In today’s evolving job market, the definition of “full time” is more fluid than ever. While many assume that working 40 hours a week automatically qualifies as full time, the reality is more complex. The designation affects eligibility for benefits, tax status, labor protections, and work-life balance. Understanding what constitutes full time employment—and why it matters—is essential for both employees navigating career decisions and employers structuring fair, compliant workplaces.

What Is Considered Full Time Employment?

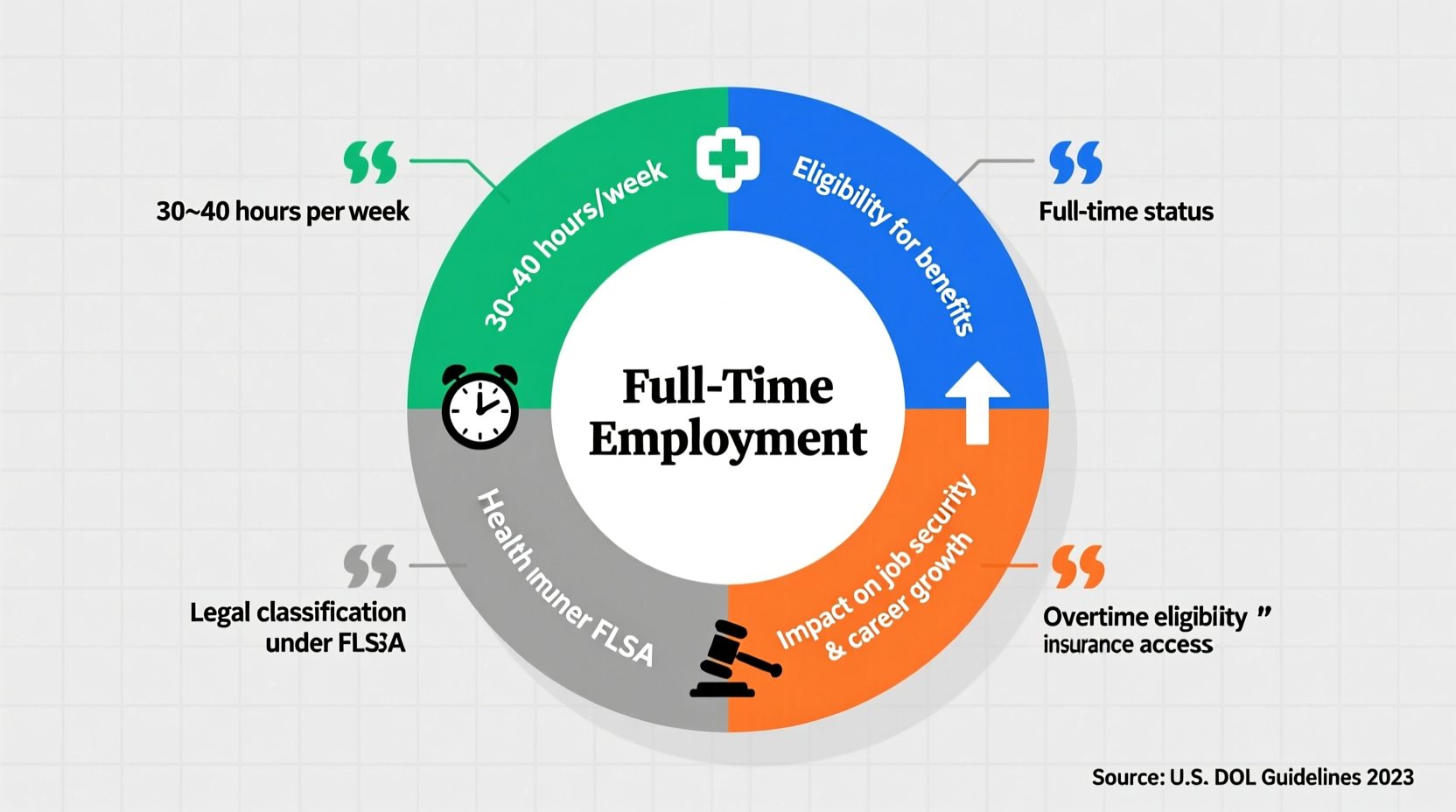

The term \"full time\" lacks a single universal definition. In the United States, the Fair Labor Standards Act (FLSA) does not legally define full time. Instead, it leaves the determination to employers, industries, and specific regulations tied to other laws. However, common benchmarks exist:

- General Practice: Most companies consider 35–40 hours per week as full time.

- Affordable Care Act (ACA): For health insurance purposes, the IRS defines full time as at least 30 hours per week or 130 hours per month.

- Department of Labor: While no federal standard exists, 40 hours has long been the cultural norm due to historical labor agreements.

This variation means an employee working 32 hours at one company may be classified as full time, while another in a similar role at a different firm might be considered part-time. The classification often depends on internal policies, industry standards, and compliance requirements rather than a fixed national rule.

Why Full Time Status Matters

Being classified as a full time employee goes beyond just the number of hours logged. It directly influences access to critical workplace benefits and protections.

Access to Benefits

Full time employees are typically eligible for employer-sponsored benefits such as:

- Health, dental, and vision insurance

- Retirement plans with employer matching (e.g., 401(k))

- Paid time off (PTO), sick leave, and holidays

- Lifecycle benefits like parental leave or tuition reimbursement

Under the ACA, businesses with 50 or more full time equivalent employees must offer affordable health coverage to those working 30+ hours weekly. This regulation has led many employers to use the 30-hour threshold as their benchmark—even if the role isn’t traditionally seen as full time.

Job Security and Career Advancement

Full time positions often come with greater stability. They are less likely to be cut during downturns and more likely to include performance reviews, raises, and promotion pathways. Part-time roles, even when consistent, may lack structured growth opportunities.

Overtime and Pay Structure

While salaried full time employees are often exempt from overtime pay under FLSA rules, hourly full time workers are entitled to time-and-a-half for hours exceeding 40 in a week. Misclassifying someone as full time without proper compensation can lead to legal issues for employers.

“Employers who clearly define full time status reduce confusion, increase trust, and ensure compliance with healthcare and labor laws.” — Laura Simmons, HR Compliance Director

Comparing Full Time, Part Time, and Full Time Equivalent

To clarify the distinctions, here's a breakdown of key categories:

| Type | Typical Hours/Week | Benefits Eligibility | Common Use Cases |

|---|---|---|---|

| Part Time | Less than 30 | Limited or none | Students, supplemental income, flexible roles |

| Full Time (Traditional) | 35–40 | Full benefits package | Standard professional roles |

| Full Time (ACA Standard) | 30+ | Health insurance required | Large employers complying with ACA |

| Full Time Equivalent (FTE) | Calculated aggregate | Used for organizational reporting | Combining multiple part-time roles into one full-time unit |

FTE is particularly important for government reporting, grant applications, and determining employer size under laws like the ACA. For example, two employees each working 20 hours count as one FTE.

Real-World Scenario: How Classification Impacts Employees

Consider Maria, a customer service representative at a mid-sized tech company. She works 32 hours per week, consistently scheduled across five days. Her manager considers her integral to the team, but because the company defines full time as 36 hours, Maria is classified as part-time.

As a result, she does not qualify for the company’s health insurance, 401(k) match, or paid parental leave. When she becomes pregnant, she must choose between unpaid leave or quitting. Meanwhile, a colleague working 37 hours receives full benefits despite only working five more hours weekly.

This case illustrates how small differences in hour thresholds can have major life impacts. It also highlights the importance of transparency in employer policies and the growing push for equitable benefit structures regardless of slight hour variations.

How to Determine Your Employment Status

If you're unsure whether you’re considered full time, follow these steps:

- Review your offer letter or contract – Look for stated weekly hours and employment classification.

- Check your company’s employee handbook – Most organizations define full time explicitly.

- Ask HR about benefits eligibility – Specifically inquire about health insurance, PTO accrual, and retirement plans.

- Monitor your monthly hours – Track if your schedule fluctuates near the 30- or 35-hour mark.

- Understand tax implications – Full time status can affect dependent care credits and student loan repayment plans.

Emerging Trends and the Future of Full Time Work

The post-pandemic workforce has seen a shift toward flexibility. Many companies now offer hybrid schedules, compressed workweeks (e.g., four 10-hour days), or results-only work environments (ROWE). These changes challenge traditional notions of full time.

Some organizations are moving toward outcome-based evaluations rather than hour tracking. Others are expanding benefits to employees working as few as 24 hours weekly to attract and retain talent. This trend suggests that the future of full time may focus less on rigid hour counts and more on commitment, contribution, and consistency.

However, until federal law standardizes the definition, ambiguity will persist. Until then, clarity in communication between employers and employees remains critical.

FAQ

Is 32 hours a week considered full time?

It depends on the employer and context. Under the ACA, yes—32 hours exceeds the 30-hour threshold for health insurance eligibility. But some companies still require 35 or 40 hours to qualify for all benefits.

Can a full time employee be paid hourly?

Yes. Many full time employees are paid hourly and are non-exempt from overtime. Salaried status does not automatically determine full time classification—it’s based on hours worked.

Do part time employees ever get full time benefits?

Some do. Progressive employers extend pro-rated or full benefits to part time workers to improve morale and retention. Union contracts and state laws (like in California) may also mandate certain benefits for part time staff.

Final Thoughts: Take Control of Your Work Status

Understanding what counts as full time employment empowers you to make informed career choices. Whether you're negotiating a job offer, seeking benefits, or managing a team, clarity around hours and classification prevents misunderstandings and ensures fairness.

Don’t assume. Ask questions. Review policies. Advocate for yourself. As the nature of work continues to evolve, being proactive about your employment status is not just smart—it’s necessary.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?