Receiving or writing a check is still a common financial practice, whether for payroll, rent, or personal payments. Once a check is issued, uncertainty often follows: Has it been cashed? Was it lost in the mail? Did someone else deposit it? The good news is that every check carries a unique identifier—its check number—that can be used to monitor its status. Understanding how to track a check using this number empowers you to manage your finances with confidence and security.

While the check number alone isn’t enough to pull up transaction details from public databases, when combined with other account information and proper banking channels, it becomes a critical tool in tracing a check’s journey from issuance to clearance.

Understanding the Check Number and Its Role

The check number is a sequential digit printed in the upper right corner and repeated at the bottom of every paper check. It typically ranges from 1000 to 9999, depending on the starting point of your checkbook. This number serves multiple purposes: organizing transactions, preventing duplicates, and enabling accurate tracking through your bank’s system.

When a check is written, banks use the check number in conjunction with the routing number and account number (found in the magnetic ink character recognition line at the bottom) to process and record the transaction. While the check number isn’t a standalone tracker, it acts as a reference point within your bank’s internal ledger.

“Every check number is like a fingerprint in your financial history. Paired with account data, it allows institutions to trace exactly when and where a check was processed.” — Lisa Tran, Senior Banking Advisor at National Financial Services Group

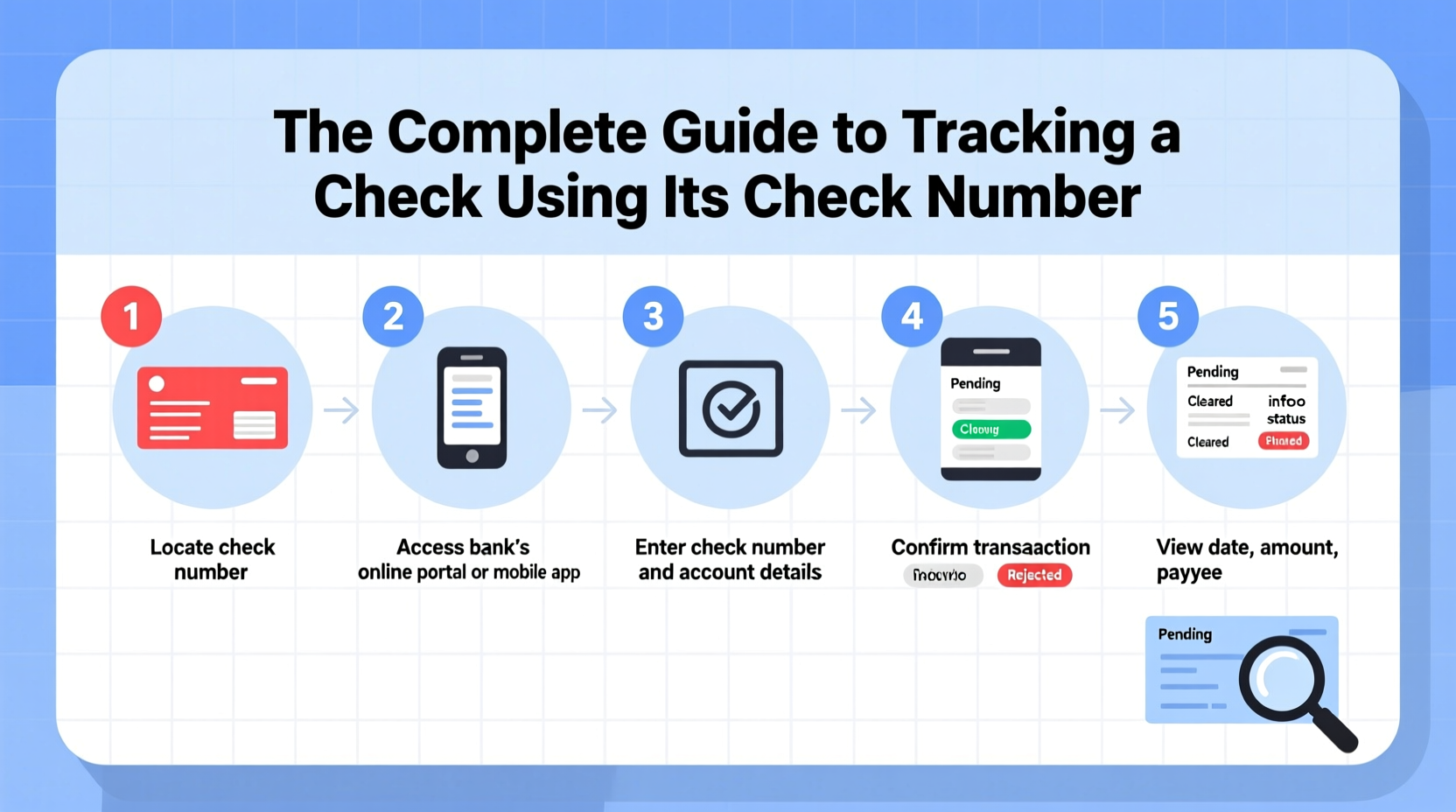

How to Track a Check Using Its Number: Step-by-Step Process

Tracking a check starts with knowing what information you have and which channels to use. Follow this logical sequence to determine the status of any check:

- Gather necessary details: Have the check number, amount, date issued, payee name, and your account number ready.

- Log into your online banking portal: Navigate to the “Check Status” or “Account Activity” section.

- Search by check number: Use the search or filter function to enter the check number.

- Review transaction details: If the check has cleared, you’ll see a cleared status, deposit date, and sometimes an image of the front and back.

- Contact customer service if needed: If no results appear and the check should have cleared, call your bank with the check number and supporting details.

Bank Tools and Digital Features That Support Check Tracking

Most major banks now offer digital tools that make tracking checks easier than ever. These features are built into mobile and online banking platforms:

- Check Image Access: After a check clears, many banks provide a scanned image of both sides, confirming who endorsed it and where it was deposited.

- Real-Time Status Updates: Some institutions label checks as “In Transit,” “Processed,” or “Returned” based on clearing stage.

- Alerts and Notifications: Enable alerts for check clearance so you’re notified the moment a specific check is cashed.

- Advanced Search Filters: Platforms like Chase, Bank of America, and Wells Fargo allow filtering transactions by check number directly in the activity feed.

If your bank doesn’t offer direct check number search, you can still manually scan recent transactions and match them to your check records. Look for entries labeled “Check #1234” or similar notations in the transaction description.

Common Scenarios and Real-World Examples

Sometimes, real-life situations reveal the importance of check tracking. Consider this scenario:

Sarah mailed a rent check (#2157) for $1,200 on the first of the month. By the fifth, her landlord claimed non-receipt. Sarah logged into her online banking, searched for check #2157, and discovered it had already cleared—deposited at a branch in another state. Suspicious, she contacted her bank, which confirmed the endorsement signature didn’t match hers. Fraud was suspected, and the bank reversed the transaction after an investigation. The check number was pivotal in identifying the unauthorized deposit.

This case illustrates how tracking via check number can protect against fraud and resolve disputes quickly. Without that unique identifier, proving the check’s misuse would have been far more difficult.

Do’s and Don’ts of Check Tracking

| Do’s | Don’ts |

|---|---|

| Keep a physical or digital check register updated with each transaction. | Never share your check number publicly or on unsecured platforms. |

| Use online banking tools to verify check clearance regularly. | Assume a check hasn’t cleared just because the recipient says so. |

| Contact your bank promptly if a check doesn’t clear within expected time. | Destroy check stubs before confirming the check has fully processed. |

| Request stop payments early if a check is lost or stolen. | Rely solely on memory—always document check details. |

When You Can’t Track a Check Immediately

Not all checks appear in your system right away. The processing timeline depends on several factors:

- Type of deposit: Mobile deposits may take 1–3 business days; in-branch deposits clear faster.

- Banks involved: Checks drawn from smaller credit unions or regional banks may take longer to clear than those from national institutions.

- Amount: Large checks may be subject to extended holds for verification.

- Fraud detection: Suspicious activity can delay processing while the bank investigates.

If a check hasn’t shown up after 10 business days, it’s reasonable to contact your bank. Provide the check number and ask whether it has entered the clearing system. In some cases, the bank can initiate a trace using the Automated Clearing House (ACH) network or the Federal Reserve’s check inquiry system.

FAQ

Can I track a check using only the check number?

No, the check number alone isn’t sufficient. You must access your own bank account where the check was drawn. Banks require authentication and additional account details to retrieve transaction records.

What if the check number isn’t showing up online?

It may not have cleared yet, or your bank might not support direct search by check number. Try reviewing recent transactions manually or contact customer service with the check number and date for assistance.

Is it safe to give someone my check number?

Only under controlled circumstances—such as setting up direct deposits or recurring bill payments. Never disclose it publicly. Combined with your account and routing numbers, it could be used to create counterfeit checks.

Essential Checklist for Effective Check Monitoring

- ☑ Maintain a check register with numbers, dates, payees, and amounts

- ☑ Enable online banking alerts for check clearance

- ☑ Regularly review cleared checks in your account activity

- ☑ Save check stubs or digital copies until funds are confirmed

- ☑ Request stop payments promptly if a check is compromised

- ☑ Contact your bank with the check number if discrepancies arise

Conclusion

Tracking a check using its number is a straightforward yet powerful way to maintain control over your finances. With the right tools and habits, you can verify payments, prevent fraud, and resolve disputes efficiently. Your check number is more than just a sequence—it’s a key to transparency in your financial transactions.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?