Certificates of Deposit (CDs) remain a cornerstone of conservative investing, offering guaranteed returns with minimal risk. As interest rates fluctuate in response to Federal Reserve policy and economic conditions, today’s CD rates range widely—from as low as 0.10% APY at traditional brick-and-mortar banks to as high as 5.50% APY at select online institutions. Understanding where these rates come from, which terms yield the highest returns, and how to optimize your investment can make a meaningful difference in your financial growth.

This guide breaks down current CD rate trends, explains what drives variation across institutions, and equips you with actionable strategies to secure the best available return on your deposit.

Understanding CD Rates: How They Work Today

A Certificate of Deposit is a time-bound savings account that pays a fixed interest rate over a set period—commonly ranging from three months to five years. In exchange for locking in your funds, banks reward you with higher yields than standard savings accounts.

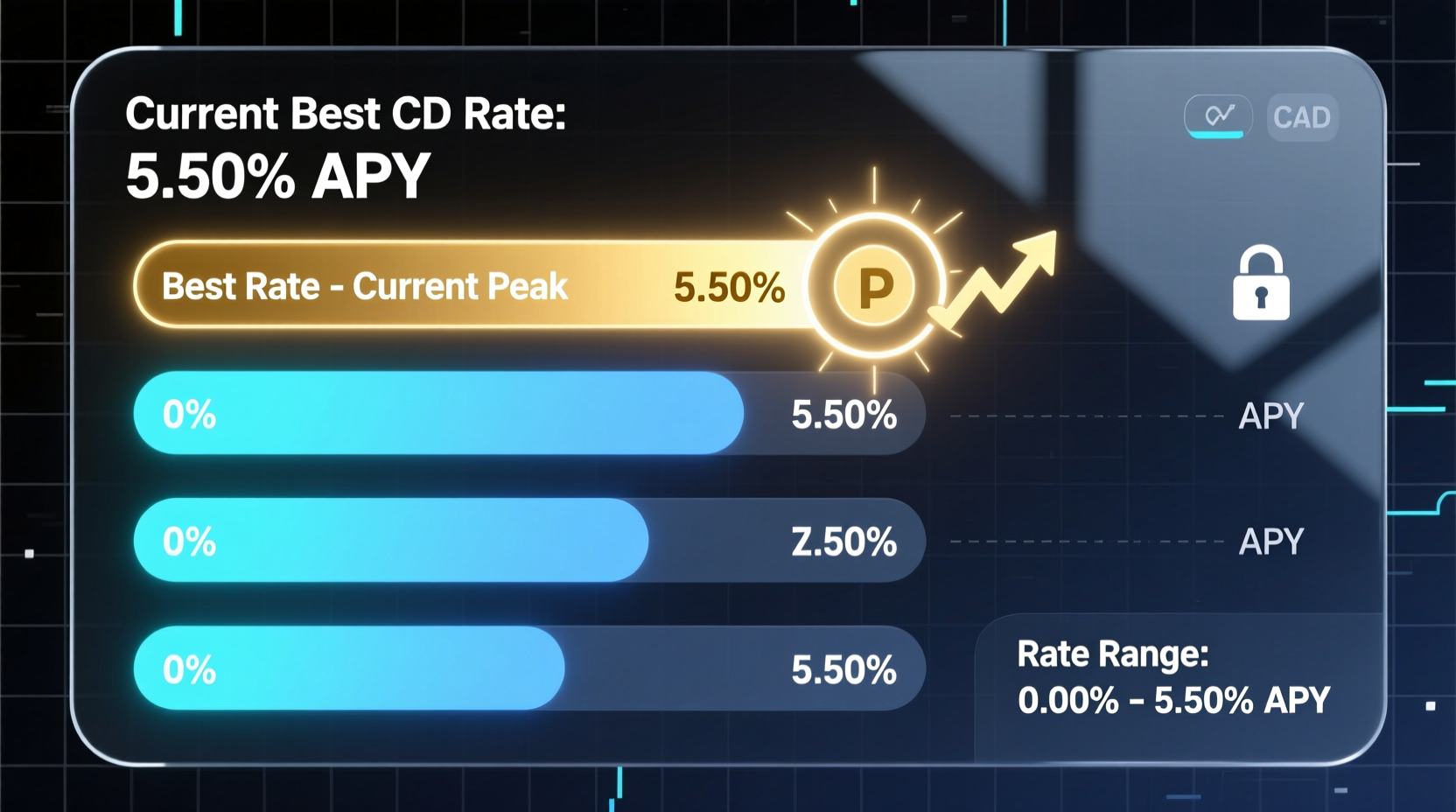

As of mid-2024, the national average APY for a one-year CD sits around 1.35%, according to the FDIC. However, many online banks and credit unions offer significantly higher rates, with top-tier institutions paying up to 5.50% APY on select terms. The disparity stems from differences in operating costs, competitive positioning, and regional banking models.

The key takeaway: not all CDs are created equal. A 5.50% APY can nearly quadruple your earnings compared to a 1.50% rate over the same period. For example, $10,000 invested at 5.50% APY over 12 months earns $550 in interest, versus just $150 at 1.50%. That’s a $400 difference—essentially free money left on the table if you’re not shopping around.

Current CD Rate Landscape: From 0.10% to 5.50% APY

The spread between the lowest and highest CD rates reflects a broader shift in consumer banking. Legacy banks with physical branches often offer lower yields due to higher overhead, while digital-first institutions pass savings onto customers in the form of competitive interest.

Below is a snapshot of real-world CD rates as observed across major U.S. financial institutions in mid-2024:

| Institution Type | Typical APY Range | Example Institutions | Notes |

|---|---|---|---|

| Traditional Banks | 0.01% – 0.50% | Bank of America, Chase | Lowest yields; convenience over returns |

| National Online Banks | 4.50% – 5.50% | Ally Bank, Marcus by Goldman Sachs, Discover | No branch access; FDIC-insured; high liquidity options |

| Credit Unions | 3.00% – 5.25% | Pentagon FCU, Alliant Credit Union | Membership required; strong member benefits |

| Regional Banks | 0.50% – 2.00% | TD Bank, PNC | Moderate rates with local service |

Notably, some online banks offer “bump-up” CDs or no-penalty CDs that allow flexibility without sacrificing yield. These innovations have made high-rate CDs more accessible and adaptable to changing market conditions.

How to Maximize Your CD Returns: A Step-by-Step Strategy

Securing the best CD rate isn’t just about finding the highest number—it’s about aligning your strategy with your financial timeline and risk tolerance. Follow this six-step process to optimize your returns:

- Assess your liquidity needs. Determine how long you can realistically commit funds without needing early withdrawal access.

- Check your credit union eligibility. Many high-yield credit unions have membership requirements based on employer, location, or association.

- Compare APYs across at least five institutions. Use trusted comparison sites like Bankrate, NerdWallet, or DepositAccounts.

- Review term lengths. Shorter terms (3–12 months) may offer lower rates but provide faster reinvestment opportunities if rates rise.

- Watch for promotional rates. Some banks offer limited-time bonuses for new deposits.

- Diversify maturities with a CD ladder. Stagger investments across multiple terms to balance yield and access.

“Interest rates are cyclical. Locking into a 5.50% CD during a peak cycle can outperform stocks over a 2-year horizon with zero volatility.” — Dr. Lena Torres, Fixed-Income Strategist at Horizon Wealth Advisors

Mini Case Study: Building a CD Ladder for Optimal Yield

Sarah, a 42-year-old school administrator, had $20,000 in a savings account earning 0.01% APY at her local bank. Concerned about inflation eroding her purchasing power, she researched high-yield alternatives. After comparing options, she opened four CDs at an online bank offering 5.25% APY on 12-month terms.

Instead of placing all $20,000 into a single five-year CD, she built a laddered portfolio:

- $5,000 in a 6-month CD

- $5,000 in a 12-month CD

- $5,000 in an 18-month CD

- $5,000 in a 24-month CD

Every six months, a portion matures, giving her access to cash or the option to reinvest at prevailing rates. When the first CD matured, rates had increased slightly, allowing her to reinvest at 5.40%. This strategy provided both competitive returns and periodic flexibility—proving that structure matters as much as the rate itself.

Common Pitfalls to Avoid When Choosing a CD

Even with high advertised rates, several traps can undermine your gains. Be mindful of the following:

- Early withdrawal penalties – These can erase months of interest, especially on long-term CDs.

- Minimum deposit requirements – Some high-yield CDs require $10,000 or more to qualify for the top rate.

- Introductory vs. ongoing rates – Confirm whether the rate is guaranteed for the full term.

- Lack of FDIC/NCUA insurance – Never invest in a non-insured CD unless you fully understand the risks.

- Overlooking inflation – A 5.50% APY sounds impressive, but after taxes and inflation, real returns may be closer to 2–3%.

Frequently Asked Questions

Are 5.50% APY CDs safe?

Yes, if offered by an FDIC-insured bank or NCUA-insured credit union. As long as your deposit is within insurance limits ($250,000 per institution), your principal and interest are protected.

Can I lose money on a CD?

Under normal circumstances, no. CDs guarantee both principal and interest. However, early withdrawals typically incur penalties that could reduce your total balance below the original deposit amount.

Will CD rates go up or down in 2025?

Market forecasts suggest potential rate cuts in late 2024 and early 2025 as the Federal Reserve responds to cooling inflation. If accurate, locking in a high rate now could be advantageous before yields decline.

Final Thoughts: Act Now to Capture Peak Rates

The window for 5.00%+ CD rates won’t stay open forever. Economic indicators point toward a gradual easing cycle, meaning today’s high yields may soon become tomorrow’s relics. Whether you're saving for a home, building an emergency fund, or preserving capital during market uncertainty, a well-chosen CD can serve as both a shield and a growth engine.

Don’t settle for 0.10% when 5.50% is available. Compare options, diversify your maturity dates, and take control of your savings trajectory. The extra effort pays compound interest—literally.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?