Since its enactment in 2010, the Affordable Care Act (ACA), commonly known as Obamacare, has reshaped the American healthcare landscape. While it succeeded in expanding coverage to millions of previously uninsured individuals, it has also drawn persistent criticism from across the political and economic spectrum. Understanding these criticisms is essential—not to dismiss the law’s achievements, but to recognize where it falls short and how future reforms might improve upon it.

The ACA was designed to increase access, reduce long-term healthcare spending, and protect patients from insurance industry practices like denying coverage for pre-existing conditions. Yet, despite its noble goals, several structural and practical issues have fueled public skepticism and policy debate. This article examines the most common and substantiated criticisms of the ACA, backed by data, expert insights, and real-world implications.

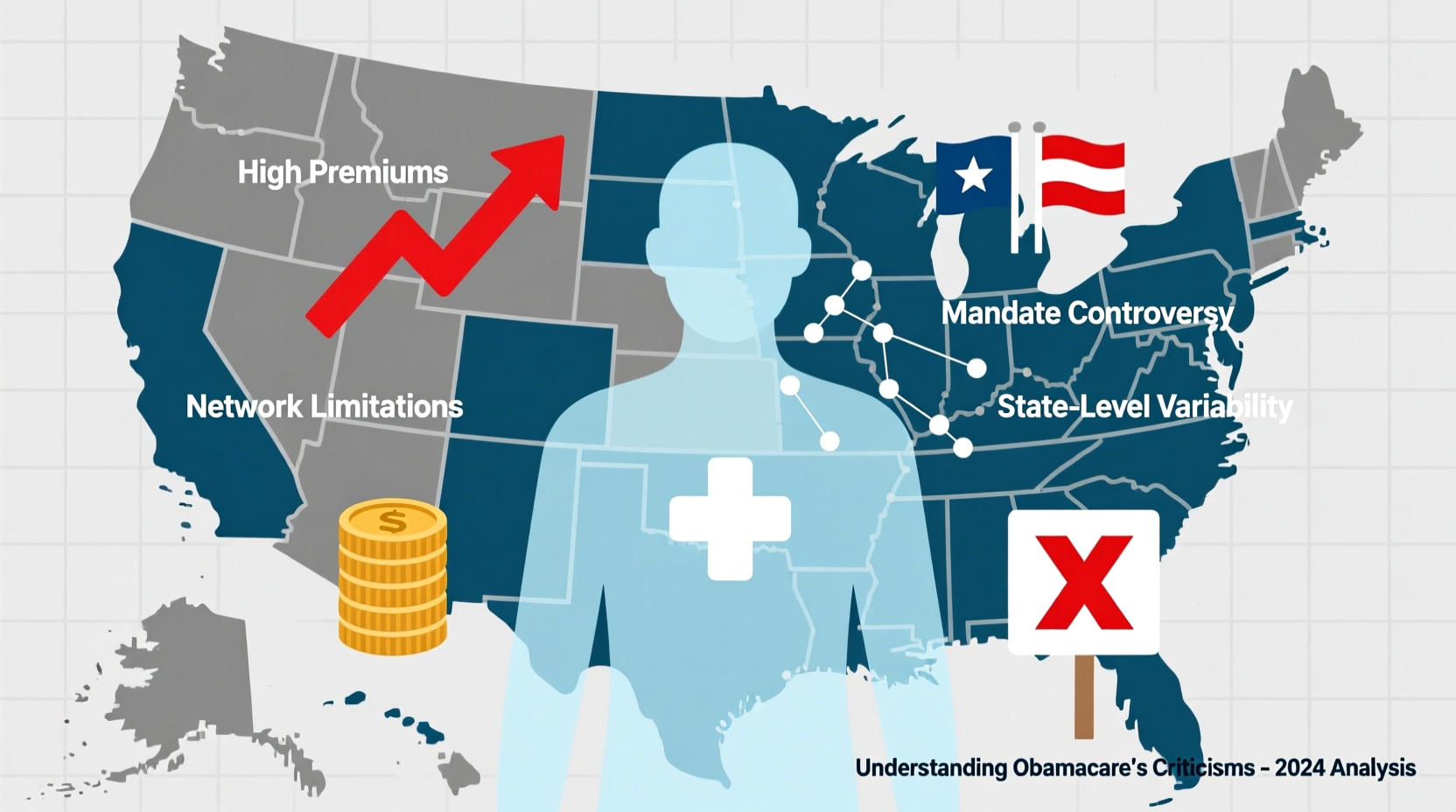

1. High Premiums and Affordability Concerns

One of the most frequent complaints about the ACA is the rising cost of premiums, particularly for middle-income individuals who do not qualify for subsidies. While the law provides tax credits to lower premiums for those earning between 100% and 400% of the federal poverty level, many Americans just above this threshold face steep monthly payments.

In some states, benchmark silver plan premiums have increased significantly since 2010. According to the Kaiser Family Foundation, average premiums for ACA marketplace plans rose by over 100% between 2017 and 2023 in certain regions—outpacing inflation and wage growth.

Even with subsidies, out-of-pocket costs such as deductibles, co-pays, and coinsurance remain high on many plans. A 2022 Commonwealth Fund report found that nearly half of working-age adults enrolled in marketplace plans reported difficulty affording care due to cost-sharing requirements.

2. Limited Provider Networks and Access Issues

To keep premiums low, many ACA-compliant plans use narrow provider networks—limiting enrollees to specific doctors, hospitals, and specialists. While this strategy reduces costs, it often restricts patient choice and can lead to unexpected \"out-of-network\" bills.

A study published in Health Affairs revealed that more than 30% of ACA silver plans in major metropolitan areas excluded at least one top-rated hospital from their network. Patients may discover too late that their preferred cardiologist or oncologist does not accept their plan.

“Narrow networks can make insurance feel like a false promise—if you can’t see the doctor you trust, what good is the coverage?” — Dr. Rachel Kim, Health Policy Analyst at the Urban Institute

This issue disproportionately affects rural populations, where provider shortages already limit access. In some counties, only one insurer participates in the marketplace, offering just a single plan option with minimal provider choices.

3. Complexity and Confusion in Enrollment

The ACA marketplace system, while well-intentioned, is often criticized for being overly complex. Consumers must navigate a maze of plan tiers (bronze, silver, gold, platinum), subsidy eligibility rules, and open enrollment periods. Misunderstandings can lead to underinsurance or costly mistakes.

For example, many people assume all \"silver\" plans offer similar benefits, but cost-sharing reductions (CSRs) are only available to those with incomes below 250% of the poverty line—and only if they select specific silver-tier plans. Without guidance, eligible individuals may unknowingly choose non-CSR plans and pay hundreds more annually.

Step-by-Step Guide to Navigating ACA Enrollment

- Determine your income: Calculate your expected annual household income to assess subsidy eligibility.

- Check your state’s marketplace: Visit Healthcare.gov or your state-based exchange (e.g., Covered California).

- Compare plan tiers: Evaluate bronze, silver, gold, and platinum options based on premiums vs. out-of-pocket costs.

- Verify provider inclusion: Confirm your doctors and preferred hospitals are in-network.

- Apply for subsidies: Enter income details to receive advance premium tax credits.

- Enroll during open season: Or qualify for a special enrollment period due to life changes (marriage, job loss, etc.).

4. Employer Mandate and Workforce Implications

The ACA requires businesses with 50 or more full-time employees to offer health insurance or pay penalties. While intended to expand employer-sponsored coverage, critics argue this provision discourages hiring and encourages employers to limit employee hours.

A 2019 study by the Mercatus Center found that firms near the 50-employee threshold were more likely to freeze hiring or shift workers to part-time status after the mandate took effect. Small business owners frequently cite administrative burden and rising insurance costs as deterrents to expansion.

Additionally, some companies have responded by shifting toward high-deductible health plans (HDHPs) paired with health savings accounts (HSAs), which may reduce premiums but increase financial risk for employees facing major medical events.

Real-World Example: The Restaurant Owner’s Dilemma

Consider Maria, who owns a chain of three family-style restaurants employing 48 full-time workers. As her business grows, she hesitates to hire two additional full-time staff because doing so would trigger the ACA’s employer mandate. Instead, she relies on part-time workers, limiting their hours and benefits. While legally compliant, this decision reflects how regulatory thresholds can distort labor market behavior.

5. Regional Disparities and Market Instability

The ACA’s success varies dramatically by state, largely due to differences in implementation, Medicaid expansion decisions, and local insurance competition. States that expanded Medicaid under the ACA saw greater enrollment and lower uninsured rates. However, 10 states have not adopted expansion, leaving a \"coverage gap\" for low-income adults who earn too much for traditional Medicaid but too little for marketplace subsidies.

| Factor | Expansion States | Non-Expansion States |

|---|---|---|

| Uninsured Rate (2023) | 8.2% | 13.7% |

| Marketplace Participation | High (avg. 3+ insurers) | Low (often 1–2 insurers) |

| Subsidy Access | Broad | Limited for poorest |

| Rural Hospital Closures | Fewer | More prevalent |

Furthermore, insurer participation in the marketplace has fluctuated. After initial enthusiasm, many private insurers pulled out due to financial losses, citing adverse selection—where sicker individuals enroll while healthier ones opt out. This has led to consolidation and reduced competition in some areas.

FAQ: Common Questions About ACA Criticisms

Does the ACA make health insurance unaffordable for healthy people?

For some younger, healthier individuals, especially those earning just above subsidy levels, ACA premiums can seem high relative to their perceived need. Since the individual mandate penalty was reduced to $0 in 2019, fewer healthy people enroll, which skews risk pools and drives up premiums—a phenomenon known as adverse selection.

Can I be denied coverage under Obamacare?

No. One of the ACA’s strongest consumer protections is the ban on denying coverage due to pre-existing conditions. However, insurers can still vary premiums based on age, location, tobacco use, and family size—within limits set by law.

Why don’t more insurers participate in the marketplace?

Many insurers exited the marketplace after early years due to financial losses. Risk adjustment mechanisms exist, but they haven’t fully stabilized markets in low-population or high-cost areas. Rebuilding trust and profitability remains a challenge.

Conclusion: Toward a More Sustainable System

The ACA undeniably improved access to healthcare for millions and introduced vital patient protections. Yet, its shortcomings—high costs for unsubsidized individuals, narrow networks, regional inequities, and complexity—remain significant barriers to truly universal, affordable care.

Criticism of the ACA should not be seen as opposition to reform, but as a call for refinement. Future policy efforts could explore public options, enhanced subsidies, standardized benefit designs, and stronger incentives for insurer participation in underserved areas.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?