A Home Equity Line of Credit (HELOC) offers homeowners flexible access to funds by leveraging the equity they’ve built in their property. Unlike a traditional loan, a HELOC works like a revolving credit line—similar to a credit card—with your home serving as collateral. While this financial tool can be powerful for home improvements, debt consolidation, or emergency expenses, one of the most common concerns applicants have is: How long will it take to get approved? The answer isn’t straightforward. Approval timelines vary widely based on several key factors, from documentation readiness to lender policies and market conditions.

What Is the Typical HELOC Approval Timeline?

On average, the HELOC approval process takes between two to six weeks. However, some borrowers report receiving funding in as little as 10 days, while others wait over a month. This variation stems from differences in lender efficiency, applicant preparedness, and external verification processes such as appraisals and title checks.

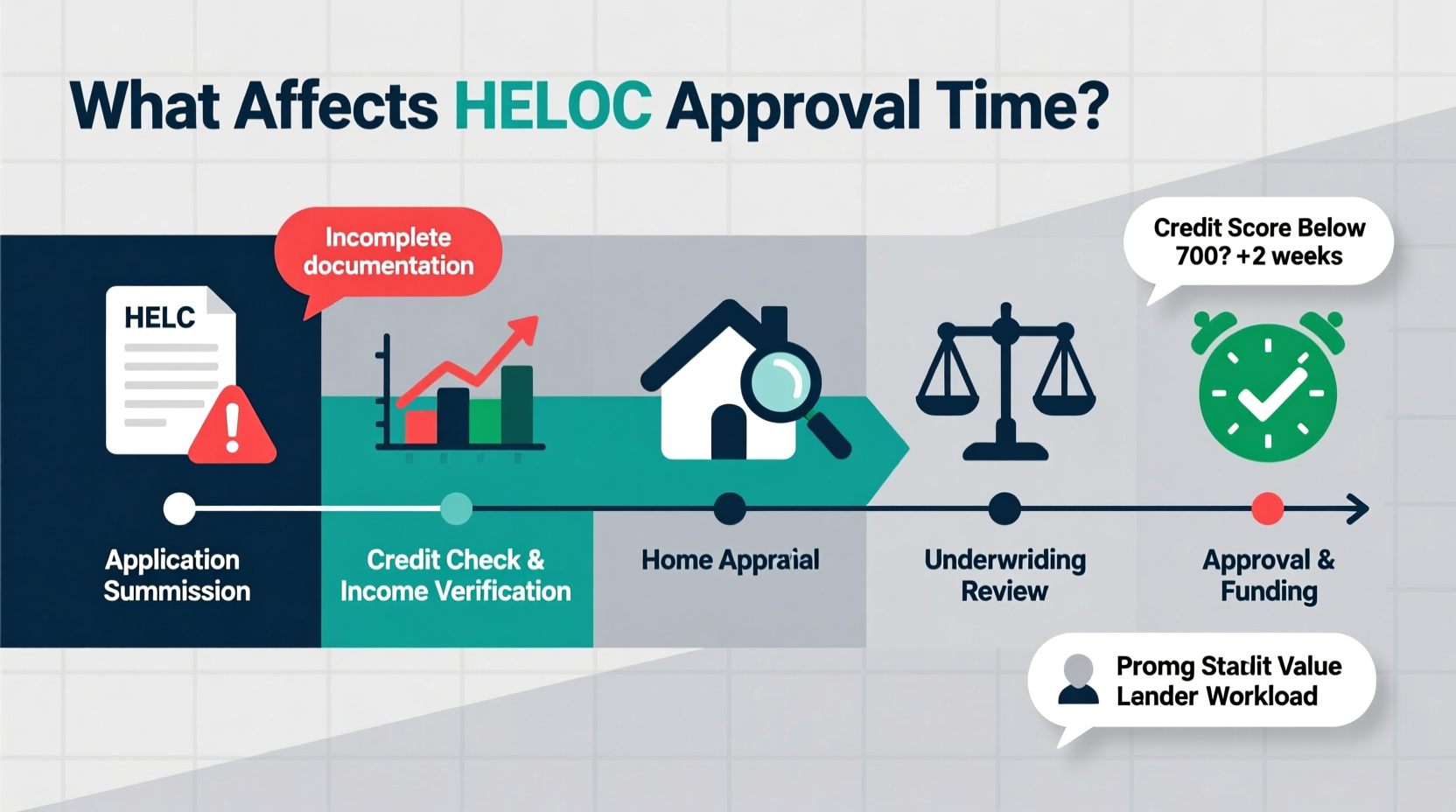

The timeline generally follows these stages:

- Application submission – Gathering documents and completing forms.

- Credit and income verification – Lender reviews financial history.

- Home appraisal – Determines current market value of the property.

- Underwriting decision – Final risk assessment and approval.

- Funding – Disbursement of funds after closing.

Each phase introduces potential delays, especially if information is incomplete or third-party services are backlogged.

Key Factors That Influence HELOC Approval Time

1. Completeness of Your Application

Submitting an incomplete application is the most common reason for delays. Lenders require detailed documentation to assess your eligibility, including:

- Recent pay stubs or income verification

- Tax returns (typically two years)

- Bank statements

- Photo ID and Social Security number

- Mortgage account details

2. Credit History and Score

Your credit score plays a pivotal role in both approval likelihood and processing speed. Most lenders prefer a minimum FICO score of 680, though top-tier rates go to those with scores above 740. A strong credit history reduces underwriting scrutiny, allowing for faster decisions.

Conversely, applicants with late payments, high credit utilization, or recent collections may face additional review steps, delaying approval.

3. Loan-to-Value Ratio (LTV)

Lenders calculate your LTV by dividing your outstanding mortgage balance by your home’s appraised value. Most cap HELOC availability at 80–85% combined LTV (including your primary mortgage).

For example, if your home is worth $500,000 and you owe $350,000, your LTV is 70%. You may qualify for up to $75,000 more in combined credit (85% of $500,000 = $425,000; subtract $350,000). Higher LTVs often trigger deeper underwriting, extending approval time.

4. Appraisal Requirements and Scheduling

An accurate home valuation is essential. While some lenders use automated valuation models (AVMs), others require a physical appraisal—especially if your area has volatile pricing or limited recent sales data.

Scheduling delays are common during peak seasons (spring/summer), when demand for appraisers spikes. Rural properties or unique homes may also take longer to evaluate due to fewer comparable sales.

5. Lender Type and Processing Efficiency

Not all lenders operate at the same pace. Banks, credit unions, and online lenders each have different workflows:

| Lender Type | Typical Approval Time | Pros | Cons |

|---|---|---|---|

| National Banks | 3–6 weeks | Trusted brands, branch support | Slower digital systems, rigid requirements |

| Credit Unions | 2–4 weeks | Personalized service, lower rates | Limited geographic reach, smaller staff |

| Online Lenders | 2–3 weeks | Faster processing, digital convenience | Less human interaction, stricter automation rules |

Online lenders often lead in speed due to streamlined platforms and e-signature capabilities.

Step-by-Step Guide to Speed Up Your HELOC Approval

To minimize delays, follow this actionable sequence:

- Check your credit report – Obtain free copies from AnnualCreditReport.com. Dispute errors early.

- Calculate your available equity – Use online tools or consult a real estate agent for a preliminary estimate.

- Gather documentation – Collect two years of tax returns, recent pay stubs, bank statements, and mortgage info.

- Compare lenders – Prioritize those offering prequalification with soft credit checks.

- Submit a complete application – Double-check every field and attachment before sending.

- Respond promptly to requests – Monitor email and phone daily during underwriting.

- Schedule the appraisal quickly – If required, book the earliest available slot.

- Review closing terms carefully – Delays sometimes occur due to last-minute clarification needs.

Real-World Example: A Faster Approval Success Story

Sarah, a homeowner in Austin, Texas, needed $40,000 for a kitchen renovation. She had a credit score of 760, steady income, and 60% LTV. After researching lenders, she chose an online provider known for fast HELOC processing.

She uploaded her documents the same day she applied, including W-2s, bank statements, and a copy of her deed. The lender used an AVM instead of a physical appraisal, saving nearly a week. Within nine business days, Sarah was approved and received her funds after a brief virtual closing.

Her preparation and choice of a tech-savvy lender made the difference. In contrast, her neighbor, who applied with a local bank requiring a full appraisal and missing one tax return, waited five weeks.

Expert Insight on Streamlining the Process

“Borrowers who come prepared with clean credit, organized paperwork, and realistic expectations move through the HELOC pipeline fastest. It’s not just about qualifying—it’s about minimizing friction.” — James Rutherford, Senior Mortgage Advisor at Coastal Financial Group

Common Pitfalls That Delay HELOC Approvals

- Waiting until the last minute – Starting the process right before a project begins invites stress.

- Ignoring credit issues – Small balances in collections can halt approvals until resolved.

- Choosing the wrong lender – Some institutions specialize in mortgages but lack efficient HELOC workflows.

- Overlooking rate locks – Though HELOCs are usually variable-rate, promotional fixed-rate periods may expire during delays.

FAQ: Common Questions About HELOC Approval Timelines

Can I get a HELOC without an appraisal?

Yes, some lenders use Automated Valuation Models (AVMs) based on public records and recent sales. These are faster but less common for higher loan amounts or complex properties.

Does prequalification guarantee approval?

No. Prequalification is an initial estimate based on self-reported data. Full approval requires verified documents, credit checks, and property valuation.

Are HELOC approvals harder during economic downturns?

Yes. During uncertain markets, lenders often tighten standards, increase documentation requirements, and slow down underwriting to manage risk—extending average wait times.

Conclusion: Take Control of Your HELOC Timeline

Understanding the HELOC process means recognizing that timing is not entirely out of your hands. While factors like lender policies and appraisal availability are external, your preparation, document accuracy, and lender selection significantly influence how quickly you gain access to funds. By organizing your financial records early, improving your credit profile, and choosing a responsive lender, you can cut weeks off the typical waiting period.

If you're considering a HELOC, start now—review your credit, estimate your equity, and research lenders with strong reputations for speed and transparency. The sooner you act, the faster you’ll be positioned to move forward when the need arises.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?