Finding your checking account number shouldn’t require digging through old checks or visiting a branch. Whether you’ve lost your checkbook, are setting up direct deposit, or need the number for an online payment, there are several reliable ways to retrieve it quickly and securely. With digital banking now standard, most people can access their account details in minutes using tools they already have. This guide walks through every practical method—no guesswork, no delays.

Why You Need Your Checking Account Number

Your checking account number is a unique identifier used by financial institutions to process transactions. It’s essential for:

- Setting up direct deposits (e.g., payroll, government benefits)

- Authorizing automatic bill payments

- Receiving money via ACH transfers or peer-to-peer apps

- Linking accounts to investment platforms or loan services

Unlike your routing number—which identifies your bank—your account number is personal to you. Never share it unnecessarily, but know where to find it when needed.

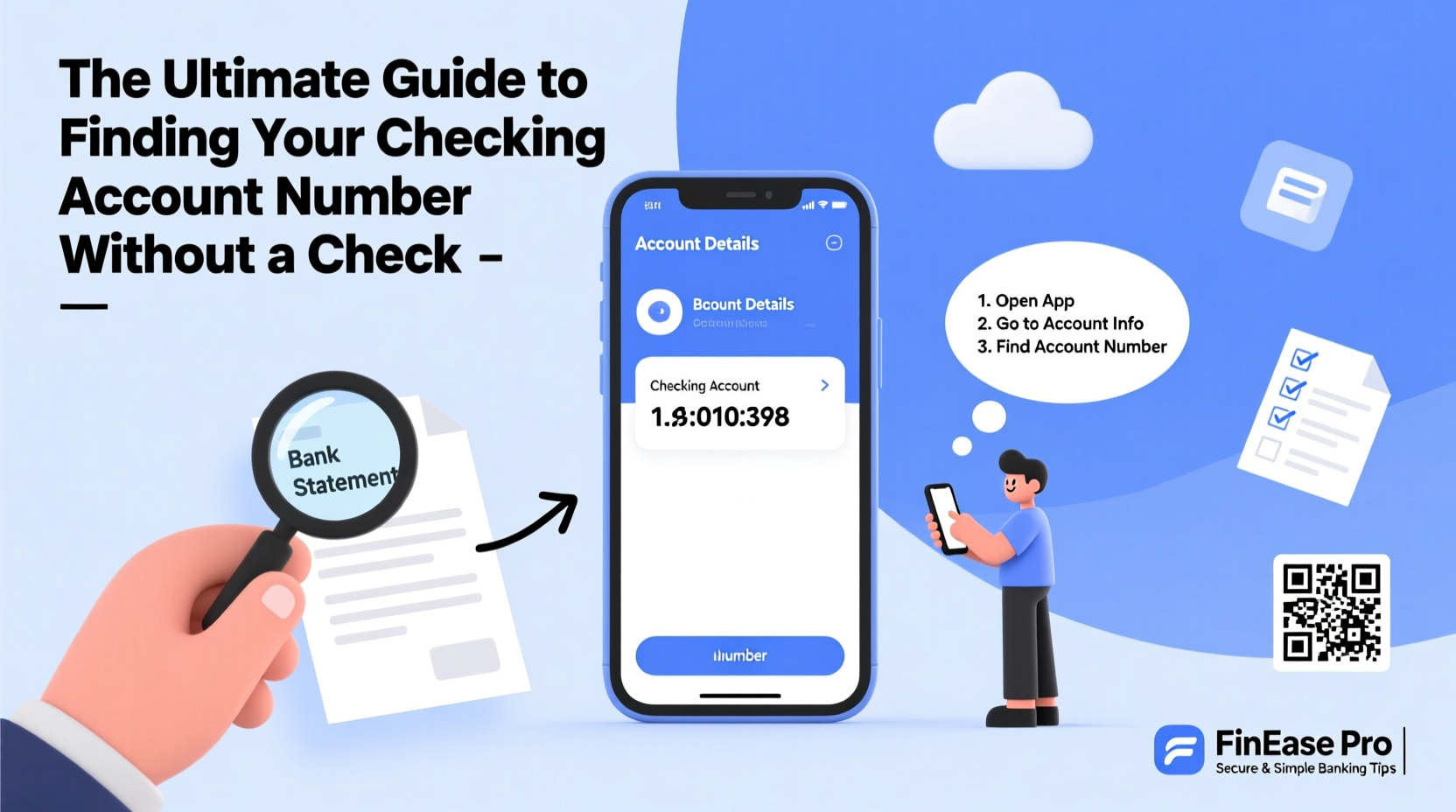

Step-by-Step: How to Find Your Account Number Digitally

The fastest and most secure way to locate your checking account number is through your bank’s digital channels. Follow this sequence for guaranteed results.

- Log in to your online banking portal. Use your username and password at your bank’s official website.

- Navigate to your checking account dashboard. Select the correct account if you have multiple.

- Click on “Account Details” or “Account Information.” This section often includes sensitive data behind an extra layer of authentication.

- Look for “Account Number” or “Primary Account Number.” It may be partially masked for security.

- Select “Show” or “Reveal” after verifying your identity. Some banks require a one-time passcode sent via SMS or email.

- Record the number securely. Avoid saving it in plain text on devices.

If you're using a mobile app, the path is similar. Tap your checking account, then look for an info icon (i) or “Details” button. Many apps now allow facial recognition or fingerprint verification to reveal hidden digits.

Alternative Methods When Online Access Isn’t Available

Not everyone uses online banking regularly. If you don’t have login credentials or prefer offline options, here are trusted alternatives.

Review Your Bank Statement

Whether paper or PDF, your monthly statement contains your account number—usually near the top right corner or within the transaction summary. Look for a label like “Account:” followed by a 10–12 digit number.

Call Customer Service

Dial the number on the back of your debit card or your bank’s official website. After verifying your identity with personal questions (e.g., date of birth, address, recent transactions), a representative can provide your account number over the phone.

Visit a Local Branch

Bring a government-issued ID and, if possible, your debit card. A teller can pull up your account information instantly. This method is ideal if you’re also requesting additional services like a new check order or account upgrade.

| Method | Speed | Security Level | Best For |

|---|---|---|---|

| Online Banking | Immediate | High (with 2FA) | Most users |

| Mobile App | Immediate | High | On-the-go access |

| Bank Statement (PDF) | Fast (if saved) | Moderate | Backup verification |

| Phone Support | 5–15 min wait | Moderate | Non-digital users |

| In-Person Branch | Depends on wait time | High | Complex needs |

Real Example: Sarah Recovers Her Account Number Remotely

Sarah moved to a new city and misplaced her checkbook. She needed her account number to set up rent payments but hadn’t used online banking before. She downloaded her bank’s app, registered using her Social Security number and mailing address, verified her identity via email, and accessed her account dashboard in under ten minutes. By tapping the “View Full Account Number” option and confirming with a texted code, she retrieved the number and completed her setup—all without leaving her apartment.

This scenario is increasingly common. Banks have optimized self-service tools precisely for situations like this, reducing dependency on physical checks.

Expert Insight: What Financial Institutions Recommend

“Customers should never feel they need a check to access their account number. Our digital platforms are designed to be the primary tool for secure, instant access.” — James Lin, Senior Customer Experience Officer at First National Trust

“The biggest mistake people make is writing down their account number on sticky notes or unsecured documents. Use a password manager with a notes feature instead.” — Lena Patel, Cybersecurity Advisor at SecureBank Solutions

Common Mistakes to Avoid

- Confusing the routing number with the account number. The routing number is usually 9 digits and appears first on checks; the account number comes after.

- Using third-party websites to retrieve account details. Only use official bank domains or apps.

- Sharing screenshots of your account dashboard. They may expose more data than intended.

- Assuming all banks display the number the same way. Layouts vary—explore menus thoroughly.

FAQ: Quick Answers to Common Questions

Can I find my checking account number on my debit card?

No. Debit cards have a unique card number that differs from your checking account number. While linked, they are not interchangeable for account verification purposes.

What if I don’t have any bank statements?

You can request a copy of your latest statement through customer service or your online portal. Most banks keep 7–12 months of statements available digitally.

Is it safe to view my account number on a public Wi-Fi network?

It’s not recommended. Public networks are vulnerable to snooping. Always use a secure, private connection or your mobile data when accessing sensitive financial information.

Checklist: How to Retrieve Your Account Number Safely

- ✅ Confirm you’re on your bank’s official website or app

- ✅ Log in using strong credentials and two-factor authentication

- ✅ Navigate to your checking account’s detail page

- ✅ Reveal the full account number using verified methods

- ✅ Store the number securely (e.g., encrypted note or password manager)

- ✅ Log out after completion, especially on shared devices

Conclusion: Take Control of Your Financial Access

You don’t need a check to find your checking account number. Modern banking gives you immediate, secure access through tools you likely already use every day. Whether you rely on mobile apps, online portals, or direct support, retrieving your account details should be quick and stress-free. The key is knowing where to look and how to protect your information once you have it. Stay proactive—save your bank’s contact info, enable alerts, and familiarize yourself with your digital dashboard now, so you’re prepared when the need arises.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?