Egg prices have remained stubbornly high in recent years, defying the usual post-holiday dip and leaving many consumers puzzled and frustrated. Once a budget-friendly protein staple, eggs now often cost more than some specialty cheeses or meat cuts in grocery stores across the U.S. and several other countries. While temporary spikes are not uncommon, the sustained elevation in egg prices since 2022 reflects deeper structural and economic shifts within the poultry industry. Understanding these underlying causes is essential for both consumers and policymakers navigating food affordability challenges.

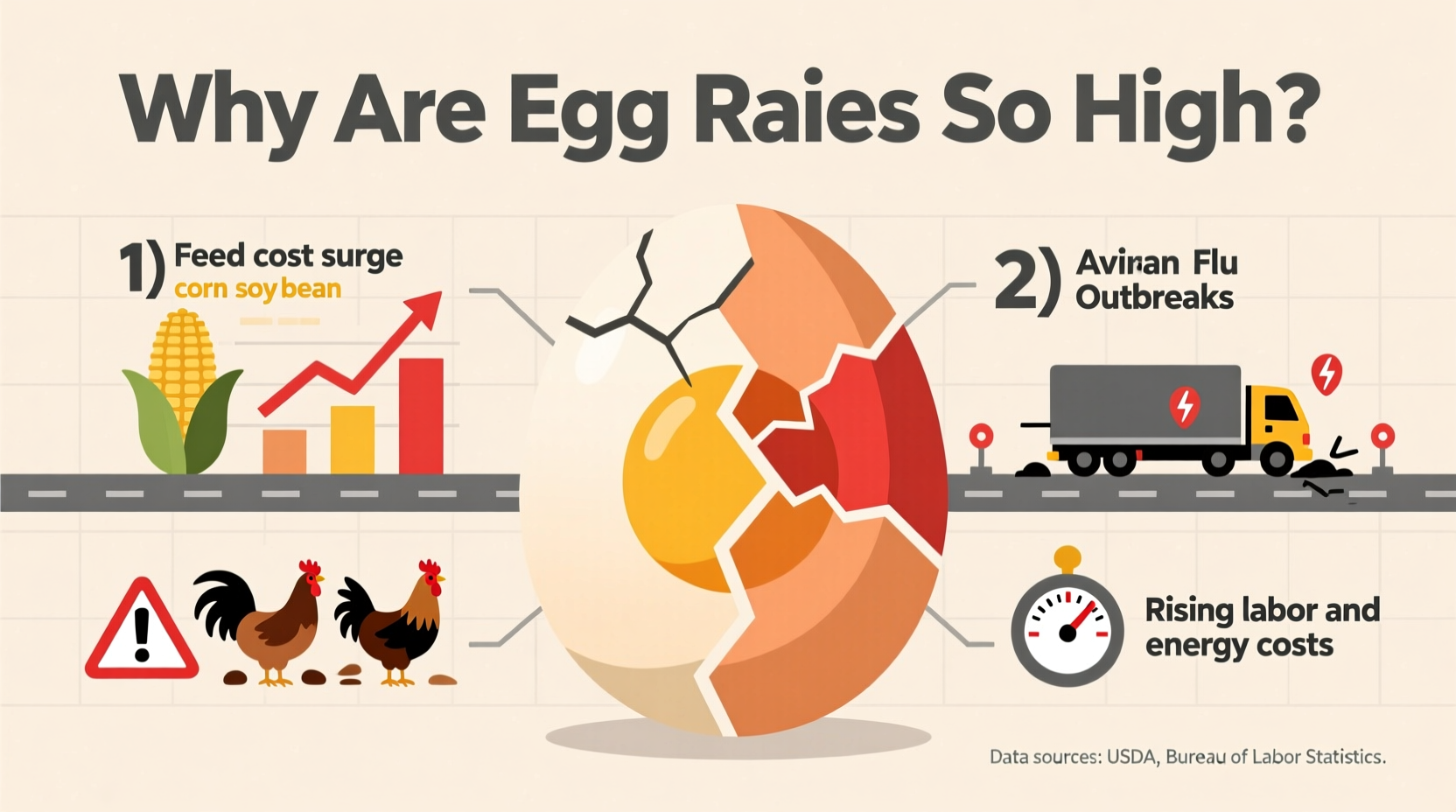

Avian Influenza: The Primary Disruptor

The most significant driver of egg price increases has been the recurring outbreaks of highly pathogenic avian influenza (HPAI), commonly known as bird flu. Starting in early 2022, the largest bird flu outbreak in U.S. history swept through commercial poultry farms, leading to the culling of over 58 million birds—nearly 40% of which were egg-laying hens. This unprecedented loss drastically reduced egg supply just as demand remained steady or increased.

When entire flocks are destroyed to contain the virus, it takes months for producers to rebuild their operations. Hens don’t start laying until they’re about 18–20 weeks old, meaning replacements cannot immediately fill the gap. Even after new hens are introduced, production levels take time to return to pre-outbreak capacity.

“Bird flu isn’t just a health crisis—it’s an economic shock to the entire egg supply chain.” — Dr. Margaret Ng, Poultry Epidemiologist at Cornell University

Outbreaks continue to flare up seasonally, particularly during migration periods when wild birds spread the virus to commercial farms. Each recurrence delays recovery and keeps wholesale egg prices elevated.

Rising Feed and Production Costs

Beyond disease, the cost of producing eggs has climbed steadily. Feed accounts for nearly 70% of total production expenses for egg farmers. Key ingredients like corn and soybeans saw dramatic price increases due to global supply disruptions, extreme weather affecting harvests, and rising fertilizer costs linked to geopolitical tensions such as the war in Ukraine.

In 2022, corn prices surged by over 30% compared to the previous year, while soybean meal prices rose by nearly 50%. These increases were passed down the line, forcing egg producers to raise prices to maintain margins. Even as grain prices have slightly stabilized, transportation, labor, and energy costs remain high, further pressuring profitability.

Supply Chain Bottlenecks and Labor Shortages

The pandemic exposed vulnerabilities in food logistics, and the egg industry was no exception. Processing plants faced shutdowns or reduced staffing due to illness, safety protocols, and worker shortages. With fewer workers available to pack, inspect, and transport eggs, bottlenecks formed at critical junctions—even when hens were producing normally.

Labor remains a persistent challenge. Egg farming and processing are labor-intensive, yet rural areas struggle to attract and retain workers. Wages have increased in response, adding another layer to operational costs. Additionally, refrigerated trucking capacity tightened during peak periods, increasing shipping fees that ultimately affect retail pricing.

Consolidation in the Egg Industry

The U.S. egg market is highly concentrated, with a small number of large producers dominating supply. Four companies control over 50% of the shell egg market. While consolidation can improve efficiency, it also reduces competitive pressure that might otherwise keep prices lower.

With fewer players managing large portions of production, any disruption—whether disease, fire, or mechanical failure—at a single facility can ripple across regional and national markets. This lack of redundancy amplifies the impact of shocks and limits the ability of smaller farms to quickly scale up and compensate.

Moreover, large integrators often prioritize contract buyers (like fast-food chains or bakeries) during shortages, leaving retail shelves understocked and retailers forced to pay premium prices for limited supply.

Consumer Demand and Behavioral Shifts

Demand for eggs has not waned—in fact, it has grown. Eggs remain one of the most affordable sources of high-quality protein, especially as beef, chicken, and dairy prices have also risen. During economic uncertainty, consumers often turn to eggs as a cost-effective alternative.

Additionally, dietary trends favoring low-carb, high-protein diets (such as keto and paleo) have boosted egg consumption. Sales of specialty eggs—organic, cage-free, pasture-raised—have expanded rapidly, driven by consumer willingness to pay more for perceived welfare and sustainability benefits. However, these premium eggs require more space, feed, and care, making them inherently more expensive to produce.

As more producers shift toward cage-free systems to meet corporate and regulatory mandates (e.g., California’s Prop 12), short-term inefficiencies and capital investments add upward pressure on prices across all categories—even conventional eggs.

Comparison of Egg Types and Price Drivers

| Egg Type | Average Retail Price (2024) | Key Cost Factors |

|---|---|---|

| Conventional White | $3.50–$5.00 per dozen | Feed costs, bird flu losses, transportation |

| Cage-Free | $5.00–$7.50 per dozen | Higher labor, larger facilities, certification |

| Organic | $7.00–$9.00 per dozen | Organic feed (2x conventional cost), land requirements |

| Pasture-Raised | $8.00–$12.00 per dozen | Land access, seasonal availability, lower density |

What Can Consumers Do? Practical Strategies

While individuals can’t control macroeconomic forces, there are steps shoppers can take to manage egg-related expenses without sacrificing nutrition.

- Buy in bulk when on sale: Stock up and freeze whisked eggs for future use in scrambles, baking, or casseroles.

- Switch between types: Use conventional eggs for baking and save premium eggs for dishes where flavor and texture matter more.

- Check warehouse clubs: Costco, Sam’s Club, and similar stores often offer lower per-unit prices, especially for large cartons.

- Explore local farms: Some small farms sell directly to consumers at lower prices than supermarkets, bypassing distribution markups.

- Use egg substitutes wisely: For baking, applesauce, mashed banana, or commercial replacers can work—though not ideal for frying or scrambling.

Mini Case Study: The Johnson Family Grocery Adjustment

The Johnsons, a family of four in Ohio, noticed their monthly egg spending had tripled—from $12 to over $36—between 2021 and 2023. After analyzing their habits, they made changes: switching from organic to conventional eggs for weekday breakfasts, buying 18-packs on sale every two weeks, and using frozen blended eggs for weekend frittatas. Within three months, they cut their egg expenditure by 40% without reducing consumption. They also started visiting a nearby farm stand during summer, where locally sourced eggs were 25% cheaper than at the supermarket.

FAQ: Common Questions About High Egg Prices

Will egg prices ever go back down?

Yes, but not necessarily to pre-2022 levels. As the industry recovers from bird flu and input costs stabilize, prices may ease. However, long-term trends—like the shift to cage-free housing and climate-related crop volatility—are likely to keep baseline prices higher than in the past.

Are egg producers making excessive profits?

Not uniformly. While some large integrators reported strong earnings during peak price periods, many mid-sized and independent farmers operated at a loss due to high mortality rates and input costs. The structure of contracts in the industry means profits are not evenly distributed along the supply chain.

Is buying cheaper eggs unethical or unsafe?

No. Conventional eggs are safe, regulated, and nutritious. Housing type (cage vs. cage-free) relates more to animal welfare than food safety or nutritional value. All eggs sold in the U.S. must meet FDA safety standards for Salmonella prevention.

Conclusion: What’s Next for Egg Affordability?

The high cost of eggs is not a fleeting trend but the result of intersecting biological, economic, and structural forces. Bird flu remains a looming threat, feed prices are vulnerable to global instability, and the transition to more humane farming practices carries real financial trade-offs. While relief may come in waves, a full return to $1.50-a-dozen eggs is unlikely in the near term.

Consumers who adapt their purchasing strategies, stay informed about sales cycles, and understand the true cost of production will be better equipped to navigate this new reality. Supporting transparent farming practices and advocating for resilient food systems can also contribute to long-term stability.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?