 5 Verified Methods

The safest way to locate your bank account number always involves using tools and channels directly provided by your bank. Below are five trusted approaches, ranked by convenience and security.

- Online Banking Portal – Log into your bank’s website using a secure connection. Navigate to your account dashboard, select the relevant account, and click “Account Details” or similar. Most banks display the full account number here or allow you to reveal it after re-authentication.

- Mobile Banking App – Open your bank’s official app, sign in with biometrics or password, go to the account summary screen, and tap the masked digits. Many apps temporarily unmask the number after facial recognition or PIN entry.

- Personal Checks – If you have checks, look at the bottom row. The long string of numbers consists of three parts: routing number (9 digits), account number (typically 10–12 digits), and check number (3–4 digits). The middle set is your account number.

- Monthly Bank Statements – Whether digital or paper, official statements list your account number—usually in the top-right corner or within transaction details. Never store these unsecured.

- Customer Service (With Verification) – Call your bank’s toll-free number listed on their official site. After passing identity verification (security questions, one-time codes, etc.), a representative may read your account number aloud or send it via secure message.

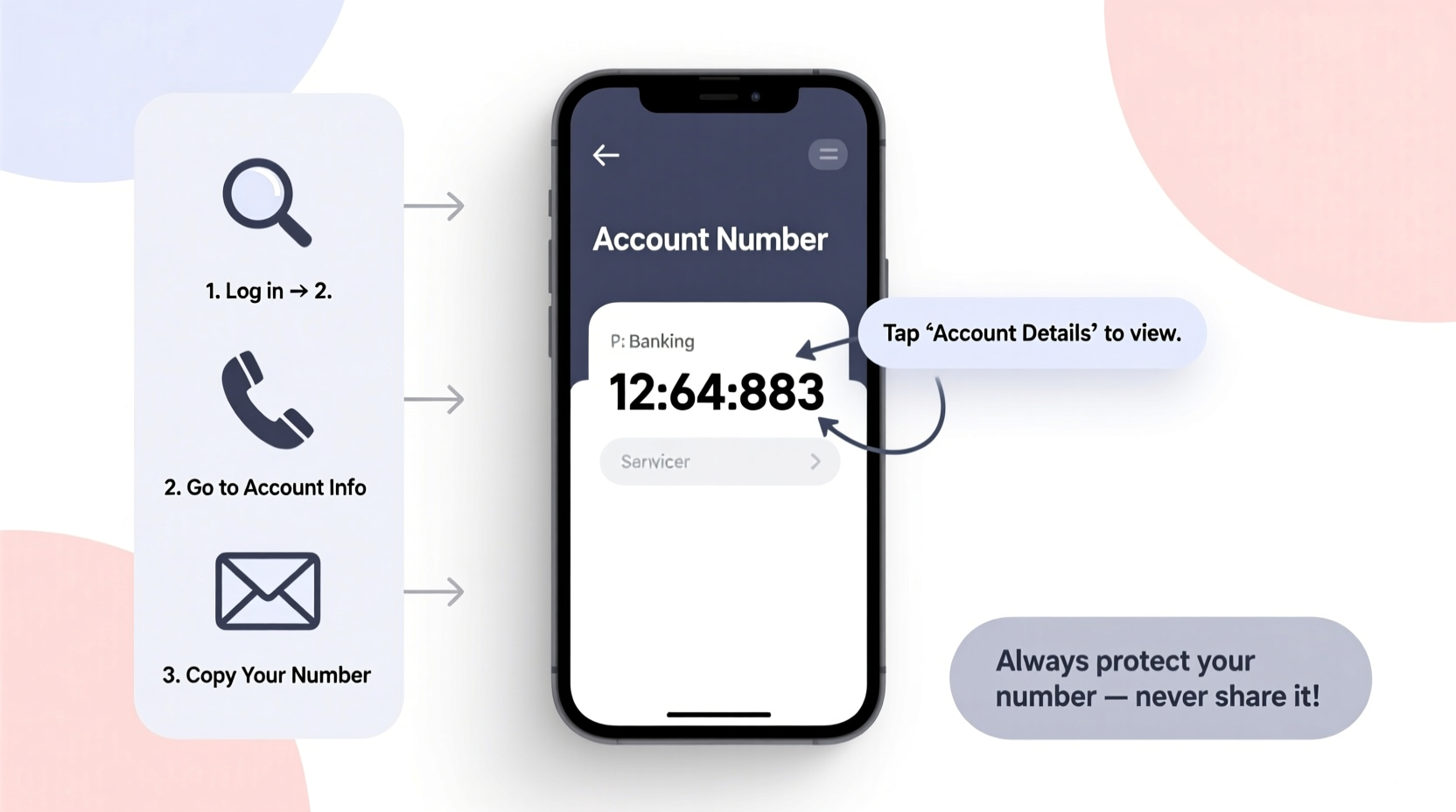

Step-by-Step: Retrieving Your Account Number Using a Mobile App

If you're using a smartphone, your bank’s mobile app is likely the fastest and most secure method. Follow this sequence carefully:

- Open the official banking app (ensure it's downloaded from Apple App Store or Google Play).

- Authenticate using fingerprint, face ID, or passcode.

- Select the account you need (e.g., checking or savings).

- Tap “Account Information” or “View Details.”

- Look for an option labeled “Show Account Number” — some apps require another authentication step.

- Once revealed, note it down only in a secure location or use copy-to-clipboard for immediate electronic use.

- Close the app and ensure no screenshots were taken.

This process typically takes under two minutes and keeps your data encrypted end-to-end. Avoid public Wi-Fi during this activity; instead, use cellular data or a trusted home network.

Common Mistakes That Risk Security

While searching for your account number, certain habits increase the risk of fraud or data leaks. Recognizing these errors helps you avoid them:

| Mistake | Risk | Better Alternative |

|---|---|---|

| Searching “my bank account number” in a search engine | Landing on phishing sites mimicking your bank | Go directly to your bank’s official URL |

| Taking screenshots of account details | Unintended sharing if phone is lost or cloud-synced | Type manually or use secure note apps with encryption |

| Asking customer service to email your account number | Email is not secure for transmitting sensitive data | Use secure messaging within online banking portals |

| Writing the number on sticky notes or unsecured documents | Physical theft or prying eyes | Store in password manager with strong master password |

“Your account number is like a key to your financial home. Just as you wouldn’t mail a photo of your house key, don’t expose your account number over unsecured channels.” — Linda Reyes, Senior Fraud Analyst at National Consumer Finance Association

Real Example: Recovering an Account Number After Moving Abroad

Sophie, a freelance designer based in Portugal, needed to provide her U.S. bank account number to receive payment from a client. She had lost her checkbook and didn’t have recent statements. Instead of panicking, she followed protocol: she connected to a trusted Wi-Fi network, opened her bank’s app, verified her identity with Face ID and a two-factor code, navigated to her checking account, and tapped “Show Account Number.” She copied it into an encrypted note, pasted it into a secure client portal, and deleted the temporary file immediately. No third-party access, no risks. Within hours, the transfer was initiated.

This scenario illustrates how preparedness and adherence to security practices make accessing critical financial data both fast and safe—even across borders.

Checklist: Securely Accessing Your Account Number

- ✅ Use only official bank websites or apps

- ✅ Confirm you’re on a secure network (HTTPS, private Wi-Fi)

- ✅ Enable multi-factor authentication on your accounts

- ✅ Never share your login credentials with anyone

- ✅ Avoid writing down the number unless absolutely necessary

- ✅ If written, destroy the paper immediately after use

- ✅ Do not disclose your account number via email, text, or social media

Frequently Asked Questions

Can I find my account number without logging in?

No legitimate method allows you to view your full account number without authentication. Banks require login or identity verification to protect against unauthorized access. If a site claims otherwise, it is likely fraudulent.

Is it safe to show my account number on video calls or screenshares?

No. Even in trusted settings, avoid displaying your account number on camera. Scammers can capture stills or record sessions. Share such details only through secure messaging platforms or in person with verified professionals.

What should I do if my account number is exposed?

Contact your bank immediately. They may freeze the account, monitor for suspicious activity, or issue a new account number. Also, enable transaction alerts and review your statements weekly for any unauthorized movements.

Final Thoughts: Stay Informed, Stay Protected

Accessing your bank account number doesn’t have to be stressful or risky. By relying on official tools—your mobile app, checks, statements, or verified customer service—you maintain control over your financial information. Combine these methods with disciplined digital hygiene: strong passwords, updated software, and skepticism toward unsolicited requests. Knowledge is power, but secure knowledge is peace of mind.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?