Your credit report is more than just a number—it's a detailed financial record that influences loan approvals, interest rates, housing applications, and even job opportunities. With three major credit bureaus generating reports—Equifax, Experian, and TransUnion—many consumers ask: which is best credit report? The truth is, no single bureau holds the \"best\" report, but understanding their differences, strengths, and how they’re used can help you make informed decisions about monitoring and improving your credit health.

Credit reports are not created equally across bureaus. Each collects slightly different information based on which lenders report to them, when updates occur, and how disputes are handled. To get a full picture of your financial standing, it’s essential to know how each agency operates, what data they prioritize, and which tools offer the most reliable insights.

How Credit Bureaus Collect and Report Data

The U.S. has three primary credit reporting agencies: Equifax, Experian, and TransUnion. While they all follow similar regulatory frameworks under the Fair Credit Reporting Act (FCRA), their data collection practices vary. Lenders and creditors voluntarily report consumer payment history, balances, account ages, and public records such as bankruptcies or liens—but not all institutions report to all three bureaus.

For example, a regional credit union might only report to Experian, while a national bank sends updates to all three. This leads to discrepancies between reports. Additionally, timing differences in reporting cycles mean one bureau may show an updated balance while another still reflects last month’s data.

Each bureau also uses proprietary scoring models alongside the widely accepted FICO Score and VantageScore systems. These variations affect how lenders interpret risk, making it crucial to review multiple sources rather than relying on just one.

Comparing the Big Three: Equifax, Experian, and TransUnion

To determine which credit report offers the most reliable data, consider accuracy, accessibility, customer support, and additional monitoring features. Below is a comparison of core attributes:

| Bureau | Data Accuracy | Free Access Options | Premium Monitoring | Unique Features |

|---|---|---|---|---|

| Equifax | Moderate; known for occasional lag in dispute resolution | One free report/year via AnnualCreditReport.com | Equifax Core Advantage ($9.95/month) | Dedicated identity theft protection; employment verification services |

| Experian | High; often first to update with new credit activity | Free weekly reports + FICO Score via Experian website | Experian IdentityWorks (from $21.99/month) | Free FICO 8 access; Boost program for alternative data inclusion |

| TransUnion | High; strong in rental and utility reporting partnerships | Free monthly reports via app or website | TrueIdentity (free basic tier; premium from $14.95/month) | Includes personal information monitoring; trended credit data for lenders |

While all three are legitimate, Experian stands out for offering free FICO Scores and real-time updates without requiring a subscription. TransUnion excels in incorporating non-traditional data like rent payments, beneficial for thin-file consumers. Equifax, despite past security concerns, continues to improve its transparency and fraud alert systems.

“Consumers should treat all three credit reports as equally important. No single bureau is universally 'better'—each plays a role depending on the lender and context.” — Laura Adams, Credit Education Specialist at NerdWallet

Step-by-Step Guide to Evaluating Your Credit Reports

To ensure you're working with accurate, up-to-date information, follow this process every 3–6 months:

- Request Reports from All Three Bureaus: Visit AnnualCreditReport.com, the only federally authorized site for free credit reports. You're entitled to one free report per bureau per year.

- Check Personal Information: Verify your name, address, Social Security number, and employment history. Errors here could indicate identity mix-ups.

- Review Accounts: Confirm all listed accounts are yours. Look for incorrect balances, late payments, or closed accounts marked as open.

- Scan for Inquiries: Identify hard inquiries (from loan applications) and soft ones (pre-approved offers). Unauthorized hard pulls may signal fraud.

- Look for Public Records: Bankruptcies, tax liens, or civil judgments should be accurate and within legal reporting timeframes (typically 7–10 years).

- Dispute Errors Immediately: File disputes directly through each bureau’s online portal. Include documentation such as ID, proof of address, and creditor correspondence.

- Track Resolution Timelines: By law, bureaus must investigate disputes within 30 days. Follow up if corrections aren’t made promptly.

Real Example: How Discrepancies Affected a Home Loan Application

Sarah M., a teacher from Austin, Texas, applied for a mortgage preapproval expecting a smooth process. Her FICO Score from Experian was 760, qualifying her for the best rates. However, the lender pulled her TransUnion report, which showed a 680 due to an unresolved medical collection account incorrectly attributed to her.

Because she hadn’t reviewed all three reports recently, the error delayed her application by six weeks. After filing a dispute and providing hospital billing records proving the debt belonged to someone else, TransUnion corrected the mistake. She reapplied and secured her loan—but learned a costly lesson about cross-bureau monitoring.

This case highlights why relying on a single source—even a reputable one—is risky. Lenders choose which bureau(s) to pull from, so being blind to one report can derail major financial goals.

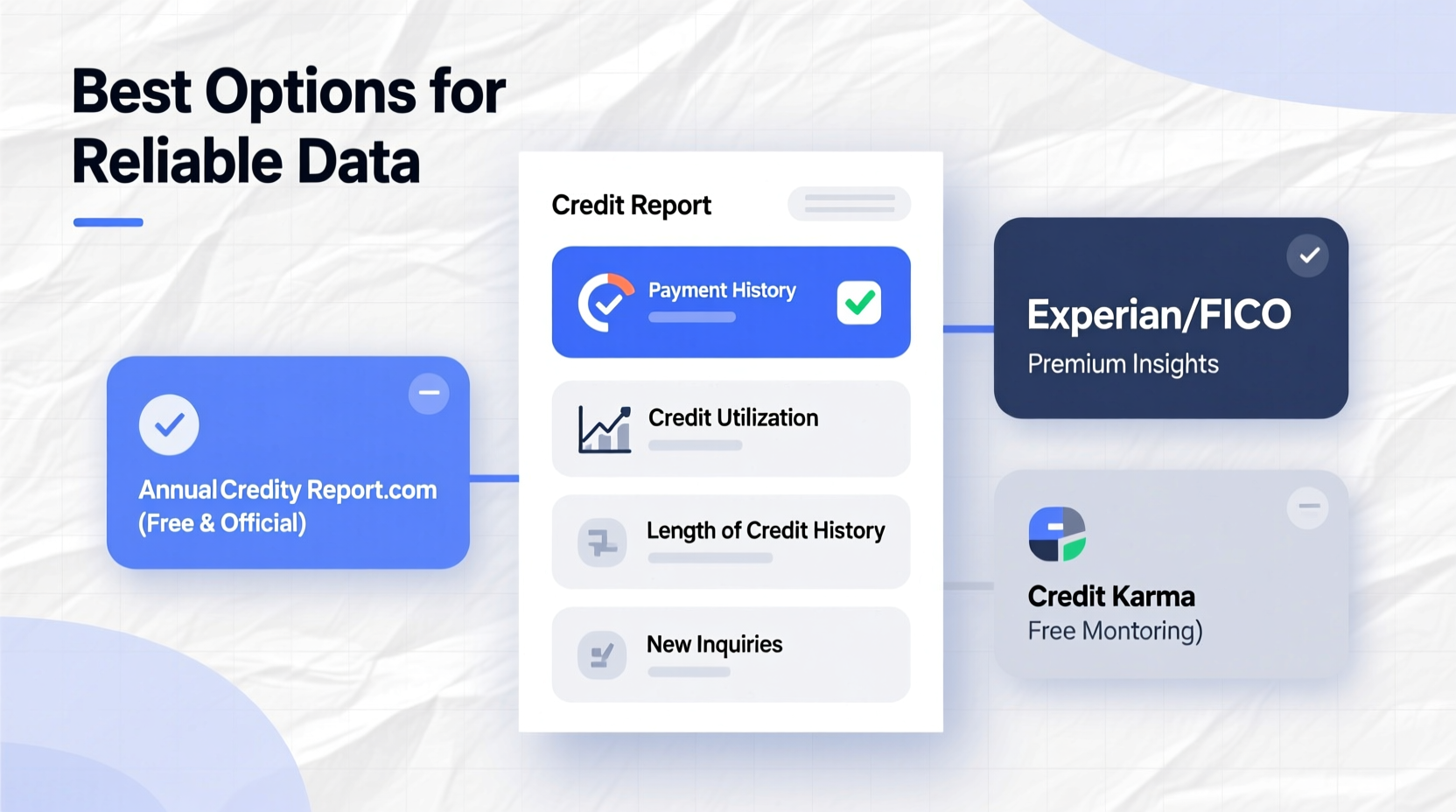

Best Practices for Reliable Credit Monitoring

- Use Free Tools Strategically: Leverage Experian’s free FICO access and TransUnion’s monthly alerts to stay informed without paying for subscriptions unless needed.

- Enable Fraud Alerts or Credit Freezes: If you’re concerned about identity theft, place a freeze with each bureau. It stops new accounts from being opened in your name.

- Monitor with Apps That Aggregate Data: Services like Credit Karma (now part of Intuit) pull data from TransUnion and Equifax, giving a broader view. Note: They use VantageScore, not FICO, so numbers may differ from lender-used scores.

- Avoid “Credit Repair” Scams: Legitimate errors can be fixed yourself at no cost. Companies promising quick fixes often charge high fees and deliver little.

- Build Positive History Consistently: On-time payments, low credit utilization (under 30%), and long-standing accounts matter most across all scoring models.

Checklist: Essential Actions for Maintaining Accurate Credit Reports

- ✅ Pull one credit report every four months (rotate bureaus)

- ✅ Check for inaccurate personal details or fraudulent accounts

- ✅ Dispute errors using certified mail or online portals

- ✅ Set up free credit monitoring where available

- ✅ Freeze credit if you’re not actively seeking loans

- ✅ Review your FICO Score variation across lenders (auto, mortgage, credit card)

Frequently Asked Questions

Do all lenders use the same credit bureau?

No. Lenders select which bureau—or combination of bureaus—to pull reports from. Mortgage lenders often use all three and take the middle score. Auto lenders may use only one, typically Experian. Credit card issuers vary by institution.

Why do my credit scores differ between bureaus?

Variations arise due to differences in reported data, scoring models used (FICO 8 vs. FICO Auto Score 2, etc.), and update frequencies. A 30-point difference between bureaus is common and not necessarily a cause for concern.

Is one credit score more important than others?

FICO Scores are used in over 90% of lending decisions. Among these, FICO Score 8 is the most widely adopted. However, specific industries use tailored versions—FICO Auto Score 9 for car loans, FICO Bankcard Score 8 for credit cards—so no single score tells the whole story.

Take Control of Your Credit Story

There is no single “best” credit report. The power lies in understanding that each of the three major bureaus contributes a unique piece of your financial narrative. Relying solely on one report risks missing critical details that could impact your ability to borrow, rent, or even land a job. By proactively reviewing all three, correcting inaccuracies, and leveraging free monitoring tools, you gain control over your creditworthiness.

Start today: visit AnnualCreditReport.com, download your first report, and begin building a clearer, more accurate picture of your financial health. Knowledge isn’t just power—it’s protection.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?