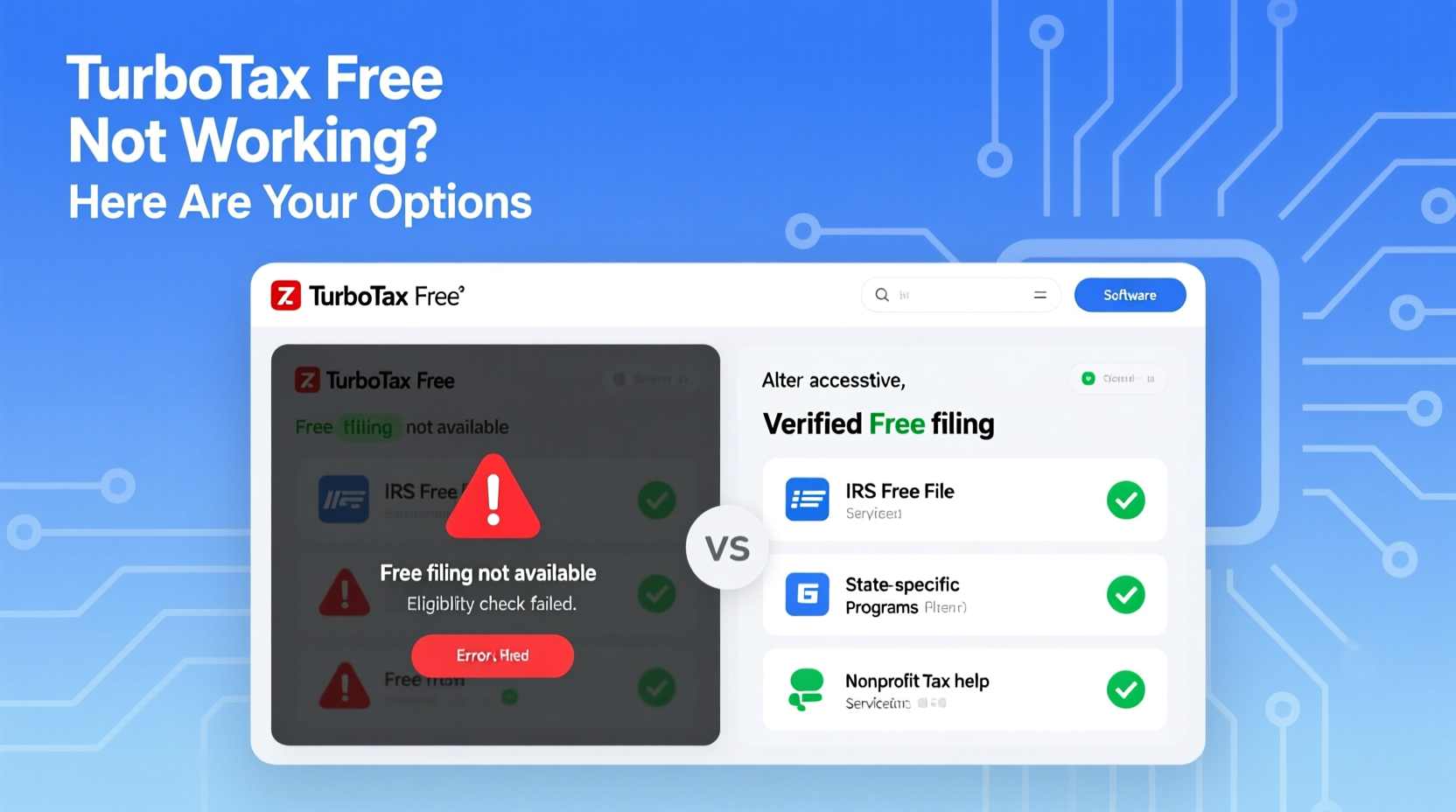

Every tax season, millions of Americans turn to free online tools to file their federal and state returns without paying a dime. TurboTax Free File has long been one of the most advertised options—promising zero cost for eligible taxpayers. But many users report that \"TurboTax Free\" isn't working as expected: pages fail to load, eligibility checks block simple returns, or the tool pushes paid upgrades despite qualifying for free service. If you've encountered these issues, you're not alone—and more importantly, you have alternatives.

This guide breaks down the common technical and policy-related reasons why TurboTax Free might not be working for you, explains how Intuit's design choices impact accessibility, and provides actionable, IRS-approved free filing options that actually work.

Why TurboTax Free Might Not Be Working

TurboTax promotes its Free File program heavily each year, yet numerous users find themselves unable to access truly free services—even when they meet income and eligibility requirements. Several factors contribute to this disconnect:

- Geolocation or browser issues: Some users experience loading errors based on location settings or outdated browsers.

- Redirects to “Free Edition” (not Free File): TurboTax often directs users to its limited “Free Edition,” which only supports basic 1099-INT or unemployment income—not full Free File eligibility.

- Narrow eligibility filters: Even if your income is below $45,000 (or $79,000 for AARP version), TurboTax may exclude you if you claim certain credits like the Earned Income Tax Credit (EITC).

- Server overloads during peak season: In January and April, high traffic can cause timeouts or incomplete form processing.

- Aggressive upselling algorithms: The software may detect user intent and trigger paid upgrade prompts early in the process, even before assessing eligibility.

Understanding the Difference: Free File vs. Free Edition

A major source of confusion lies in TurboTax’s naming. There are two distinct offerings:

- TurboTax Free File: Available only through the IRS partnership. It offers full federal and state return filing at no cost for those who qualify (typically under $45K–$79K adjusted gross income, depending on age and filing status).

- TurboTax Free Edition: A separate product available directly on TurboTax.com. This version handles only very basic returns (like W-2 and interest income) and excludes common deductions and credits.

The Free Edition is what most people land on after searching “TurboTax Free.” While it’s genuinely free for the forms it supports, it fails to serve the majority of low-to-moderate-income filers who need to claim EITC, Child Tax Credit, or education benefits.

“The Free File program was designed to give underserved taxpayers a real pathway to free filing—but too often, commercial partners make it harder to find than their paid products.” — Nina Olson, Former National Taxpayer Advocate

Reliable Free Filing Alternatives to TurboTax

If TurboTax Free isn’t working—or doesn’t serve your needs—consider these fully IRS-certified, no-cost alternatives. All are part of the IRS Free File Alliance and offer complete federal and state e-filing at no charge.

| Service | Max Income Eligibility | Supports Common Credits? | Direct IRS Link? |

|---|---|---|---|

| H&R Block Free Online | $45,000 | Yes (EITC, CTC, education) | Yes, via IRS portal |

| Rocket Money (formerly TaxSlayer) | $73,000 | Yes, including adoption credit | Yes |

| FreeTaxUSA | $45,000 (Federal Free; State $14.99) | Yes, full federal free | Yes |

| MilTax (via Military OneSource) | No income cap | Yes, includes combat pay, housing | Separate military program |

Each of these platforms allows you to import W-2s, claim key deductions, and file both federal and (in most cases) state returns—all without paying a fee. Unlike TurboTax, many do not push aggressive upsells once you begin.

Step-by-Step: How to Access True Free Tax Filing

To ensure you’re using a legitimate free filing option, follow this verified process:

- Visit the IRS Free File Portal: Go to IRS.gov/FreeFile.

- Select “Start with a Product Search”: Enter your ZIP code and indicate whether you want free federal and state filing.

- Choose from eligible providers: The tool will show only services you qualify for based on income, age, and state.

- Click through to the provider site: You’ll be redirected securely to the partner website (e.g., TaxSlayer, H&R Block).

- Prepare and file your return: Use the guided interview process to enter your data. Most support direct deposit and refund tracking.

- Save your confirmation: Print or save your submission receipt for your records.

Real Example: Maria’s Experience With TurboTax Free

Maria, a home health aide from Phoenix, earns $38,000 annually and qualifies for the Earned Income Tax Credit. She visited TurboTax.com to file her return for free, entering her W-2 and answering all prompts honestly. After 20 minutes of inputting her information, she was told she “qualified” for the Free Edition—but only if she didn’t claim EITC. When she tried to proceed with her full return, the system demanded a $60 fee.

Frustrated, Maria searched online and found the IRS Free File page. She used the product search tool and was directed to TaxSlayer Free File, where she completed her entire return—including EITC and Child Tax Credit—in under 30 minutes, at no cost. Her refund was processed in nine days.

Maria’s story reflects a widespread issue: TurboTax’s Free Edition is not designed for typical working families who rely on tax credits. True Free File exists—but you must use the IRS gateway to access it.

Checklist: Your Guide to Successful Free Tax Filing

- ✅ Start at IRS.gov/FreeFile, not TurboTax.com

- ✅ Confirm your income falls within eligibility limits ($45K–$79K depending on provider)

- ✅ Ensure the service supports credits you plan to claim (EITC, CTC, education)

- ✅ Use a modern browser (Chrome, Firefox, or Safari) with cookies enabled

- ✅ Have your prior-year return, W-2s, and bank details ready

- ✅ File early to avoid last-minute server congestion

- ✅ Save your e-file confirmation number and PDF copy

Frequently Asked Questions

Why does TurboTax say I don’t qualify for free filing if my income is under $45,000?

TurboTax uses narrow criteria beyond income. Claiming certain credits, having self-employment income, or living in specific states may disqualify you from their Free File program—even though other providers accept those situations.

Is FreeTaxUSA really free?

Yes—for federal returns. FreeTaxUSA offers completely free federal filing for all taxpayers regardless of income. State returns cost $14.99, but there are no hidden fees or upgrade pressures.

Can I file state taxes for free too?

Many Free File providers include one free state return. Check the offering details before starting. For example, H&R Block Free Online includes one free state form, while MilTax includes unlimited state filings.

Conclusion: Take Control of Your Tax Filing Experience

The promise of free tax filing should mean exactly that—free, accessible, and transparent. While TurboTax Free may not be working due to technical issues or restrictive policies, you’re not out of options. The IRS Free File program remains a powerful resource, connecting eligible taxpayers with trusted providers who deliver full-service returns at no cost.

Don’t let confusing interfaces or misleading ads deter you. By starting at IRS.gov, understanding the difference between Free File and Free Edition, and choosing a platform that supports your tax situation, you can file confidently and keep more of your hard-earned money.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?