Many people assume their annual income is simply their salary or hourly wage multiplied by 2,080 hours—the standard full-time work year. But that number rarely reflects what actually lands in your bank account. True financial clarity comes from understanding not just your gross pay, but also taxes, deductions, employer benefits, and other factors that shape your real earning power. Without this awareness, budgeting, saving, and planning for the future can be misleading or even counterproductive.

This guide breaks down the process of calculating your actual annual income with precision. You’ll learn how to move beyond surface-level numbers and uncover the complete picture of your financial reality—empowering smarter decisions about jobs, raises, side gigs, and long-term goals.

Step 1: Determine Your Gross Annual Income

Your gross annual income is the starting point—the total amount you earn before any taxes or deductions are taken out. How you calculate it depends on whether you’re paid a salary or hourly wages.

For salaried employees: This is straightforward. If your employment contract states $65,000 per year, that’s your gross annual income.

For hourly workers: Multiply your hourly rate by the average number of hours you work each week, then multiply that by 52 weeks.

Example: $25/hour × 40 hours/week × 52 weeks = $52,000 gross annual income.

If your hours vary, use a 3–6 month average to estimate more accurately.

Step 2: Subtract Mandatory Deductions

From your gross income, several mandatory deductions are typically withheld. These reduce your taxable income and ultimately determine your net pay.

- Federal income tax

- State and local income taxes (if applicable)

- Social Security (6.2%)

- Medicare (1.45%)

- Payroll taxes (e.g., state disability insurance)

The exact percentages depend on your filing status, number of allowances claimed on your W-4, and where you live. For example, someone earning $65,000 in California will have different state tax obligations than someone in Texas, which has no state income tax.

To estimate these deductions without waiting for your next paycheck stub, use the IRS Tax Withholding Estimator (irs.gov) or payroll calculators like ADP’s online tool.

Estimated Deduction Breakdown (Single Filer, $65k Salary, No State Tax)

| Deduction Type | Rate | Annual Amount |

|---|---|---|

| Federal Income Tax | ~12% | $7,800 |

| Social Security | 6.2% | $4,030 |

| Medicare | 1.45% | $942.50 |

| State/Local Tax | 0–10% (varies) | $0–$6,500 |

| Total Estimated Withholdings | $12,772.50+ |

After subtracting these, your income drops significantly before even considering voluntary deductions.

Step 3: Account for Voluntary Payroll Deductions

These are amounts you choose to have withheld from your paycheck, often for benefits or retirement savings. While they reduce take-home pay, many offer tax advantages.

- Health insurance premiums: Monthly cost shared between employee and employer.

- Dental & vision insurance: Often optional but valuable.

- Retirement contributions: 401(k), 403(b), or similar plans. Contributions may be pre-tax (traditional) or post-tax (Roth).

- Flexible Spending Accounts (FSA) or Health Savings Accounts (HSA): Pre-tax funds for medical expenses.

- Union dues, charitable donations, or transit passes: Other common payroll deductions.

For instance, if you contribute 7% of your $65,000 salary to a traditional 401(k), that’s $4,550 annually coming out pre-tax. While this lowers your taxable income, it still reduces the cash available each month.

“Most employees underestimate how much their benefits and retirement plans affect their immediate cash flow. What looks like a generous salary can feel tight once all deductions hit.” — Lisa Tran, Certified Financial Planner

Step 4: Add Back Employer-Paid Benefits

Your total compensation isn’t limited to what appears on your pay stub. Employers often contribute to benefits that have real monetary value—even if you don’t receive them as direct cash.

Common employer-paid components include:

- Employer portion of health insurance premiums

- Retirement plan matches (e.g., dollar-for-dollar up to 5%)

- Paid time off (PTO), holidays, and sick leave

- Tuition reimbursement or professional development funding

- Life or disability insurance coverage

- Commuter benefits or wellness stipends

For example, if your employer pays $8,000 toward your family health plan and matches $3,250 of your 401(k) contribution, that’s an additional $11,250 in non-cash compensation.

True Total Compensation Example

| Component | Value |

|---|---|

| Gross Salary | $65,000 |

| Employer Health Insurance Contribution | $8,000 |

| 401(k) Match | $3,250 |

| PTO Value (2 weeks at daily rate) | $2,500 |

| Total Estimated Compensation | $78,750 |

This broader definition helps when comparing job offers or evaluating a raise request. A lower base salary with strong benefits might actually provide greater overall value.

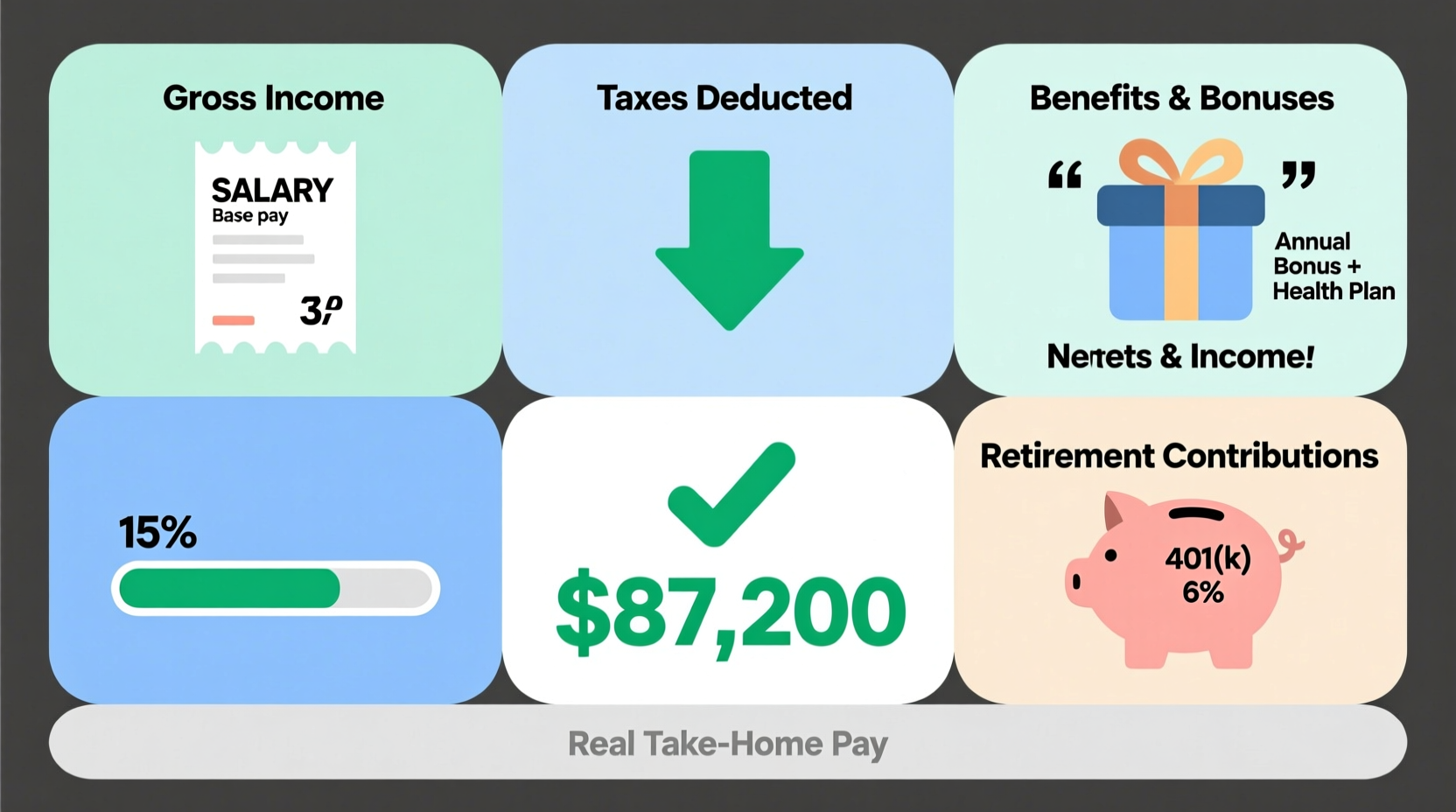

Step 5: Calculate Your Real Take-Home Pay

Now, combine all elements to determine how much money actually reaches your bank account each year.

- Start with gross annual income.

- Subtract federal, state, and FICA taxes.

- Subtract voluntary deductions (insurance, retirement, etc.).

- Divide the result by 12 for monthly net income, or by 26 for biweekly take-home pay.

Using our $65,000 example:

- Gross Income: $65,000

- Estimated Taxes & Mandatory Deductions: ~$12,772

- Voluntary Deductions (health insurance + 401(k)): $7,000 ($3,450 insurance + $3,550 401(k))

- Annual Net (Take-Home) Pay: ~$45,228

- Monthly Take-Home: ~$3,769

This is nearly $20,000 less than the original salary figure—a gap that surprises many people.

Mini Case Study: From $70k Offer to $3,800 Monthly Reality

Jamal accepted a job offer at $70,000 per year. Excited, he calculated his monthly income as $5,833. But after his first paycheck, he was confused—he only received $3,802.

Here’s why:

- Federal & State Taxes: $14,000

- Social Security & Medicare: $5,355

- Health Insurance Premium: $2,200 (employee share)

- 401(k) Contribution (6%): $4,200

Total deductions: $25,755. Net annual pay: $44,245 ($3,687/month). The difference wasn’t an error—it was the hidden cost of earning an income.

Once Jamal recalculated using this guide, he adjusted his budget accordingly and began valuing employer contributions like the $9,000 health plan and 4% 401(k) match as part of his total package.

FAQ

Does bonus income count in my annual income?

Yes, if it’s regular or expected. One-time bonuses should be noted separately, but recurring performance bonuses or commissions should be averaged over the past 12 months and included in your annual calculation.

How do I calculate income if I’m self-employed?

Use your net profit (revenue minus business expenses) from your tax return (Schedule C or Form 1040). Remember, you’ll also pay self-employment tax (~15.3%), so factor that into your effective take-home rate.

Should I include stock options or equity in my income?

Only if they’ve vested and been sold. Unvested or speculative equity isn’t guaranteed income. When shares do vest, treat the market value at vesting as supplemental income for that year.

Checklist: Calculate Your Real Annual Income

- ✅ Gather your latest pay stub and employment contract

- ✅ Confirm your gross annual salary or hourly rate

- ✅ List all tax withholdings (federal, state, FICA)

- ✅ Identify voluntary deductions (retirement, insurance, etc.)

- ✅ Research employer contributions (health, retirement match, PTO value)

- ✅ Calculate net annual take-home pay

- ✅ Compare gross vs. net vs. total compensation

- ✅ Update your budget based on actual cash flow

Conclusion

Understanding your annual income goes far beyond the number on your offer letter. By dissecting gross pay, tracking deductions, and recognizing the value of benefits, you gain a truthful picture of your financial standing. This knowledge strengthens your ability to negotiate salaries, manage household budgets, save effectively, and evaluate career moves with confidence.

Don’t let assumptions dictate your financial decisions. Take one hour this week to pull your pay stubs, run the numbers, and see exactly how much you really make. That clarity could change the way you plan your entire financial future.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?