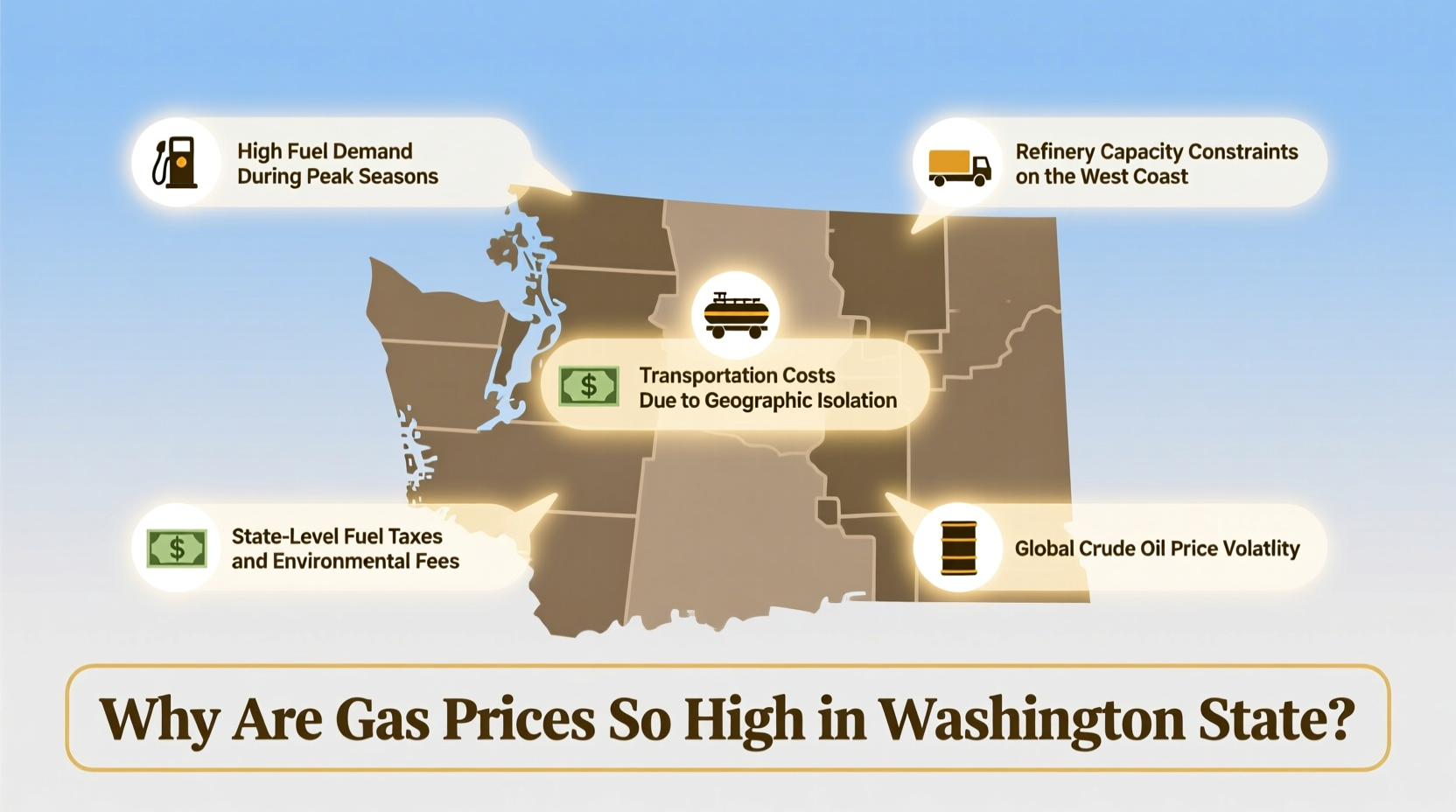

Gasoline prices in Washington State consistently rank among the highest in the nation. While national trends influence fuel costs, several state-specific and regional conditions amplify the burden on consumers. Understanding why gas prices remain elevated requires a closer look at taxation, refining capacity, environmental regulations, supply logistics, and broader economic forces. This article breaks down the primary drivers behind high fuel costs in Washington and offers practical insights for navigating them.

Tax Burden: One of the Highest in the Nation

Washington imposes one of the most substantial fuel tax structures in the United States. As of 2024, the combined state and local fuel tax averages around 63 cents per gallon, placing it in the top five nationally. This includes:

- State excise tax: 49.5 cents per gallon

- Local sales tax: Varies by county (typically 6–10%)

- Carbon emissions fees: Part of the Climate Commitment Program adds indirect cost pressures

These taxes directly increase the base price at the pump. Unlike states with lower tax rates or periodic freezes, Washington’s fuel tax is indexed to inflation, meaning it rises automatically over time. Additionally, recent investments in transportation infrastructure have been funded through fuel tax revenues, further entrenching its role in pricing.

Refining Constraints and Limited Local Supply

Washington has only three major oil refineries—Puget Sound Refinery (Marty), Cherry Point Refinery (BP), and Tacoma Refinery (PBF). Together, they supply about 70% of the state’s gasoline demand. The remaining 30% must be imported via marine tanker from California or Alaska, or transported by pipeline from inland refineries.

This limited refining capacity creates vulnerability. Any unplanned shutdown—due to maintenance, safety inspections, or regulatory compliance—can trigger immediate price spikes. For example, in 2022, a fire at the BP Cherry Point facility led to a statewide average increase of 35 cents per gallon within two weeks.

“Refinery outages in the Pacific Northwest have an outsized impact because there’s no surplus capacity to absorb the shock.” — Dr. Linda Chen, Energy Economist at University of Washington

Environmental Regulations and Cleaner Fuel Standards

Washington mandates the use of cleaner-burning reformulated gasoline, known as “CARB-like” fuel, which meets strict air quality standards. While beneficial for reducing smog and emissions, this specialized blend is more expensive to produce and distribute than conventional gasoline.

The state also participates in the Clean Fuel Standard (CFS), requiring fuel suppliers to reduce the carbon intensity of transportation fuels. Compliance costs are passed on to consumers. According to the Washington State Department of Ecology, these programs add an estimated 12 to 18 cents per gallon to retail prices.

Moreover, seasonal transitions between summer and winter fuel blends disrupt supply temporarily and often coincide with price hikes. These transitions require refineries and distributors to reconfigure operations, limiting availability during changeover periods.

Geographic Isolation and Distribution Costs

Washington’s geographic position contributes to higher fuel prices. Located far from major Gulf Coast refineries, the state relies heavily on West Coast supply chains, which are inherently less competitive than national networks. Most gasoline consumed west of the Rocky Mountains is produced locally due to the lack of cross-mountain pipelines.

The distribution process involves multiple steps: refined product moves from refinery to terminal, then to storage depots, and finally to retail stations. Each step adds handling, transportation, and margin costs. Rural areas face even higher prices due to longer hauls and lower volume turnover.

| Region | Average Gas Price (2024) | Price Premium vs. National Avg |

|---|---|---|

| Seattle-Tacoma | $4.89/gal | +$0.65 |

| Spokane | $4.67/gal | +$0.43 |

| Rural Eastern WA | $5.10/gal | +$0.86 |

| U.S. National Average | $4.24/gal | — |

Market Structure and Retail Competition

The retail fuel market in Washington is moderately concentrated. Major brands like Shell, Chevron, and 76 dominate urban corridors, while independent operators run many rural stations. However, consolidation in recent years has reduced competitive pressure in some areas.

In cities like Seattle, high land values and operating costs push station owners to maintain slimmer margins but higher per-gallon prices. Conversely, warehouse club stations (e.g., Costco) leverage membership models to offer lower prices, creating sharp regional disparities. In 2024, Costco averaged $4.35 per gallon in the Puget Sound region—nearly 50 cents below some standalone stations.

Additionally, Washington law prohibits \"below-cost\" gasoline pricing, meaning stations cannot sell fuel for less than their acquisition cost plus taxes. While intended to prevent predatory pricing, this rule can limit deep discounting during price wars, keeping floors artificially high.

Mini Case Study: The 2023 Spring Surge

In April 2023, Washington drivers saw gas prices jump from $4.10 to $5.05 per gallon in just six weeks. A confluence of factors triggered the surge:

- BP’s Cherry Point Refinery entered unscheduled maintenance

- California experienced refinery issues, tightening regional supply

- Spring transition to summer-blend fuel began

- Crude oil prices rose globally due to geopolitical tensions

With limited inventory buffers and no alternative supply routes, wholesalers raised wholesale prices by 78 cents. Retailers followed suit within days. Consumers in Bellingham reported paying $5.29 at some stations—the highest in state history at the time. Prices stabilized only after Alaska-sourced imports arrived three weeks later.

Actionable Checklist: Reducing Your Fuel Costs

While you can’t control statewide pricing factors, you can minimize your personal fuel expenses. Follow this checklist:

- Track daily prices using apps like GasBuddy or Waze

- Fill up on weekdays, preferably Monday or Tuesday

- Use grocery or credit card rewards that offer fuel discounts

- Join loyalty programs at bulk retailers (Costco, Sam’s Club)

- Maintain proper tire pressure and vehicle tune-ups to improve MPG

- Combine errands to reduce total miles driven

- Consider carpooling or public transit for regular commutes

Frequently Asked Questions

Why is gas more expensive in Washington than in Oregon or Idaho?

Oregon does not impose a state sales tax on gasoline, and Idaho has significantly lower excise taxes (around 27 cents per gallon). Washington’s combination of high base taxes, environmental fees, and supply constraints makes it more expensive than its neighbors.

Will electric vehicles reduce pressure on gas prices?

While EV adoption reduces individual demand, widespread impact on gas prices will take decades. Currently, only about 12% of vehicles in Washington are electric or hybrid. Until internal combustion engines dominate the road, overall fuel demand—and thus price sensitivity—remains high.

Does the government cap gas prices in Washington?

No. Washington does not have price controls or caps on gasoline. Prices are determined by market forces, taxes, and operational costs. The state monitors for price gouging during emergencies but rarely intervenes in normal market conditions.

Conclusion: What You Can Do Now

High gas prices in Washington State stem from a mix of structural, geographic, and policy-driven factors that aren’t likely to disappear soon. From steep taxes to fragile supply chains and stringent environmental rules, consumers face a complex pricing environment beyond simple global oil trends.

The best strategy is proactive management: monitor prices, optimize driving habits, and leverage available savings tools. As the state transitions toward cleaner energy and expanded public transit, long-term relief may come—but for now, smart consumer behavior is your strongest defense against rising fuel costs.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?