Finding a lost credit card can feel like a minor stroke of luck—until you realize the responsibility that comes with it. While it might be tempting to ignore it or even consider using it, doing so could lead to serious legal consequences and ethical breaches. On the other hand, returning the card properly protects both the rightful owner and yourself from fraud, identity theft, and suspicion. This guide walks you through the correct, safe, and responsible steps to take when you come across a lost credit card.

Why Returning a Lost Credit Card Matters

Credit cards are more than just plastic—they're gateways to personal financial accounts. When someone loses their card, they’re not only at risk of unauthorized charges but also potential damage to their credit score and emotional distress. As the finder, your actions can prevent significant harm. Moreover, keeping or misusing a found card—even briefly—is considered theft in most jurisdictions, regardless of intent.

Acting responsibly protects your integrity and avoids legal trouble. According to the U.S. Secret Service, over 1 million credit card fraud cases are reported annually, many stemming from lost or stolen cards. Your decision to return it properly contributes to reducing this number.

Step-by-Step Guide: What to Do If You Find a Credit Card

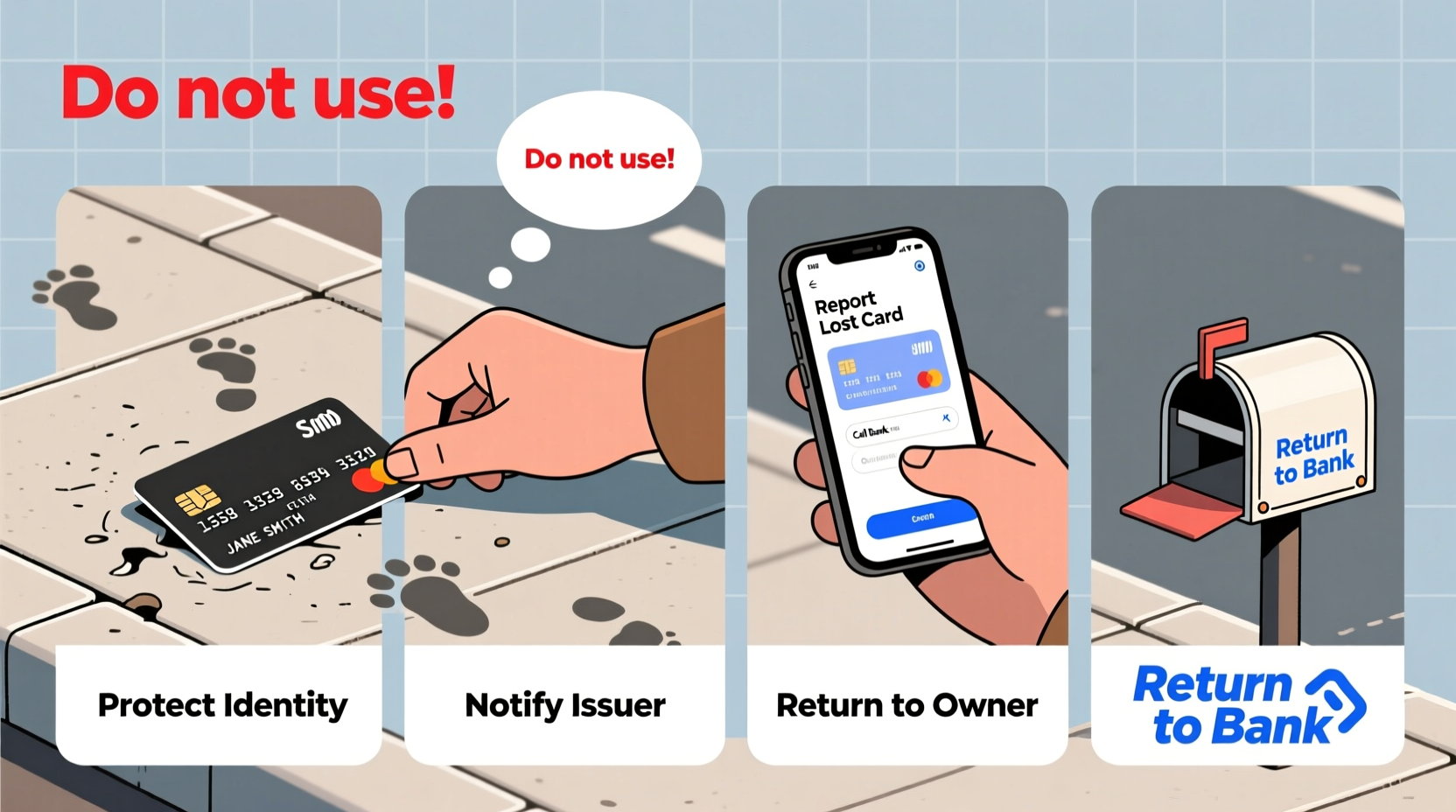

- Don’t Use the Card

Under no circumstances should you attempt to use the card, even for a small purchase. Doing so is illegal and can result in criminal charges, including fraud and identity theft. - Check for Owner Information

Look at the front and back of the card. Some cards include contact details or customer service numbers. The issuing bank (e.g., Chase, Bank of America) is usually listed on the front or back. - Contact the Issuing Bank Immediately

Call the customer service number on the back of the card. Explain that you’ve found a lost credit card and want to return it. Provide the card number and any other visible information. The bank will verify ownership and deactivate the card to prevent fraudulent use. - Do Not Mail the Card Yourself

Avoid sending the card through regular mail unless instructed by the bank. Mailing it risks it being lost again or intercepted. Instead, ask the bank how they’d like to receive it—some offer secure drop-off locations or prepaid envelopes. - Document Your Actions

Keep a record of the date, time, and name of the representative you spoke with. Note the confirmation number or reference ID. This creates a paper trail in case questions arise later. - Consider Dropping It Off at a Local Branch

If the card is from a major bank with nearby branches (e.g., Wells Fargo, Citi), you can bring it directly to a local office. Hand it to a manager with a brief explanation. Request a receipt or acknowledgment if possible.

Do’s and Don’ts When Handling a Found Credit Card

| Do’s | Don’ts |

|---|---|

| Call the bank’s customer service number immediately | Use the card for any transaction |

| Provide basic card details to the bank | Share the card number online or with strangers |

| Ask for a confirmation number after reporting | Keep the card “just in case” you see the owner |

| Drop it off at an official bank branch | Try to track down the owner yourself using personal info |

| Record details of your interaction with the bank | Assume the card is expired or inactive |

Real-Life Example: A Responsible Decision Prevents Fraud

In 2022, Sarah Thompson, a teacher from Portland, Oregon, found a Visa card inside a library book. She noticed the name and bank logo and called the number on the back. After verifying her report, the bank confirmed the card had already been used twice that day at gas stations over 100 miles away. Thanks to Sarah’s quick action, the bank froze the account, reimbursed the fraudulent charges, and issued a new card to the owner. The cardholder later sent a thank-you letter, expressing relief that someone had acted ethically.

This case illustrates how one person’s responsible choice can disrupt a chain of financial crime. Had Sarah ignored the card or tried to return it informally, the fraudulent activity might have continued unchecked.

Expert Insight: Why Ethical Action Protects Everyone

“Every reported lost card stops an average of $300 in unauthorized charges. When citizens return cards properly, they become frontline defenders against financial crime.” — James R. Lowell, Senior Fraud Analyst at FDIC

Experts agree that public cooperation is essential in combating credit card fraud. Banks rely on timely reports to freeze compromised accounts. Delays increase exposure and complicate investigations. By acting swiftly and correctly, you support broader financial security efforts.

Checklist: How to Responsibly Return a Found Credit Card

- ✅ Pick up the card and avoid touching the magnetic strip or chip unnecessarily

- ✅ Locate the customer service number on the back

- ✅ Call the bank and report the found card

- ✅ Provide the card number and expiration date (if visible)

- ✅ Ask for a confirmation number or reference ID

- ✅ Follow instructions for returning the physical card

- ✅ Record the date, time, and name of the agent you spoke with

- ✅ Avoid sharing details publicly or attempting DIY returns

Frequently Asked Questions

Can I be rewarded for returning a lost credit card?

Most banks do not offer rewards for returning lost cards, though some cardholders may choose to send a thank-you gift. However, the primary benefit is knowing you’ve prevented financial harm and upheld ethical standards.

What if the card has no customer service number?

If the number is missing or worn off, identify the network (Visa, Mastercard, American Express) and issuer from the logo. Search online for the bank’s official customer service line. For example, American Express: 1-800-528-4800. Only use verified numbers from official websites.

Am I legally required to return a found credit card?

While laws vary by state and country, failing to return a found card can be interpreted as intent to commit fraud or theft. In many U.S. states, keeping lost property of significant value—including credit cards—is a misdemeanor or felony. Acting promptly removes any ambiguity about your intentions.

Protecting Yourself and Others Starts with One Choice

Finding a credit card is a moment of moral clarity. It tests your integrity and awareness. Choosing to act responsibly safeguards the cardholder from financial loss, prevents misuse, and insulates you from suspicion or legal trouble. There’s no need for heroics—just a simple phone call to the right number.

Financial institutions are equipped to handle these situations efficiently. Your role is not to investigate or intervene beyond reporting. By following the steps outlined here, you contribute to a safer, more trustworthy system for everyone.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?