The IRS annual gift tax exclusion is a powerful tool for individuals looking to transfer wealth, support loved ones, or reduce future estate taxes. As inflation adjustments take effect, the 2025 gifting limit marks a significant increase from previous years, offering more flexibility than ever before. Whether you're planning for retirement, funding education, or simply helping family members with large purchases, understanding the updated rules is essential.

The IRS revises key tax figures each year based on inflation, and 2025 brings one of the most generous gifting thresholds in history. This change allows individuals to give more money and assets without triggering gift tax or reducing their lifetime exemption. However, misconceptions about what constitutes a \"gift\" and how the limits apply can lead to costly errors. Let’s break down exactly what the 2025 IRS gifting limit means and how you can use it wisely.

What Is the 2025 Annual Gift Tax Exclusion?

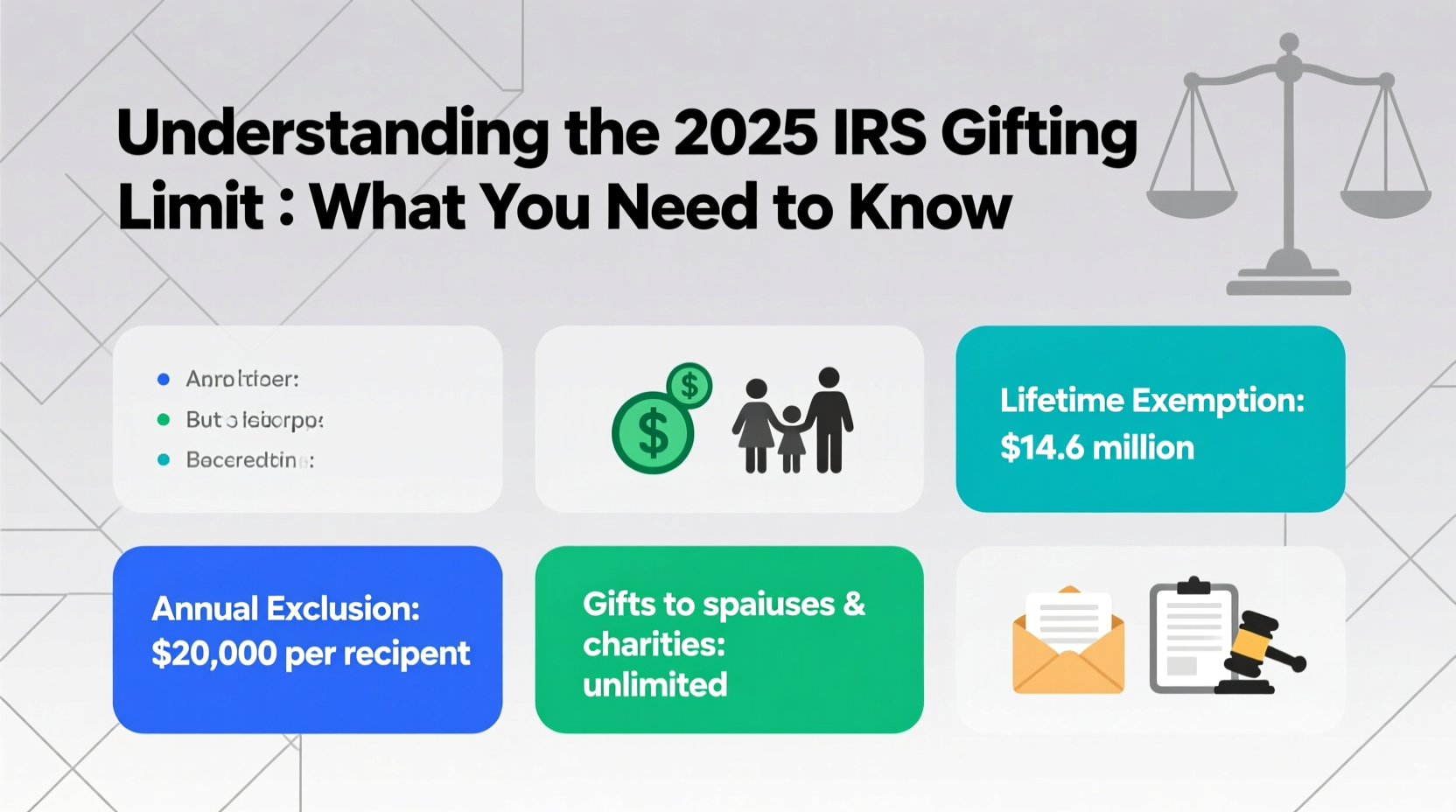

In 2025, the IRS has increased the annual gift tax exclusion to **$18,000 per recipient**. This means you can give up to $18,000 in cash or assets to any individual in a single year without having to report the gift or pay gift tax. If you're married, you and your spouse can together gift up to $36,000 to the same person under the concept of gift splitting.

This exclusion applies per donor and per recipient. For example, if you have three children, you can give each of them $18,000—totaling $54,000—without any tax implications. The same rule applies to grandchildren, friends, or anyone else. Gifts that fall within this limit do not count against your lifetime gift and estate tax exemption, which in 2025 is projected to be approximately $13.61 million per individual ($27.22 million for married couples).

How the Lifetime Exemption Works Alongside Annual Gifts

While the annual exclusion allows for tax-free giving each year, larger gifts may still be made using part of your lifetime gift and estate tax exemption. Any amount gifted above the $18,000 threshold (per recipient) must be reported on IRS Form 709, United States Gift (and Generation-Skipping Transfer) Tax Return. However, you won’t owe gift tax until you exceed your lifetime exemption.

For instance, if you give your daughter $50,000 in 2025, $18,000 falls under the annual exclusion, and the remaining $32,000 counts against your lifetime exemption. No tax is due immediately, but this reduces the amount you can pass estate-tax-free upon death.

It's important to note that only \"present interest\" gifts qualify for the annual exclusion. A present interest means the recipient has immediate use, possession, or enjoyment of the gift. Gifts placed in trust where access is delayed (e.g., a trust that pays out at age 25) generally do not qualify unless special provisions like Crummey powers are included.

“Strategic gifting isn’t just about generosity—it’s a cornerstone of smart estate planning. The 2025 limits offer a rare opportunity to shift wealth efficiently.” — Laura Simmons, Estate Planning Attorney and Partner at Hartwell Legal Group

Key Gifting Strategies for 2025

With higher limits, now is an ideal time to reassess your financial strategy. Consider these practical approaches:

- Educational expenses: Payments made directly to a school for tuition are exempt from gift tax, regardless of amount. This exclusion does not count toward the $18,000 limit.

- Medical bills: Similarly, payments made directly to a medical provider for someone else’s care are not considered taxable gifts.

- Gifting to spouses: Transfers between U.S. citizen spouses are generally unlimited and not subject to gift tax.

- Using gift splitting: Married couples can elect to split gifts, effectively doubling the annual exclusion to $36,000 per recipient without filing a gift return—provided both spouses agree and file Form 709 if required.

| Year | Annual Gift Tax Exclusion (Per Recipient) | Lifetime Exemption (Est.) |

|---|---|---|

| 2023 | $17,000 | $12.92 million |

| 2024 | $18,000 | $13.61 million |

| 2025 | $18,000 | $13.61 million |

Common Mistakes to Avoid When Gifting

Even well-intentioned gifting can run into complications. Here are frequent pitfalls and how to avoid them:

- Failing to file Form 709 when required: Even if no tax is due, gifts over the annual exclusion must be reported. Skipping this step can create issues during estate audits.

- Mixing loans and gifts without documentation: If you lend money to a family member and later forgive the loan, the forgiven amount is treated as a gift and may require reporting.

- Overlooking state-level implications: While federal gift tax is unified, some states have inheritance or estate taxes with different thresholds.

- Gifting appreciated assets without planning: Giving stocks or real estate with high capital gains could trigger tax consequences for the recipient upon sale. Consider stepped-up basis rules and timing.

Real-Life Example: Using the 2025 Limit to Fund College

Consider the Thompson family: both parents want to help their twin daughters start college with minimal debt. Each daughter needs $40,000 for the first year. Instead of paying the full amount outright—which would exceed the annual exclusion—the Thompsons structure their gifting strategically.

In January 2025, each parent gives each daughter $18,000, totaling $72,000 across all four gifts. They elect gift splitting, allowing them to stay within the exclusion limit without tapping into their lifetime exemption. Then, they pay the remaining $8,000 per student directly to the university for tuition, which is excluded from gift tax entirely. The entire $88,000 is transferred tax-efficiently, preserving their estate exemption for future needs.

Step-by-Step Guide to Making a Tax-Smart Gift in 2025

- Identify the recipient(s): Determine who will receive the gift and how much each will get.

- Check the $18,000 limit: Ensure gifts per person do not exceed the annual exclusion unless intended to use part of the lifetime exemption.

- Decide on direct vs. indirect payments: Use direct payments to institutions for tuition or medical expenses to bypass limits entirely.

- Document the transaction: Keep records of transfers, including dates, amounts, and purposes.

- Determine if Form 709 is needed: File if you’re making a gift above $18,000 to one person and wish to apply it toward your lifetime exemption.

- Consult a professional: Speak with a tax advisor or estate attorney to align gifting with broader financial goals.

Frequently Asked Questions

Can I give more than $18,000 to someone in 2025?

Yes, you can give more than $18,000 to an individual in 2025, but the excess amount must be reported on Form 709 and will count against your lifetime gift and estate tax exemption. No gift tax is due until that exemption is exhausted.

Do I have to report gifts under $18,000?

No. Gifts that fall within the annual exclusion do not need to be reported to the IRS. This includes cash, checks, wire transfers, or even assets like stocks or vehicles, as long as the value is $18,000 or less per recipient.

Does the recipient pay tax on the gift?

No. The recipient of a gift never owes income tax on the amount received. The responsibility for gift tax lies solely with the donor, though in most cases, no tax is actually paid due to the annual and lifetime exclusions.

Final Thoughts and Action Steps

The 2025 IRS gifting limit presents a valuable opportunity to transfer wealth efficiently while minimizing tax exposure. With the annual exclusion holding steady at $18,000 and the lifetime exemption at historic highs, now is the time to review your financial plan. Whether you're supporting family, funding education, or preparing for estate transitions, strategic gifting can make a meaningful difference.

Start by reviewing your current gifting patterns. Are you fully utilizing the annual exclusion? Could direct payments for education or medical costs further reduce your tax burden? Consider coordinating with your spouse to maximize joint gifting potential. And always keep detailed records—clarity today prevents confusion tomorrow.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?