Identifying the rightful owner of a piece of land is essential for real estate investors, legal professionals, environmental planners, and even curious neighbors. Whether you're considering a property purchase, resolving a boundary dispute, or conducting due diligence, knowing who owns a parcel can prevent costly mistakes. Fortunately, land ownership information is largely public in the United States and accessible through government records and digital platforms. This guide walks you through reliable methods, tools, and best practices to accurately determine landownership—legally and efficiently.

Understanding Public Land Records

In the U.S., land ownership details are maintained at the county level by local government offices, primarily the County Assessor, Recorder, and Clerk. These agencies collect and store data on property assessments, deeds, tax payments, and legal descriptions. Because ownership records are considered public information, anyone can access them—either in person or online—provided they know where to look.

The foundation of any landowner search lies in understanding three key documents:

- Deeds: Legal documents that transfer ownership from one party to another. Recorded in the County Clerk or Recorder’s office.

- Property Tax Records: Maintained by the County Assessor, these include current owner names, mailing addresses, parcel numbers, and assessed values.

- Plat Maps and GIS Data: Visual representations of land divisions, often available through Geographic Information Systems (GIS) portals.

“Public land records are among the most transparent systems in American governance. The challenge isn’t access—it’s knowing how to interpret and cross-reference the data.” — Sarah Lin, Land Use Attorney and Title Analyst

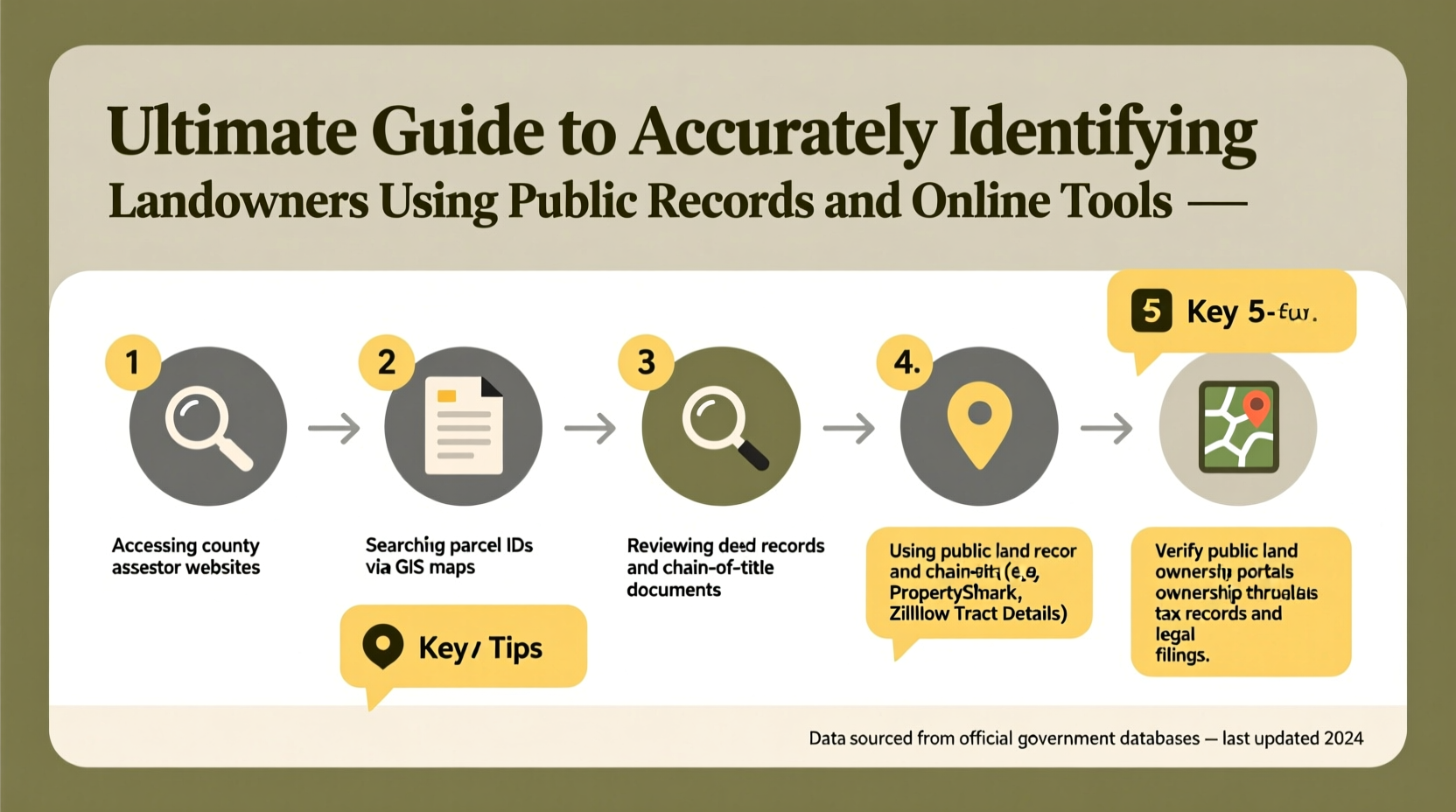

Step-by-Step Guide to Identifying Landowners

Finding accurate landowner information follows a logical process. Follow these steps to ensure precision and avoid misinformation.

- Determine the Property Location: Start with the physical address or approximate location. If no address exists, use landmarks, GPS coordinates, or nearby intersections.

- Visit the County Assessor’s Website: Search by address, parcel number (APN), or owner name. Most counties offer free online databases with up-to-date ownership and tax data.

- Obtain the Parcel Number (APN): This unique identifier is critical for cross-referencing across databases. It's usually listed on tax bills or property maps.

- Search the County Recorder’s Office: Look up recent deeds using the APN. This confirms the latest transfer of title and lists grantor and grantee names.

- Cross-Check with GIS Mapping Tools: Use the county’s GIS portal to view parcel boundaries, zoning, and ownership overlays.

- Verify Through Multiple Sources: Compare results from the assessor, recorder, and third-party tools to resolve discrepancies.

Top Online Tools for Landowner Research

While visiting county offices remains an option, digital tools have made remote research faster and more efficient. Below is a comparison of widely used platforms.

| Tool | Best For | Cost | Reliability |

|---|---|---|---|

| County Assessor Websites | Official ownership & tax data | Free | High – Primary source |

| County GIS Portals | Visual mapping & parcel ID lookup | Free | High – Government-maintained |

| PropStream | Real estate investors & wholesalers | Paid (subscription) | Moderate – Aggregated data |

| LandGlide | Mobile field identification | Paid (app-based) | High – Uses real-time GIS |

| Zillow / Realtor.com | General info & estimated value | Free | Low – Not legally binding |

For legal or transactional purposes, always prioritize official county sources over commercial sites. While Zillow may display “current owner” fields, this information is often outdated or inferred—not verified.

Case Study: Resolving a Boundary Dispute

A homeowner in rural Oregon noticed a neighbor installing a fence that appeared to encroach on their property. With no clear deed description at hand, they began their investigation by entering the property address into the county assessor’s online portal. They retrieved the parcel number and pulled up the official plat map via the county’s GIS system. Cross-referencing with recorded deeds from the past 20 years, they confirmed that the disputed strip had never been transferred.

Armed with printed records and GIS visuals, the homeowner approached the neighbor calmly. The issue was resolved amicably when the neighbor realized the error. This case illustrates how accurate public records can prevent legal escalation and preserve relationships.

Avoiding Common Pitfalls

Even experienced researchers make errors when identifying landowners. Here are frequent missteps and how to avoid them.

- Mistaking Mailing Address for Property Location: Owners often list a P.O. box or out-of-state address. This doesn’t mean the land is unoccupied or abandoned.

- Relying Solely on Name Searches: Common names (e.g., John Smith) can return false matches. Always use the APN to isolate the correct parcel.

- Ignoring Trusts and LLCs: High-net-worth individuals often hold property under business entities. A deed listing “Sunset Holdings LLC” won’t reveal individual owners without additional corporate filings.

- Overlooking Unrecorded Easements: Some rights of way or utility access aren’t reflected in ownership records but affect usage.

Checklist: Accurate Landowner Identification

Use this checklist to ensure thoroughness in your search:

- ✅ Confirm the exact property location (address, GPS, or legal description)

- ✅ Access the county assessor’s website and retrieve the APN

- ✅ Review current tax records for owner name and mailing address

- ✅ Search the recorder’s database for the most recent deed

- ✅ View the parcel on the county GIS map to confirm boundaries

- ✅ Check for ownership under trusts, LLCs, or estates if applicable

- ✅ Cross-verify information across at least two official sources

Frequently Asked Questions

Can I find landowner information for free?

Yes. Most county assessors and recorders provide free online access to ownership records, tax data, and GIS maps. Third-party services may charge for enhanced features or bulk data.

What if the property is owned by a trust or corporation?

Ownership will appear under the entity’s name. To identify individuals, consult state business registration databases or request disclosure documents if involved in a legal proceeding.

How quickly are ownership changes updated?

Processing times vary by county. Deeds are typically recorded within 2–8 weeks after closing. Tax rolls may only update annually. Always allow time for lag in updates.

Conclusion: Take Action with Confidence

Accurately identifying landowners is a skill rooted in methodical research and source verification. By leveraging public records and modern tools, you can uncover ownership details with confidence—whether for investment, legal clarity, or personal knowledge. Don’t rely on assumptions or incomplete data. Start with your county’s official resources, follow a structured approach, and double-check every finding.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?