In today’s digital world, subscriptions are everywhere: streaming platforms, fitness apps, meal kits, cloud storage, and even smart home devices. While many offer convenience, they can quietly accumulate into a significant monthly expense—often forgotten until the bill arrives. The average consumer unknowingly pays for 4–6 inactive subscriptions, costing hundreds per year. Worse, some auto-renew without clear notice, making cancellation confusing or deliberately difficult.

This guide equips you with actionable strategies to identify, cancel, and prevent unwanted subscriptions—saving money, reducing clutter, and regaining control over your finances.

Why Subscriptions Become Financial Traps

Subscription models thrive on inertia. Companies rely on users forgetting to cancel free trials, missing renewal dates, or struggling with opaque cancellation processes. Some use dark patterns—design tricks that make opting out harder than signing up. For example, requiring phone calls instead of online options or hiding cancellation links in complex menus.

A 2023 study by Consumer Reports found that 68% of people had accidentally continued paying for a service they no longer used. Many cited confusion about how to cancel or assumed the free trial would end automatically.

“Companies profit from friction. If it feels too hard to cancel, they’ve already won.” — Lena Patel, Consumer Rights Advocate at Fair Digital Practices Coalition

Step-by-Step Guide to Cancel Any Subscription

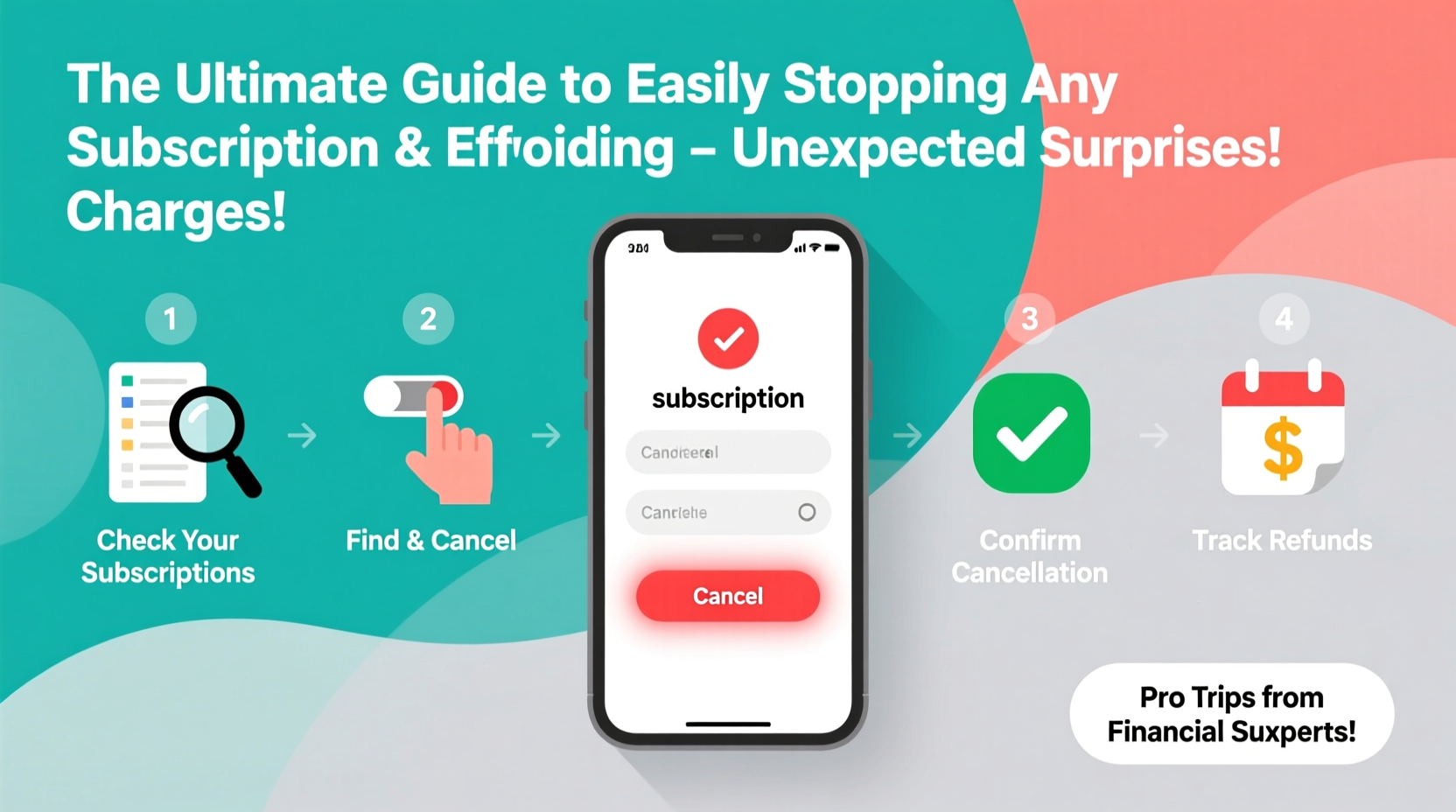

Cancelling a subscription doesn’t have to be frustrating. Follow this five-step process to handle any service efficiently:

- Identify all active subscriptions. Review bank and credit card statements from the past three months. Look for recurring charges under names like “*NETFLIX.COM*”, “*APPLE*BILL*”, or “*SPOTIFY*”.

- Determine the platform. Was it purchased via an app store (Apple App Store, Google Play), directly from the company website, or through a third party (e.g., Amazon Subscribe & Save)? This affects how you cancel.

- Find the official cancellation method. Visit the provider’s help or account settings page. Search “[Service Name] + cancel subscription” if navigation is unclear.

- Cancel before the next billing cycle. Most services require action at least 24–48 hours before renewal to avoid being charged again.

- Request confirmation. After cancellation, look for an email receipt or check your account dashboard to ensure access will end on the promised date.

Do’s and Don’ts When Cancelling Subscriptions

| Do’s | Don’ts |

|---|---|

| Check your email for welcome or billing messages from the service—they often contain direct cancellation links. | Assume a deactivated account means you’re no longer being billed. |

| Use your bank’s transaction notes to label recurring payments (e.g., “Monthly Canva Pro”). | Ignore small charges—even $3.99/month adds up to $48/year. |

| Contact customer support via live chat or email if the self-service option fails. | Delete the app without cancelling first—this does not stop billing. |

| Take screenshots of confirmation pages or emails as proof of cancellation. | Rely solely on unsubscribe links in marketing emails—they don’t cancel billing. |

Real Example: How Sarah Recovered $220 in One Hour

Sarah, a freelance designer, reviewed her credit card statement after noticing lower-than-expected savings. She spotted charges for Adobe Creative Cloud ($54.99), Figma Pro ($15), two cloud backup services, and a meditation app she tried once. None were actively used.

She spent one evening going through each:

- The Adobe plan was tied to her Apple ID. She went to Settings > [Her Name] > Subscriptions and turned it off.

- Figma required logging into the web dashboard and navigating to Billing > Plans > Downgrade to Free.

- One cloud service asked her to email support—a request she sent and received confirmation within four hours.

Total time: 55 minutes. Total saved: $220 annually. “I didn’t realize how much I was leaking,” she said. “Now I set calendar reminders for every new trial.”

Essential Tools to Track and Prevent Future Charges

Prevention is more effective than cleanup. Use these tools to stay ahead:

- Mint or YNAB (You Need A Budget): Automatically flag recurring transactions and estimate annual costs.

- Truebill (now Rocket Money): Identifies subscriptions, helps cancel them, and negotiates bills.

- Card issuer alerts: Chase, Capital One, and others offer notifications for recurring charges.

- Google Sheets tracker: Manually log subscriptions with renewal dates, cost, and cancellation status.

Free Tracker Template (Simple Setup)

Create a spreadsheet with these columns:

- Service Name

- Billing Date (e.g., 5th of each month)

- Cost per Month

- Platform (App Store, Website, etc.)

- Next Renewal Date

- Status (Active, Trial, Cancelled)

- Notes (e.g., “Free trial ends June 10”)

FAQ: Common Subscription Questions Answered

Can I get a refund after being charged?

Sometimes. If you cancelled on time but were still billed, contact customer support with proof. App stores often issue refunds for accidental charges. Banks may also reverse unauthorized renewals as a courtesy.

What if the company won’t cancel my subscription?

If online methods fail, send a written cancellation request via email or certified mail. Keep records. If ignored, file a complaint with the FTC (U.S.), CFPB, or your national consumer protection agency.

Are free trials really free?

Only if you cancel before the trial ends. Most require a credit card and auto-enroll into paid plans. Set a phone reminder 2–3 days before expiration to decide whether to continue.

Final Checklist: Stay Subscription-Smart

To maintain full control, follow this checklist every 90 days:

- Download and review your latest bank and credit card statements.

- Highlight all recurring charges—even familiar ones.

- Verify which services you’re currently using and gaining value from.

- Cancel at least one unused or low-value subscription.

- Update your subscription tracker with new dates or changes.

- Enable renewal alerts for upcoming trials or annual plans.

“The best budget isn’t about cutting coffee—it’s about eliminating invisible expenses.” — Marcus Tran, Personal Finance Educator

Take Control Today

Subscriptions aren’t inherently bad—they deliver value when used intentionally. The problem lies in autopilot spending. By applying the steps in this guide, you reclaim both money and mental clarity. Start now: spend 20 minutes reviewing your last statement. Cancel one thing. Update your tracker. These small actions compound into meaningful financial freedom.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?