Paying off a mortgage early isn’t just about financial discipline—it’s about making intelligent choices that align with your long-term goals. While a 30-year mortgage may seem like a manageable path, the total interest paid over decades can exceed the original loan amount. The good news? With the right approach, homeowners can significantly shorten their repayment timeline, reduce interest costs, and gain financial freedom sooner. This guide explores practical, data-backed methods to accelerate mortgage payoff without sacrificing stability.

Understand How Mortgages Work: The Interest Trap

Mortgages are structured so that early payments mostly cover interest rather than principal. For example, in the first few years of a 30-year loan at 6%, over 70% of each payment goes toward interest. This means even consistent on-time payments do little to reduce the principal balance initially.

The longer you keep the loan, the more interest accumulates. A $300,000 mortgage at 5.5% over 30 years results in nearly $314,000 in total interest—more than the home’s value. Reducing the term or increasing payments strategically can cut this cost dramatically.

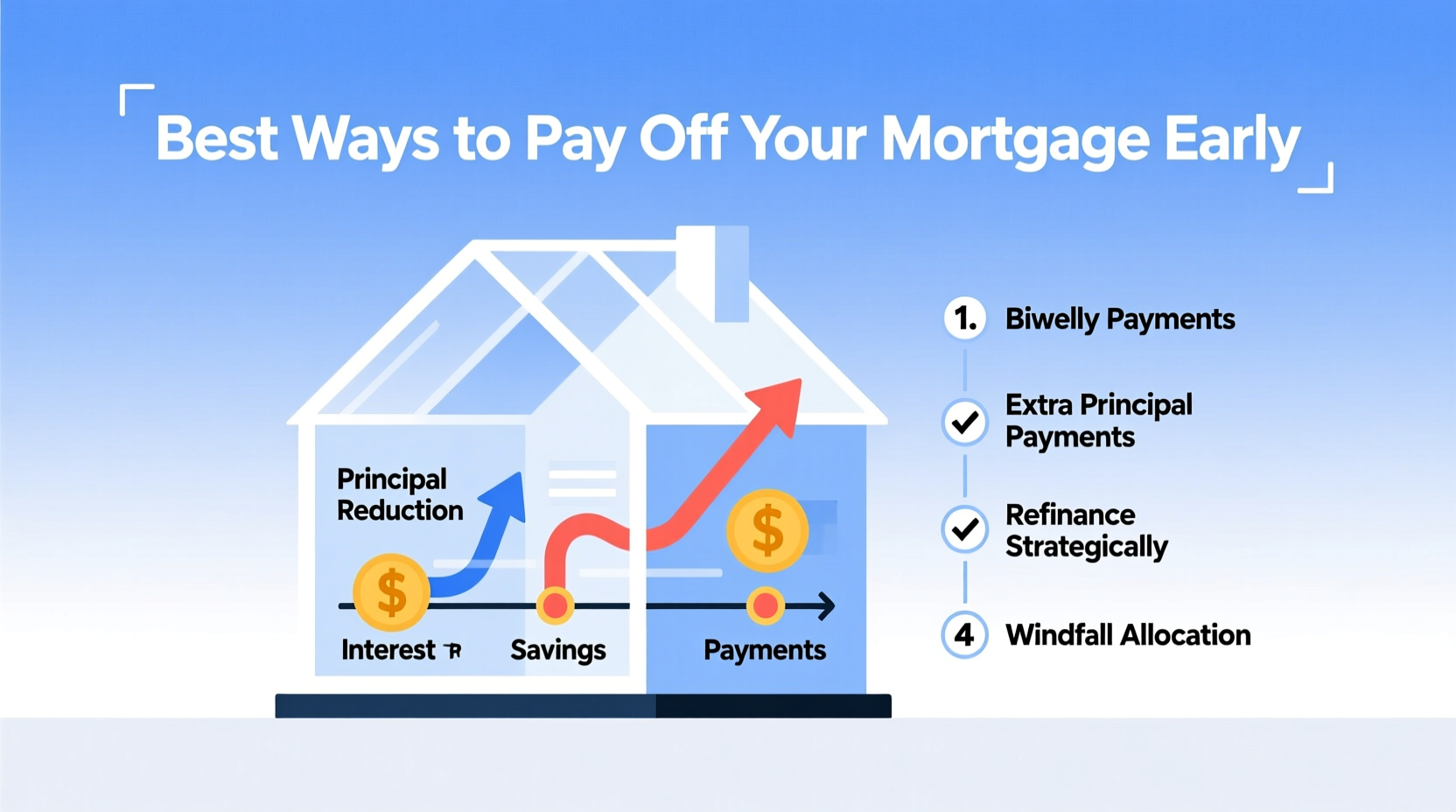

Smart Strategies to Pay Off Your Mortgage Faster

1. Make Biweekly Payments Instead of Monthly

Switching from monthly to biweekly payments means you make 26 half-payments per year—equivalent to 13 full monthly payments. That extra payment annually accelerates payoff without straining your budget.

For a $300,000 loan at 5.5% fixed over 30 years, biweekly payments can shorten the term by nearly 4 years and save over $40,000 in interest.

2. Round Up Your Monthly Payment

Add an extra $50, $100, or even $200 to each payment. Even small increases compound over time. Rounding up a $1,278 monthly payment to $1,300 saves thousands and shaves years off the loan.

“Paying an extra $100 per month on a 30-year mortgage can reduce the term by up to six years, depending on the rate.” — Laura Adams, Financial Analyst and Author of The Healthy Homeowner

3. Use Windfalls Wisely

Bonuses, tax refunds, inheritance, or side income offer prime opportunities to make lump-sum principal reductions. Applying a $5,000 bonus directly to principal not only lowers the balance but also reduces future interest accrual.

Some lenders allow “targeted” payments—specify that extra funds go to principal only, not future payments.

4. Refinance to a Shorter Term

Refinancing from a 30-year to a 15-year mortgage often comes with lower interest rates and forces faster equity buildup. Although monthly payments rise, the lifetime savings are substantial.

| Loan Type | Interest Rate | Monthly Payment | Total Interest Paid | Payoff Time |

|---|---|---|---|---|

| 30-Year Fixed | 5.5% | $1,718 | $314,000 | 30 years |

| 15-Year Fixed | 4.75% | $2,352 | $123,000 | 15 years |

While the monthly cost is higher, the 15-year option saves over $190,000 in interest and builds ownership quickly.

5. Increase Payments as Income Grows

Whenever you receive a raise, promotion, or new source of income, allocate a portion—ideally 50% or more—to your mortgage. This strategy leverages rising earning power without impacting lifestyle.

A teacher earning $50,000 who gets a $5,000 annual raise and commits half ($2,500) to her mortgage could eliminate a 30-year loan seven years early.

Step-by-Step Guide to Accelerating Your Mortgage Payoff

- Review your current loan terms: Confirm your interest rate, remaining balance, and whether prepayment penalties apply.

- Obtain your amortization schedule: See how payments break down between principal and interest.

- Choose one primary acceleration method: Start with biweekly payments or rounding up.

- Set up automatic extra payments: Automate transfers to ensure consistency.

- Apply windfalls annually: Mark calendar events like tax season to redirect bonuses or refunds.

- Reassess every 1–2 years: Adjust contributions as income changes or refinancing opportunities arise.

- Communicate with your lender: Ensure all extra payments are applied correctly to principal.

Mini Case Study: The Martins’ Early Payoff Journey

John and Maria Martin bought a $375,000 home in 2018 with a 30-year fixed mortgage at 4.25%. Their monthly payment was $1,850. Instead of sticking to the standard plan, they adopted three key strategies:

- Switched to biweekly payments (effectively 13 months per year)

- Rounded up to $1,900/month

- Applied their average $3,200 tax refund to principal each spring

By 2025, they had reduced their principal by nearly $98,000—over $30,000 ahead of schedule. Based on projections, they’ll own their home free by 2034—11 years early—and save approximately $82,000 in interest.

Common Mistakes to Avoid

- Neglecting emergency savings: Don’t drain reserves to pay off a mortgage. Maintain 3–6 months of expenses.

- Ignores investment opportunities: If your mortgage rate is 3–4%, investing in the market (avg. 7% return) may yield better returns.

- Failing to verify payment allocation: Some lenders default extra payments to next month’s due date unless instructed otherwise.

- Overextending financially: Aggressive payments shouldn’t compromise retirement contributions or daily living.

“The goal isn’t just to be mortgage-free—it’s to be financially healthy. Balance speed with sustainability.” — David Nguyen, Certified Financial Planner

Checklist: Is Your Strategy on Track?

- ✅ Confirmed no prepayment penalty on my loan

- ✅ Set up automatic extra payments to principal

- ✅ Scheduled annual windfall contributions (tax refund, bonus)

- ✅ Reviewed amortization impact using an online calculator

- ✅ Discussed plan with lender to ensure proper processing

- ✅ Balanced mortgage goals with retirement and emergency savings

FAQ

Can I pay off my mortgage too early?

Not financially—but consider opportunity cost. If your mortgage has a low interest rate (e.g., below 4%), investing excess cash might yield higher long-term returns. Also, ensure you have sufficient liquidity before accelerating payoff.

Does paying extra each month really make a difference?

Yes. Even $50 extra per month can reduce a 30-year loan by 3–5 years and save tens of thousands in interest. The earlier you start, the greater the impact due to compounding interest reduction.

Should I refinance to a 15-year loan just to pay it off faster?

Only if you can comfortably afford the higher monthly payment. A 15-year loan typically has a lower interest rate and builds equity faster, but it reduces cash flow flexibility. Run the numbers using a refinance calculator to compare total costs.

Conclusion: Take Control of Your Financial Future

Paying off a mortgage early is one of the most powerful steps toward financial independence. By combining disciplined habits with strategic decisions—like biweekly payments, targeted lump sums, and smart refinancing—you can reclaim tens of thousands in interest and unlock true ownership of your home. The best strategy isn’t the fastest—it’s the one you can sustain without sacrificing other financial priorities.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?