Wage garnishment is a legal process where a portion of your earnings is withheld by your employer to pay off a debt. While it may feel like a sudden and overwhelming event, understanding how and why garnishments occur—and knowing the steps you can take—can help you regain control. Whether the debt stems from unpaid credit card balances, student loans, child support, or medical bills, there are legal protections and practical actions available to challenge or mitigate the impact.

What Is Wage Garnishment?

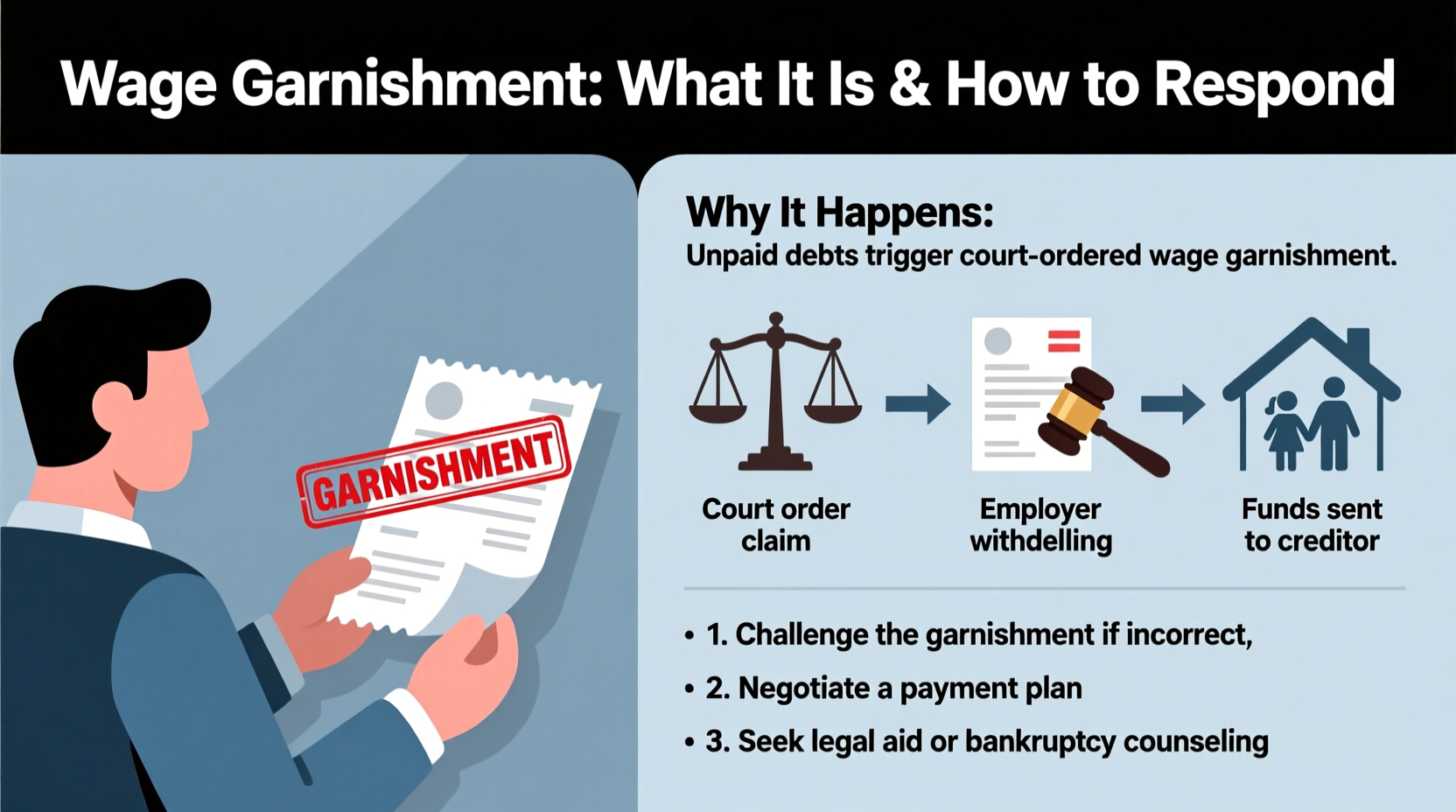

Wage garnishment occurs when a creditor obtains a court order (or in some cases, acts without one) authorizing them to collect money directly from your paycheck. Your employer is legally required to comply once they receive notice. The amount taken is typically a percentage of your disposable income—what remains after mandatory deductions like taxes.

Garnishment is not the first step creditors take. It usually follows months of nonpayment, collection calls, and possibly default judgments. Once a creditor wins a lawsuit against you, they can request wage garnishment as an enforcement tool. However, certain types of debt—like federal student loans or tax obligations—allow for administrative garnishment without going through court.

Why Does Wage Garnishment Happen?

Garnishment is triggered by unpaid debts that have escalated to a legal level. Common causes include:

- Credit card defaults: After prolonged nonpayment, creditors may sue and obtain a judgment.

- Personal loans: Unsecured loans with missed payments can lead to litigation.

- Child support arrears: Courts often prioritize family obligations, allowing automatic garnishment.

- Back taxes: The IRS can garnish wages without a court order under federal tax law.

- Student loan defaults: Federal loans allow up to 15% garnishment via administrative action.

- Medical debt: Though less common, providers may sue and secure judgments leading to garnishment.

It’s important to note that not all debts qualify for garnishment. For example, utility bills or gym memberships rarely result in wage withholding unless they escalate into legal judgments.

How Much Can Be Taken From Your Paycheck?

Federal law limits wage garnishment to protect basic living standards. Under the Consumer Credit Protection Act (CCPA), the maximum amount that can be garnished is the lesser of:

- 25% of your disposable earnings, OR

- The amount by which your weekly income exceeds 30 times the federal minimum wage ($7.25), currently $217.50.

For example, if you earn $500 per week after deductions, 25% would be $125. But since $500 - $217.50 = $282.50, the limit would still be $125—the lower of the two figures. If you earn only $400, the calculation changes: 25% is $100, but $400 - $217.50 = $182.50, so $100 is still allowed.

However, exceptions exist:

| Debt Type | Garnishment Limit | Court Order Required? |

|---|---|---|

| Consumer Debt (credit cards, personal loans) | Up to 25% | Yes |

| Child Support | Up to 50–65% (depending on dependents) | No (administrative order) |

| Federal Student Loans | 15% | No |

| IRS Tax Debt | Varies by income and dependents | No |

“Wage garnishment should be a last resort, not a first move. Consumers need to know their rights and act quickly to avoid long-term financial damage.” — Lisa Ramirez, Consumer Law Attorney

What You Can Do: Steps to Stop or Reduce Garnishment

Receiving a garnishment notice doesn’t mean you’re powerless. Several legal and practical options exist to contest, reduce, or stop the withholding.

1. Challenge the Garnishment Legally

If you believe the debt is inaccurate, already paid, or the court didn’t follow proper procedure, you can file an objection. Most states provide a short window—often 10 to 20 days—to respond. This may delay or halt the garnishment pending review.

2. Claim Exemptions Based on Financial Hardship

Even if the debt is valid, you may qualify for partial or full exemption if garnishment would cause undue hardship. Low income, disability, or supporting dependents can strengthen your case. File an exemption claim form with the court, often titled “Claim of Exemption from Wage Garnishment.”

3. Negotiate a Settlement or Payment Plan

Creditors often prefer a lump-sum settlement or structured payments over lengthy garnishment. Contact them directly or through a lawyer to propose terms. A signed agreement can lead to withdrawal of the garnishment order.

4. File for Bankruptcy (Last Resort)

Chapter 7 or Chapter 13 bankruptcy triggers an automatic stay, halting most garnishments immediately. While this has long-term credit implications, it can provide breathing room and potentially discharge unsecured debts.

5. Consolidate or Refinance Debts

For those facing multiple debts, consolidation loans or debt management plans can prevent further legal action. Nonprofit credit counseling agencies can help negotiate lower interest rates and manageable repayment schedules.

Mini Case Study: How Maria Stopped Her Garnishment

Maria, a single mother working part-time, fell behind on her credit card payments during a medical crisis. After ignoring several collection letters, she was sued and lost by default. Her employer began withholding 25% of her paycheck.

Distressed but determined, Maria contacted a local legal aid nonprofit. With their help, she filed a Claim of Exemption citing her low income and childcare expenses. She also negotiated a one-time settlement for 40% of the balance. The creditor agreed to withdraw the garnishment upon payment. Within six weeks, the withholding stopped, and Maria enrolled in a budgeting program to avoid future issues.

Her story underscores the importance of acting quickly—even after garnishment begins, relief is possible.

Action Checklist: What to Do When Facing Garnishment

- Review the garnishment notice carefully—verify the creditor, amount, and court details.

- Contact the creditor to confirm the debt and explore repayment options.

- Consult a consumer rights attorney or legal aid organization.

- Determine eligibility for exemption based on income and essential expenses.

- File a formal objection or exemption claim within the deadline.

- Negotiate a settlement or payment plan in writing.

- Monitor your pay stubs to ensure correct withholding amounts.

- Consider credit counseling for long-term debt management.

Frequently Asked Questions

Can my employer fire me for having a wage garnishment?

Federal law prohibits employers from firing employees due to a single garnishment. However, protections weaken if you have multiple garnishments. Some states offer stronger safeguards, so check local regulations.

Does wage garnishment affect my credit score?

The garnishment itself isn’t reported to credit bureaus, but the underlying judgment is. This can significantly lower your score and remain on your report for up to seven years.

Can I stop garnishment by changing jobs?

No. If you switch employers, the creditor can simply issue a new garnishment order to your new workplace. This delays but does not eliminate the obligation.

Conclusion: Take Control Before It’s Too Late

Wage garnishment is a serious financial event, but it’s not the end of the road. Understanding why it happens—and knowing your legal rights and options—can make the difference between prolonged hardship and a path to resolution. Whether through negotiation, exemption claims, or professional guidance, proactive steps can reduce or stop garnishment and help you rebuild financial stability.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?