Credit scores are a crucial part of financial life—they influence loan approvals, interest rates, insurance premiums, and even job opportunities. Yet many people are puzzled when they check their credit score and find that it's not the same across all platforms or bureaus. One lender reports a 720, another shows 695, and a free credit monitoring site displays 740. What gives?

The reality is that having multiple credit scores isn’t a mistake—it’s normal. In fact, most consumers have dozens of credit scores at any given time. Understanding why these numbers differ empowers you to manage your credit more effectively and avoid confusion during major financial decisions.

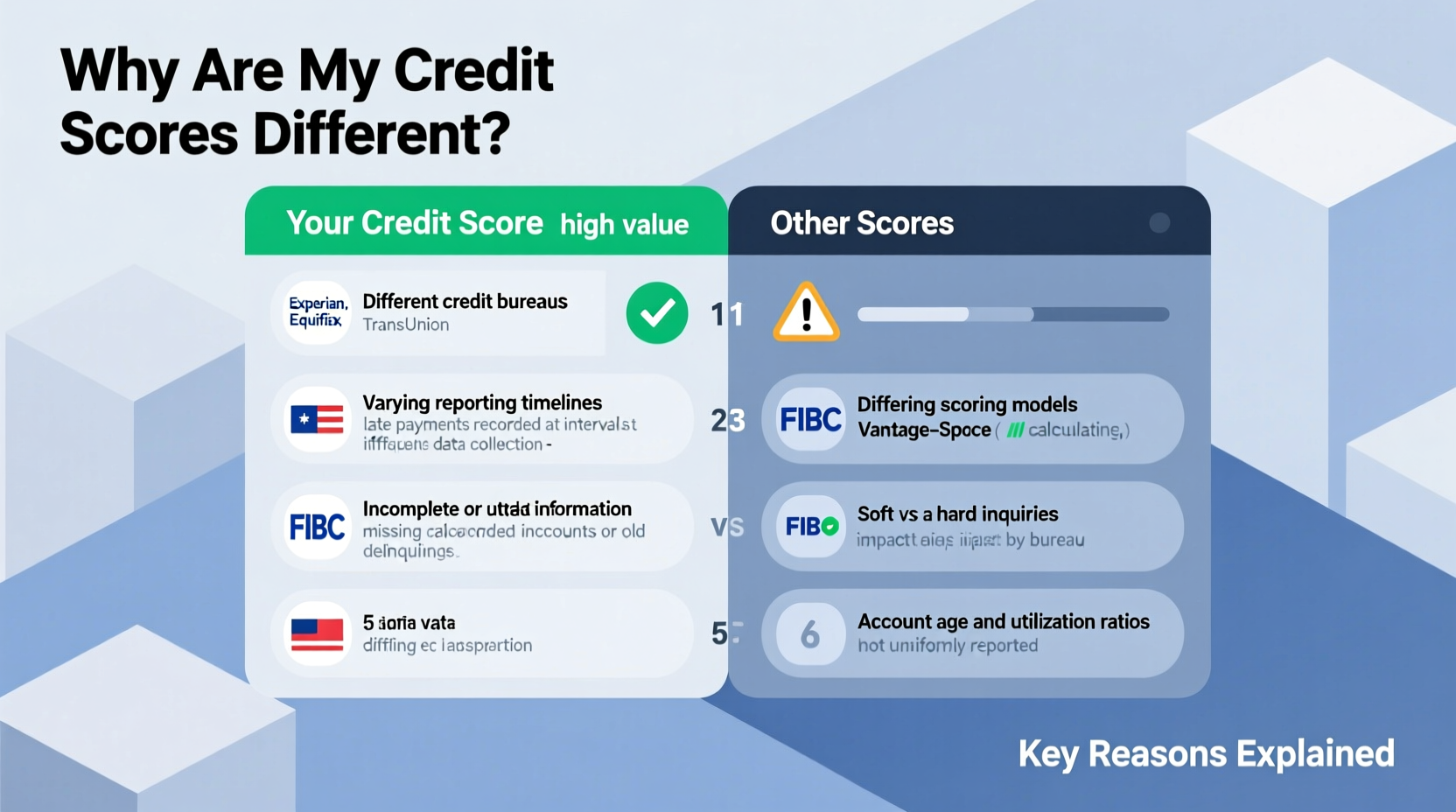

Different Credit Bureaus, Different Data

The three major credit bureaus—Equifax, Experian, and TransUnion—each maintain their own version of your credit report. While they collect similar types of information, they don’t always receive the same data from lenders, and reporting timelines can vary.

For example, one creditor may report to all three bureaus, while another only reports to two. If you recently paid off a credit card balance, that update might appear on your Experian report but not yet be reflected in Equifax or TransUnion. These discrepancies naturally lead to variations in your credit scores.

Variations in Scoring Models

Not all credit scores are created equal. There are multiple scoring models, each using slightly different algorithms to calculate risk. The two most common systems are FICO and VantageScore, but within each, there are several versions.

FICO has over 60 different score variants, including industry-specific models like FICO Auto Score or FICO Bankcard Score. These are tailored to predict risk in particular lending scenarios. For instance, a FICO Score 8 used for general lending may differ from a FICO Auto Score 9 used by car dealerships—even if pulled from the same bureau.

VantageScore, developed jointly by the three credit bureaus, also releases updated versions (like VantageScore 3.0 and 4.0), which weigh factors differently than earlier iterations.

“Lenders choose scoring models based on their risk tolerance and the type of credit being offered. No single 'true' credit score exists.” — John Ulzheimer, Credit Expert and Former Employee of FICO and Equifax

Timing of Updates and Reporting Cycles

Credit scores aren't static. They change as new information is added to your credit report. But updates don’t happen in real time. Most creditors report to the bureaus once a month, often at different times. This means your score today could be different tomorrow—even if you haven’t taken any new financial action.

Additionally, some credit monitoring services update weekly, while others do so monthly. Free services may use older scoring models or estimated scores, further contributing to inconsistencies.

Which Score Matters Most?

You might wonder: if there are so many scores, which one should I care about? The answer depends on what you’re applying for.

- Mortgages typically use FICO Score 2 (Experian), FICO Score 5 (Equifax), and FICO Score 4 (TransUnion).

- Auto loans often rely on FICO Auto Scores.

- Credit cards usually pull FICO Score 8 or 9, or VantageScore 3.0.

- Rentals or utilities may use alternative data or softer inquiries with less traditional models.

This means checking your “generic” VantageScore from a free app won’t necessarily reflect what a mortgage lender sees. However, trends matter more than exact numbers. If your scores are consistently in the “good” or “excellent” range across platforms, you’re likely in solid shape.

| Lending Type | Common Scoring Model(s) | Bureau Typically Used |

|---|---|---|

| Mortgage | FICO Score 2, 4, 5 | Experian, Equifax, TransUnion |

| Auto Loan | FICO Auto Score 8, 9 | All three, varies by lender |

| Credit Card | FICO Score 8/9, VantageScore 3.0 | Often TransUnion or Experian |

| Personal Loan | FICO Score 8, VantageScore | Varies |

Real-Life Example: Sarah’s Confusing Car Loan Application

Sarah checked her credit score on a popular financial website and saw a VantageScore of 742. Encouraged, she applied for an auto loan expecting favorable terms. However, the dealership pulled her FICO Auto Score 8 from Experian and offered her a higher interest rate than expected—her score was 698.

Confused, Sarah requested her full credit reports. She discovered that a medical bill had been reported to Equifax and TransUnion but not to Experian. Additionally, the scoring model used for auto lending placed heavier emphasis on recent credit behavior, and a new credit inquiry from a store card lowered her score in that specific model.

After disputing inaccuracies and waiting a few months, Sarah re-applied with improved scores across the board and secured better financing. Her experience highlights why understanding the nuances behind score differences is critical.

Actionable Steps to Navigate Multiple Scores

Instead of fixating on one number, adopt a strategic approach to managing your credit health across the board.

- Monitor all three credit reports annually for errors or outdated information.

- Use consistent scoring sources when tracking progress over time—don’t compare FICO with VantageScore week to week.

- Check lender-specific scores if possible. Some banks offer free FICO scores to customers (e.g., Chase, Bank of America).

- Focus on behaviors, not just scores. Paying on time, keeping credit utilization below 30%, and avoiding unnecessary applications will improve all versions of your score.

- Dispute inaccuracies promptly. Even small errors can impact multiple scores.

Frequently Asked Questions

Why is my credit score higher on one site than another?

Different websites use different scoring models and data sources. A free service might show a VantageScore based on TransUnion data, while your bank provides a FICO Score from Experian. Both are accurate—but they measure different things.

Do hard inquiries affect all my credit scores equally?

Hard inquiries appear on whichever bureau’s report was accessed during the application. If a lender pulls only your Experian report, the inquiry will only impact scores derived from that bureau—though other bureaus may still see related activity if you apply elsewhere.

Should I worry if my scores vary by more than 20 points?

Minor fluctuations (up to 30 points) between scores are normal. Larger discrepancies may indicate missing information, reporting delays, or errors. Investigate if the gap seems unusual or affects lending outcomes.

Final Thoughts: Embrace the Complexity

Your credit score isn’t a single number—it’s a dynamic reflection of your financial behavior through various analytical lenses. Differences between scores aren’t flaws in the system; they reflect its sophistication and adaptability to different lending contexts.

Instead of chasing one perfect score, focus on building strong credit habits: pay bills on time, keep balances low, limit new credit applications, and review reports regularly. Over time, all your scores will trend upward.

浙公网安备

33010002000092号

浙公网安备

33010002000092号 浙B2-20120091-4

浙B2-20120091-4

Comments

No comments yet. Why don't you start the discussion?