When borrowing money—whether for a car, home, or credit card—the interest rate is rarely the full story. What truly determines the cost of your loan is the Annual Percentage Rate (APR). Unlike a simple interest rate, APR includes both interest and additional fees, offering a more accurate picture of what you’ll pay over time. Understanding APR isn’t just for financial experts; it’s essential knowledge for anyone making borrowing decisions. Ignoring it can lead to higher-than-expected payments, poor credit choices, and long-term financial strain.

What Exactly Is APR?

APR, or Annual Percentage Rate, represents the total yearly cost of borrowing money, expressed as a percentage. It includes not only the base interest rate but also certain fees such as origination charges, closing costs, and administrative fees associated with the loan. This makes APR a more comprehensive metric than the interest rate alone.

For example, two loans might advertise the same 5% interest rate, but if one includes high origination fees while the other doesn’t, their APRs will differ significantly. The loan with added fees could have an APR of 6.2%, revealing a much higher real cost.

It’s important to note that APR does not account for compounding interest in all cases—especially with credit cards, where the Annual Percentage Yield (APY) may be more accurate. However, for installment loans like mortgages or auto loans, APR remains the gold standard for comparison.

“APR levels the playing field so consumers can compare loans apples-to-apples, including both interest and mandatory fees.” — Federal Trade Commission

How APR Impacts Your Financial Decisions

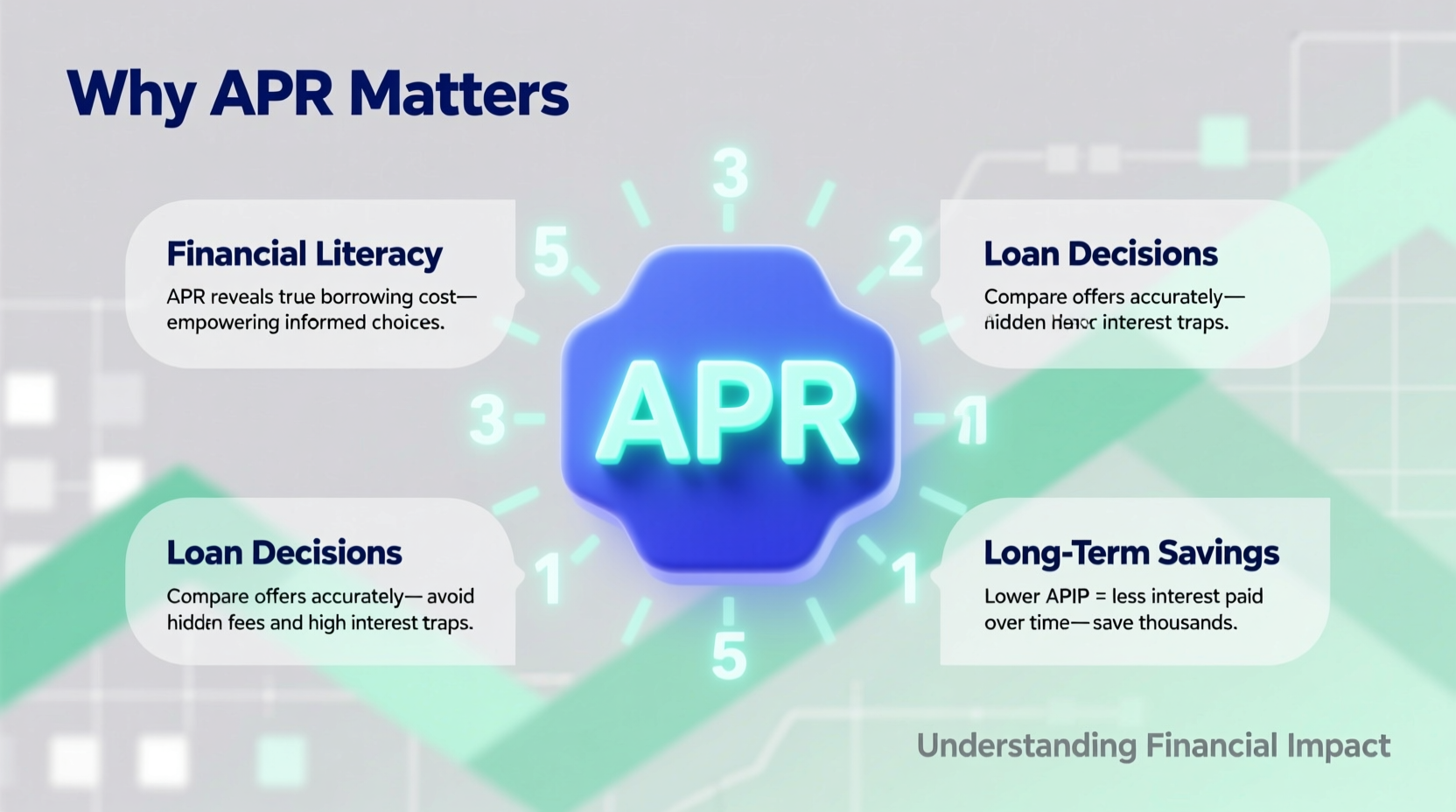

The true power of APR lies in its ability to reveal hidden costs. Many borrowers focus solely on monthly payments or headline interest rates, missing the broader financial implications. A slightly higher APR today can translate into thousands of dollars in extra costs over the life of a long-term loan.

Consider a $300,000 mortgage at 4.5% interest with no additional fees versus the same loan at 4.75% APR due to $5,000 in closing costs. Over 30 years, the difference in total interest paid exceeds $18,000. That’s money that could have gone toward retirement, education, or emergency savings.

APR also influences credit accessibility. Lenders use APR to communicate risk-based pricing. Borrowers with lower credit scores often face higher APRs because they’re deemed riskier. Conversely, strong credit histories unlock access to lower APR offers, saving substantial amounts over time.

Types of APR and How They Work

Not all APRs are created equal. Depending on the product, APR can vary in structure and application:

- Fixed APR: Remains constant throughout the life of the loan. Common in most installment loans, this provides predictable payments.

- Variable APR: Fluctuates based on a benchmark interest rate (like the prime rate). Common in credit cards and adjustable-rate mortgages, these can rise unexpectedly.

- Promotional or Introductory APR: Offers low or 0% APR for a limited time (e.g., “0% APR for 12 months”). After the period ends, the rate jumps to a higher standard rate.

- Penalty APR: A punitive rate applied when you miss payments or violate card terms. Can exceed 30% and severely damage affordability.

Understanding which type applies to your loan or credit card helps anticipate future costs. For instance, someone transferring balances using a 0% introductory APR must plan to repay the debt before the promotional period ends—or face steep increases.

Comparing APR Across Loan Products

One of APR’s greatest benefits is enabling direct comparisons between different lenders and products. The table below illustrates how APR varies across common borrowing options:

| Loan Type | Average APR (Good Credit) | Average APR (Poor Credit) | Key Fees Included in APR |

|---|---|---|---|

| Mortgage (30-year fixed) | 6.2% – 7.0% | 8.0% – 10.5% | Origination fee, appraisal, title insurance |

| Auto Loan (new vehicle) | 5.5% – 6.8% | 10.0% – 14.5% | Processing, documentation fees |

| Credit Card (standard) | 16% – 22% | 24% – 29.9% | Annual fees (if applicable), cash advance fees |

| Personal Loan | 9% – 13% | 18% – 36% | Origination fee (1–8%), late payment penalties |

This comparison shows that even within similar credit tiers, APRs vary widely by product. Shopping around and requesting APR disclosures can save hundreds or thousands annually.

Real-Life Example: Choosing Between Two Credit Cards

Sarah needs a new credit card for travel rewards. She considers two offers:

- Card A: 18% APR, $95 annual fee, 50,000 bonus points after $3,000 spend.

- Card B: 22% APR, no annual fee, 30,000 bonus points after $1,000 spend.

At first glance, Card B seems cheaper. But Sarah typically carries a balance of $4,000 due to irregular income. Let’s calculate the true cost:

Over one year, Card A would cost: (18% of $4,000) + $95 = $720 + $95 = $815

Card B would cost: (22% of $4,000) = $880

Despite the annual fee, Card A has a lower total borrowing cost. By focusing on APR and usage patterns, Sarah makes a smarter financial decision.

Actionable Steps to Manage and Reduce Your APR

You’re not locked into high APRs forever. With strategic planning, you can reduce your borrowing costs significantly. Follow this step-by-step guide:

- Check your credit report regularly. Errors or outdated information can drag down your score and inflate APR offers.

- Improve your credit utilization ratio. Aim to use less than 30% of your available credit to boost your score.

- Negotiate with lenders. Call your credit card issuer and ask for a lower APR—especially if you’ve made on-time payments.

- Explore balance transfer options. Use 0% intro APR cards to consolidate high-interest debt, but pay off balances before the promotional period ends.

- Shop multiple lenders. Get pre-approved quotes from at least three sources when applying for loans to compare APRs side by side.

- Avoid unnecessary fees. Late payments trigger penalty APRs. Set up autopay to stay on track.

Frequently Asked Questions

Is APR the same as interest rate?

No. The interest rate is the basic cost of borrowing, while APR includes the interest rate plus certain fees and charges. APR gives a fuller picture of the loan’s total cost.

Can APR change after I sign the loan?

Yes, if you have a variable APR product (like many credit cards or adjustable-rate mortgages), your APR can increase based on market conditions. Fixed APRs generally remain unchanged unless you default or refinance.

Why do some loans show \"APR from X%\"?

Lenders use \"from\" language to highlight their lowest available APR, typically reserved for borrowers with excellent credit. Most applicants will receive a higher rate based on their credit profile and risk factors.

Final Thoughts: Why APR Should Never Be an Afterthought

APR is more than a number—it’s a window into the real cost of borrowing. Whether you're financing a home, managing credit card debt, or taking out a personal loan, understanding APR empowers you to make informed, financially sound decisions. It reveals hidden fees, enables smarter comparisons, and highlights opportunities to save.

Too many people accept loan terms without questioning the APR, only to face unexpected burdens later. By prioritizing APR in your financial evaluations, you gain control over your money and avoid long-term debt traps.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?