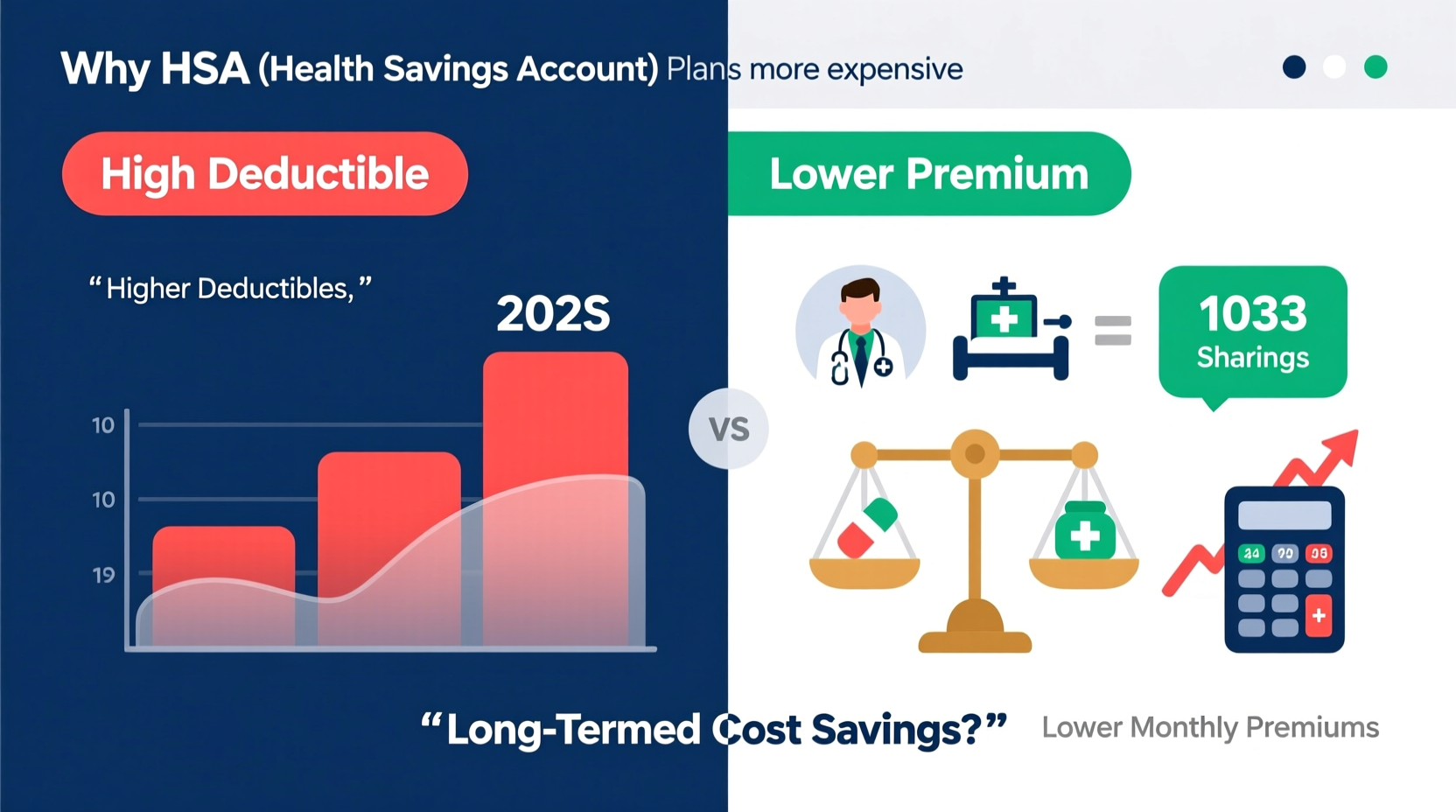

At first glance, High Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) often appear more affordable due to lower monthly premiums. Yet many consumers find themselves asking: why are HSA plans more expensive in practice? The answer lies not in a flaw, but in structure—these plans shift cost responsibility from insurers to individuals, particularly in the early stages of care. Understanding this dynamic is essential for making informed decisions about healthcare coverage.

While HDHPs qualify you to open an HSA—a tax-advantaged account used to pay for qualified medical expenses—the upfront financial burden can feel steep. This article breaks down the real costs behind HSA-eligible plans, explains when they make financial sense, and provides strategies to maximize their long-term benefits.

How HSA Plans Are Structured

HSA-eligible health plans are legally defined by the IRS as High Deductible Health Plans. For 2024, an HDHP must have a minimum deductible of $1,600 for individual coverage or $3,200 for family coverage. The maximum out-of-pocket limit is $7,050 for individuals and $14,100 for families.

Unlike traditional PPO or HMO plans, which may feature copays for doctor visits or prescriptions before meeting your deductible, most HDHPs require you to pay 100% of medical costs until the deductible is met. Only preventive services are typically covered at no cost prior to deductible fulfillment.

The trade-off? Lower monthly premiums. But this benefit comes with greater financial risk in the event of unexpected illness or injury. What makes these plans seem “more expensive” isn’t always the premium—it’s the potential for higher out-of-pocket spending in a given year.

Breaking Down the True Costs

The perception that HSA plans are more expensive often stems from short-term cash flow rather than total annual cost. Consider two hypothetical plans:

| Plan Type | Monthly Premium | Deductible | Out-of-Pocket Max | Copay (PCP Visit) |

|---|---|---|---|---|

| Traditional PPO | $550 | $3,000 | $8,000 | $30 (before deductible) |

| HDHP + HSA | $375 | $7,000 | $7,050 | $0 (full charge until deductible) |

In this example, the HSA plan saves $175 per month—$2,100 annually—in premiums. However, if you visit your primary care physician four times a year, the PPO costs $120 in copays, while the HDHP could charge $300–$600 per visit, totaling $1,200–$2,400 before any lab work or diagnostics.

This disparity creates the illusion of higher cost. But over time—and especially if you remain relatively healthy—the HSA plan can be significantly cheaper, provided you avoid major claims.

Tax Advantages That Offset Long-Term Costs

What sets HSA plans apart is not just affordability, but tax efficiency. Contributions to an HSA are:

- Tax-deductible (or pre-tax if through payroll)

- Tax-free growth via interest or investment

- Tax-free withdrawals for qualified medical expenses

No other account offers this triple tax advantage. For someone earning $75,000 annually who contributes $3,000 to their HSA, the federal tax savings alone could exceed $750—equivalent to a 25% discount on contributions.

“An HSA is the most powerful tax-advantaged account available to middle-income Americans—even more so than a Roth IRA.” — Michael Kitces, Financial Advisor & Nerd’s Eye View Publisher

Additionally, unused funds roll over indefinitely. Unlike Flexible Spending Accounts (FSAs), there’s no “use it or lose it” rule. Over decades, consistent contributions can grow into a substantial healthcare nest egg—or even serve as a supplemental retirement fund, since non-medical withdrawals after age 65 are taxed like a traditional IRA (penalty-free, though income tax applies).

When HSA Plans Become Costly: Real-Life Scenarios

Consider Sarah, a 38-year-old graphic designer enrolled in an HDHP. She chose the plan because her employer contributed $1,000 annually to her HSA and the premium was $180/month less than the PPO option.

In March, she began experiencing severe migraines. After three neurologist visits, an MRI, and prescription medications, her total billed charges reached $8,200. Because her deductible was $7,000, she paid nearly all of it out of pocket before insurance kicked in. Her final outlay: $7,050 (maximum out-of-pocket), plus premiums.

Had she been on the PPO plan, her deductible was lower ($3,000), and each specialist visit carried a $60 copay. Her total cost? Approximately $3,500 in deductibles/copays plus higher premiums—still less than the HDHP in that specific year.

Sarah’s experience illustrates a key truth: HSA plans are risk-based. They favor healthy individuals who anticipate minimal care. For those with chronic conditions or uncertain health needs, the financial exposure can outweigh the tax perks.

Smart Strategies to Reduce Net Costs

To truly benefit from an HSA plan, proactive management is crucial. Follow this checklist to minimize unnecessary expenses:

- Contribute enough to cover your deductible—ideally via automatic payroll deductions to maximize tax savings.

- Negotiate cash prices—many providers offer discounts if you pay upfront and self-pay.

- Use telehealth services for minor issues—they’re often low-cost and prevent ER visits.

- Review Explanation of Benefits (EOBs) carefully to catch billing errors.

- Delay elective procedures until after deductible resets if possible.

- Invest HSA funds once balance exceeds $2,000—many accounts allow investment in mutual funds for long-term growth.

Frequently Asked Questions

Can I use my HSA for over-the-counter medications?

Yes, but only if prescribed by a doctor. As of 2020, the CARES Act expanded eligible OTC items (like pain relievers, allergy meds, and menstrual products) to include those purchased without a prescription. Always check IRS Publication 502 for updates.

What happens to my HSA if I switch to a non-HDHP plan?

You keep the account and can still use funds for qualified expenses, but you cannot make new contributions unless re-enrolled in an HDHP. There’s no penalty for keeping the balance.

Are HSA plans worth it if I’m not rich?

Absolutely. Middle-income earners benefit significantly from tax savings. Even modest contributions reduce taxable income and build a buffer for future healthcare costs, especially in retirement when medical spending rises.

Conclusion: Rethinking “Expensive” in Healthcare

The idea that HSA plans are more expensive depends heavily on timeframe and usage. In a high-claim year, yes—they can cost more out of pocket. But over five or ten years, especially for healthy individuals, they often result in net savings due to lower premiums and compound tax advantages.

The real issue isn’t cost—it’s predictability. HSA plans demand financial discipline, planning, and comfort with risk. When used strategically, they’re not just a health benefit, but a wealth-building tool.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?