When shopping for a certificate of deposit (CD), many savers assume that longer-term CDs automatically come with higher interest rates. While this is often true, it’s not always the case. In fact, under certain economic conditions, longer-term CD rates can be equal to—or even lower than—shorter-term ones. This counterintuitive scenario raises an important question: why are CD rates sometimes lower for longer terms? Understanding this phenomenon requires insight into banking practices, interest rate trends, and broader economic forces.

How CD Rates Typically Work

A certificate of deposit is a time-bound savings account where you agree to keep your money deposited for a fixed period in exchange for a guaranteed interest rate. Generally, banks reward longer commitments with higher yields. For example, a 5-year CD might offer a 3.5% APY, while a 1-year CD offers 2.8%. This structure aligns with the principle of \"term premium\"—the idea that investors should earn more for locking up their funds longer.

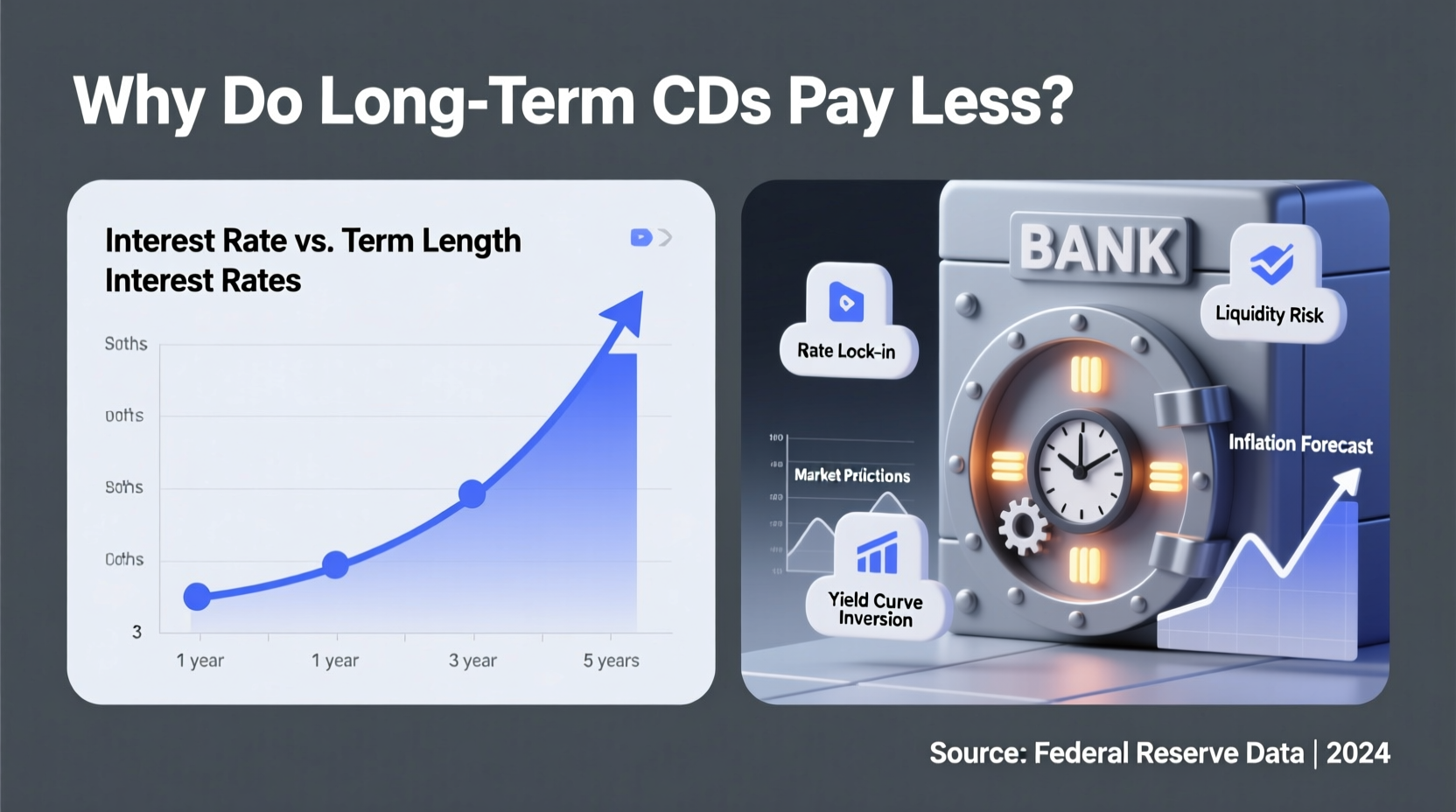

However, this expected upward slope doesn’t hold during all economic cycles. When market expectations shift, so do CD rate structures. The yield curve—a graphical representation of interest rates across different maturities—can flatten or even invert, directly impacting CD offerings.

The Role of the Yield Curve in CD Pricing

The yield curve is one of the most powerful predictors of CD rate behavior. It plots interest rates on U.S. Treasury securities from short-term (e.g., 3-month) to long-term (e.g., 10-year). Banks use this curve as a benchmark when setting their own CD rates.

- Normal (Upward-Sloping) Yield Curve: Short-term rates are lower than long-term rates. This reflects confidence in future economic growth and inflation. Banks typically follow suit by offering higher rates on longer-term CDs.

- Flat Yield Curve: Short- and long-term rates are nearly equal. Banks may offer similar APYs across CD terms, reducing the incentive to lock in for years.

- Inverted Yield Curve: Short-term rates exceed long-term ones. This often signals a looming recession. In such environments, banks may offer lower rates on 4- or 5-year CDs than on 1-year options.

“An inverted yield curve doesn’t just affect bonds—it trickles down to consumer products like CDs. Savers need to recognize that longer isn’t always better.” — Dr. Lena Matthews, Senior Economist at National Financial Insights

Bank Liquidity Needs and Risk Management

Banks set CD rates based not only on market benchmarks but also on their own financial strategies. A bank facing excess liquidity (too much cash on hand) may have little incentive to attract long-term deposits. Offering high rates on 5-year CDs would increase their interest expense without immediate benefit.

Conversely, if a bank needs stable funding for long-term loans—like mortgages—they may boost long-term CD rates to attract capital. But when economic uncertainty looms, institutions become risk-averse. They prefer flexibility over long-term obligations, leading them to cap long-term CD yields.

This strategic behavior explains why two banks can offer vastly different CD rate structures despite operating in the same economy. Regional credit unions might emphasize competitive long-term rates to build member loyalty, while large national banks adjust rates dynamically based on capital allocation goals.

Interest Rate Expectations and Inflation Outlook

Another key factor is the market’s expectation of future interest rates. When investors believe the Federal Reserve will cut rates due to slowing growth, long-term bond yields fall. Since CD rates often track these yields, longer-term CDs may carry lower rates today in anticipation of cheaper borrowing tomorrow.

Inflation also plays a role. Long-term CDs expose banks to inflation risk—if prices rise faster than expected, the real cost of paying fixed interest increases. To protect themselves, banks may limit long-term rate offers unless they’re confident inflation will remain controlled.

| Economic Condition | Impact on Long-Term CD Rates | Example Scenario |

|---|---|---|

| Rising Interest Rate Environment | Higher long-term CD rates | Fed hiking rates; banks offer 4.0% on 3-year CDs vs. 3.2% on 1-year |

| Falling Interest Rate Forecast | Lower long-term CD rates | Recession fears; 1-year CD at 4.5%, 5-year at 4.1% |

| High Inflation | Suppressed long-term rates due to risk | Banks hesitant to lock in rates amid CPI volatility |

| Bank Excess Liquidity | Reduced incentive to offer high long-term yields | Local bank caps 4-year CD at 3.0% despite market averages at 3.8% |

Real-World Example: The 2023 Banking Shift

In late 2023, several major U.S. banks began offering higher rates on 12- to 18-month CDs than on 3- or 5-year options. At Ally Bank, the 1-year CD yielded 4.75% APY, while the 5-year option offered only 4.25%. Similarly, Marcus by Goldman Sachs displayed a flat rate structure across multiple terms.

This pattern emerged because the yield curve had inverted earlier that year—the 2-year Treasury yield exceeded the 10-year. Investors anticipated Fed rate cuts in 2024. Banks responded by minimizing long-term liabilities. For consumers, this meant locking money away for five years came with a penalty in potential returns.

Jamal Reed, a freelance graphic designer from Austin, faced this decision firsthand. “I was ready to sign a 4-year CD for what I thought was a great rate,” he said. “But after comparing terms and reading about the yield curve, I realized I’d earn more—and keep flexibility—by choosing a 14-month CD instead. Six months later, I rolled it into another high-rate option and came out ahead.”

Step-by-Step Guide to Choosing the Right CD Term

- Assess Your Financial Goals: Determine whether you need access to funds within a few years or can afford to lock in long-term.

- Check the Current Yield Curve: Visit the U.S. Treasury website and review the latest yield data. Look for inversion or flattening.

- Compare CD Rates Across Terms: Don’t assume longer equals better. Pull quotes for 6-month, 1-year, 3-year, and 5-year CDs from multiple institutions.

- Consider Laddering: Spread investments across multiple maturities to balance yield and liquidity.

- Monitor Economic Indicators: Track Fed announcements, inflation reports (CPI), and unemployment data to anticipate rate changes.

- Reevaluate Before Maturity: Set calendar reminders 30 days before your CD expires to explore renewal options or withdrawals.

CD Rate Checklist: Smart Shopping Tips

- ✅ Compare APYs across multiple banks and credit unions

- ✅ Verify early withdrawal penalties

- ✅ Check if rates are tiered by deposit amount

- ✅ Confirm whether the institution is FDIC-insured

- ✅ Look for bump-up or no-penalty CD options

- ✅ Review customer service ratings and online accessibility

FAQ: Common Questions About CD Rates

Can a longer-term CD ever have a lower rate than a shorter one?

Yes. During periods of economic uncertainty or inverted yield curves, banks may offer lower rates on long-term CDs. This reflects expectations of falling interest rates and reduced demand for long-term funding.

Are no-penalty CDs worth considering?

They can be, especially when rates are volatile. No-penalty CDs allow you to withdraw funds without fees after a short waiting period (usually 7–10 days). While they often offer slightly lower APYs, they provide valuable flexibility.

What is CD laddering, and how does it help?

CD laddering involves spreading your investment across multiple CDs with staggered maturity dates. For example, investing $5,000 each in 1-, 2-, 3-, 4-, and 5-year CDs. As each matures, you can reinvest at current rates. This strategy balances yield, liquidity, and protection against rate drops.

Conclusion: Make Informed Decisions, Not Assumptions

The assumption that longer-term CDs always pay more is outdated in today’s dynamic financial climate. Rate structures are shaped by macroeconomic forces, bank strategies, and forward-looking expectations. By understanding why CD rates may be lower for longer terms, you gain the power to optimize your savings strategy rather than defaulting to convention.

Don’t let inertia dictate your financial choices. Whether you're safeguarding an emergency fund or growing a nest egg, take control of your CD decisions. Compare terms, stay informed, and adapt as conditions change. The best rate isn’t always the longest—it’s the one that aligns with your goals and the economic reality of the moment.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?