Gifting money or assets to loved ones is a thoughtful way to support family, reduce future estate taxes, or simply share wealth during your lifetime. However, without proper knowledge of IRS rules, such generosity could trigger unexpected tax liabilities. Central to smart gifting is the annual gift exclusion amount—a powerful tool that allows individuals to transfer wealth tax-free each year. Understanding how this exclusion works can help you make informed decisions, avoid penalties, and maximize your financial planning.

What Is the Annual Gift Exclusion?

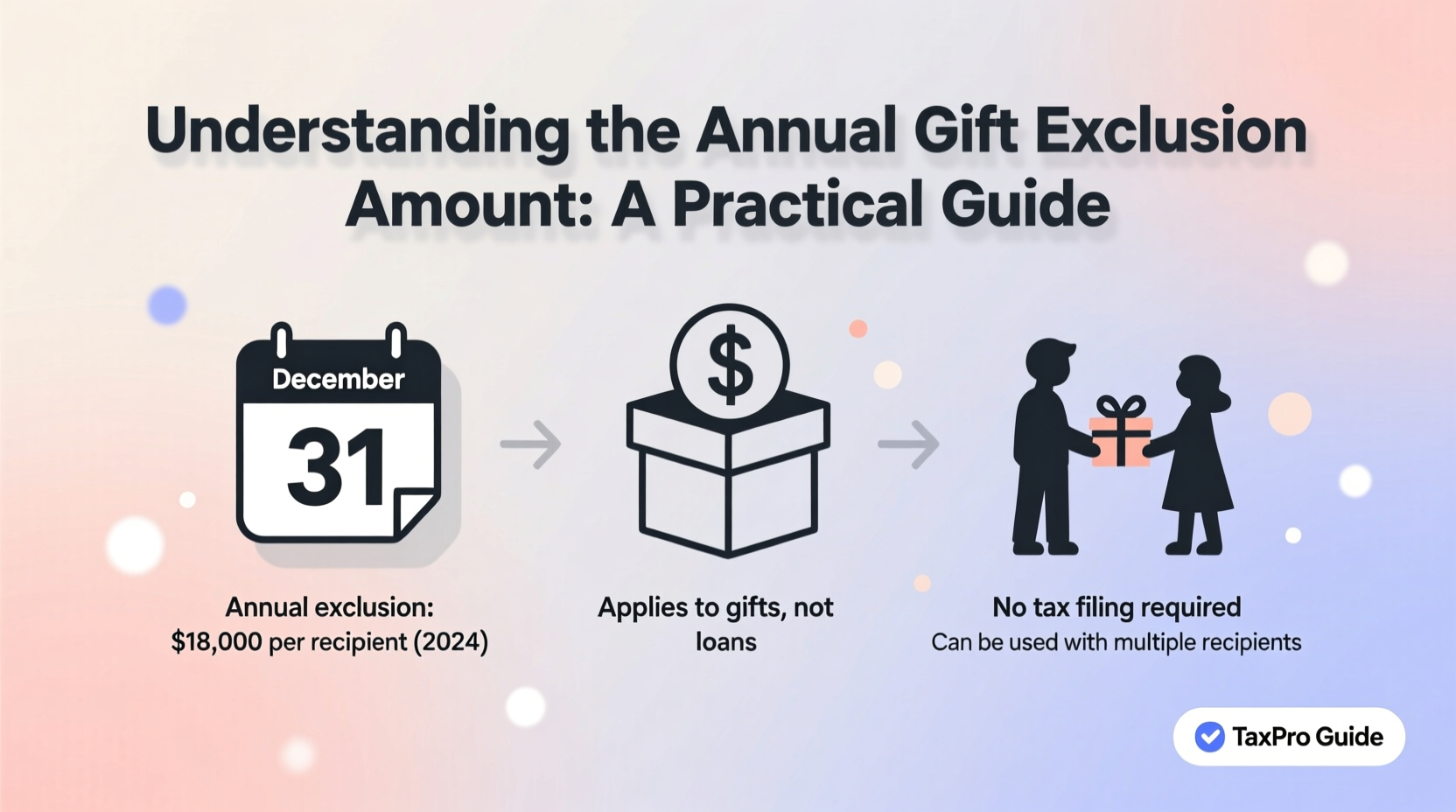

The annual gift exclusion is a provision in the U.S. tax code that allows individuals to give a certain amount of money or property to another person each year without having to file a gift tax return or use any portion of their lifetime gift and estate tax exemption. As of 2024, the annual exclusion stands at $18,000 per recipient. This means you can give up to $18,000 to as many people as you’d like in a single year without incurring gift tax or reporting the gift to the IRS.

If a gift exceeds this amount, the excess may need to be reported on IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. However, even then, no actual gift tax is due unless the giver has already used up their lifetime exemption, which in 2024 is $13.61 million per individual.

How the Annual Exclusion Works in Practice

The exclusion applies per donor and per recipient. For example, if John wants to gift money to his three children, he can give each child $18,000 in 2024—totaling $54,000—without triggering any gift tax consequences. If he were married, and his spouse joined in the gift, they could give each child $36,000, totaling $108,000, all within the annual exclusion limits.

It’s important to note that the exclusion resets every calendar year. Gifts made in December do not count toward the next year’s limit. Also, only completed gifts—where the recipient has full control over the asset—qualify. Promises to give or transfers with strings attached generally don’t qualify.

Certain types of gifts are entirely excluded from the annual limit and don’t count against it at all. These include:

- Direct payments made to medical providers for someone’s healthcare

- Tuition payments made directly to an educational institution

- Gifts to a spouse who is a U.S. citizen

- Contributions to political organizations

- Gifts to qualified charitable organizations

“Strategic use of the annual exclusion allows families to transfer wealth efficiently while staying well under the IRS radar.” — Laura Simmons, CPA and Estate Planning Advisor

Step-by-Step Guide to Using the Annual Gift Exclusion

To make the most of the annual exclusion, follow these steps:

- Determine your recipients: Identify who you want to gift to—children, grandchildren, friends, or others.

- Calculate total annual gifts: Multiply $18,000 by the number of recipients to see how much you can transfer tax-free.

- Document the transfers: Keep records of bank transfers, checks, or asset re-titling to prove the gift was made.

- Coordinate with your spouse (if applicable): Elect gift splitting to double the exclusion per recipient.

- Avoid exceeding the limit unintentionally: Be cautious with large transfers late in the year or recurring monthly gifts that might accumulate beyond $18,000.

- Consult a tax advisor: Especially if you're close to your lifetime exemption limit or making complex gifts like real estate or business interests.

Common Misconceptions About Gift Taxes

Many people misunderstand how gift taxes work, leading to unnecessary caution or errors. Below is a table clarifying key Do’s and Don’ts:

| Do | Don’t |

|---|---|

| Give up to $18,000 per person per year without filing a form | Assume all gifts are taxable—many aren’t |

| Use gift splitting with your spouse to double the exclusion | Forget that the exclusion is per recipient, not per year total |

| Pay tuition or medical bills directly—these don’t count toward the limit | Combine multiple small gifts without tracking the annual total |

| Keep records of gifts for your own protection | Expect the recipient to pay gift tax—the giver is responsible |

Real-Life Example: Funding Grandchildren’s Futures

Consider the case of Robert and Maria, a retired couple with four grandchildren. In 2024, they decide to help fund their grandchildren’s education and long-term savings. By leveraging the annual gift exclusion and gift splitting, they can give each grandchild $36,000 per year ($18,000 from each spouse). Over five years, that totals $720,000 transferred tax-free—money that can be invested in 529 college savings plans or custodial accounts.

They set up automatic bank transfers of $3,000 per grandchild per month from each of their accounts, ensuring the annual total stays within limits. They also document each transfer and notify their accountant annually. This strategy not only reduces their taxable estate but also gives their grandchildren a meaningful head start in life—all without owing a single dollar in gift tax.

Frequently Asked Questions

Can I carry forward unused annual exclusion amounts?

No. The annual gift exclusion does not roll over. If you don’t use the full $18,000 with a particular recipient in one year, you cannot apply the unused portion in a future year. It resets to zero on January 1.

Do I have to report gifts under $18,000?

No. Gifts that fall within the annual exclusion limit do not need to be reported to the IRS. You only file Form 709 if you give more than $18,000 to a single person in a year (excluding direct medical or tuition payments).

What happens if I exceed the annual exclusion?

If you exceed the limit, you must file Form 709. However, you won’t owe gift tax unless your cumulative taxable gifts exceed your lifetime exemption amount ($13.61 million in 2024). The excess amount simply reduces your remaining lifetime exemption.

Key Checklist for Effective Gifting

- ✅ Confirm the current year’s annual exclusion amount ($18,000 in 2024)

- ✅ List all intended recipients

- ✅ Calculate total gifts to ensure compliance

- ✅ Coordinate with spouse for gift splitting, if applicable

- ✅ Avoid combining gifts that could exceed limits (e.g., cash + car)

- ✅ Document all transfers with dates, amounts, and methods

- ✅ File Form 709 if required (gifts over $18,000 per recipient)

- ✅ Consult a tax professional for complex assets or large estates

Conclusion: Plan Smart, Give Confidently

The annual gift exclusion is a valuable yet often underutilized tool in personal finance and estate planning. By understanding its mechanics and applying it thoughtfully, you can transfer wealth efficiently, support loved ones, and reduce future tax burdens—all within legal boundaries. Whether you're helping a child buy a home, funding education, or simply sharing prosperity, smart gifting starts with awareness and careful planning.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?