In an era of rising inflation and fluctuating markets, finding safe yet effective ways to grow your money is more important than ever. While traditional savings accounts offer minimal returns—often below 0.01% APY—high-yield savings accounts can deliver significantly better interest rates, sometimes exceeding 4.5%. These accounts provide a secure, liquid way to earn compound interest without exposing your principal to market risk. The key lies in knowing where to look, how to compare options, and when to act.

Why High-Yield Savings Outperform Traditional Accounts

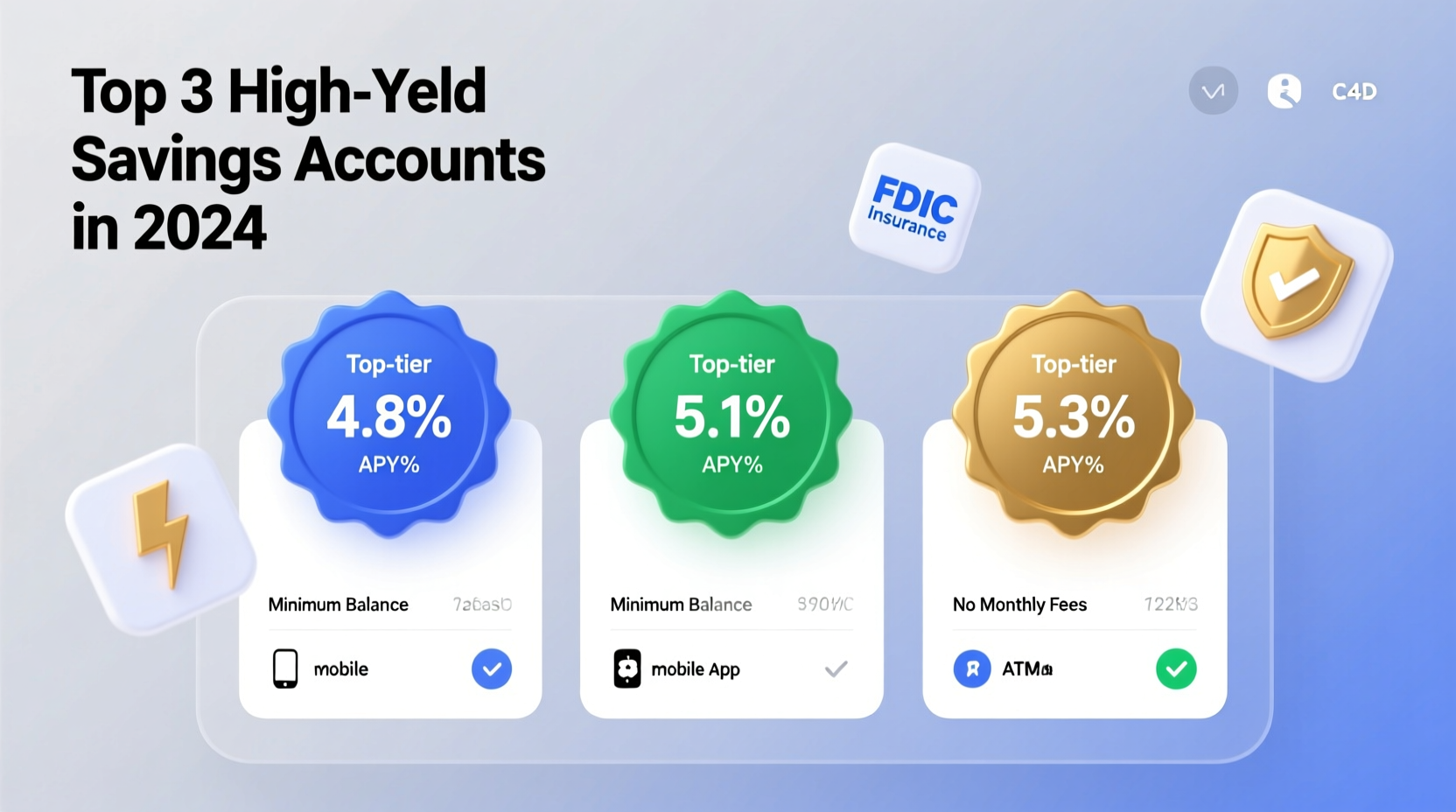

Most brick-and-mortar banks operate with higher overhead costs, which limits their ability to pass competitive interest rates to customers. In contrast, online banks and fintech platforms have lower operational expenses, allowing them to offer much higher annual percentage yields (APYs). As of 2024, while a typical national bank may pay just 0.01% on savings, top-tier high-yield accounts are offering between 4.0% and 5.0% APY, often with no monthly fees or minimum balance requirements.

The difference compounds quickly. For example, $10,000 in a standard account at 0.01% earns about $1 per year. The same amount in a 4.5% high-yield account earns $450 annually—450 times more—with identical safety through FDIC insurance.

Top Strategies to Maximize Interest Earnings

Earning high interest isn’t just about opening one account—it’s about strategy. Here’s how to optimize your approach for real financial gain.

1. Compare Rates Across Reputable Institutions

Interest rates change frequently based on Federal Reserve policy and competition among lenders. Regularly monitoring rate trends ensures you’re not leaving money on the table. Use trusted comparison sites like NerdWallet, Bankrate, or DepositAccounts to evaluate current offerings.

| Bank Type | Avg. APY (2024) | Fees | Access & Features |

|---|---|---|---|

| Traditional National Bank | 0.01% | Monthly maintenance fees common | Branch access, limited digital tools |

| Online High-Yield Bank | 4.0% – 5.0% | No monthly fees | Digital-only, mobile app, ATM network |

| Credit Union (High-Yield) | 3.5% – 4.75% | Rare; membership required | Hybrid access, community-focused |

2. Leverage Tiered Accounts and Promotions

Some banks offer promotional bonuses or tiered interest rates based on balance size. For instance, a bank might pay 5.00% APY on balances under $25,000 and 4.75% above that threshold. Others provide cash sign-up bonuses—sometimes $200 or more—for funding a new account with a minimum deposit.

While chasing bonuses shouldn't be your primary goal, combining a strong APY with a short-term incentive can boost early returns.

3. Automate Transfers to Build Momentum

Set up automatic transfers from your checking to your high-yield savings account right after each paycheck. Even $100 per week grows to over $5,000 annually—and earns interest immediately upon deposit. Automation removes temptation and builds discipline.

“People underestimate how much small, consistent deposits can grow when compounded at high rates. It's not magic—it's math.” — Sarah Lin, Certified Financial Planner

Step-by-Step Guide to Opening and Optimizing a High-Yield Account

Opening a high-yield savings account is straightforward if you follow a structured process. This timeline ensures you make informed decisions without rushing.

- Assess Your Emergency Fund Needs: Determine how much you want to keep liquid. Most experts recommend 3–6 months of living expenses.

- Research Top-Rated Banks: Focus on institutions with APYs above 4.5%, no fees, and strong customer reviews.

- Check FDIC Coverage: Confirm the bank is FDIC-insured. If consolidating large sums, stay under $250,000 per institution.

- Gather Required Documents: You’ll need government ID, Social Security number, and a linked external bank account.

- Open the Account Online: Most applications take less than 15 minutes. Fund via direct transfer or ACH.

- Set Up Automatic Deposits: Schedule recurring transfers to maintain growth momentum.

- Monitor and Reassess Quarterly: Rates change. Be ready to move funds if a better option emerges.

Expanding Beyond Basic Savings: Ladders and Alternatives

While high-yield savings accounts are ideal for emergency funds and short-term goals, pairing them with other instruments can further boost overall returns.

Certificate of Deposit (CD) Ladders

A CD ladder involves spreading your money across multiple certificates with staggered maturity dates. For example:

- $5,000 in a 6-month CD

- $5,000 in a 12-month CD

- $5,000 in an 18-month CD

- $5,000 in a 24-month CD

As each CD matures, you can reinvest at prevailing rates or access the funds. This balances liquidity with higher yields—some long-term CDs currently offer over 5.0% APY.

Money Market Accounts (MMAs)

Some institutions offer high-yield money market accounts with check-writing privileges and debit cards, blending flexibility with competitive interest. They often require slightly higher minimum balances but remain low-risk and FDIC-protected.

Mini Case Study: How Maria Grew Her Emergency Fund

Maria, a freelance graphic designer, had $8,000 sitting in a traditional bank savings account earning 0.01% APY. After researching options, she moved her funds to an online bank offering 4.80% APY with no fees. She also set up an automatic $300 monthly transfer from her checking account.

Within one year:

- Initial $8,000 earned $384 in interest

- New contributions totaled $3,600

- Interest on incremental deposits added ~$85

- Total savings: $12,069 (vs. $11,600 without optimization)

By simply switching accounts and automating deposits, Maria earned nearly $500 more in interest than she would have otherwise—all without taking on additional risk.

Common Pitfalls to Avoid

Even savvy savers can fall into traps that reduce returns or create unnecessary friction.

- Ignoring fees: Monthly maintenance or withdrawal penalties can erase interest gains.

- Overlooking taxes: Interest is taxable income. Plan accordingly during tax season.

- Staying loyal to underperforming banks: There’s no penalty for moving your money to a better rate.

- Chasing unverified platforms: Avoid fintech apps promising “too good to be true” returns without clear FDIC backing.

FAQ

Is my money safe in a high-yield savings account?

Yes—if the bank is FDIC-insured. Your deposits are protected up to $250,000 per depositor, per institution. Always confirm FDIC status before opening an account.

How often do high-yield savings rates change?

Rates typically adjust within weeks of Federal Reserve interest rate decisions. While they don’t change daily, reviewing your account every 3–6 months helps ensure you’re still getting a competitive return.

Can I have more than one high-yield savings account?

Absolutely. Many people use separate accounts for different goals—like emergencies, vacations, or home down payments. Just ensure total deposits at one institution don’t exceed FDIC limits unless necessary.

Final Checklist: Getting Started the Right Way

- ☐ Research current top APYs

- Use reliable financial comparison sites to find rates above 4.5%.

- ☐ Confirm FDIC insurance

- Visit FDIC.gov or check the bank’s website footer for certification.

- ☐ Check for hidden fees

- Look for no monthly maintenance, transfer, or minimum balance fees.

- ☐ Prepare identification and funding method

- Have your SSN, ID, and external bank login ready.

- ☐ Set up automated transfers

- Start small if needed—even $50/week adds up over time.

- ☐ Monitor and optimize quarterly

- Reevaluate rates and customer service performance regularly.

Conclusion: Turn Idle Cash Into Active Growth

Your money doesn’t have to sit idle earning next to nothing. With high-yield savings accounts, you can achieve meaningful returns while maintaining full access and complete safety. The best part? It takes less effort than most realize. By choosing the right institution, setting up automation, and staying informed, you transform passive savings into an active financial tool.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?