In recent years, the price of graphics processing units (GPUs) has surged well beyond their original retail values, leaving consumers frustrated and retailers overwhelmed. What was once a predictable cycle of hardware upgrades has turned into a high-stakes market shaped by supply shortages, demand spikes, and global economic forces. Whether you're building a gaming PC, setting up a workstation, or exploring AI development, understanding why GPUs remain so expensive is essential to making informed purchasing decisions.

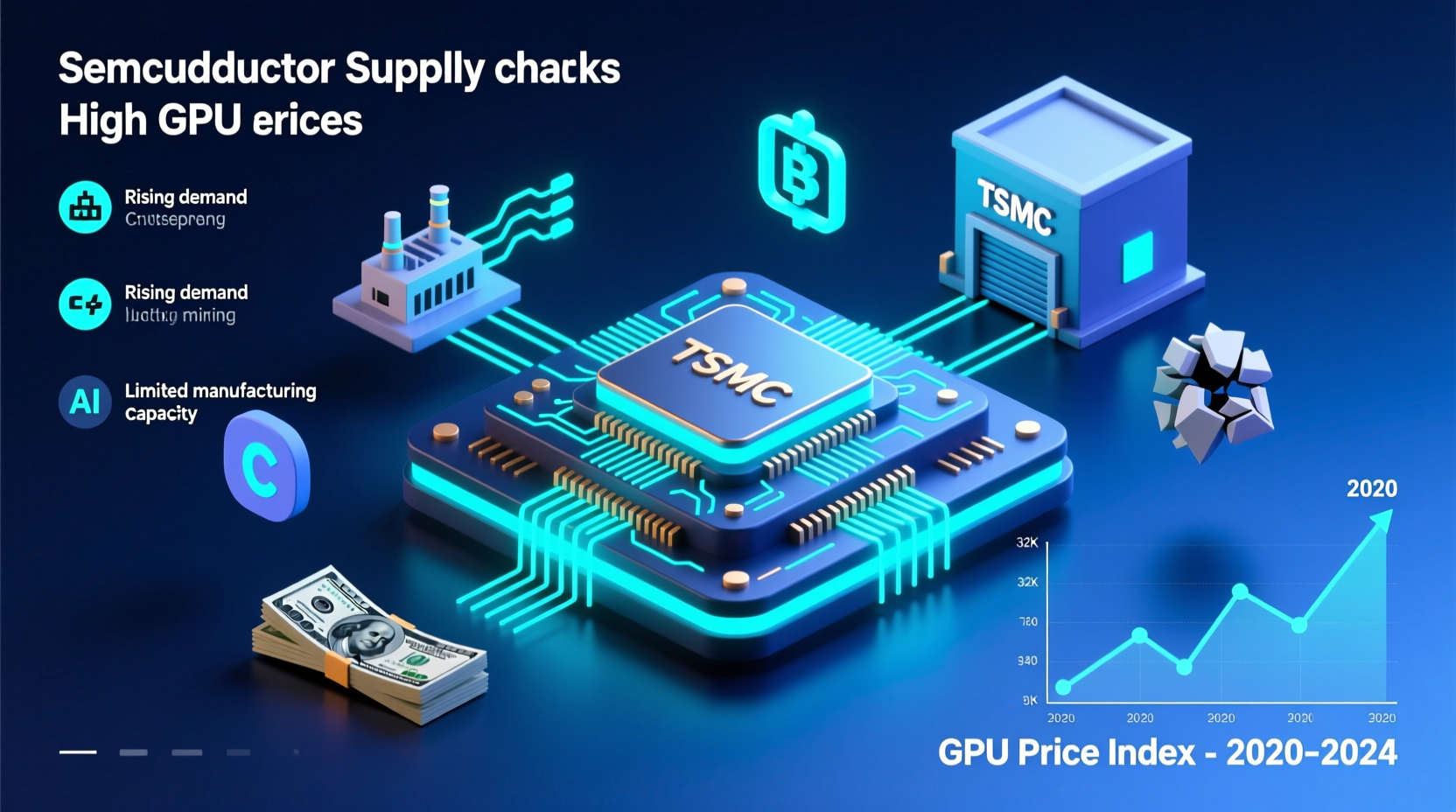

Supply Chain Disruptions and Semiconductor Shortages

The foundation of modern GPUs lies in advanced semiconductor manufacturing, a process heavily concentrated in a few key regions—primarily Taiwan, South Korea, and parts of China. Since 2020, the global semiconductor industry has faced unprecedented disruptions due to the pandemic, factory shutdowns, geopolitical tensions, and logistical bottlenecks.

Chip foundries like TSMC operate at near-full capacity, with lead times stretching over six months for critical components. This bottleneck directly affects GPU production, as each unit requires not only the main processor (die) but also high-bandwidth memory (GDDR6/GDDR6X), power delivery systems, and PCB substrates—all of which were impacted by material shortages and shipping delays.

“Even a minor delay in one component can halt an entire production line. We’re seeing ripple effects from micro-level disruptions across the entire tech ecosystem.” — Dr. Lin Wei, Senior Analyst at Semiconductor Insights Group

Cryptocurrency Mining and Scalping Dynamics

One of the most significant drivers of GPU price inflation has been cryptocurrency mining. During bull runs in Bitcoin and Ethereum (prior to its transition to proof-of-stake), miners sought out powerful GPUs to maximize hash rates. The NVIDIA RTX 3060, 3070, and 3080 became particularly desirable, causing instant sellouts and secondary market markups of 200% or more.

Even after Ethereum’s merge reduced GPU-based mining demand, residual effects persist. Many cards previously used in mining farms entered the resale market in poor condition, reducing consumer trust in used inventory and pushing buyers toward new, inflated-priced units.

Additionally, scalpers equipped with bots have exploited online launches, purchasing thousands of units within seconds to resell at premium prices. Retailers have implemented anti-bot measures and purchase limits, but enforcement remains inconsistent.

Real Example: The RTX 3080 Launch (2020)

When NVIDIA launched the RTX 3080 in September 2020, it was priced at $699. Within minutes of release, every major retailer sold out. On eBay and StockX, the same card appeared for $1,500–$2,000. Some resellers reported profits exceeding $1 million during peak periods. This event set a precedent for subsequent GPU launches, conditioning the market to expect scarcity and high prices.

AI Boom and Data Center Demand

A transformative shift occurred in 2023 with the explosion of generative AI applications like ChatGPT, image synthesis models, and large language training frameworks. These technologies rely heavily on parallel computing capabilities—exactly what GPUs excel at.

NVIDIA’s data center segment, powered by A100 and H100 GPUs, saw revenue grow by over 200% year-over-year. Enterprises, cloud providers, and startups scrambled to acquire these chips, often paying premiums far above list price. While consumer-grade GPUs differ from data center models, they share the same fabrication lines and underlying technology, creating resource competition.

This surge in institutional demand has diverted production capacity away from gaming and desktop markets, further tightening supply for average users.

| GPU Model | Original MSRP | Avg. Resale Price (Peak) | Primary Demand Driver |

|---|---|---|---|

| NVIDIA RTX 3080 | $699 | $1,800 | Mining & Gaming |

| NVIDIA A100 | $10,000+ | $15,000+ | AI Training |

| AMD RX 6800 XT | $649 | $1,400 | Gaming & Mining |

| NVIDIA H100 | $30,000+ | $40,000+ | Data Centers |

Inflation, Logistics, and Manufacturing Costs

Beyond digital demand, real-world economic factors play a crucial role. Global inflation rates since 2021 have increased raw material costs—including copper, silicon, and rare earth elements—used in PCBs and chip packaging. Energy prices, especially in Europe, have raised operational costs for fabrication plants, which are passed down through the supply chain.

Shipping costs also spiked during the pandemic. At their peak, container freight rates from Asia to North America increased fivefold. While logistics have stabilized somewhat, manufacturers still factor in buffer costs to hedge against future disruptions.

Moreover, newer GPUs require more complex cooling solutions, larger boards, and higher-quality components to manage thermal loads from denser transistor designs. These engineering improvements add to the bill of materials, contributing to higher base prices.

How to Navigate the Current GPU Market: Practical Checklist

Despite ongoing challenges, savvy buyers can still find value. Follow this checklist to make smarter decisions:

- Set alerts on price tracking sites (e.g., CamelCamelCamel, PCPartPicker) for drops below 10–15% above MSRP.

- Consider last-gen models—the RTX 30 series and RX 6000 series now offer better value as stock stabilizes.

- Buy refurbished or open-box from authorized retailers (Best Buy, B&H) with warranties.

- Avoid third-party sellers without reviews—stick to platforms with buyer protection.

- Look for bundle deals where GPUs are included with CPUs or motherboards at discounted rates.

- Wait for seasonal sales such as Black Friday, Newegg Shell Shocker, or Amazon Prime Day.

Future Outlook and When Prices May Stabilize

Analysts project gradual normalization in GPU pricing through 2024–2025. Several factors support this optimism:

- NVIDIA and AMD are diversifying production partners and increasing yields at existing fabs.

- The end of Ethereum mining reduced speculative demand significantly.

- New architectures (e.g., NVIDIA Blackwell, AMD RDNA 4) will eventually refresh the market, prompting older models to drop in price.

- Government investments in domestic semiconductor production (e.g., U.S. CHIPS Act) may ease long-term supply constraints.

However, sustained interest in AI could continue pulling resources toward enterprise segments, meaning consumer GPUs may never return to pre-2020 pricing levels. Instead, a \"new normal\" of slightly elevated prices—reflecting true production and R&D costs—is likely.

Frequently Asked Questions

Will GPU prices ever go back to MSRP?

For some older or previous-generation models, yes—especially during sales events or when newer versions launch. However, due to increased manufacturing complexity and demand from AI sectors, flagship GPUs may permanently carry higher price tags than in the past.

Are used GPUs safe to buy now?

Yes, but with caution. Many mining-used GPUs suffered from poor cooling conditions and constant load. Check for benchmarks, stress test results, and warranty status. Prefer models known for durability, like the RTX 3060 or RX 6600, which were less commonly used in large-scale farms.

Is building a PC still worth it given GPU costs?

It depends on your needs. If you’re upgrading from a system more than five years old, even a mid-tier GPU today offers substantial performance gains. For budget builds, integrated graphics (e.g., AMD Ryzen APUs) or entry-level discrete cards (like the RTX 3050 or RX 6600) can deliver playable frame rates in 1080p gaming without breaking the bank.

Conclusion: Making Informed Choices in a Tight Market

The high cost of GPUs today isn't due to a single cause, but rather a convergence of technological demand, economic pressure, and global supply limitations. From cryptocurrency booms to artificial intelligence breakthroughs, the very capabilities that make GPUs indispensable also make them scarce and expensive.

Understanding these dynamics empowers you to navigate the market strategically—timing purchases, choosing alternatives, and avoiding overpaying. As innovation continues, so too will the value these chips provide. The key is patience, research, and knowing when to act.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?